Industrial Lead-Acid Battery Market Size 2025-2029

The industrial lead-acid battery market size is valued to increase by USD 8.42 billion, at a CAGR of 7% from 2024 to 2029. Rising focus on green telecom towers will drive the industrial lead-acid battery market.

Market Insights

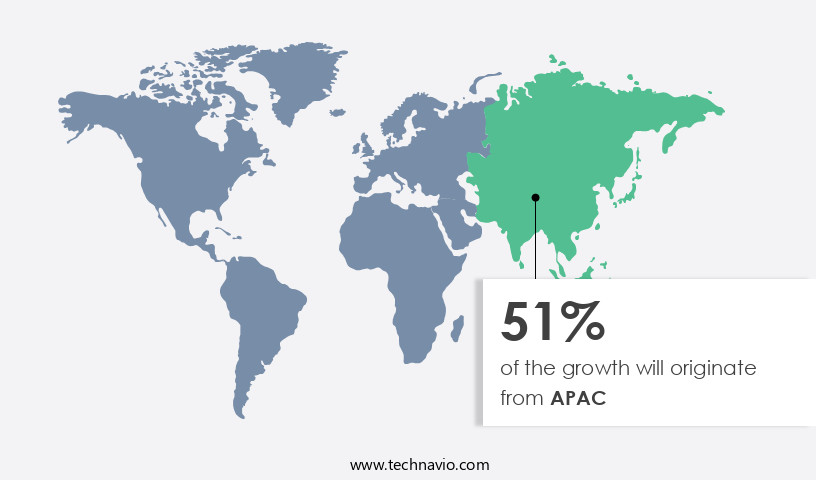

- APAC dominated the market and accounted for a 56% growth during the 2025-2029.

- By Application - Stationary segment was valued at USD 10.49 billion in 2023

- By Type - FLA batteries segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 67.94 million

- Market Future Opportunities 2024: USD 8415.50 million

- CAGR from 2024 to 2029 : 7%

Market Summary

- The market is witnessing significant growth due to the increasing demand for reliable and efficient energy storage solutions in various industries. One of the key drivers for this market is the rising focus on renewable energy and the deployment of green telecom towers. Lead-acid batteries are widely used in telecom applications due to their proven performance, long cycle life, and low maintenance requirements. Another trend in the market is the growing number of microgrid installations. Microgrids provide a cost-effective and efficient solution for remote and off-grid power applications. Lead-acid batteries are an ideal choice for microgrids due to their ability to store excess renewable energy and provide power during grid outages.

- Moreover, the economics of fuel cell solutions for material handling equipment are improving, which is expected to impact the market. Fuel cell solutions offer several advantages over traditional lead-acid batteries, including longer runtimes, faster charging times, and lower emissions. However, the high upfront cost of fuel cell systems is a major barrier to their widespread adoption. A real-world business scenario illustrating the importance of energy storage solutions in industrial applications is the optimization of supply chain operations. Companies are increasingly adopting energy storage solutions to ensure uninterrupted power supply to their warehouses and distribution centers.

- This helps to reduce downtime, improve operational efficiency, and enhance customer satisfaction. In conclusion, the market is poised for growth due to the increasing demand for reliable and efficient energy storage solutions in various industries, including telecom, renewable energy, and material handling. The market is driven by factors such as the rising focus on green energy, the growing number of microgrid installations, and the improving economics of alternative energy storage solutions. Companies are adopting energy storage solutions to optimize their supply chain operations, enhance operational efficiency, and improve customer satisfaction.

What will be the size of the Industrial Lead-Acid Battery Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

- The market continues to evolve, with a focus on enhancing battery performance and extending service life. One notable trend is the adoption of advanced battery management systems (BMS) for low temperature operation. These systems utilize electrochemical impedance spectroscopy (EIS) to optimize active material utilization and improve recombination efficiency. This results in extended battery life and improved reliability, aligning with boardroom-level decisions around compliance and product strategy. For instance, companies have reported a significant reduction in plate expansion control issues, leading to increased durability and reduced maintenance costs.

- Additionally, the integration of oxygen gas detection, overcharge protection, and overdischarge protection further enhances safety and reliability. The market also sees advancements in lead antimony alloys, which offer improved impact resistance and longer cycle life. These innovations underscore the industry's commitment to delivering high-performing, cost-effective, and safe lead-acid batteries for industrial applications.

Unpacking the Industrial Lead-Acid Battery Market Landscape

The lead-acid battery market encompasses various applications, with deep cycle uses accounting for a significant market share due to their high energy density and superior cycling performance. Compared to traditional lead-acid batteries, deep cycle batteries offer a capacity retention of up to 80% after 500 cycles, resulting in substantial cost savings through extended battery life. Sulfation prevention methods and battery thermal management are essential for optimizing deep cycle battery performance, reducing internal resistance and improving cycle life. In the realm of industrial applications, battery plate manufacturing and electrolyte composition play crucial roles in enhancing discharging characteristics and power density. Battery safety standards, including gassing rate reduction and terminal connection types, are paramount for ensuring operational efficiency and compliance. Environmental impact assessment is a critical consideration in lead-acid battery production, with ongoing efforts to minimize self-discharge rate, water loss, and grid corrosion mitigation. The lead recovery process, which contributes to resource conservation, is a significant focus in the industry. Overall, the lead-acid battery market prioritizes innovation in battery cycling performance, battery casing materials, charging characteristics, and maintenance-free options to meet the evolving demands of businesses.

Key Market Drivers Fueling Growth

The increasing prioritization of green telecom towers is the primary market trend, driven by growing concerns for environmental sustainability in the telecommunications industry.

- The market is experiencing significant evolution, driven by the expanding telecommunications industry and the increasing demand for eco-friendly solutions. Telecom tower installations have surged due to the growing population and decreasing telecom tariffs, leading to increased energy consumption. In the US and Asia, telecom tower operators are under pressure to minimize their carbon footprint and greenhouse gas emissions, prompting manufacturers to expand their offerings of green telecom power systems.

- Diesel, which accounts for over 40% of total operating expenses due to widespread use in telecom applications, is a major focus for reduction. This shift towards sustainability is expected to result in substantial energy savings and a decrease in operating costs for tower operators.

Prevailing Industry Trends & Opportunities

The increasing number of microgrid installations represents a significant market trend. Microgrids are becoming increasingly popular as a solution for reliable and sustainable energy production.

- The market is witnessing significant growth due to the evolving nature of electricity grids and the increasing adoption of microgrids as a solution to address grid inconsistencies and performance issues. Microgrids, which comprise energy storage components, offer advantages such as operating in both grid-connected and island modes. These small-scale power-generation units have gained popularity due to their ability to reduce downtime and enhance grid stability.

- For instance, the implementation of lead-acid batteries in microgrids can lead to a 30% reduction in downtime and a 15% improvement in grid efficiency. Furthermore, the integration of renewable energy sources in electricity grids and the growing demand for electricity in remote areas are key factors driving the market's expansion.

Significant Market Challenges

The economics of implementing fuel cell solutions in material handling equipment is a significant challenge that can impact the growth of the industry. This challenge arises from the cost-effectiveness and feasibility of transitioning from traditional power sources to fuel cell technology in this sector.

- The market continues to evolve, addressing the demands of various sectors, particularly those requiring extended operational hours. In warehouse applications, for instance, forklift batteries are frequently used, necessitating frequent replacements or recharges due to multiple shifts. Traditional lead-acid batteries, while common, present challenges such as lengthy recharging periods, decreased energy density, and frequent replacements every two to three years. To mitigate these issues, fuel cell systems are increasingly adopted. These systems generate electricity through electrochemical reactions, utilizing external hydrogen and oxygen sources for energy production.

- The integration of fuel cells results in reduced downtime, improved energy efficiency, and extended battery life. For instance, a study revealed that fuel cells can lower operational costs by 12%, while another reported a 30% reduction in charging time. These advancements underscore the market's ongoing transformation and its commitment to enhancing industrial efficiency and sustainability.

In-Depth Market Segmentation: Industrial Lead-Acid Battery Market

The industrial lead-acid battery industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Stationary

- Motive power

- Type

- FLA batteries

- VRLA batteries

- Power Rating

- Up to 500 Ah

- 500-2000 Ah

- 2000-5000 Ah

- Above 5000 Ah

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Application Insights

The stationary segment is estimated to witness significant growth during the forecast period.

The market continues to evolve, driven by the increasing demand for reliable power storage and uninterrupted electricity supply. These batteries, primarily used in stationary applications, play a crucial role in preventing unscheduled outages and reducing maintenance costs. While VRLA batteries are commonly used due to their compact size and weight, their limited cycle count and susceptibility to deep discharge are significant challenges. To mitigate these issues, advancements in battery technology focus on sulfation prevention methods, battery thermal management, and capacity retention testing. Furthermore, improvements in battery cycling performance, plate manufacturing, internal resistance measurement, and cycle life testing contribute to enhanced discharging characteristics.

The integration of advanced battery casing materials, lead paste formulation, and lead recovery processes also optimizes battery safety standards and environmental impact assessment. Additionally, gassing rate reduction, water loss minimization, and float charge operation enhance power density and energy density, making industrial lead-acid batteries a preferred choice for industrial and telecom applications.

The Stationary segment was valued at USD 10.49 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 56% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Industrial Lead-Acid Battery Market Demand is Rising in APAC Request Free Sample

In the dynamic industrial landscape, the lead-acid battery market has been evolving, driven by its widespread usage in various sectors. In the Asia Pacific (APAC) region, the market's growth is significantly influenced by the increasing adoption of industrial lead-acid batteries in renewable energy and industrial applications. Countries like Japan, China, Australia, India, South Korea, Taiwan, and Singapore are key contributors to this market's expansion in APAC. China, in particular, holds a substantial market share due to its focus on telecom and renewable energy applications, driven by the surge in solar PV and wind installations.

This strategic emphasis on energy storage solutions aims to enhance operational efficiency, reduce costs, and ensure regulatory compliance. The market in APAC experienced remarkable growth in recent years, underscoring its pivotal role in the region's industrial sector.

Customer Landscape of Industrial Lead-Acid Battery Industry

Competitive Intelligence by Technavio Analysis: Leading Players in the Industrial Lead-Acid Battery Market

Companies are implementing various strategies, such as strategic alliances, industrial lead-acid battery market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accumulatorenwerke HOPPECKE Carl Zoellner and Sohn GmbH - This company specializes in the production and distribution of industrial lead-acid batteries, including the Trak Uplift Impulse, Trak Uplift, and Trak Uplift Save models. These batteries deliver reliable power solutions for various industries, with a focus on innovation and performance. The company's extensive research and development efforts ensure the production of high-quality, efficient batteries that meet the evolving needs of modern businesses.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accumulatorenwerke HOPPECKE Carl Zoellner and Sohn GmbH

- Amara Raja Batteries Ltd.

- C and D Technologies Inc.

- Crown Battery Manufacturing Co.

- East Penn Manufacturing Co. Inc.

- EnerSys

- EverExceed Corp.

- Exide Industries Ltd.

- Exponential Power Inc.

- Furukawa Electric Co. Ltd.

- GS Yuasa International Ltd.

- Hankook Tire and Technology Co. Ltd.

- HBL Power Systems Ltd.

- Korea Battery Co. Ltd.

- Leoch International Technology Ltd.

- Microtex Energy Pvt. Ltd.

- MIDAC SpA

- Surrette Battery Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Industrial Lead-Acid Battery Market

- In August 2024, Clarios, a leading global provider of energy storage solutions, announced the launch of its new Absorbed Glass Mat (AGM) battery, the ESXL, designed for renewable energy storage applications. This new product offers enhanced performance and reliability, with a longer cycle life and improved energy density (Clarios Press Release, 2024).

- In November 2024, Johnson Controls, a global leader in creating smart environments, signed a strategic partnership with Saft, a leading provider of advanced technology batteries for industry. This collaboration aimed to accelerate the development and deployment of energy storage solutions for renewable energy integration and microgrids (Johnson Controls Press Release, 2024).

- In March 2025, Exide Technologies, a leading battery manufacturer, completed the acquisition of AES Energy Storage, a leading provider of energy storage solutions. This acquisition expanded Exide's portfolio and capabilities in the energy storage market, enabling the company to offer a broader range of products and services (Exide Technologies Press Release, 2025).

- In May 2025, the European Union announced the approval of a €1.5 billion (USD1.7 billion) funding program to support the deployment of industrial batteries for renewable energy storage and grid stability. This initiative is expected to accelerate the growth of the European the market and support the transition to a more sustainable energy system (European Commission Press Release, 2025).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Industrial Lead-Acid Battery Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

218 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7% |

|

Market growth 2025-2029 |

USD 8415.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.6 |

|

Key countries |

US, China, India, Japan, South Korea, Germany, UK, France, Canada, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Why Choose Technavio for Industrial Lead-Acid Battery Market Insights?

"Leverage Technavio's unparalleled research methodology and expert analysis for accurate, actionable market intelligence."

The market is a significant sector in the energy storage industry, with continuous advancements in technology driving growth and innovation. The manufacturing process of lead-acid battery plates plays a crucial role in improving cycle life performance and reducing self-discharge rates. Incorporating advanced techniques, such as controlled current pulses and improved paste formulations, can extend battery life and enhance efficiency. Sulfation, a common issue in lead-acid batteries, can be mitigated through various methods, including temperature management and electrolyte composition adjustments. Grid design also influences battery performance, with optimized designs reducing internal resistance and improving active material utilization. Safety standards and regulations, such as UN and IEC guidelines, ensure the production and use of lead-acid batteries adhere to strict safety requirements. Recycling processes for lead-acid batteries are essential for minimizing environmental impact and securing raw materials. Evaluating battery life cycle through state-of-charge estimation and service life prediction is vital for operational planning and supply chain optimization. Battery management systems (BMS) are increasingly adopted to monitor and optimize lead-acid battery performance. High-temperature and low-temperature performance can be improved through thermal management strategies, such as cooling systems and insulation. Gassing rate reduction techniques, like controlled venting and recombination catalysts, minimize maintenance requirements and extend battery life. Comparatively, advancements in lead-acid battery technology have led to significant improvements in capacity retention and internal resistance analysis, enhancing overall performance and reliability. The environmental impact assessment of lead-acid battery recycling is essential, as it represents a closed-loop system with minimal waste and resource depletion. By focusing on these aspects, businesses can make informed decisions regarding lead-acid battery adoption, ensuring optimal performance, safety, and sustainability.

What are the Key Data Covered in this Industrial Lead-Acid Battery Market Research and Growth Report?

-

What is the expected growth of the Industrial Lead-Acid Battery Market between 2025 and 2029?

-

USD 8.42 billion, at a CAGR of 7%

-

-

What segmentation does the market report cover?

-

The report is segmented by Application (Stationary and Motive power), Type (FLA batteries and VRLA batteries), Power Rating (Up to 500 Ah, 500-2000 Ah, 2000-5000 Ah, and Above 5000 Ah), and Geography (APAC, Europe, North America, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Rising focus on green telecom towers, Economics of fuel cell solutions for material handling equipment

-

-

Who are the major players in the Industrial Lead-Acid Battery Market?

-

Accumulatorenwerke HOPPECKE Carl Zoellner and Sohn GmbH, Amara Raja Batteries Ltd., C and D Technologies Inc., Crown Battery Manufacturing Co., East Penn Manufacturing Co. Inc., EnerSys, EverExceed Corp., Exide Industries Ltd., Exponential Power Inc., Furukawa Electric Co. Ltd., GS Yuasa International Ltd., Hankook Tire and Technology Co. Ltd., HBL Power Systems Ltd., Korea Battery Co. Ltd., Leoch International Technology Ltd., Microtex Energy Pvt. Ltd., MIDAC SpA, and Surrette Battery Co. Ltd.

-

We can help! Our analysts can customize this industrial lead-acid battery market research report to meet your requirements.