Industrial Floor Mats Market Size 2024-2028

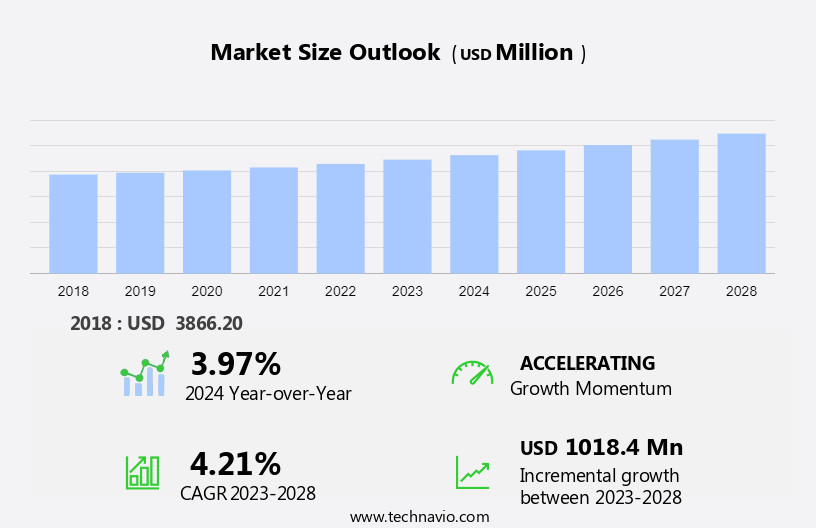

The industrial floor mats market size is forecast to increase by USD 1.02 billion at a CAGR of 4.21% between 2023 and 2028.

- The industrial floor mat market is experiencing significant growth due to the incorporation of multiple safety features in mats, including textured surfaces, anti-slip properties, and drainage systems. This trend is driven by the increasing focus on workplace safety and the need to prevent workplace accidents. Additionally, the use of recycled materials In the production of industrial floor mats is gaining popularity due to environmental concerns and cost savings. Materials such as rubber, vinyl, fiber, PVC, and gel are utilized based on ergonomic demands and the specific requirements of the application. Another emerging trend is the adoption of interlock floors, which offer easy installation and replacement, as well as improved durability and design flexibility. These trends are expected to drive the growth of the industrial floor mat market In the coming years.

What will be the Size of the Industrial Floor Mats Market During the Forecast Period?

- The market is witnessing significant growth due to ergonomic needs and worker comfort considerations. With the evolving consumer preferences, there is an increasing demand for mats that offer electrostatic discharge protection and chemical-resistant properties. Regulatory modifications have also played a crucial role in driving market growth, as stricter safety regulations have led to the adoption of anti-static mats and ribbed mats for improved traction and impact protection. The urbanization growth in both residential and non-residential sectors has led to a rise In the demand for commercial floor mats. The high population density in urban areas has increased the focus on hygiene and aesthetics, making floor mats an essential safety measure for businesses. Consolidations and strategic collaborations among key players have further boosted market growth. Rising disposable incomes and productivity demands have also contributed to the market's expansion. Overall, the market is expected to continue its growth trajectory In the coming years, driven by the increasing ergonomic demands and safety measures across various industries.

How is this Industrial Floor Mats Industry segmented and which is the largest segment?

The industrial floor mats industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Ergonomic floor mats

- Entrance floor mats

- Application

- Manufacturing

- Warehouse and logistics

- Healthcare

- Hospitality

- Others

- Geography

- North America

- US

- APAC

- China

- Europe

- Germany

- UK

- France

- South America

- Middle East and Africa

- North America

By Product Insights

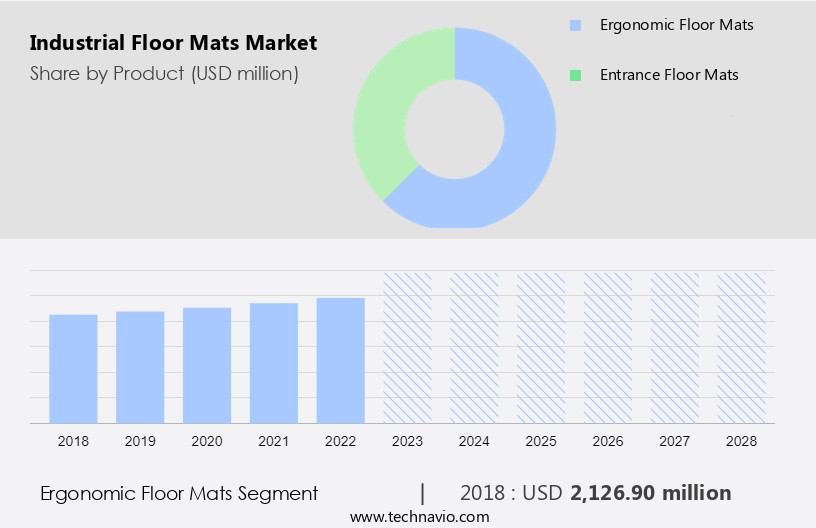

- The ergonomic floor mats segment is estimated to witness significant growth during the forecast period.

The market caters to the demand for effective solutions in wet areas, prioritizing both beauty and functionality. Cutting-edge Technology Insights reveal the growing trend towards antimicrobial anti-fatigue mats, which prevent the growth of bacteria and fungi while offering comfort through foam, gel, and other ergonomic materials. Strategic Market Intelligence reports a global reach for these mats, with applications extending to industrial kitchens and food processing areas. Customized Solutions cater to the unique needs of various industries, including designs that meet ergonomic demands and safety measures for foot pain, back pain, and joint stress. Materials such as Rubber, Vinyl, Fiber, PVC, and Rubber materials ensure product quality, durability, and resistance to liquids. The Anti-fatigue segment and Anti-slip segment continue to gain traction due to rising living standards and technological advancements. CleverMats, for instance, offer advanced features like clever designs and factory closures for customized installations.

Get a glance at the market report of share of various segments Request Free Sample

The ergonomic floor mats segment was valued at USD 2.13 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

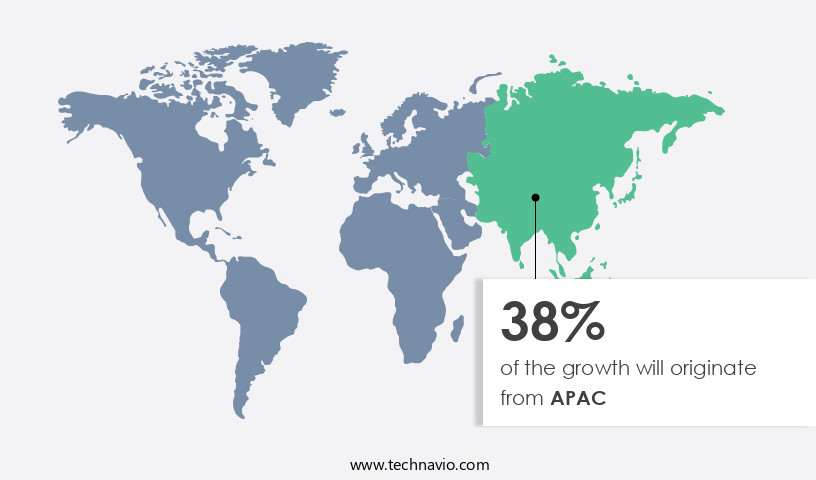

- APAC is estimated to contribute 38% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market caters to the demand for advanced solutions in wet areas such as industrial kitchens and food processing units. Beauty meets functionality in this segment, with cutting-edge technology insights driving the production of antimicrobial anti-fatigue mats, foam mats with gel infusion, and customized solutions for various industries. These mats are essential for preventing the growth of bacteria and fungi, ensuring hygiene and safety in industrial settings. Strategic Market Intelligence reports reveal a global reach for these mats, with local expertise guiding the design and development of industry solutions.

The Anti-fatigue segment is gaining popularity due to its role in fatigue prevention, offering relief from foot pain, back pain, and joint stress. The Anti-slip segment ensures safety by providing resistance to liquids and enhancing traction. Technological advancements in Rubber materials have led to increased durability and resistance to wear and tear. Overall, the market is evolving to meet the rising living standards and evolving demands of various industries. CleverMats and similar solutions are leading the way with innovative designs and product quality that prioritize both functionality and aesthetics.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Industrial Floor Mats Industry?

Incorporation of multiple safety features in mats is the key driver of the market.

- Industrial mats play a crucial role in enhancing productivity, hygiene, and appearance in various industries. companies provide a range of features In these mats, including impact protection, slip resistance, and chemical resistance, to cater to diverse end-user needs. For instance, sensitive mats with anti-microbial formulas offer protection against bacterial growth, making them suitable for industrial kitchens and healthcare facilities.

- Customized floor mats with traction properties ensure safety measures in industries with high foot traffic, such as manufacturing plants and construction sites. Pricing tactics, such as bulk discounts and customization options, further enhance customer satisfaction. Overall, the market for industrial mats is thriving due to the increasing demand for mats with advanced features that offer superior performance and durability.

What are the market trends shaping the Industrial Floor Mats Industry?

The increasing use of recycled materials is the upcoming market trend.

- Industrial floor mats are essential safety measures in various industries, particularly in sectors where heavy foot traffic and potential for slippery surfaces are prevalent. The market for industrial floor mats is witnessing significant growth due to the increasing demand for products that offer impact protection and traction. In the mop industry, customized floor mats have gained popularity as they cater to specific requirements, enhancing customer satisfaction.

- Pricing tactics are a crucial factor In the industrial floor mat market. companies are offering affordable options using recycled materials such as recycled rubber from tires and disposed mats. These sensitive floor mats provide benefits like better affordability than synthetic rubber, reduced landfills, and durability and stability. Manufacturers' use of recycled materials not only reduces their manufacturing costs but also contributes to environmental conservation efforts, making it a win-win situation for both the industry and the environment.

What challenges does the Industrial Floor Mats Industry face during its growth?

Emergence of interlock floors is a key challenge affecting the industry growth.

- Industrial mats have long been a staple in various industries for providing impact protection and traction. However, the emergence of interlock floors as a customized and versatile alternative is gaining significant attention. Interlock floors, unlike traditional mats, offer a wider coverage area and can be easily installed, uninstalled, or reinstalled without the need for machinery.

- The companies such as Bergo Flooring and Wearwell provide interlock floors that offer additional benefits, including anti-fatigue, slip-resistance, and anti-static properties. As interlock floors become more popular, there may be a decrease In the demand for industrial mats. This shift in preference could potentially impact pricing tactics In the mop industry and prioritize customer satisfaction through safety measures.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- American Floor Mats LLC

- American Pro Marketing LLC

- Americo Manufacturing Co.

- Apache Mills

- ARA Mats International

- Bergo Flooring AB

- Durable Corp.

- Eagle Mat and Floor Products

- ES ROBBINS Corp.

- Flooratex Rubber and Plastics Pvt. Ltd.

- General Mat Co.

- Justrite Mfg. Co. LLC

- KLEEN TEX Industries Inc.

- Ludlow Composites Corp.

- Mountville Mills Inc.

- Polymax Ltd.

- Unimat Industries LLC

- Wearwell LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to ergonomic needs and worker comfort considerations. Ergonomic mats, such as anti-fatigue and anti-static mats, are increasingly being adopted to enhance productivity and reduce worker fatigue. The market is also driven by urbanization growth and rising disposable incomes, leading to an increase in demand for industrial floor mats in both residential and non-residential sectors. Regulatory modifications and evolving consumer preferences are key trends influencing the market. For instance, there is a growing demand for chemical-resistant mats and those with antimicrobial treatment for hygiene reasons. Strategic collaborations and consolidations are also shaping the market landscape.

The North American market holds a significant share In the market due to safety enhancements and productivity concerns. Traction tread features and aesthetics are also important factors influencing consumer preferences. The market research intellect also indicates that anti-slip materials, such as rubber and PVC, are widely used In the production of industrial floor mats. Emerging opportunities include the use of disinfectants and antimicrobial treatment in industrial mats for dry areas, as well as the development of scrape mats for heavy-duty applications. The market is expected to continue growing due to the increasing focus on safety and hygiene in various industries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

168 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.21% |

|

Market growth 2024-2028 |

USD 1.02 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.97 |

|

Key countries |

US, China, UK, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Industrial Floor Mats Market Research and Growth Report?

- CAGR of the Industrial Floor Mats industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the industrial floor mats market growth of industry companies

We can help! Our analysts can customize this industrial floor mats market research report to meet your requirements.