Industrial Metrology Market Size 2024-2028

The industrial metrology market size is forecast to increase by USD 2.37 billion at a CAGR of 4.5% between 2023 and 2028. The market is experiencing significant growth, driven by the increasing importance of accuracy in manufacturing processes. With the rise of manufacturing industries in regions such as North America and Europe, there is a growing demand for advanced metrological systems to ensure product quality and consistency. However, a lack of expertise in handling these complex systems poses a challenge for many organizations. To address this, market trends include the adoption of user-friendly software and outsourcing metrology services to specialized providers. Additionally, the integration of Industry 4.0 technologies, such as IoT and AI, is revolutionizing metrology, enabling real-time monitoring and predictive maintenance. Overall, the market is poised for continued growth as manufacturers seek to improve efficiency, reduce costs, and maintain a competitive edge.

Industrial metrology refers to the science and technology of measuring and controlling dimensions, shapes, and positions of objects in manufacturing processes and various industries. The market for industrial metrology is witnessing significant growth due to the increasing demand for precision measurement in various sectors such as aerospace, defense, manufacturing, electric vehicles, and food inspection. The integration of cloud services, IoT sensors, and smart manufacturing in industrial metrology is driving innovation and efficiency in the industry. The defense industry is a major consumer of industrial metrology solutions due to the need for precise measurement in manufacturing aircraft parts and microelectronics for military applications.

Additionally, reverse engineering and mapping and modeling are also crucial in the defense industry for the development of new weapons systems and the maintenance of existing ones. In the manufacturing sector, industrial metrology is used to ensure dimensional accuracy and quality control in the production of various products. Portable metrology solutions such as handheld 3D scanners, portable Coordinate Measuring Machines (CMMs), and laser trackers are increasingly popular in the shop floor due to their flexibility and ease of use. The semiconductor industry also relies heavily on industrial metrology for the production of faulty product-free microelectronics. In addition, the growing trend of smart cities is expected to create new opportunities for industrial metrology in infrastructure measurement and monitoring.

Market Segmentation

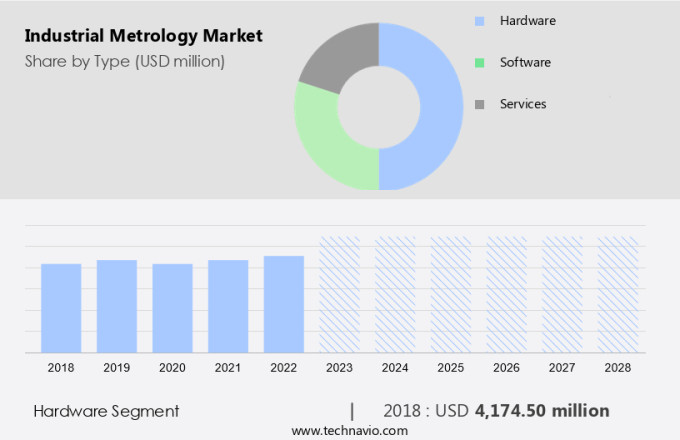

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Hardware

- Software

- Services

- Geography

- North America

- US

- APAC

- China

- Japan

- South Korea

- Europe

- Germany

- South America

- Middle East and Africa

- North America

By Type Insights

The hardware segment is estimated to witness significant growth during the forecast period. Industrial metrology plays a pivotal role in various industries, including aerospace, defense, manufacturing, electric vehicles, and others, by ensuring precise measurement and quality control. The integration of cloud services, IoT sensors, artificial intelligence, and information technology in industrial metrology has led to the development of smart manufacturing and factories. This includes the use of coordinate measuring machines, X-ray, and computed tomography systems for reverse engineering, mapping and modeling, and faulty product inspection in industries such as semiconductors, building materials, and food inspection. In the aerospace and defense industry, dimensional discrepancies in aircraft parts and tolerance issues are critical. Industrial metrology solutions, including portable metrology solutions like handheld 3D scanners, portable CMMs, and laser trackers, are essential for maintaining international standards.

In addition, in the manufacturing sector, smart sensors and automation are used to optimize production processes and improve efficiency. The use of industrial metrology extends beyond manufacturing to industries such as smart cities, where it is used for mapping and modeling infrastructure and ensuring compliance with regulations. In the defense industry, industrial metrology is crucial for ensuring the accuracy and precision of components in weapons systems. In the electric vehicle industry, battery inspection and microelectronics manufacturing require high-precision measurement capabilities. In conclusion, industrial metrology is an essential component of modern manufacturing and production processes. Its applications span across various industries, including aerospace, defense, manufacturing, electric vehicles, and others.

Also, the integration of advanced technologies such as cloud services, IoT sensors, artificial intelligence, and information technology has led to the development of smart manufacturing and factories, enabling more efficient and precise production processes.

Get a glance at the market share of various segments Request Free Sample

The hardware segment was valued at USD 4.17 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

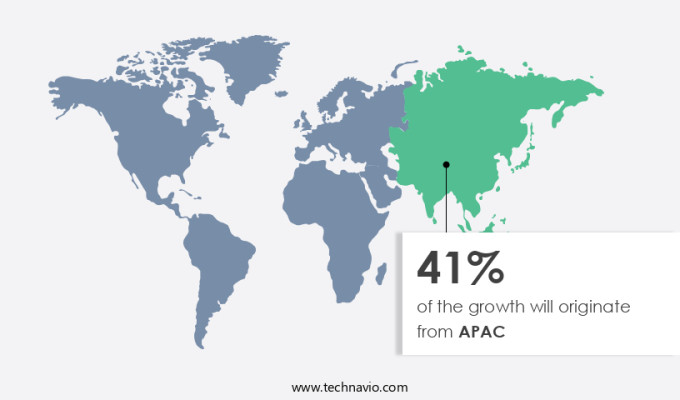

APAC is estimated to contribute 41% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Industrial metrology plays a crucial role in various sectors, including aerospace, defense, manufacturing, electric vehicles, and others, by ensuring precise measurements and quality control. The integration of cloud services, IoT sensors, artificial intelligence, and big data in industrial metrology enhances smart manufacturing processes. Hardware offerings such as coordinate measuring machines, X-ray, and computed tomography systems, along with automation, enable the defense industry and food inspection industry to adhere to international standards. In the manufacturing sector, smart factories leverage information technology and smart sensors for fault detection and tolerance analysis. Reverse engineering, mapping, and modeling are essential in industries like the semiconductor industry, where battery inspection and building materials manufacturing require high precision.

Moreover, portable metrology solutions, including handheld 3D scanners, portable CMMs, and laser trackers, facilitate shop floor measurements and improve factory automation. Aircraft parts and microelectronics require stringent dimensional discrepancies checks, making industrial metrology indispensable.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The growing importance of accuracy manufacturing is the key driver of the market. Industrial metrology plays a pivotal role in enhancing manufacturing standards and practices without increasing production costs. With the increasing complexity and large-scale production in various sectors, ensuring precision and quality becomes a significant challenge. Agile manufacturing practices and digital manufacturing technologies, including Internet of Things (IoT) and digital twins, are being adopted to address these challenges.

Moreover, IoT-enabled sensors collect sensor data, providing connectivity for process optimization and virtual simulation. Automated optical inspection, form measurement equipment, and 2D and 3D modeling techniques, such as virtual reality, laser-based scanning, structured light scanning, photogrammetry, and white light scanning, enable defect detection and process improvement. By implementing industrial metrology solutions, manufacturers can reduce production and support costs, lower waste and rework levels, and enhance overall operational productivity.

Market Trends

The reshoring of the manufacturing industry is the upcoming trend in the market. The market is experiencing significant growth due to the adoption of agile manufacturing practices and digital manufacturing technologies. Digital twins, IoT-enabled sensors, and connectivity are playing a crucial role in process optimization and virtual simulation. Automated optical inspection, form measurement equipment, and 2D and 3D modeling are essential components of industrial metrology. Digital technologies such as virtual reality, laser-based scanning, structured light scanning, photogrammetry, and white light scanning are revolutionizing defect detection and measurement accuracy.

Additionally, with the increasing emphasis on process efficiency and quality, manufacturers are investing in advanced metrology solutions. The trend towards reshoring manufacturing operations from developing countries to developed ones is also driving the demand for industrial metrology systems. The use of IoT-enabled sensors and connectivity enables real-time monitoring and analysis of sensor data, leading to improved productivity and cost savings.

Market Challenge

The lack of expertise in handling metrological systems is a key challenge affecting the market growth. The market is experiencing significant growth due to the adoption of agile manufacturing practices and digital manufacturing technologies. Digital twins, IoT enabled sensors, and connectivity are transforming the industry by enabling process optimization through virtual simulation and real-time monitoring. Sensor data collected from form measurement equipment, including 2D and 3D modeling tools, is used to identify defects and improve quality control. Advanced technologies such as virtual reality, laser based scanning, structured light scanning, photogrammetry, and white light scanning are increasingly being used for defect detection and process improvement. However, the market faces a major challenge in the form of a shortage of skilled workers.

Additionally, the efficient handling of metrological systems requires expertise in geometrical and dimensional measurements, quality control analysis, production processes, equipment maintenance, and repair. This is particularly challenging in developing economies such as India, South Korea, and Mexico. To address this issue, there is a growing need for training programs and collaborations between industry and educational institutions to develop a skilled workforce.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Creaform Inc. - The company offers industrial metrology that includes portable 3d scanners, portable coordinate measuring machine, automated quality control solutions, photogrammetry, optical coordinate measuring system, 3d scanning services, reverse engineering services.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ATT Metrology Services

- Baker Hughes Co.

- Bruker Corp.

- Cairnhill Metrology Pte Ltd.

- CARMAR ACCURACY CO. LTD.

- CyberOptics

- FARO Technologies Inc.

- Hexagon AB

- Intertek Group Plc

- Jenoptik AG

- Keyence Corp.

- KLA Corp.

- Metrologic Group SAS

- Mitutoyo America Corp.

- Nikon Corp.

- Precision Products Marketing Pvt. Ltd.

- Renishaw Plc

- SGS SA

- TriMet Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Industrial metrology refers to the measurement science applied to manufacturing industries. It plays a crucial role in ensuring product quality and maintaining tolerances in various sectors such as Aerospace, Defense, Manufacturing, Electric vehicles, and more. The market for industrial metrology is driven by the increasing adoption of Information Technology, Big data, IoT sensors, and Smart manufacturing in these industries. Key technologies in industrial metrology include 3D metrology equipment like Coordinate measuring machines (CMMs), X-ray, and computed tomography systems. These technologies enable precise measurement and inspection of complex geometries and materials. Automation, international standards, and reverse engineering are also significant trends in the market.

In conclusion, the Defense industry relies on industrial metrology for manufacturing precision parts for military equipment. In the Food inspection industry, it ensures food safety and quality. In the semiconductor industry, it is used for battery inspection and microelectronics manufacturing. Smart cities use industrial metrology for mapping and modeling infrastructure. Hardware offerings like portable metrology solutions, handheld 3D scanners, Portable CMMs, and Laser trackers are gaining popularity due to their flexibility and ease of use on the shop floor. The market is expected to grow significantly due to the increasing demand for faulty product detection and dimensional discrepancies measurement.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

139 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 2.37 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Regional analysis |

North America, APAC, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 41% |

|

Key countries |

US, China, Germany, Japan, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

ATT Metrology Services, Baker Hughes Co., Bruker Corp., Cairnhill Metrology Pte Ltd., CARMAR ACCURACY CO. LTD., Creaform Inc., CyberOptics, FARO Technologies Inc., Hexagon AB, Intertek Group Plc, Jenoptik AG, Keyence Corp., KLA Corp., Metrologic Group SAS, Mitutoyo America Corp., Nikon Corp., Precision Products Marketing Pvt. Ltd., Renishaw Plc, SGS SA, and TriMet Group |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch