API Management Market Size 2025-2029

The API management market size is forecast to increase by USD 3.75 billion at a CAGR of 12.3% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing adoption of digital payment solutions and the proliferation of digital wallets. However, challenges persist, including poor internet connectivity in developing countries, which can hinder the adoption and effective implementation of Api Management solutions. Companies must navigate these challenges to capitalize on the market's potential. Strategies such as investing in offline solutions and partnering with local providers can help overcome connectivity issues and expand market reach.

- Additionally, focusing on security and scalability will be crucial, as businesses demand reliable and secure Api Management solutions to support their digital initiatives. These trends reflect the digital transformation underway in various industries, as businesses seek to enhance customer experience and streamline operations. Overall, the market presents opportunities for innovation and growth, with companies that address the unique challenges of this dynamic landscape poised to succeed.

What will be the Size of the API Management Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market is experiencing significant innovation, with a focus on enhancing API Return on Investment (ROI) through multi-cloud API adoption and API-driven development. API maturity is on the rise, driving the need for advanced API logging, performance benchmarking, and usage analytics. API interoperability and standardization are crucial to addressing integration challenges in complex API ecosystems. API observability and developer experience are becoming key differentiators, with the emergence of API documentation generators and debugging tools. API adoption rates continue to grow, fueled by the increasing use of composite and hybrid cloud APIs, serverless functions, and microservices orchestration.

The market is experiencing significant growth, driven by the increasing adoption of digital payment solutions and the proliferation of digital wallets. API platform comparisons and compliance are essential for businesses navigating the diverse landscape of API offerings. API monetization strategies, such as API-led connectivity and edge computing APIs, are gaining traction. API evolution is ongoing, with a shift towards API-first design and headless CMS integration. API usage patterns are evolving, requiring new testing frameworks and security measures to address API performance optimization and vulnerabilities. Ultimately, API governance policies and discovery tools are essential for managing the complexities of API consumption and ensuring compliance in the dynamic API market.

How is this API Management Industry segmented?

The api management industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Deployment

- Cloud

- On-premises

- Solution

- API gateways

- API lifecycle management

- API security

- API analytics and monitoring

- API developer portals

- End-user

- Large enterprises

- SMEs

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

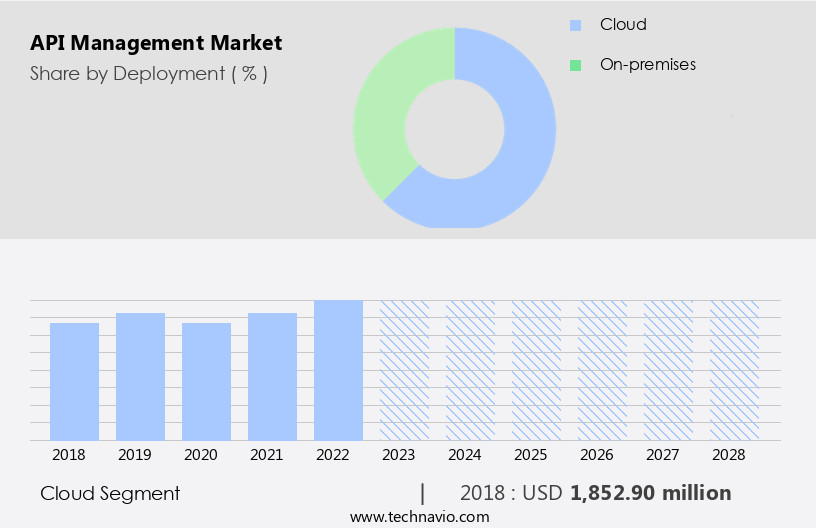

By Deployment Insights

The cloud segment is estimated to witness significant growth during the forecast period. The market is experiencing significant growth, driven by the digital transformation sweeping across industries. Cloud-based API solutions dominate the market, enabling seamless communication and data transfer between applications and the cloud. This segment's dominance is attributed to the proliferation of IoT and Big Data, which enhance application interfaces for superior customer experiences. Additionally, the increasing awareness of security vulnerabilities and the demand for automation have fueled the market's expansion in sectors like BFSI, e-commerce, healthcare and life sciences, education, and retail. Cloud APIs facilitate the integration of various cloud and on-premises applications, simplifying API provisioning, activation, setup, monitoring, and troubleshooting for developers and administrators.

Agile development methodologies, such as DevOps and CI/CD, have further accelerated the adoption of cloud APIs. APIs have become essential components of modern application architectures, including microservices, event-driven, and real-time systems. GraphQL APIs and service meshes have emerged as popular choices, offering improved performance, flexibility, and security. API design, documentation, testing, and versioning are crucial aspects of API management, ensuring compatibility and interoperability across various systems. API security is a top priority, with API keys, tokens, and proxies employed to protect against unauthorized access. Load balancing, fault tolerance, and high availability are essential features for ensuring optimal API performance and reliability.

API analytics, monitoring, and rate limiting provide valuable insights into API usage and performance, enabling proactive management and optimization. The API economy continues to evolve, with monetization strategies like API subscriptions and pay-per-use models gaining popularity. Serverless computing and message queues have also emerged as key technologies, enhancing API scalability and flexibility. As the API landscape becomes increasingly complex, API management platforms have become indispensable tools for managing and securing APIs at scale.

The Cloud segment was valued at USD 2.02 billion in 2019 and showed a gradual increase during the forecast period.

The API Management Market is expanding rapidly as organizations focus on secure, scalable, and efficient API ecosystems. Key to this growth is API versioning, which ensures backward compatibility and smooth upgrades across services. Clear API contract define how APIs behave, improving integration and governance. Companies are investing in a robust API developer portal to streamline onboarding and encourage adoption. Demand for realtime API is rising across fintech and IoT, while asynchronous APIs and synchronous APIs support diverse application workflows. API proxies enhance scalability and performance by abstracting backend services, and API tokens safeguard access, ensuring secure transactions.

The API Management Market is transforming rapidly, driven by rising API adoption rate and the need for robust API security to combat API security vulnerabilities. Enhancing the API developer experience is a key priority, supported by advanced API testing frameworks, API tracing, and API debugging tools. Organizations are pushing for API standardization and API compliance to streamline development across ecosystems. The rise of composite APIs and multicloud APIs highlights the need for flexible integration and seamless scalability. Businesses are investing in API innovation and leveraging API usage analytics alongside API performance benchmarking to optimize functionality. Scrutiny over API costs and demand for measurable API ROI are guiding decisions. Modern platforms enhance API discovery, boosting agility and enterprise growth.

Regional Analysis

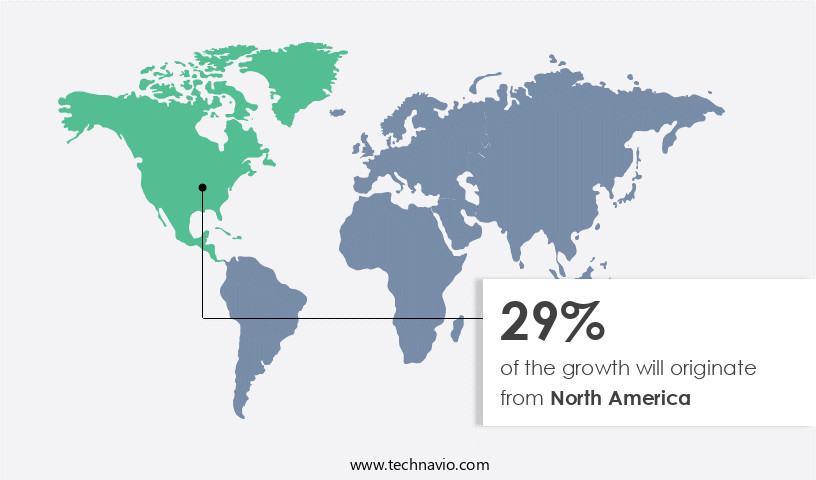

North America is estimated to contribute 29% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth, particularly in North America, where the increasing demand for high connectivity and bandwidth, driven by the proliferation of smartphones, has led to a rise in e-commerce transactions. This trend, in turn, has fueled the need for robust API management solutions among retailers. Furthermore, the growing awareness of security vulnerabilities and the early adoption of mobile payments by various industries, including BFSI, e-commerce, retail, and consumer goods, have accelerated the market's expansion. The use of cloud computing services in these sectors is also on the rise, necessitating API management platforms for automation.

Agile development methodologies and event-driven architectures are increasingly being adopted, leading to the integration of APIs into various applications and systems. Service meshes and GraphQL APIs are gaining popularity due to their ability to provide real-time data and improve application performance. API design, documentation, testing, and versioning are crucial aspects of API management, ensuring seamless integration and communication between applications. API security is a top priority, with API keys, tokens, and proxies being commonly used for authentication and access control. API rate limiting, throttling, and analytics help manage API traffic and ensure fault tolerance and high availability.

API virtualization, contract testing, and monitoring are essential for ensuring API reliability and performance. The API economy is thriving, with monetization becoming a significant focus for businesses. Serverless computing and message queues are being used to build scalable and efficient API architectures. API lifecycle management, CI/CD, and specification are essential for managing the entire API development process. Microservices architecture and both synchronous and asynchronous APIs are being used to build complex applications and systems. Load balancing and API gateways are crucial for managing API traffic and ensuring high availability and scalability. Overall, the market is dynamic and evolving, with various entities, including OpenID Connect, integration platforms, and API documentation, playing essential roles in its growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the API Management market drivers leading to the rise in the adoption of Industry?

- The increasing prevalence of digital payment solutions serves as the primary catalyst for market growth. In the global business landscape, the adoption of digital payment solutions is on the rise, particularly in the banking industry. According to recent research, digital payments are projected to account for nearly 90% of total transactions in countries like Canada by 2030. This trend is driving numerous enterprises to offer digital payment services, enabling seamless business processes and gaining a competitive edge. One such example is American Express Canada's digital payment solution, American Express Payment, which offers virtual account numbers, replacing traditional plastic cards. Moreover, the digital transformation in businesses is leading to the implementation of advanced technologies such as event-driven architecture, API design, and API management platforms.

- These technologies facilitate the integration of data from various sources, ensuring efficient data flow and real-time processing. APIs, including GraphQL APIs and SOAP APIs, are increasingly being used for data integration and communication between different applications and services. API management platforms offer features like API analytics, API monitoring, API rate limiting, and API virtualization, ensuring optimal performance and security. Message queues and service mesh are other essential components of modern architectures, enabling asynchronous communication and microservices-based applications. In summary, the digital transformation in businesses is leading to the adoption of advanced technologies and architectures, such as APIs, message queues, and service mesh, to streamline processes, improve efficiency, and gain a competitive edge.

What are the API Management market trends shaping the Industry?

- The increasing prevalence of digital wallets represents a significant market trend in the financial industry. This shift towards digital payments is driven by the growing number of consumers seeking convenience and security in managing their finances. The banking industry is experiencing significant innovation, particularly in digital wallets for mobile transactions. These software-based systems enable secure online purchases through smartphones, linking customers' bank accounts and verifying credentials. The global adoption of digital wallets is increasing, leading enterprises to implement Application Programming Interfaces (APIs) for effective transaction tracking and database management. APIs facilitate communication between different applications and services, ensuring fault tolerance, versioning, and governance. They are essential for real-time, synchronous, and REST APIs in an API catalog, as well as API gateways. API monetization and serverless computing are emerging trends, offering new revenue streams and operational efficiencies.

- In the dynamic digital wallet market, enterprises must prioritize API management to maintain a robust and scalable infrastructure. This includes handling API deprecation, versioning, and ensuring fault tolerance for seamless user experience. API governance is crucial for maintaining security and compliance, while real-time APIs enable instant access to critical information. Ultimately, APIs are a vital component in the banking industry's digital transformation journey, enabling seamless integration and innovation.

How does API Management market face challenges during its growth?

- In developing countries, inadequate internet connectivity poses a significant challenge to the expansion and growth of various industries. API management is a crucial aspect of cloud computing for enterprises seeking to efficiently manage their application programming interfaces (APIs) throughout their lifecycle. High availability and constant Internet connectivity are essential for API service providers to ensure real-time, efficient operations. APIs are integral to various services, such as internet banking, mobile banking, and digital payments, making a reliable network a necessity. Moreover, API security is paramount, with the use of API keys to ensure access control and prevent unauthorized usage.

- Microservices architecture and asynchronous APIs are popular trends in modern application development, requiring robust load balancing and API throttling to manage traffic and prevent overload. API security is further driven through encryption, authentication, and access control mechanisms. Continuous integration and continuous delivery (CI/CD) practices enable developers to release updates and improvements quickly while maintaining API stability and compatibility. API specifications, such as OpenAPI and RAML, provide a standardized format for defining, documenting, and testing APIs, ensuring interoperability and reducing development time.

Exclusive Customer Landscape

The api management market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the api management market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, api management market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Akamai Technologies Inc. - The company specializes in API management solutions, featuring the advanced Akamai API Security platform.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Akamai Technologies Inc.

- Amazon.com Inc.

- Axway Software SA

- Boomi LP

- Broadcom Inc.

- Google LLC

- International Business Machines Corp.

- Kong Inc

- Microsoft Corp.

- Oracle Corp.

- Postman Inc.

- Salesforce Inc.

- SAP SE

- Sensedia SA

- Software GmbH

- TIBCO Software Inc.

- Torry Harris Business Solutions

- Workato Inc.

- WSO2 Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in API Management Market

- In January 2024, Microsoft announced the general availability of Azure API Management v3, which introduced new features like AI-driven policies and improved developer portal customization (Microsoft Press Release).

- In March 2024, IBM and Red Hat joined forces to offer an integrated API management solution, combining IBM's API Connect and Red Hat's OpenShift container application platform (IBM Press Release).

- In May 2024, Google Cloud Platform secured a strategic partnership with MuleSoft, a leading provider of integration and API management solutions, to offer a unified solution for managing APIs and integrations in the cloud (MuleSoft Press Release).

- In April 2025, Amazon Web Services (AWS) announced the acquisition of Split Software, a feature flagging and experimentation platform, to enhance its API Gateway offering and provide more advanced capabilities for API management and development (AWS Press Release).

Research Analyst Overview

The market continues to evolve, driven by the ever-expanding digital transformation across various sectors. OpenID Connect and integration platforms facilitate seamless authentication and data exchange, while API testing ensures the reliability of these critical interfaces. API documentation and developer portals enhance developer experience, and API mocking enables efficient development in agile environments. The API economy thrives on the monetization of APIs, with serverless computing and API catalogs offering cost-effective solutions. Fault tolerance and versioning ensure business continuity, and real-time APIs cater to the growing demand for instant data access. API gateways, synchronous and asynchronous APIs, and REST APIs are integral components of modern architectures, including event-driven and microservices.

API management platforms provide essential features such as API analytics, monitoring, rate limiting, and security. Service meshes and message queues optimize communication between microservices, while SOAP APIs maintain their relevance in specific industries. API lifecycle management, CI/CD, and API specification ensure consistent development and deployment. High availability, API keys, and cloud computing further enhance the capabilities of API management, addressing the diverse needs of businesses in today's dynamic market. API design, virtualization, and analytics continue to evolve, shaping the future of this ever-evolving landscape.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled API Management Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

211 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 12.3% |

|

Market growth 2025-2029 |

USD 3.75 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

10.7 |

|

Key countries |

US, Brazil, China, Germany, Japan, UAE, UK, Canada, France, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this API Management Market Research and Growth Report?

- CAGR of the API Management industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the api management market growth of industry companies

We can help! Our analysts can customize this api management market research report to meet your requirements.