Industrial Safety Gloves Market Size 2025-2029

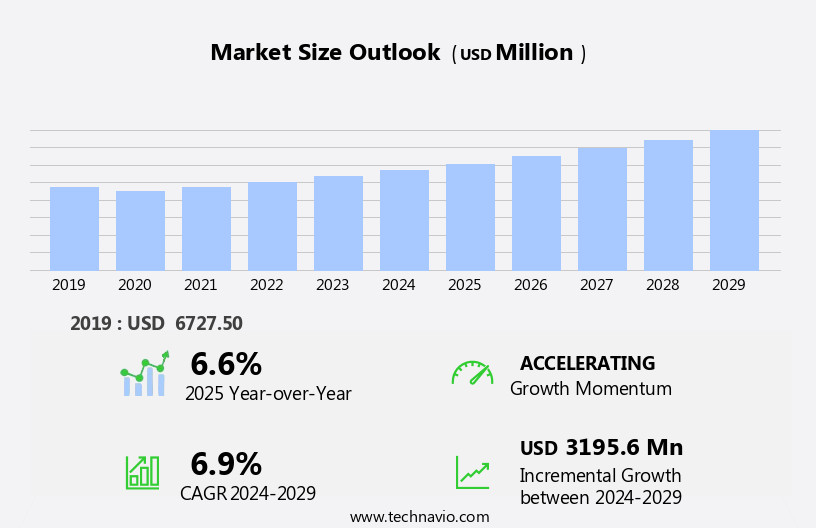

The industrial safety gloves market size is forecast to increase by USD 3.2 billion, at a CAGR of 6.9% between 2024 and 2029.

- The market is witnessing significant growth, driven by the continuous launch of new and innovative products. Manufacturers are focusing on enhancing the performance and durability of safety gloves by incorporating advanced materials and technologies. However, this market faces challenges due to the volatile prices of raw materials, which can impact the profitability of manufacturers. Raw material prices, particularly for natural rubber and synthetic polymers, have been fluctuating significantly, posing a significant challenge for industrial safety glove manufacturers. This volatility can lead to increased production costs, potentially impacting the competitiveness of manufacturers in the market. To mitigate this challenge, some companies are exploring alternative raw materials and sourcing strategies to reduce their reliance on volatile markets and secure a stable supply chain.

- Additionally, the market is witnessing a trend towards sustainable and eco-friendly raw materials, providing opportunities for manufacturers to differentiate themselves and cater to the growing demand for environmentally conscious products.

What will be the Size of the Industrial Safety Gloves Market during the forecast period?

The market continues to evolve, driven by the diverse needs of various sectors and the ongoing pursuit of enhanced safety standards. In the realm of material handling, synthetic leather and nitrile gloves are gaining popularity for their grip enhancement and resistance to punctures and chemicals. Occupational safety in industries such as oil & gas and food processing is paramount, leading to the demand for flame retardant, heat-resistant, and chemical-resistant gloves. Safety regulations, including ASTM D6319 and ANSI/ISEA 105, play a crucial role in shaping market dynamics. Kevlar gloves offer superior cut resistance, while coated gloves provide an additional layer of protection against hazardous materials.

Latex gloves are essential in chemical handling, ensuring compliance with safety standards and minimizing the risk of contamination. Reusable PVC gloves are preferred in industries with heavy lifting requirements, offering durability and resistance to abrasion. Nylon, dipped, woven, and knitted gloves cater to various applications, with each material offering unique benefits. Risk assessment and safety training are integral components of workplace safety, ensuring that the appropriate gloves are used for each task. Industrial manufacturing continues to push the boundaries of hand protection, with ongoing research and development leading to advancements in glove technology. The market's continuous dynamism reflects the evolving nature of industry demands and the commitment to ensuring a safe working environment.

How is this Industrial Safety Gloves Industry segmented?

The industrial safety gloves industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Material

- Natural rubber gloves

- Vinyl gloves

- Nitrile gloves

- Neoprene gloves

- Others

- End-user

- Manufacturing

- Construction

- Automotive

- Oil and gas

- Others

- Product Type

- Re-usable gloves

- Disposable gloves

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Material Insights

The natural rubber gloves segment is estimated to witness significant growth during the forecast period.

The market encompasses a range of materials and applications, with natural rubber, or latex, holding a significant position due to its inherent advantages. Latex gloves offer superior flexibility and strength compared to alternatives like vinyl and nitrile. Additionally, natural rubber is biodegradable, allowing for eco-friendly disposal. These gloves can be worn for extended periods and provide excellent elasticity and resistance to tearing. In industries such as oil & gas, food processing, and chemical handling, safety regulations mandate the use of gloves for occupational safety. The market includes various types of gloves, including nitrile gloves for chemical resistance, PVC gloves for oil resistance, and leather gloves for heavy-duty applications.

Grip enhancement, puncture resistance, and cut resistance are essential features for gloves in assembly lines and manufacturing environments. Safety training is crucial for proper usage and maintenance, ensuring workplace safety. Standards like ASTM D6319 and ANSI/ISEA 105 guide glove selection based on specific hazards and applications. Other materials, such as nylon, polyester, and knitted fabrics, offer varying degrees of abrasion resistance, heat resistance, and flame retardancy. The market continues to evolve with innovations in material technology and safety regulations.

The Natural rubber gloves segment was valued at USD 2.34 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

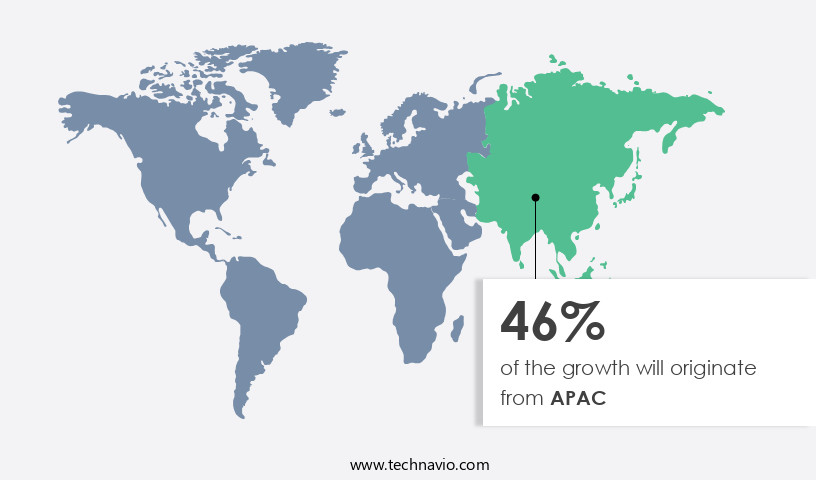

APAC is estimated to contribute 46% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is experiencing significant growth due to the region's rapid industrialization and urbanization. The construction, automotive, and manufacturing industries are driving this growth, with China, India, Japan, and Australia being key contributors. The increasing economic activities in these countries have resulted in substantial investments in various industries, leading to a surge in urban population growth. Public and private sector enterprises in APAC are expected to invest heavily in construction and manufacturing projects due to the availability of inexpensive labor. Occupational safety remains a top priority in these industries, leading to a high demand for safety gloves.

Nitrile gloves, PVC gloves, and synthetic leather gloves are popular choices due to their puncture resistance and chemical resistance properties. Grip enhancement is another essential feature in gloves used for heavy lifting and assembly line work. Safety regulations and workplace safety standards, such as ASTM D6319 and ANSI/ISEA 105, are stringently enforced in the region. Industrial manufacturing processes involve handling hazardous materials, necessitating the use of gloves with flame retardant, cut resistance, and abrasion resistance properties. Latex gloves are commonly used in chemical handling processes due to their chemical resistance and flexibility. Moreover, safety training programs are increasingly being implemented to ensure the proper use and disposal of gloves.

Reusable gloves are gaining popularity due to their cost-effectiveness and reduced environmental impact. Kevlar and coated gloves offer additional protection against heat and sharp objects, making them ideal for high-risk industries. In conclusion, the market in APAC is witnessing a steady growth due to the increasing industrialization and urbanization in the region. The market is characterized by a high demand for gloves with features such as puncture resistance, chemical resistance, grip enhancement, and flame retardancy. Safety regulations and workplace safety standards are driving the adoption of safety gloves in various industries, including construction, automotive, and manufacturing.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Industrial Safety Gloves Industry?

- Product innovations are the primary catalyst for market growth, as companies continually introduce new and improved offerings to meet evolving consumer needs and stay competitive within their industries.

- Industrial safety gloves are essential personal protective equipment (PPE) in various industries to ensure worker safety and productivity. Two primary types of industrial safety gloves are dipped gloves and woven gloves. Dipped gloves, also known as dipped rubber gloves, are made by dipping a base material, such as natural rubber or synthetic rubber, into a curing agent. These gloves offer excellent protection against chemicals, oil, and water. Woven gloves, on the other hand, are made from synthetic or natural fibers, such as polyester or cotton, and are woven into a fabric. They provide cut resistance, abrasion resistance, and flame retardancy.

- Consumer demand for industrial safety gloves that offer protection, comfort, and dexterity is driving market growth. Companies cater to this demand by providing gloves that meet specific industry requirements. For instance, Honeywell International offers industrial safety gloves with stainless-steel metal mesh, which provides cut resistance and hand protection in industries like food processing, metal processing, agriculture, and more. These gloves are corrosion-resistant, ergonomically designed, and can be easily sanitized since they resist fats and oils. Risk assessment is a crucial factor in selecting the appropriate gloves for different applications. Industrial safety gloves play a vital role in ensuring workplace safety and productivity while minimizing risks.

What are the market trends shaping the Industrial Safety Gloves Industry?

- The launch of new products is currently a significant market trend. It reflects the dynamic nature of businesses continually innovating to meet consumer demands.

- The industrial manufacturing sector's growth, fueled by infrastructure development and favorable policies, has led to an increased demand for hand protection solutions. Workers in industries such as construction, healthcare, food, pharmaceuticals, automotive, and engineering handle hazardous materials and operate machinery, necessitating the use of gloves for cut resistance and skin safety. Companies like Globus Group continue to innovate, introducing new products to cater to diverse industries.

- For example, Protective Industrial Products Inc. Launched the MaxiCut Ultra Gloves in May 2024, offering cut protection and skin safety without silicone, Oeko-Tex certification, and dermatological accreditation. These gloves adhere to stringent safety standards, ensuring optimal performance in various industrial applications.

What challenges does the Industrial Safety Gloves Industry face during its growth?

- The volatility in the pricing of raw materials poses a significant challenge to the growth of the industry.

- Industrial safety gloves are essential for material handling in various industries, including oil & gas. These gloves are primarily manufactured using natural and synthetic rubber, with latex being the most common base material. Synthetic latex is produced through rubber processing, while natural latex is sourced directly from the rubber tree. The availability of natural latex varies globally, impacting production capacities and prices. For instance, natural rubber gloves' prices are influenced by geographical and environmental conditions, making them less price competitive. Synthetic latex gloves, on the other hand, undergo price volatility due to the demand-supply gap of rubber. Nitrile and PVC are other materials used in the production of safety gloves for enhanced grip and resistance to chemicals.

- Safety training is crucial in ensuring the correct usage of these gloves to optimize their effectiveness in occupational safety. Reusable gloves, such as cotton and synthetic leather, are gaining popularity due to their cost-effectiveness and durability. Grip enhancement technologies continue to evolve, providing better protection and comfort for workers.

Exclusive Customer Landscape

The industrial safety gloves market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the industrial safety gloves market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, industrial safety gloves market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - This company specializes in providing industrial safety gloves, including comfort grip and high performance options, ensuring worker safety and productivity. Our product range caters to various industries and applications, prioritizing durability, dexterity, and grip. Comfort grip gloves offer an ergonomic design for enhanced hand comfort and reduced fatigue, while high performance gloves provide superior protection against chemicals, heat, and cuts. By investing in our gloves, businesses can mitigate risks, boost employee morale, and maintain operational efficiency.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Ansell Ltd.

- Atlas Protective Products

- Delta Plus Group

- Globus Shetland Ltd.

- Hartalega Holdings Berhad

- Hase Safety Gloves GmbH

- Honeywell International Inc.

- Industrial Safety Products Pvt. Ltd.

- Kossan Rubber Industries Bhd

- Midas Safety Inc.

- Radians Inc.

- Riverstone Holdings Ltd.

- Schweitzer Mauduit International Inc.

- Semperit AG Holding

- Showa International BV

- The Glove Co.

- Top Glove Corp. Bhd

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Industrial Safety Gloves Market

- In January 2023, Ansell Limited, a leading global provider of protective solutions, launched a new range of industrial safety gloves, the 'HyFlex 2.0', featuring enhanced grip and cut resistance properties (Ansell Press Release). In March 2023, DuPont and 3M, two major players in the market, announced a strategic collaboration to jointly develop and commercialize next-generation protective gloves using DuPont's Kevlar fiber technology (DuPont Press Release). In May 2024, MSA Safety, a leading safety equipment manufacturer, acquired Safeskin, a South African industrial safety gloves producer, expanding its global footprint and strengthening its product offerings (MSA Safety Press Release). In October 2024, the European Union's REACH regulation imposed stricter guidelines on the use of certain chemicals in safety gloves, driving the market towards the adoption of alternative materials (European Chemicals Agency Press Release).

Research Analyst Overview

- The market encompasses a wide range of products designed to protect hands from various hazards in diverse industries. Key features driving market growth include anti-static properties, wearable sensors, data logging, and smart gloves. Protective coatings, reinforced stitching, and durable construction ensure hand safety in robotic applications and extreme temperatures. Wrist closure, improved tactility, and moisture management enhance user comfort. Oil resistance, puncture resistant inserts, and hand hygiene are essential for industries handling chemicals and food products. Skin protection is crucial in industries with solvent exposure, while flame retardant fabrics and cut resistant fibers safeguard against fire and cutting hazards.

- Ergonomic design, grip enhancements, and extended cuffs cater to various user needs. Advanced materials, such as breathability membranes, abrasion resistant coatings, and biodegradable gloves, contribute to the market's innovation. RFID tagging and recyclable materials offer increased efficiency and sustainability. The integration of antimicrobial technology, gloves for automation, and gloves for industries further expands the market's scope. Overall, the market continues to evolve, addressing the unique needs of various industries with high-performance, customizable, and technologically advanced solutions.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Industrial Safety Gloves Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

233 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.9% |

|

Market growth 2025-2029 |

USD 3195.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.6 |

|

Key countries |

US, China, Germany, Japan, UK, Canada, India, South Korea, Australia, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Industrial Safety Gloves Market Research and Growth Report?

- CAGR of the Industrial Safety Gloves industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the industrial safety gloves market growth of industry companies

We can help! Our analysts can customize this industrial safety gloves market research report to meet your requirements.