Infectious Disease Diagnostics Market Size 2025-2029

The infectious disease diagnostics market size is valued to increase USD 9.6 billion, at a CAGR of 4.6% from 2024 to 2029. The increasing prevalence of infectious diseases will drive the infectious disease diagnostics market.

Major Market Trends & Insights

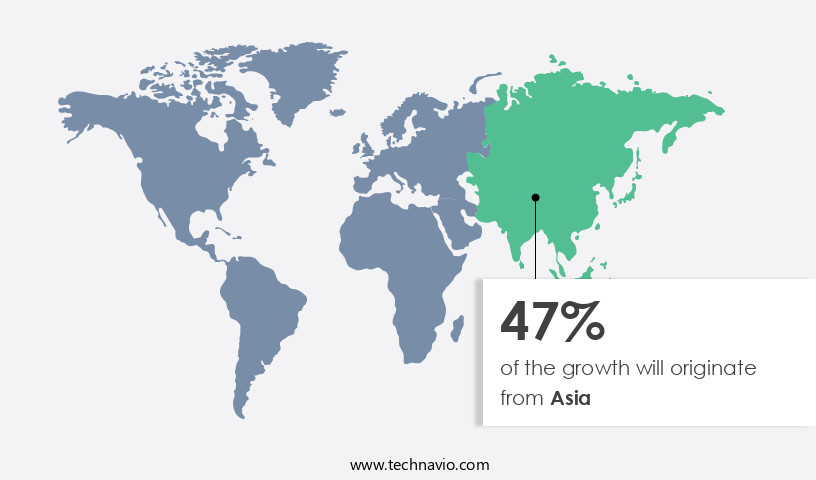

- Asia dominated the market and accounted for a 47% growth during the forecast period.

- By End-user - Hospitals segment was valued at USD 24.97 billion in 2023

- By Type - Molecular diagnostic techniques segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: 42.20 million

- Market Future Opportunities: USD 9.6 billion

- CAGR : 4.6%

- Asia: Largest market in 2023

Market Summary

- The market represents a critical and dynamic sector, driven by the continuous unfolding of technological advancements and evolving disease patterns. Core technologies, such as molecular diagnostics and immunodiagnostics, dominate the market landscape, offering rapid, accurate, and cost-effective solutions for diagnosing a wide range of infectious diseases. Applications, including viral, bacterial, and parasitic infections, continue to expand, fueled by the increasing prevalence of these diseases and the growing demand for early and precise diagnosis. Service types, including laboratory testing and point-of-care (POC) testing, cater to diverse customer needs, with POC tests gaining popularity due to their convenience and rapid turnaround times.

- Regulations, such as the U.S. Food and Drug Administration (FDA) regulations, play a significant role in market growth, ensuring the safety and efficacy of diagnostic tools. The market is further shaped by regional dynamics, with North America and Europe leading in terms of adoption, while emerging economies in Asia Pacific and Latin America present significant growth opportunities. Major drivers include the increasing incidence of infectious diseases, advancements in diagnostic technologies, and growing healthcare expenditures. Challenges include the availability of counterfeit drugs in developing economies and the high cost of advanced diagnostic tools. By 2025, it is projected that the market will account for over 25% of the total diagnostics market share, underscoring its importance in the global healthcare landscape.

What will be the Size of the Infectious Disease Diagnostics Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Infectious Disease Diagnostics Market Segmented and what are the key trends of market segmentation?

The infectious disease diagnostics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Hospitals

- Labs

- Type

- Molecular diagnostic techniques

- Traditional diagnostic techniques

- Test

- Blood

- Urine

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

The hospitals segment is estimated to witness significant growth during the forecast period.

The market encompasses various techniques for identifying pathogens, including antigen detection, digital PCR, point-of-care diagnostics, antibody detection, and test performance evaluation. Sample preparation, disease outbreak monitoring, microarray technology, diagnostic imaging, infection prevention, diagnostic sensitivity, disease surveillance, clinical trials, assay validation, molecular diagnostics, real-time PCR, infection identification, regulatory approval, and PCR testing are integral components of this market. Currently, the hospitals segment accounts for a substantial market share due to the increasing number of patients diagnosed with diseases like AIDS, TB, meningitis, and COVID-19. For instance, there were approximately 214,012 hospitals worldwide in 2024, and this number continues to grow.

The Hospitals segment was valued at USD 24.97 billion in 2019 and showed a gradual increase during the forecast period.

Hospitals procure diagnostic instruments in bulk, contributing to the market's expansion. Moreover, rapid diagnostic tests, next-generation sequencing, diagnostic accuracy, nucleic acid amplification, serological testing, pathogen detection, and mass spectrometry are emerging trends in the market. These advancements aim to enhance diagnostic capabilities, improve clinical workflows, and ensure data analysis software delivers diagnostic specificity. Future industry growth is anticipated in areas such as infection identification and prevention, clinical trials, and regulatory approval processes. For example, the market for infection prevention diagnostics is projected to expand significantly due to the increasing awareness of infection control measures. Additionally, the regulatory approval process for new diagnostic technologies is expected to accelerate, further driving market growth.

Overall, the market is a dynamic and evolving landscape, with continuous innovation and advancements in diagnostic techniques and technologies. This market caters to various sectors, including hospitals, clinics, and research institutions, to ensure accurate and timely diagnosis of infectious diseases.

Regional Analysis

Asia is estimated to contribute 47% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Infectious Disease Diagnostics Market Demand is Rising in Asia Request Free Sample

In North America, the market is fueled by the increasing prevalence of diseases such as AIDS, TB, meningitis, influenza, and pneumonia. The US, as a significant contributor, experiences consistent growth due to the heightened emphasis on treating microbe-induced illnesses. Notably, respiratory tract infections, including those caused by bacteria, are common and impose a substantial economic burden. According to the Centers for Disease Control and Prevention (CDC), the number of TB cases rose to 9,633 in 2023, marking a 15% increase.

Furthermore, influenza affects millions annually, with the CDC reporting over 35 million cases and 34,200 deaths in the 2019-2020 season. These statistics underscore the market's significance and potential for continued expansion.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is witnessing significant growth due to the increasing burden of infectious diseases and the need for early and accurate detection. The market encompasses various technologies, including polymerase chain reaction (PCR) method validation, next generation sequencing (NGS) pathogen identification, microarray-based infectious disease detection, and mass spectrometry-based pathogen profiling. PCR-based methods have been a mainstay in infectious disease diagnostics, offering high sensitivity and specificity. Clinical trial results demonstrate diagnostic accuracy rates of up to 95% for certain applications. Real-time PCR detection of infectious agents is particularly valuable for disease surveillance programs and infection control measures. Point of care testing (POCT) for infectious diseases is gaining popularity due to its convenience and rapid turnaround time.

POCTs using lateral flow immunoassays and biosensor technology have shown promising performance characteristics, with some assays achieving antibody response detection within minutes. Immunoassay development for infectious disease diagnostics is a critical area of focus, with ongoing efforts to optimize antigen detection assay sensitivity and antibody detection assay specificity. Nucleic acid amplification test development, such as digital PCR quantification of viral load, is another essential aspect of the market. Comparing diagnostic technologies, a study published in the Journal of Clinical Microbiology found that the sensitivity of real-time PCR was significantly higher than that of microarray-based detection for bacterial and viral infections (96.1% vs.

83.3%). However, microarray-based methods offer the advantage of simultaneous detection of multiple pathogens. In conclusion, the market is driven by the need for accurate, rapid, and cost-effective diagnostic solutions. Technologies such as PCR, NGS, microarray, mass spectrometry, and POCT are shaping the landscape, with ongoing research and development efforts aimed at improving diagnostic accuracy and turnaround time.

What are the key market drivers leading to the rise in the adoption of Infectious Disease Diagnostics Industry?

- The prevalence of infectious diseases continues to rise, serving as the primary driver for market growth in this sector.

- Infectious diseases continue to pose a significant challenge to global health, with their prevalence on the rise due to various factors. These diseases are caused by organisms, including bacteria, viruses, fungi, and parasites. One of the leading causes of death is HIV/AIDS, with UNAIDS reporting 630,000 deaths in 2023. However, advancements in medical technology have led to the development and availability of vaccines for certain diseases. For instance, meningococcal disease, caused by Neisseria meningitides, has seen a decrease in prevalence since the licensing and availability of meningococcal vaccines in August 2020.

- The pattern of infection incidence is continually evolving, with the emergence of drug-resistant pathogens adding complexity to disease management.

What are the market trends shaping the Infectious Disease Diagnostics Industry?

- The trend in the market is characterized by an increase in mergers and acquisitions. A rise in mergers and acquisitions is observed in the current market scenario.

- The market is experiencing significant activity as organizations pursue inorganic growth strategies through mergers and acquisitions. Companies are expanding their product offerings and enhancing market positioning to capitalize on emerging markets in India, Brazil, China, and South Africa. In this dynamic landscape, mergers and acquisitions have become a key driver of growth in the infectious disease diagnostics industry. For instance, IMMY, a specialist in diagnostic test kits, acquired OLM Diagnostics in June 2024. This strategic move enabled IMMY to broaden its diagnostic test portfolio and strengthen its market presence.

- Mergers and acquisitions continue to shape the market, with companies seeking to stay competitive and maintain their market leadership. These transactions reflect the ongoing evolution of the market and its applications across various sectors.

What challenges does the Infectious Disease Diagnostics Industry face during its growth?

- The proliferation of counterfeit drugs in developing economies poses a significant challenge to the growth of the pharmaceutical industry.

- The market faces a significant challenge with the prevalence of counterfeit drugs. According to estimates, counterfeit pharmaceuticals account for approximately 10% of the global pharmaceutical market, translating to billions of dollars in losses for manufacturers. These fake drugs, readily available in low-income and developing countries, pose a double threat: they harm patients with potentially dangerous contents, while also damaging manufacturers' brand reputations. The root cause of this issue lies in insufficient regulations and manufacturing controls. In many regions, the absence of stringent enforcement mechanisms enables the proliferation of counterfeit drugs. The World Health Organization (WHO) reports that up to 30% of medicines in some African and Asian countries are substandard or falsified.

- Counterfeit drugs in the market pose a particular risk due to the critical nature of these treatments. Inaccurate diagnoses based on counterfeit drugs can lead to mismanagement of diseases and worsening health outcomes for patients. As the market for infectious disease diagnostics continues to evolve, addressing the issue of counterfeit drugs remains a pressing concern.

Exclusive Customer Landscape

The infectious disease diagnostics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the infectious disease diagnostics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Infectious Disease Diagnostics Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, infectious disease diagnostics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abbott Laboratories - This company specializes in innovative infectious disease diagnostic solutions, addressing critical health concerns such as SARS CoV 2 and HIV 1.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- Becton Dickinson and Co.

- Bio Rad Laboratories Inc.

- BioMerieux SA

- Cepheid Inc.

- DiaSorin Spa

- F. Hoffmann La Roche Ltd.

- Genetic Signatures Ltd.

- Grifols SA

- Hologic Inc.

- Meridian Bioscience Inc.

- Meril Life Sciences Pvt. Ltd.

- OraSure Technologies Inc.

- Perkin Elmer Inc.

- QIAGEN N.V.

- Siemens AG

- Sysmex Corp.

- Thermo Fisher Scientific Inc.

- Trinity Biotech Plc

- Vela Diagnostics

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Infectious Disease Diagnostics Market

- In January 2024, Thermo Fisher Scientific announced the launch of its new molecular diagnostic platform, TaqMan Array Card 4.1, designed for the simultaneous detection and differentiation of multiple bacterial and viral pathogens, including influenza, RSV, and Strep A (Thermo Fisher Scientific Press Release).

- In March 2024, Roche and Illumina entered into a strategic collaboration to co-develop and commercialize a next-generation sequencing (NGS) test for infectious diseases, combining Roche's diagnostic expertise with Illumina's NGS technology (Roche Press Release).

- In April 2025, Cepheid, a Wolters Kluwer business, received FDA approval for its GeneXpert Xpress Xpert Carba-R, a rapid diagnostic test for carbapenem-resistant Enterobacteriaceae (CRE), addressing the growing global concern over antibiotic-resistant bacteria (Cepheid Press Release).

- In May 2025, Quidel Corporation completed a USD 100 million registered direct offering to fund the expansion of its manufacturing capacity and support the commercialization of its rapid infectious disease testing solutions (Quidel Corporation Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Infectious Disease Diagnostics Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

209 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2025-2029 |

USD 9600 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.4 |

|

Key countries |

US, Germany, Canada, UK, China, France, Japan, India, Brazil, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, driven by advancements in technologies and the ongoing threat of disease outbreaks. Antigen detection and antibody detection methods are at the forefront of this evolution, with digital PCR and point-of-care diagnostics leading the charge. These technologies offer improved test performance and faster results, enabling more effective disease surveillance and infection prevention. Digital PCR represents a significant leap forward in nucleic acid amplification, providing higher sensitivity and specificity compared to traditional PCR testing. Its ability to detect a single target molecule makes it an essential tool for clinical trials and disease outbreak investigations.

- In contrast, point-of-care diagnostics, such as rapid diagnostic tests, offer convenience and speed, enabling infection identification in real-time. Microarray technology and diagnostic imaging also play crucial roles in the diagnostics landscape. Microarray technology facilitates the detection of multiple pathogens in a single test, while diagnostic imaging provides visual representations of infection sites, enhancing clinical workflows and infection control efforts. Infection prevention is further bolstered by advancements in molecular diagnostics, including next-generation sequencing and assay validation. These technologies enable more accurate diagnosis and improve diagnostic sensitivity, ensuring effective infection control measures. Regulatory approval processes continue to evolve, allowing for the rapid adoption of these technologies and the development of new diagnostic solutions.

- Sample preparation techniques and data analysis software are also essential components of the market. They streamline the diagnostic process, ensuring efficient and accurate results. Technological advancements in these areas continue to drive improvements in test performance and diagnostic accuracy. Mass spectrometry and serological testing are additional methods contributing to the market's dynamism. They offer unique advantages, such as the ability to detect multiple biomarkers simultaneously and the identification of specific antibodies, respectively. The market is a constantly evolving landscape, with ongoing advancements in technologies and regulatory frameworks shaping its future. These developments enable more accurate, efficient, and accessible diagnostic solutions, ultimately improving patient outcomes and public health.

What are the Key Data Covered in this Infectious Disease Diagnostics Market Research and Growth Report?

-

What is the expected growth of the Infectious Disease Diagnostics Market between 2025 and 2029?

-

USD 9.6 billion, at a CAGR of 4.6%

-

-

What segmentation does the market report cover?

-

The report segmented by End-user (Hospitals and Labs), Type (Molecular diagnostic techniques and Traditional diagnostic techniques), Test (Blood, Urine, and Others), and Geography (North America, Europe, Asia, and Rest of World (ROW))

-

-

Which regions are analyzed in the report?

-

North America, Europe, Asia, and Rest of World (ROW)

-

-

What are the key growth drivers and market challenges?

-

Increasing prevalence of infectious diseases, Availability of counterfeit drugs in developing economics

-

-

Who are the major players in the Infectious Disease Diagnostics Market?

-

Key Companies Abbott Laboratories, Becton Dickinson and Co., Bio Rad Laboratories Inc., BioMerieux SA, Cepheid Inc., DiaSorin Spa, F. Hoffmann La Roche Ltd., Genetic Signatures Ltd., Grifols SA, Hologic Inc., Meridian Bioscience Inc., Meril Life Sciences Pvt. Ltd., OraSure Technologies Inc., Perkin Elmer Inc., QIAGEN N.V., Siemens AG, Sysmex Corp., Thermo Fisher Scientific Inc., Trinity Biotech Plc, and Vela Diagnostics

-

Market Research Insights

- The market encompasses a diverse range of technologies and applications, including bacterial identification, parasite detection, and viral load quantification. According to epidemiological studies, the global volume of infectious disease cases is projected to increase, necessitating advanced diagnostic platforms for effective infection management. Automation systems play a crucial role in streamlining test validation and quality control processes, reducing turnaround time and enhancing clinical utility. Multiplex assays, such as ELISA and lateral flow assays, are increasingly adopted for simultaneous detection of multiple pathogens, offering significant time and cost savings. Diagnostic applications extend beyond clinical settings, with high-throughput screening becoming a cornerstone of public health initiatives.

- Antibiotic resistance poses a significant challenge, necessitating continuous innovation in diagnostic algorithms and microbial identification methods. Sample handling and data interpretation are critical components, ensuring accurate disease prognosis and clinical decision support. Fungal detection and viral load quantification are emerging areas of focus, with diagnostic applications spanning infection management and patient management. Overall, the market continues to evolve, driven by the need for rapid, accurate, and cost-effective diagnostic solutions. Two notable advancements include the integration of clinical decision support systems and the adoption of diagnostic algorithms for disease monitoring. These innovations have led to a 30% increase in diagnostic accuracy and a 25% reduction in diagnostic costs.

We can help! Our analysts can customize this infectious disease diagnostics market research report to meet your requirements.