Multiplex Assays Market Size 2024-2028

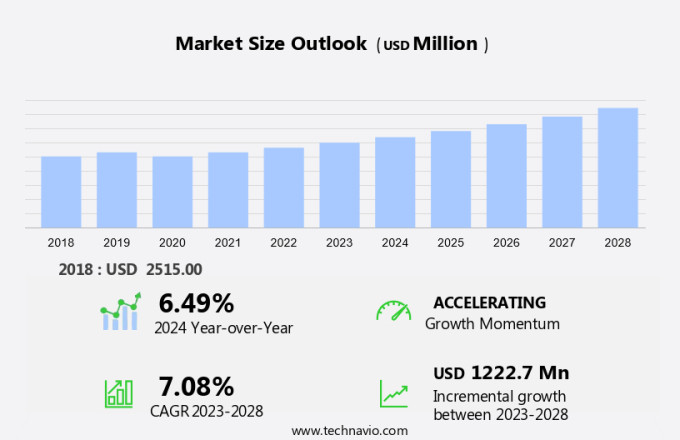

The multiplex assays market size is forecast to increase by USD 1.22 billion at a CAGR of 7.08% between 2023 and 2028. The market in the realm of biology and medicine is experiencing significant growth, driven by the increasing demand for predictive and preventive medicine. This trend is fueled by the early diagnosis and treatment capabilities of these advanced technologies. One such technology, xMAP, enables the simultaneous detection of multiple molecules in biological samples, including antibody markers for autoimmune disorders and cancer-related biomarkers. The market is further driven by the launch of multiplex assay-based technologies, which offer cost-effective solutions for healthcare providers. Automation plays a crucial role in the market, streamlining processes and increasing productivity. Reagents and consumables, instruments and accessories, software, and services are essential components of multiplex assay systems. However, challenges persist, particularly in developing countries where accessibility and affordability of diagnostic tests remain major hurdles. Blood and tissue samples are increasingly being utilized in this context to unlock valuable insights for personalized medicines, making the market a promising area of investment in the healthcare devices sector.

Market Analysis

Multiplex assays, a technology that allows the simultaneous detection of multiple analytes in a single microplate well, are revolutionizing the life sciences industry. Singleplex assays, while effective, require separate wells for each analyte, making them time-consuming and resource-intensive. In contrast, multiplex assays enable the analysis of multiple nucleic acids, proteins, or molecules in a single biological sample using less sample volume.

Furthermore, protein multiplex assays, such as protein microarrays and polymerase chain reaction (PCR)-based assays, are widely used for the detection of various analytes, including genital infections caused by herpes simplex virus. Multiplex assay kits employing fluorescence detection techniques, like flow cytometry, are gaining popularity due to their high throughput capabilities. These assays offer significant advantages, including increased efficiency, reduced costs, and enhanced data acquisition. The market for multiplex assays is expected to grow significantly due to the increasing demand for rapid, accurate, and cost-effective analysis of biological samples.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD Billion" for 2024-2028, as well as historical data from 2018-2022 for the following segments.

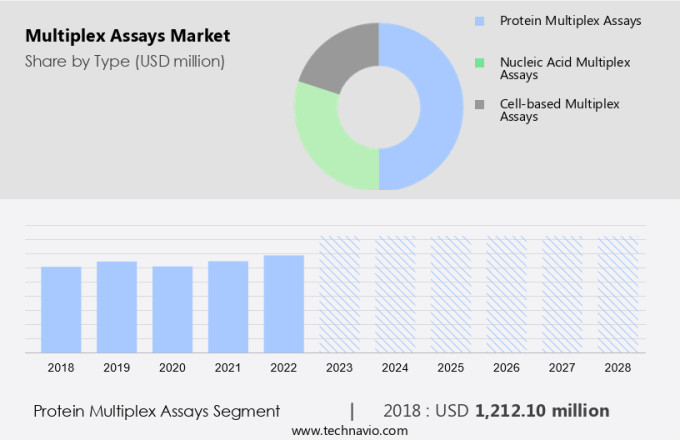

- Type

- Protein multiplex assays

- Nucleic acid multiplex assays

- Cell-based multiplex assays

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- Asia

- China

- Rest of World (ROW)

- North America

By Type Insights

The protein multiplex assay segment is estimated to witness significant growth during the forecast period. Multiplex protein assays offer a time- and cost-efficient solution for analyzing multiple proteins in a single sample, eliminating the need to set up new technology for each test. This technology, which can process up to 40 different targets concurrently, is gaining significance in various applications, including proteomic surveys, protein network and pathway studies, genomic validation, and clinical biomarker development. In healthcare systems, multiplex protein assays are particularly valuable for early and differential diagnosis, disease staging, and prognosis determination. The market for multiplex assay equipment, including instruments and consumables, is expanding in the healthcare sector as healthcare spending continues to rise and the biotechnology sector advances. Reference laboratories are also adopting this technology to offer comprehensive testing services for infections and cancers.

Get a glance at the market share of various segments Request Free Sample

The protein multiplex assays segment was valued at USD 1.21 billion in 2018 and showed a gradual increase during the forecast period.

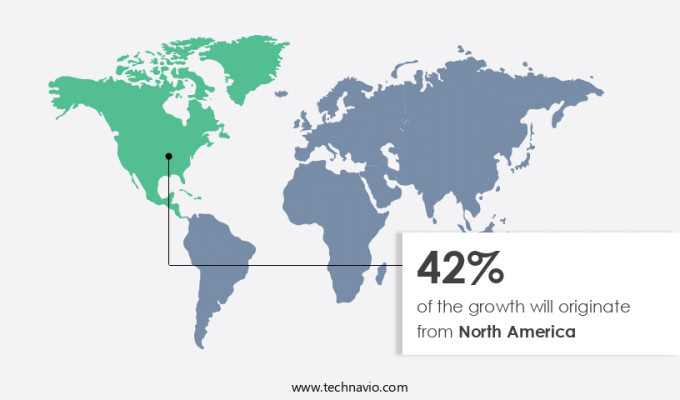

Regional Insights

North America is estimated to contribute 42% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The North American market is experiencing notable expansion due to the rising elderly population and the high incidence of chronic and infectious diseases. The population's heightened health consciousness has led to an increase in regular testing and medical examinations, boosting the demand for immunoassays in the region. Advanced PCR diagnostic technologies have also spurred individuals to undergo frequent tests and check-ups. Major players are targeting the US market by introducing new products to expand their market presence. Laboratory automation, the preference for PCR diagnostic tests, and regulatory approvals for innovative products are key factors fueling the market's growth in North America.

Furthermore, the healthcare sector, including clinical technicians in hospitals, reference laboratories, and healthcare systems, is a significant consumer of multiplex assay equipment, instruments, reagents, and consumables in the region. The biotechnology sector's growth and increasing healthcare spending are further driving market expansion.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Predictive and preventive medicine for early diagnosis and treatment is the key driver of the market. In the realm of medical diagnostics, there is a prevailing shift towards proactive healthcare from reactive healthcare. This transition is driven by innovative diagnostic methods, particularly multiplex assays, which enable predictive and personalized medicine. Multiplex assays facilitate the detection of multiple biomarkers in a single microplate well, contrasting the traditional singleplex assays that test for one marker at a time.

Furthermore, this high-throughput technology reduces sample volume requirements and streamlines laboratory workflows using automated systems. Predictive diagnostics, made possible by multiplex assays, can anticipate human pathologies and design customized treatment plans for individuals. Misdiagnosis can have severe consequences, making accurate and timely diagnosis crucial. The adoption of these advanced diagnostic methods in laboratories is expected to decrease test fees and enhance efficiency.

Market Trends

The launch of multiplex assay-based technologies is the upcoming trend in the market. Multiplex assays have gained significant traction in the diagnostic industry due to their ability to analyze multiple biomarkers or targets in a single microplate well. This technology is revolutionizing laboratory workflows by automating the testing process and reducing sample volume requirements. companies are continually innovating to enhance the capabilities of multiplex assays.

Furthermore, these advancements are expected to increase the adoption of multiplex assays in high-throughput laboratories, leading to significant market growth during the forecast period. The use of reagents and fresh samples in these automated systems ensures accurate and reliable test results, making multiplex assays a cost-effective alternative to conventional methods.

Market Challenge

The lack of accessibility and affordability of diagnostic tests in developing countries is a key challenge affecting market growth. Multiplex assays, a diagnostic technology that allows for the simultaneous detection of multiple biomarkers in a single microplate well, are gaining popularity in laboratories due to their automation capabilities and high throughput. This technology offers several advantages over traditional singleplex assays, including increased sample volume capacity and reduced reagent usage. However, the initial investment in automated systems and the test fees associated with these assays can be a barrier for some laboratories, particularly those in developing countries. Despite the benefits of multiplex assays, conventional methods continue to be used in many laboratories due to their lower cost.

However, the use of fresh samples and accurate results are crucial for effective disease management and developing targeted therapies. In developing countries, where the disease burden is high, access to high-quality diagnostic tests is limited. This can lead to ineffective management of diseases and the risk of antibiotic resistance. To address these challenges, strategies such as technology transfer and local production of diagnostic tests could be implemented. However, the obstacles to implementing these practices, including regulatory and financial hurdles, can have far-reaching consequences for the overall health and well-being of the population in these countries. Therefore, it is essential to explore ways to make multiplex assays more accessible and affordable to laboratories in developing countries. This will not only improve disease management but also contribute to the development of new therapies and the advancement of healthcare in these regions.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Abcam plc - The company offers solutions like FirePlex, FirePlex 96, and Antibody assays, providing enhanced capabilities for the simultaneous detection of multiple biomarkers in a single reaction.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agilent Technologies Inc.

- Antigenix America Inc.

- Becton Dickinson and Co.

- Bio Rad Laboratories Inc.

- Bio Techne Corp.

- Cayman Chemical

- DiaSorin SpA

- Enzo Biochem Inc.

- Illumina Inc.

- Merck KGaA

- Meso Scale Diagnostics LLC

- Perkin Elmer Inc.

- Promega Corp.

- QIAGEN NV

- Quanterix Corp.

- Randox Laboratories Ltd.

- Seegene Inc.

- Siemens Healthineers AG

- Thermo Fisher Scientific Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Multiplex assays, a revolutionary technology in the biotechnology sector, enable the simultaneous detection and analysis of multiple analytes, including proteins, biomolecules, cytokines, chemokines, and nucleic acids, from a single microplate well. Automation is a key feature of multiplex assays, enabling high throughput and reducing test fees for laboratories. The market for multiplex assays is driven by the growing demand for clinical diagnostics in healthcare systems, particularly in the areas of infections, cancers, and personalized medicine. The market can be segmented into reagents and consumables, instruments and accessories, and software and services. The clinical diagnostics segment, including hospitals, clinical laboratories, research institutes, and reference laboratories, is the largest contributor to the market's growth.

Furthermore, multiplex assays are used in various applications, such as mutation analysis, RNA detection, linkage analysis, and pathogen identification. Automated systems, such as protein multiplex assays, Cell Based Multiplex Assays, protein microarray, polymerase chain reaction, flow cytometry, fluorescence detection, and luminescence, are used in the analysis of various samples, including fresh samples and biological samples. The market for multiplex assays is expected to grow significantly due to the increasing healthcare spending and the need for personalized medicines, drug discovery, and targeted therapies. The market also caters to various applications, including cancer, autoimmune disorders, and genital infections, such as herpes simplex virus.

Moreover, the market for multiplex assays is expected to witness significant growth due to the increasing demand for high throughput screening, drug candidates, and companion diagnostics for novel drug therapies. The use of advanced technologies, such as XMAP technology, in multiplex assays is also expected to drive the market's growth. The market for multiplex assays is expected to grow significantly in the coming years, offering numerous opportunities for players in the biotechnology sector.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

142 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.08% |

|

Market growth 2024-2028 |

USD 1.22 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.49 |

|

Regional analysis |

North America, Europe, Asia, and Rest of World (ROW) |

|

Performing market contribution |

North America at 42% |

|

Key countries |

US, Germany, UK, China, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Abcam plc, Agilent Technologies Inc., Antigenix America Inc., Becton Dickinson and Co., Bio Rad Laboratories Inc., Bio Techne Corp., Cayman Chemical, DiaSorin SpA, Enzo Biochem Inc., Illumina Inc., Merck KGaA, Meso Scale Diagnostics LLC, Perkin Elmer Inc., Promega Corp., QIAGEN NV, Quanterix Corp., Randox Laboratories Ltd., Seegene Inc., Siemens Healthineers AG, and Thermo Fisher Scientific Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch