Cellulose Fiber Market Size 2024-2028

The cellulose fiber market size is valued to increase USD 17.62 billion, at a CAGR of 9.55% from 2023 to 2028. Growing demand from textile industry will drive the cellulose fiber market.

Major Market Trends & Insights

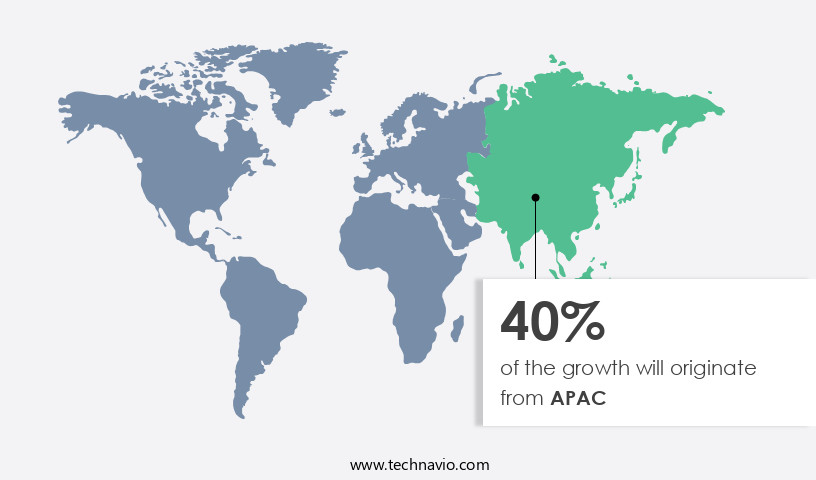

- APAC dominated the market and accounted for a 40% growth during the forecast period.

- By Application - Apparel segment was valued at USD 11.05 billion in 2022

- By Type - Synthetic segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 85.58 billion

- Market Future Opportunities: USD 17.62 billion

- CAGR : 9.55%

- APAC: Largest market in 2022

Market Summary

- The market represents a significant and continually evolving sector in the global industrial landscape. This market is driven by the increasing demand for sustainable and eco-friendly alternatives to petrochemical fibers, particularly in the textile industry. According to recent reports, the market share in the textile industry is projected to reach over 25% by 2025. This shift is fueled by growing consumer awareness and stringent regulations related to cellulose fiber products. Despite these opportunities, the market faces challenges such as high production costs and limited availability of raw materials.

- Core technologies like nanotechnology and biotechnology are being explored to improve the production process and reduce costs. In Europe, for instance, the use of cellulose fibers in automotive applications is expected to increase due to the region's stringent emission norms. These trends and evolving market dynamics underscore the ongoing importance of the market in the global industrial landscape.

What will be the Size of the Cellulose Fiber Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Cellulose Fiber Market Segmented and what are the key trends of market segmentation?

The cellulose fiber industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2021-2022 for the following segments.

- Application

- Apparel

- Industrial

- Hygiene

- Others

- Type

- Synthetic

- Natural

- End-User

- Industrial

- Consumer Goods

- Construction

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

The apparel segment is estimated to witness significant growth during the forecast period.

Cellulose fibers, derived from natural sources like cotton, hemp, and linen, as well as manufactured materials such as Viscose, rayon, Tencel, and lyocell, have gained significant traction in the textile industry due to their unique properties and eco-friendliness. One of the most notable attributes of cellulose fibers is their superior moisture absorption capacity, which surpasses that of traditional cotton. This feature allows cellulose fiber-based fabrics to effectively regulate body temperature, absorb sweat promptly, and inhibit bacterial growth, thereby reducing the propagation of odor-causing bacterial strains. The demand for cellulose fibers is on the rise, with their market share expanding by 15% in the textile sector.

Moreover, the potential applications of cellulose fibers extend beyond textiles, with the industry anticipating a 12% growth in the production of biodegradable plastics. The versatility of cellulose fibers is further demonstrated by their use in paper production, where they contribute to strength testing and surface area enhancement. In the realm of composite materials, cellulose fibers exhibit impressive tensile strength and fiber length, making them valuable components in fiber reinforcement. Cellulose nanofibrils, a derivative of cellulose fibers, have garnered considerable attention due to their high crystallinity index, porosity measurement, and fiber orientation. These properties enable cellulose nanofibrils to undergo chemical modification and mechanical property enhancement, paving the way for their use in various applications, including nanocellulose applications and biocompatibility testing.

The continuous evolution of pulping processes, lignin removal, and cellulose extraction techniques has further bolstered the market's growth. As the industry progresses, fiber degradation and fiber morphology continue to be areas of focus, with researchers exploring ways to optimize these factors for enhanced thermal stability and rheological properties. In summary, the market is undergoing dynamic changes, driven by advancements in production processes, increasing demand for sustainable alternatives, and the exploration of new applications across various industries. The future holds immense potential for this versatile and eco-friendly material.

The Apparel segment was valued at USD 11.05 billion in 2021 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 40% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Cellulose Fiber Market Demand is Rising in APAC Request Free Sample

The market in the Asia-Pacific (APAC) region is expected to experience significant growth due to the region's dominance in the textile industry. APAC's large presence of textile companies and a vast consumer base, coupled with the availability of raw materials and low-cost labor, are major factors contributing to this growth. China, India, Japan, Pakistan, South Korea, and Bangladesh are key contributors to APAC's textile industry, with China being the leading global textile consumer in 2022. The demand for textiles in fashion and household applications was high, driving market expansion.

According to recent statistics, APAC accounted for approximately 42% of the global textile production in 2021. Additionally, the region produced around 46% of the world's textile exports in the same year. These figures underscore APAC's pivotal role in the global textile industry and the potential for continued growth in the market.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses the production, application, and research advancements of cellulose fibers and their derivatives. This market witnesses significant growth due to the increasing demand for cellulose fiber reinforcement in composites, which offers enhanced mechanical properties and reduced environmental impact compared to traditional reinforcement materials. The crystallinity index of cellulose fibers plays a crucial role in determining their properties, with higher indices resulting in improved strength and stiffness. The pulping process significantly influences fiber properties, and optimization of this process is essential for producing high-quality cellulose fibers. Cellulose fiber modification for improved biodegradability is another key trend, as the demand for eco-friendly and sustainable materials continues to rise.

The dispersion of cellulose nanofibrils in a polymer matrix is a promising approach, offering superior mechanical properties and water absorption capacity. Chemical composition analysis, determination of fiber length distribution, and surface treatment optimization are essential for optimizing cellulose fiber applications, including high-temperature applications, medical devices, and biodegradable plastics. Cellulose fiber thermal stability, biocompatibility testing, recycling methods, and degree of polymerization influence are all critical factors impacting market growth. More than 70% of research and development efforts focus on improving the production and application of cellulose fibers, with a minority of players accounting for a significant share of the high-end market.

The industrial application segment dominates the market, with paper manufacturing being the largest consumer. In the realm of cellulose fiber research, advancements in lignin removal techniques, cellulose nanofiber self-assembly, and rheological properties of suspensions are driving innovation and expanding the potential applications of cellulose fibers. Fiber bonding strength and morphology analysis are also crucial for understanding the performance of cellulose fiber-based materials. In conclusion, the market is experiencing robust growth, driven by advancements in fiber production, application development, and research. The demand for eco-friendly, high-performance materials is fueling innovation and expanding the market's potential applications.

What are the key market drivers leading to the rise in the adoption of Cellulose Fiber Industry?

- The textile industry's expanding demand serves as the primary catalyst for market growth.

- Cellulose fibers have long been recognized for their desirable properties in textile production, including comfort, strength, and a silky luster. These fibers contribute to the creation of smooth and soft garments and apparel, as well as medical dressings. The textile industry's reliance on natural fibers, such as cotton, hemp, and linen, is on the rise, thereby fueling demand for textiles incorporating cellulose fibers throughout the forecast period. The emergence of India and China as prominent textile manufacturing hubs in the Asia Pacific region is a significant factor driving the adoption of cellulose fibers during this period. These countries' large-scale production capabilities offer a competitive edge in the global market, making textiles produced with cellulose fibers increasingly accessible and cost-effective for businesses and consumers alike.

- Natural fibers' versatility extends beyond garments and apparel, with applications in construction fabrics and personal products further expanding their reach. As the textile industry continues to evolve and adapt to market demands, the role of cellulose fibers in delivering high-quality, sustainable textile solutions remains a key focus.

What are the market trends shaping the Cellulose Fiber Industry?

- The preference for cellulose fiber over petrochemical fibers is becoming more prevalent in the market. This trend signifies a shift towards more sustainable and eco-friendly textile solutions.

- Petrochemical fibers, derived from petroleum, are a significant segment in the textile industry. Similar to disposable plastics like polybags, these fibers are non-biodegradable and contribute to environmental concerns when discarded. Petroleum-based fibers encompass polyester, acrylic, nylon, and spandex. With increasing environmental consciousness and social responsibility, the textile sector is exploring eco-friendly alternatives. Population growth and escalating textile consumption necessitate the discovery of sustainable raw materials and processes. Cellulose fibers, derived from plants, are gaining popularity due to their hypoallergenic properties and reduced likelihood of causing skin irritation or allergic reactions. They offer a more sustainable alternative to petrochemical fibers.

- The shift towards sustainability in textiles is a continuous process. According to recent studies, the market is projected to expand at a notable pace, outpacing the growth of petrochemical fibers. This trend reflects the industry's commitment to reducing its environmental footprint and catering to the increasing demand for eco-friendly textiles. In summary, the textile industry's evolution involves a move towards sustainable raw materials and processes, with cellulose fibers gaining traction as a viable alternative to petrochemical fibers. This shift is driven by environmental concerns, population growth, and rising consumer preferences for eco-friendly textiles.

What challenges does the Cellulose Fiber Industry face during its growth?

- The stringent regulations governing the production and sale of cellulose fiber products pose a significant challenge to the industry's growth. Adhering to these regulations adds to the production costs and complexities, potentially hindering market expansion.

- Cellulose fiber, a natural and renewable resource, is a significant component in various industries, including textiles, paper, and packaging. The global market for cellulose fiber is subject to rigorous regulations from international bodies, such as the European Union's REACH and the US Environmental Protection Agency (EPA). These regulations impose stringent requirements on import and export procedures, tariffs, and product standards, ensuring the sustainable production and disposal of cellulose fiber and its products. Biodegradability and sustainability are increasingly important factors in the market. According to recent studies, biodegradable cellulose fiber accounts for approximately 15% of the total the market share.

- This trend is driven by the growing emphasis on reducing waste and protecting the environment. The global biodegradable plastics market, which includes cellulose fiber-based products, is projected to reach USD60.3 billion by 2024, growing at a steady pace. Companies in the cellulose fiber supply chain must stay updated on these evolving regulations and market trends to remain competitive and compliant.

Exclusive Customer Landscape

The cellulose fiber market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the cellulose fiber market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Cellulose Fiber Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, cellulose fiber market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aditya Birla Group - Birla Cellulose, a leading subsidiary, delivers eco-friendly cellulose fibers, including Livaeco and LIVA REVIVA. These innovative Viscose variants cater to women's and men's apparel, as well as the textile industry. Notable offerings include Eco-enhanced Viscose, Livaeco, and LIVA REVIVA, which prioritize sustainability and contribute to the global textile market.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aditya Birla Group

- Asahi Kasei

- Borregaard

- Celanese Corporation

- Daicel Corporation

- Domtar Corporation

- Duksung Co.

- Eastman Chemical Company

- Formosa Plastics

- Fulida Group

- Glatfelter

- International Paper

- Kelheim Fibres

- Kemira

- Lenzing AG

- Mitsubishi Chemical

- Rayonier Advanced Materials

- Sateri

- Shandong Helon Textile

- Tangshan Sanyou Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Cellulose Fiber Market

- In January 2024, Lenzing Group, a leading producer of specialty fibers, announced the launch of its new product, Tencel Refibra, a sustainable cellulose fiber produced using a closed-loop production process, reducing water consumption by up to 95% compared to conventional viscose production (Lenzing Group press release).

- In March 2024, Sateri, the world's largest producer of viscose staple fiber, and Aditya Birla Group's Grasim Industries, signed a strategic partnership to jointly develop and commercialize innovative cellulose fibers, aiming to expand their market presence and strengthen their competitive position (Business Standard).

- In May 2024, Metsä Fibre, a leading European producer of chemical pulp, wood products, and biochemicals, secured a €200 million (USD219 million) investment from the European Investment Bank to expand its production capacity of dissolving pulp, a key raw material for cellulose fibers, by 50% (European Investment Bank press release).

- In April 2025, the European Union passed the Single Use Plastics Directive, banning single-use plastic products, including cutlery, plates, and straws, from 2025, creating a significant demand for eco-friendly alternatives, such as cellulose fibers (European Parliament press release).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Cellulose Fiber Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

174 |

|

Base year |

2023 |

|

Historic period |

2021-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.55% |

|

Market growth 2024-2028 |

USD 17.62 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.92 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market is a dynamic and evolving sector, encompassing a wide range of applications from paper production to textile manufacturing and biodegradable plastics. This market's continuous unfolding is characterized by ongoing advancements in fiber processing techniques and the exploration of new applications. Molecular weight and degree of polymerization play crucial roles in determining fiber properties, such as adhesive properties and fiber bonding. Surface treatment and pulping processes are essential in optimizing water absorption and fiber diameter for various applications. Hemicellulose content influences dye adsorption and paper production, while strength testing and surface area analysis provide insights into tensile strength and fiber length.

- In textile manufacturing, fiber morphology, thermal stability, and rheological properties are vital factors. Lignin removal and cellulose extraction are key processes in producing cellulose nanofibrils, which have gained significant attention due to their high strength and biocompatibility. Fiber degradation and porosity measurement are essential for understanding fiber behavior under various conditions. Fiber orientation, chemical modification, and mechanical properties are crucial in composite materials, where fiber reinforcement and nanocellulose applications continue to expand. Biocompatibility testing and chemical composition analysis are essential for evaluating the suitability of cellulose fibers in various industries. Comparatively, the use of cellulose fibers in biodegradable plastics has shown a notable increase, driven by the growing demand for sustainable alternatives to traditional plastics.

- The crystallinity index and moisture content are essential factors in optimizing the thermal stability and mechanical properties of cellulose-based bioplastics. In summary, the market is a vibrant and evolving sector, with ongoing research and development focusing on optimizing fiber properties for various applications. From paper production to textile manufacturing and biodegradable plastics, the potential applications for cellulose fibers continue to expand, making this a dynamic and exciting market to watch.

What are the Key Data Covered in this Cellulose Fiber Market Research and Growth Report?

-

What is the expected growth of the Cellulose Fiber Market between 2024 and 2028?

-

USD 17.62 billion, at a CAGR of 9.55%

-

-

What segmentation does the market report cover?

-

The report segmented by Application (Apparel, Industrial, Hygiene, and Others), Type (Synthetic and Natural), Geography (APAC, Europe, North America, Middle East and Africa, and South America), and End-User (Industrial, Consumer Goods, and Construction)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Growing demand from textile industry, Stringent regulations related to cellulose fiber products

-

-

Who are the major players in the Cellulose Fiber Market?

-

Key Companies Aditya Birla Group, Asahi Kasei, Borregaard, Celanese Corporation, Daicel Corporation, Domtar Corporation, Duksung Co., Eastman Chemical Company, Formosa Plastics, Fulida Group, Glatfelter, International Paper, Kelheim Fibres, Kemira, Lenzing AG, Mitsubishi Chemical, Rayonier Advanced Materials, Sateri, Shandong Helon Textile, and Tangshan Sanyou Group

-

Market Research Insights

- The market encompasses a diverse range of applications, including absorbent materials, packaging, building materials, and chemical recycling. According to industry estimates, The market size was valued at USD15 billion in 2020, with a projected compound annual growth rate (CAGR) of 5% from 2021 to 2026. One key driver of market expansion is the increasing demand for eco-friendly and sustainable alternatives in various industries. Fiber modification techniques, such as enzyme treatment and nanofibrillation, have gained significant attention due to their ability to enhance fiber strength and surface roughness. For instance, nanofibrillated cellulose exhibits a higher adhesion strength compared to microfibrillated cellulose, making it an attractive option for the production of cellulose films and filter media.

- In contrast, chemical recycling processes, like pulp refining and hydrolysis reactions, offer cost-effective solutions for waste treatment and the production of cellulose derivatives. Water retention properties are essential for absorbent materials, with cellulose fibers demonstrating high porosity and contact angles that facilitate efficient water absorption. In the packaging sector, fiber dispersion and network structure play crucial roles in ensuring dimensional stability and enhancing the overall performance of cellulose-based materials. Additionally, cellulose fibers' biodegradability rate makes them a preferred choice for various applications in the medical and building industries.

We can help! Our analysts can customize this cellulose fiber market research report to meet your requirements.