IP Multimedia Subsystem Market Size 2024-2028

The ip multimedia subsystem market size is forecast to increase by USD 42.35 billion, at a CAGR of 18% between 2023 and 2028.

- The IP Multimedia Subsystem (IMS) market is experiencing significant growth, driven by the global rollout of 5G networks and the proliferation of wireless technologies. The integration of IMS in 5G networks enables advanced multimedia services, such as high-definition voice and video calls, messaging, and multimedia conferencing. This convergence of telecommunications and IT services is expected to revolutionize the way businesses communicate and collaborate. However, the market faces challenges related to increasing data security and privacy concerns. With the growing adoption of cloud services and the Internet of Things (IoT), the risk of cyberattacks and data breaches is escalating.

- IMS companies must prioritize security and privacy to gain the trust of businesses and consumers. Additionally, interoperability issues between different IMS implementations and the complexity of deploying and managing IMS networks pose significant challenges for market participants. Companies seeking to capitalize on the opportunities presented by the IMS market must focus on addressing these challenges through innovative solutions and collaborative partnerships.

What will be the Size of the IP Multimedia Subsystem Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The IP Multimedia Subsystem (IMS) market continues to evolve, driven by the increasing demand for advanced communication services across various sectors. IMS is a standards-compliant architecture that seamlessly integrates subscriber data management, software defined networking, call recording, IMS architecture, network capacity planning, call transfer, fault management, network monitoring, IMS protocols, 5G IMS, signaling gateway, and network virtualization. Subscriber data management ensures user profile management, call forwarding, and home subscriber server functionality. Software defined networking enables call routing and network optimization, while call recording and fault management ensure service assurance and quality of service. IMS applications, such as multimedia messaging service, hosted IMS, and unified communications, offer enhanced user experiences.

The evolution of IMS includes the emergence of cloud-based IMS, SIP trunking, and fixed-mobile convergence. IMS services extend to call hold, call waiting, managed IMS, and next generation IMS. Performance management and security management are critical components, ensuring service reliability and user privacy. IMS components, including the media gateway controller, interworking unit, and IMS core network, require interoperability and compliance with Session Initiation Protocol (SIP) and H.323 protocols. Video conferencing and presence management are integral parts of IMS, offering real-time communication capabilities. IMS deployment models vary, from on-premise to managed services, catering to diverse business needs. The IMS market's continuous dynamism is reflected in the ongoing development of IMS components, protocols, and deployment models. IMS interoperability, network virtualization, and 5G IMS are key areas of focus, ensuring the delivery of high-quality, reliable, and secure communication services.

How is this IP Multimedia Subsystem Industry segmented?

The ip multimedia subsystem industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Component

- Product

- Services

- Application

- Mobile operators

- Fixed operators

- Geography

- North America

- US

- Europe

- Germany

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

.

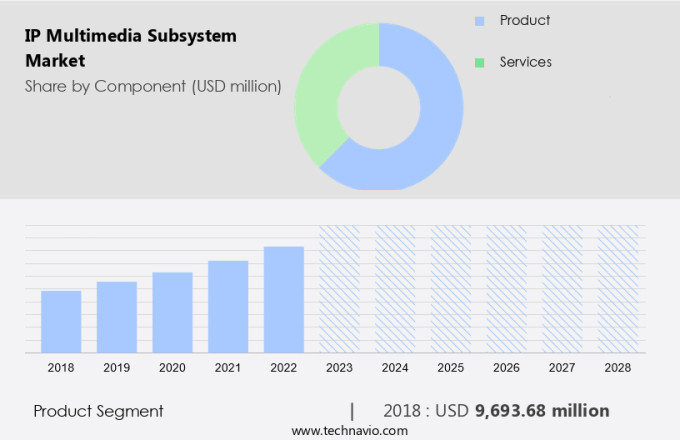

By Component Insights

The product segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth, driven by the increasing deployment of advanced communication solutions by telecom operators. IP multimedia subsystems, including VoLTE, VoWiFi, RCS, and UCaaS, are transforming networks into intelligent, device- and application-aware systems. Telecom and IT companies are introducing innovative IP multimedia subsystem solutions for mobile network operators (MNOs), enabling seamless integration of multimedia services. The proliferation of smartphones, tablets, wearables, and other wireless devices is fueling the demand for IP multimedia subsystems. Key components of IP multimedia subsystems, such as subscriber data management, software-defined networking, call recording, IMS architecture, network capacity planning, call transfer, subscriber management, fault management, network monitoring, IMS protocols, 5G IMS, signaling gateway, network virtualization, multimedia messaging service, IMS management, call hold, IMS evolution, diameter protocol, IMS applications, hosted IMS, performance management, cloud-based IMS, SIP trunking, call routing, standards compliance, call waiting, managed IMS, fixed-mobile convergence, on-premise IMS, service assurance, quality of service, security management, user profile management, call forwarding, home subscriber server, IMS interoperability, unified communications, network optimization, next-generation IMS, IMS services, presence management, IMS components, IMS deployment, media gateway controller, interworking unit, video conferencing, IMS core network, IMS security, call management, deployment models, session initiation protocol, and h.323 protocol, are all contributing to the market's expansion.

The Product segment was valued at USD 9.69 billion in 2018 and showed a gradual increase during the forecast period.

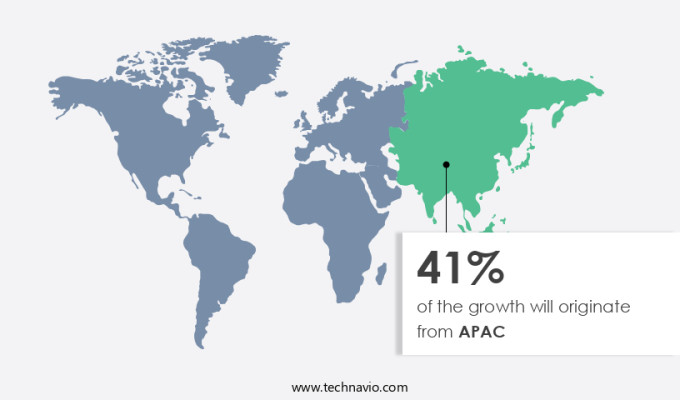

Regional Analysis

APAC is estimated to contribute 41% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the rapidly expanding economic landscape of APAC, the adoption of advanced technologies such as smart cities, autonomous vehicles, IoT applications, home automation, industrial automation, and intelligent processing technologies is driving market growth. Network infrastructure upgrades and the presence of a large number of mobile service providers in the region are further fueling this growth. Virtualization is gaining significant traction, with exponential adoption rates in APAC. The region's well-established telecom enterprises are contributing to high IP multimedia subsystem (IMS) sales. IMS is an essential component of next-generation networks, enabling services such as subscriber data management, call transfer, call waiting, call hold, and call management.

IMS architecture includes elements like the home subscriber server, media gateway controller, interworking unit, and IMS core network. IMS services also encompass multimedia messaging, presence management, and unified communications. IMS evolution includes the integration of 5G IMS, signaling gateway, network virtualization, and session initiation protocol (SIP trunking). IMS deployment models include cloud-based, managed, on-premise, and deployment models. IMS security, performance management, and fault management are crucial components of IMS. Standards compliance, network optimization, and quality of service are also essential considerations. IMS interoperability is a key factor in ensuring seamless communication between different networks and devices. Overall, the APAC market for IP multimedia subsystems is witnessing significant growth and innovation, driven by technological advancements and the expanding telecom industry.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of IP Multimedia Subsystem Industry?

- The rollout of 5G networks serves as the primary catalyst for market growth, driving innovation and advancement in various industries.

- The IP Multimedia Subsystem (IMS) market has experienced significant growth due to the increasing adoption of 5G networks. With governments and manufacturers actively supporting the rollout of 5G, the number of global 5G subscriptions surpassed 170 million by Q2 2023, bringing the total to between 1.0 and 1.5 billion worldwide. IMS plays a crucial role in the 5G ecosystem, enabling advanced multimedia services and ensuring low-latency communication, key benefits of 5G. In the US, the Federal Communications Commission (FCC) auctioned critical 5G spectrum bands in March 2021, underscoring the country's commitment to 5G deployment. IMS services, including presence management, call management, and video conferencing, rely on Session Initiation Protocol (SIP) and Interworking Unit (IWU) to facilitate communication between different networks.

- Media Gateway Controllers (MGC) and IMS Core Networks manage and secure these services. IMS security is a critical concern, with encryption, authentication, and access control essential to protect user data and privacy. Deployment models include cloud, on-premises, and hybrid, with each offering unique advantages depending on organizational needs. H.323 protocol is another communication protocol used alongside SIP in some IMS deployments.

What are the market trends shaping the IP Multimedia Subsystem Industry?

- The proliferation of wireless technologies represents a significant market trend. This trend is driven by advancements in wireless communication and the increasing demand for connectivity and mobility.

- The IP Multimedia Subsystem (IMS) market is experiencing significant growth due to the increasing demand for advanced subscriber data management and network capabilities in telecommunications. IMS architecture, which includes software-defined networking, call recording, and signaling gateway, is essential for managing network capacity and enabling call transfer, fault management, network monitoring, and adherence to IMS protocols. The advent of 5G IMS is further propelling the market forward, as it offers increased network virtualization and improved network performance. As the Internet of Things (IoT) continues to expand, the number of connected devices will require robust network infrastructure to support the transmission of vast amounts of data.

- Wireless standards such as 4G and 5G, along with wireless technologies like Bluetooth Low-Energy (BLE), Wi-Fi, ZigBee, and Z-Wave, are essential in providing immersive, harmonious wireless connections that are equivalent to broadband. In conclusion, recent research indicates that the IMS market will continue to grow as businesses and consumers increasingly rely on advanced telecommunications networks to support their evolving connectivity needs.

What challenges does the IP Multimedia Subsystem Industry face during its growth?

- The escalating importance of data security and privacy is a significant challenge that necessitates robust solutions, threatening to impede industry growth if not adequately addressed.

- The IP Multimedia Subsystem (IMS) market is witnessing significant growth due to the increasing adoption of multimedia messaging services (MMS) and IMS management solutions. IMS applications, such as call hold, call waiting, and call routing, are becoming essential for businesses seeking to enhance their communication capabilities. The evolution of IMS is being driven by the Diameter protocol, which ensures standards compliance and enables interoperability between various network elements. Cloud-based IMS and SIP trunking are gaining popularity due to their cost-effective and flexible offerings. Performance management is a critical aspect of IMS, ensuring seamless delivery of multimedia services and maintaining optimal network performance.

- Security remains a top priority, with advanced security measures being implemented to protect against potential threats. The IMS environment is constantly evolving to address new challenges, with a focus on harmonious integration of various network components and striking a balance between functionality and security. In conclusion, recent research indicates that the IMS market will continue to grow as businesses seek to enhance their communication capabilities and address the increasing demand for advanced multimedia services.

Exclusive Customer Landscape

The ip multimedia subsystem market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the ip multimedia subsystem market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, ip multimedia subsystem market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amdocs Ltd. - Amdocs Ltd. Delivers an IP multimedia subsystem, enhancing business agility through advanced communications services. This technology empowers organizations to streamline operations, improve customer engagement, and drive innovation. By leveraging cutting-edge multimedia capabilities, businesses can accelerate their digital transformation journey. Amdocs' solutions are designed to foster flexibility, scalability, and reliability, ensuring optimal performance and seamless integration with existing systems. The company's offerings encompass a wide range of services, including messaging, voice, video, and data solutions, all aimed at enhancing business productivity and competitiveness. By embracing Amdocs' IP multimedia subsystem, organizations can effectively meet the evolving communication needs of their customers and employees, ultimately leading to enhanced customer satisfaction and loyalty.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amdocs Ltd.

- Athonet Srl

- Cisco Systems Inc.

- Enghouse Systems Ltd.

- Genesys Telecommunications Laboratories Inc.

- Hewlett Packard Enterprise Co.

- Huawei Technologies Co. Ltd.

- Italtel S.p.A.

- Juniper Networks Inc.

- Mavenir Systems Inc.

- Mitel Networks Corp.

- NEC Corp.

- Nokia Corp.

- Oracle Corp.

- Reliance Industries Ltd.

- Ribbon Communications Inc.

- Samsung Electronics Co. Ltd.

- Telefonaktiebolaget LM Ericsson

- ZTE Corp.

- Cirpack

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in IP Multimedia Subsystem Market

- In February 2023, Nokia and Deutsche Telekom announced a strategic collaboration to deploy IP Multimedia Subsystem (IMS) solutions in Deutsche Telekom's fixed and mobile networks. This partnership aimed to enhance voice and multimedia services, providing a more seamless user experience for customers (Nokia Press Release).

- In April 2024, Huawei Technologies launched its latest IMS solution, the Cloud-Native IMS, which offers improved scalability and flexibility for telecom operators. This solution enables the delivery of advanced communication services, such as VoLTE, RCS, and video conferencing (Huawei Press Release).

- In January 2025, Oracle Communications and Syniverse entered into a partnership to integrate Oracle's IMS platform with Syniverse's messaging and voice services. This collaboration aimed to provide enhanced communication services for mobile network operators, enabling them to offer advanced messaging and voice capabilities to their customers (Oracle Communications Press Release).

- In March 2025, the European Union's European Electronic Communications Code came into effect, mandating the deployment of Next-Generation Services (NGS), including IMS, by telecom operators. This regulatory change is expected to drive significant growth in the market, as operators invest in upgrading their networks to meet the new requirements (European Parliament and Council of the European Union).

Research Analyst Overview

- The IP Multimedia Subsystem (IMS) market is experiencing significant growth, driven by the increasing demand for real-time communication and multimedia services in business environments. IMS, a packet-based networking solution, enables network operations to deliver advanced network services such as multimedia telephony, mobility management, and network analytics. Network infrastructure plays a crucial role in IMS implementation, requiring robust network security, network anti-virus, network anti-malware, network intrusion detection, network intrusion prevention, and network performance monitoring. Network management and network troubleshooting are essential for optimizing network capacity planning and network implementation. Network cost optimization is a key trend, with network policy management and network firewall solutions helping businesses maintain network security while minimizing expenses.

- Application programming interfaces (APIs) facilitate network design and network maintenance, while network identity management ensures secure access to network services. Network services, including network security monitoring and network design, are increasingly important for businesses seeking to enhance their network performance and network optimization. Network design involves careful planning to accommodate multimedia communication, while network capacity planning ensures the network can handle increased traffic demands. Network implementation requires careful consideration of network design, network maintenance, and network cost optimization to ensure a successful deployment. Network performance monitoring and network optimization are ongoing processes to maintain network efficiency and address any performance issues.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled IP Multimedia Subsystem Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

165 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 18% |

|

Market growth 2024-2028 |

USD 42349.88 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

16.79 |

|

Key countries |

US, China, Japan, India, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this IP Multimedia Subsystem Market Research and Growth Report?

- CAGR of the IP Multimedia Subsystem industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the ip multimedia subsystem market growth of industry companies

We can help! Our analysts can customize this ip multimedia subsystem market research report to meet your requirements.