Infrared Thermometers Market Size 2024-2028

The infrared thermometers market size is forecast to increase by USD 1.05 billion at a CAGR of 18.05% between 2023 and 2028. The market is experiencing significant growth due to the increasing prevalence of infectious diseases such as malaria and dengue. These thermometers offer the advantage of non-contact measurement, making them ideal for screening large populations with minimal contact. The market is also driven by the increasing demand from airports for passenger' temperature screening. However, the high cost of infrared thermometers may limit their adoption in some sectors. Multifunction infrared thermometers, which can measure temperature at both the ear and forehead, are gaining popularity due to their versatility and convenience. Overall, the market is expected to grow steadily due to these factors and the ongoing need for accurate and efficient temperature measurements.

Market Analysis

The infrared thermometers market is experiencing significant growth, driven by health safety concerns and the need for accurate temperature measurements in both developed and emerging countries. Non-contact thermometers, such as forehead and multifunction thermometers, are particularly popular in hospital and retail pharmacies for their ease of use and rapid results. These thermometers utilize advanced sensors, making them a safer alternative to traditional mercury thermometers. Their applications extend beyond health, measuring land temperature and monitoring industrial environments, including bearing cap temperatures, motor winding temperatures, and process piping temperatures.

As the demand for eco-friendly products increases, manufacturers are focusing on developing sustainable thermometric solutions. This versatile technology is essential for ensuring safety and efficiency across various sectors, enhancing overall public health and industrial performance. In both hospital and retail pharmacies, measurement points like forehead thermometers play a crucial role in quickly assessing patient temperatures and ensuring accurate health monitoring.

Market Segmentation

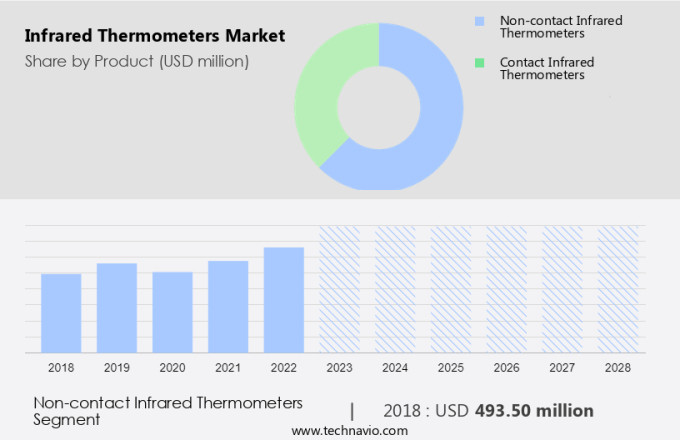

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Non-contact infrared thermometers

- Contact infrared thermometers

- Type

- Handled thermometer

- Fixed-mount thermometer

- Geography

- North America

- US

- Europe

- Germany

- France

- Asia

- China

- Japan

- Rest of World (ROW)

- North America

By Product Insights

The non-contact infrared thermometers segment is estimated to witness significant growth during the forecast period. Infrared thermometers, which utilize non-contact technology to measure temperature through electromagnetic radiation, are experiencing significant growth in the global market. Infrared thermometers are used in various applications, including medical and veterinary settings, hospital and retail pharmacies, online stores, and dairy protein-based product manufacturing. In the healthcare sector, they are particularly useful for taking temperature readings in hospitals and clinics, where non-invasive and contactless methods are preferred.

Moreover, in the industrial sector, they are used for temperature monitoring in manufacturing processes and quality control. Ear thermometers, a popular type of infrared thermometer, are widely used in both medical and consumer applications. They offer the convenience of being easy to use and provide quick and accurate temperature readings. The market is expected to witness substantial growth during the forecast period, driven by the increasing demand for non-contact temperature measurement solutions. Distribution channels, such as hospital pharmacies, retail pharmacies, and online stores, play a crucial role in the growth of the market. These channels provide easy access to consumers and healthcare professionals, enabling them to purchase these devices for various applications.

Get a glance at the market share of various segments Request Free Sample

The non-contact infrared thermometers segment was valued at USD 493.50 million in 2018 and showed a gradual increase during the forecast period.

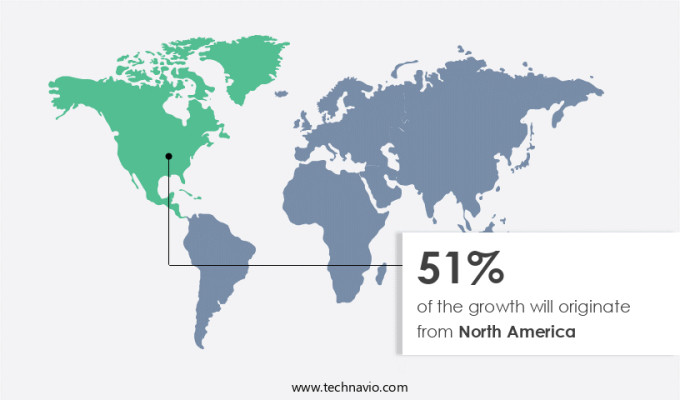

Regional Insights

North America is estimated to contribute 51% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in North America is a significant contributor to the global market, with the US and Canada being the major revenue generators. In 2023, this region is anticipated to expand at a steady pace. The increasing prevalence of chronic health conditions, a rising number of product launches, and the presence of both domestic and international players, including Fluke, Thermo Fisher Scientific, and PositiveID, are driving market growth in North America. In the healthcare sector, infrared thermometers are gaining popularity in hospitals and retail pharmacies, as well as online stores. Additionally, the industrial sector is witnessing an increasing demand for infrared thermometers due to their applications in various industries, such as chemical, oil and gas, automotive, and metals and mining.

In addition, in the medical field, infrared thermometers are used for measuring body temperature in humans and animals, while in the veterinary sector, they are used for animals' temperature monitoring. Infrared thermometers are also utilized in dairy protein-based product manufacturing for temperature monitoring. Ear thermometers, a type of infrared thermometer, are widely used due to their convenience and accuracy. Distribution channels, including hospital pharmacies, retail pharmacies, and online stores, are essential for the growth of the market.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The increasing prevalence of contagious and chronic diseases is the key driver of the market. Infrared thermometers have gained significant importance in the current healthcare landscape due to the increasing prevalence of infectious diseases, such as malaria, dengue, and the ongoing COVID-19 pandemic. These non-contact temperature measurement tools have become essential in identifying individuals with fever, a common symptom of various infectious diseases, including COVID-19.

Also, the World Health Organization (WHO) declared COVID-19 a pandemic in March 2020, leading to a growth in demand for infrared thermometers as they enable temperature measurement without physical contact, thereby reducing the risk of disease transmission. Countries like China and Italy, which were severely affected by the pandemic, experienced a shortage of medical facilities, further increasing the demand for these devices. Infrared thermometers offer versatility, as they can be used on various measurement points, including the forehead and ear, making them a multifunctional solution for temperature monitoring in both healthcare settings and homes.

Market Trends

The increasing demand from airports for passengers screening is the upcoming trend in the market. In the current scenario, the escalating number of infectious diseases such as malaria and dengue, along with the recent outbreak of COVID-19, has brought about a significant shift in airport terminal procedures. The airline industry stakeholders are grappling with the challenges of managing increased passenger traffic while maintaining stringent security protocols and minimizing capacity constraints. In response to these concerns, non-contact infrared thermometers have emerged as a preferred solution for measuring body temperature at various checkpoints.

Also, these thermometers, which can be used on the forehead or ear without physical contact, offer a more hygienic and efficient alternative to traditional methods. The multifunctional nature of these devices, which can also be used for other temperature measurement points, adds to their appeal. The implementation of these thermometers at airports is a proactive measure to safeguard public health and mitigate the negative impact of infectious diseases on airport operations and profitability.

Market Challenge

The high cost of infrared thermometers is a key challenge affecting the market growth. The global market for infrared thermometers is experiencing significant growth, driven by their non-contact functionality and ability to measure body temperature quickly and accurately, especially in the context of infectious diseases such as malaria and dengue.

However, the high cost of these devices remains a barrier to entry for many consumers, particularly in price-sensitive markets. Advanced features like multifunctionality, measurement points on the ear or forehead, and non-contact technology contribute to the increased cost. Despite these challenges, the demand for infrared thermometers is expected to continue growing due to their precision and convenience. In developed countries, the adoption of smart and connected infrared thermometers is increasing, but their high cost remains a limiting factor in high-end applications. Infrared thermometers are essential medical devices used extensively in home care settings and hospitals for temperature measurement.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Baxter International Inc. - The company provides infrared thermometers, including the BIO IRB153 model, for temperature measurement applications.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bioseb SAS

- BPL MEDICAL TECHNOLOGIES Pvt. Ltd.

- Cardinal Health Inc.

- Citizen Watch Co. Ltd.

- Contec Medical Systems Co. Ltd.

- Exergen Corp.

- Fluke Corp.

- Geratherm Medical AG

- Helen of Troy Ltd.

- HORIBA Ltd.

- Microlife Corp.

- OMRON Corp.

- Optris GmbH

- Paul Hartmann AG

- PCE Holding GmbH

- PositiveID Corp.

- Radiant

- Thermo Fisher Scientific Inc.

- Vesync Co. Ltd

- Vive Health

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Infrared thermometers have gained significant popularity in various industries due to their ability to measure temperatures without physical contact. The market for infrared thermometers is expected to grow substantially in the coming years, driven by the increasing prevalence of infectious diseases such as malaria and dengue. These thermometers are widely used in healthcare applications, including hospitals, clinics, and medical facilities, for measuring body temperatures in patients. The distribution channels for infrared thermometers include hospital pharmacies, retail pharmacies, and online stores. Beyond healthcare, infrared thermometers find applications in various sectors such as dairy protein-based products, veterinary, and environmental monitoring. They are used to measure temperatures in industrial processes, automobile sector, and even for crowd screening.

In addition, infrared thermometers offer advantages such as temperature monitoring for acute diseases, energy efficiency, and eco-friendliness. However, concerns over health safety, eye damage from prolonged use, and accuracy issues may impact the market growth. The integration of advanced technologies like smart technologies and digital services in infrared thermometers is expected to further boost the market. The ecommerce sector and telemedicine are emerging distribution channels for these thermometers. Infrared thermometers also find applications in marine life research and temperature monitoring for climate change and water bodies.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

167 |

|

Base year |

2023 |

|

Historic period |

2017-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 18.05% |

|

Market growth 2024-2028 |

USD 1.05 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

15.78 |

|

Regional analysis |

North America, Europe, Asia, and Rest of World (ROW) |

|

Performing market contribution |

North America at 51% |

|

Key countries |

US, China, Germany, Japan, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Baxter International Inc., Bioseb SAS, BPL MEDICAL TECHNOLOGIES Pvt. Ltd., Cardinal Health Inc., Citizen Watch Co. Ltd., Contec Medical Systems Co. Ltd., Exergen Corp., Fluke Corp., Geratherm Medical AG, Helen of Troy Ltd., HORIBA Ltd., Microlife Corp., OMRON Corp., Optris GmbH, Paul Hartmann AG, PCE Holding GmbH, PositiveID Corp., Radiant, Thermo Fisher Scientific Inc., Vesync Co. Ltd, and Vive Health |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch