Islamic Banking Software Market Size 2025-2029

The Islamic banking software market size is forecast to increase by USD 4.39 billion at a CAGR of 13.4% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing adoption of technology in the financial sector and the expanding Islamic banking industry. One key trend is the issue of smart cards by Islamic banks to provide greater security and convenience for their customers. Another trend is the adoption of blockchain technology, which offers enhanced security, transparency, and efficiency in transactions. However, the market also faces challenges, including the lack of expertise, awareness, and training in Islamic banking software. This creates an opportunity for companies to provide solutions that address these challenges and help Islamic banks navigate the complexities of Sharia-compliant software.

- To capitalize on this market, companies must stay abreast of the latest trends and regulations, invest in research and development, and offer comprehensive training and support to their clients. By doing so, they can differentiate themselves and gain a competitive edge in the market. Cloud-based solutions, artificial intelligence, and blockchain technology are transforming Islamic finance by streamlining processes, enhancing security, and enabling real-time transactions. Retail sector players are also leveraging Islamic banking software for asset administration and cellular banking services.

What will be the Size of the Islamic Banking Software Market during the forecast period?

- The market encompasses a range of solutions designed to facilitate the unique operations of financial institutions practicing Islamic finance. Key market drivers include the growing demand for profit-and-loss sharing and asset-backed financing models, necessitating advanced risk administration, analytics, and reporting capabilities. Online transactions and customer service are further areas of innovation, with a focus on enhancing banking efficiency through technology adoption in corporate and retail banking.

How is this Islamic Banking Software Industry segmented?

The Islamic banking software industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Retail

- Corporate

- Others

- Deployment

- On-premises

- Cloud

- Components

- Software

- Solutions

- End-User

- Islamic Banks

- Conventional Banks with Islamic Windows

- Other Financial Institutions

- Functionality

- Core Banking

- Risk Management

- Compliance and Reporting

- Distribution Channel

- Direct Sales

- Third-party Vendors

- Online Platforms

- Geography

- Middle East and Africa

- Egypt

- Qatar

- South Africa

- APAC

- China

- India

- Japan

- South Korea

- Europe

- North America

- South America

- Middle East and Africa

By Application Insights

The retail segment is estimated to witness significant growth during the forecast period. The retail segment in the market caters to the unique needs of individual clients in Islamic banks, providing solutions for Shariah-compliant retail banking products and services. These include savings accounts, personal loans, mortgages, and wealth management solutions. The software automates and streamlines retail banking procedures, integrating Islamic banking principles such as profit-sharing agreements and specific functionalities for calculating profit rates and managing Islamic contracts. The retail segment's growth is driven by the increasing global demand for Islamic banking services among retail clients, fueled by the growth of Muslim populations and greater awareness of Islamic banking principles. To meet the growing demand for automation and efficiency in Islamic banking operations, software providers offer solutions for risk administration, analytics and reporting, smart cards, and sukuk issuances.

Major software providers offer retail-focused solutions, including core banking systems, CRM systems, mobile banking apps, and Internet banking platforms. Key features of these solutions include asset administration, risk administration, analytics and reporting, integration skills, asset-backed financing, and sukuk issuances. Additionally, the adoption of fintech partnerships, data protection, and moral investing is on the rise. The industry is experiencing upheaval due to fintech disruption and regulatory initiatives. Cloud-based solutions, artificial intelligence, and blockchain technology are also transforming Islamic banking operations.

Get a glance at the market report of share of various segments Request Free Sample

The Retail segment was valued at USD 1.65 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

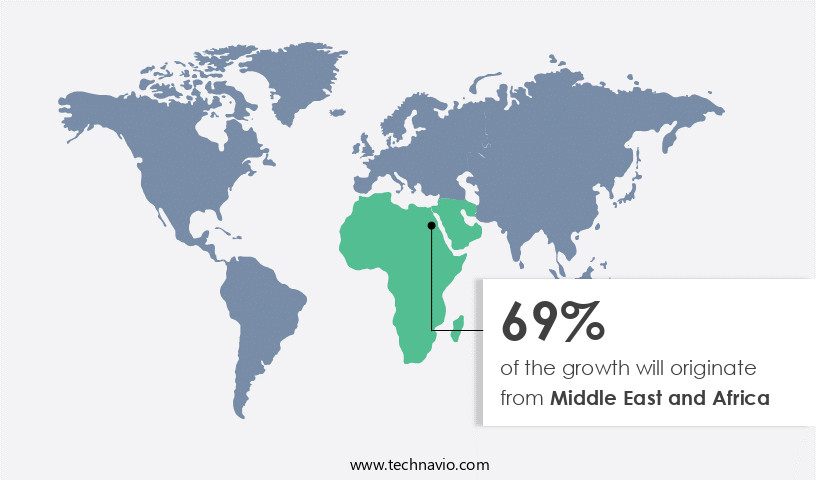

Middle East and Africa is estimated to contribute 69% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in the Middle East and Africa (MEA) is experiencing significant growth due to the region's large Muslim population, driving the demand for Shariah-compliant banking solutions. In Bahrain, ila Bank alburaq, an autonomous Islamic banking portal, was launched in May 2023, offering individualized Shariah-compliant banking services. The Shariah supervisory board of Bank ABC Islamic oversees its operations. Key features of Islamic banking software include asset administration, risk administration, analytics and reporting, integration skills, asset-backed financing, and cellular banking. Additionally, fintech partnerships, data protection, moral investing, and sukuk issuances are essential components. The banking industry's digital transformation is evident through the adoption of cloud-based solutions, artificial intelligence, blockchain technology, and regulatory initiatives.

Fintech companies and software providers cater to the needs of various sectors, including the retail sector, large corporations, and wealth management. The Islamic finance industry's growth is influenced by factors like fintech upheaval, industry saturation, and regulatory initiatives. Data protection and security are crucial considerations for companies in this market. The market in the MEA is witnessing growth due to the region's large Muslim population and the increasing demand for Shariah-compliant banking solutions. Key features of Islamic banking software include asset administration, risk administration, analytics and reporting, integration skills, asset-backed financing, and cellular banking. The market is influenced by various factors, including fintech upheaval, industry saturation, and regulatory initiatives.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Islamic Banking Software Industry?

- Issue of smart cards by Islamic banks is the key driver of the market. The market is experiencing notable growth due to the increasing adoption of smart cards by Islamic banks. These banks are issuing smart cards to provide enhanced security, convenience, and flexibility to their clients. The integration of personal and financial information on a chip within the card ensures compliance with Shariah laws, which prohibit interest-based transactions (Riba) and encourage moral investing (Halal). As a result, smart cards are becoming a crucial component of Islamic banks' digital banking strategies.

- These cards cater specifically to the demands of Muslim clients, ensuring their financial operations align with Islamic values. The market's expansion is driven by the growing number of Islamic banks and the rising demand for compliant financial solutions. Smart cards, sukuk issuances, and digital transformation through cloud-based solutions, artificial intelligence, and blockchain technology are also significant trends. Regulatory initiatives and fintech companies, including software providers, play a crucial role in the market's development. The banking industry's increasing focus on retail sector growth, asset administration, cellular banking, and banking mobility enhances the need for efficient, secure, and automated systems.

What are the market trends shaping the Islamic Banking Software Industry?

- Adoption of blockchain technology is the upcoming market trend. Blockchain technology is gaining traction in various industries, including finance and manufacturing, due to digital transformation. This trend is fueling the growth of the blockchain market. In the BFSI and manufacturing sectors, blockchain technology is facilitating the management of complex distribution and logistics systems through the use of technologies such as Smart Contracts for seamless online transactions. Blockchain technology enables real-time tracking of end-to-end transactions during the shipment of assets.

- Additionally, cloud computing solutions are enabling manufacturing industries to implement IoT technologies by connecting sensors and embedded devices for real-time data access. These advancements are streamlining operations and enhancing efficiency in the supply chain systems. The use of cloud-based solutions is gaining traction in the Islamic banking industry. These solutions offer several advantages, such as cost savings, scalability, and flexibility.

What challenges does the Islamic Banking Software Industry face during its growth?

- Lack of expertise, awareness and training in Islamic banking software is a key challenge affecting the industry growth. The integration of advanced IT solutions in Islamic banking is a complex process that necessitates specialized training for banking staff. Failure to provide adequate technology training can result in misaligned product offerings and potential damage to a bank's brand image. In response, many Islamic banks have begun merging modern technologies with their existing systems. This integration facilitates a unified interface and content management systems, enabling banks to better meet their clients' needs.

- However, the implementation of these technologies requires significant investment in time, resources, and expertise. Despite these challenges, the benefits of technological advancements in Islamic banking, such as improved operational efficiency and enhanced customer experience, make the investment worthwhile. Cloud computing enables financial institutions to access real-time data and analytics, which is crucial for effective risk administration and asset management. Another trend in the market is the adoption of artificial intelligence (AI) and blockchain technology. AI is being used for various applications, such as fraud detection, customer service, and investment analysis. Blockchain technology, on the other hand, offers secure and transparent transactions, which is essential for the Islamic banking industry's moral investing principles

Exclusive Customer Landscape

The Islamic banking software market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the Islamic banking software market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, islamic banking software market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AutoSoft Dynamics Pvt. Ltd. - The company specializes in providing Islamic banking software, catering to the requirements of retail, corporate, and microfinance sectors.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AutoSoft Dynamics Pvt. Ltd.

- Azentio Software Pvt. Ltd.

- Bank Alfalah Islamic Banking

- BML Istisharat SAL

- Codebase Technologies FZE

- Craft Silicon Ltd.

- Finastra

- ICS Financial Systems Ltd.

- INFOPRO Sdn Bhd

- International Turnkey Systems Group

- LEADS Group

- Mambu BV

- Millennium Information Solution Ltd.

- Newgen Software Technologies Ltd.

- Nucleus Software Exports Ltd.

- Oracle Corp.

- Sopra Steria Group SA

- Tata Consultancy Services Ltd.

- Virmati Infotech Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The Islamic banking sector, a distinct segment of the global financial services industry, continues to witness significant growth and innovation. This market is characterized by its adherence to Sharia law, which guides all personal loans and investments. Islamic banking operations encompass various functions, including asset-backed financing, risk administration, analytics and reporting, and asset administration. One of the key drivers propelling the growth of the market is the increasing demand for advanced technology solutions. Financial institutions are seeking to enhance their operational efficiency and effectiveness by integrating smart technologies into their Islamic banking operations. Integration skills are becoming increasingly vital for software providers and fintech companies looking to partner with Islamic banks.

The retail sector is a significant contributor to the growth of the market. Mid-sized companies and large enterprises are increasingly recognizing the benefits of Islamic banking and are partnering with software providers and fintech companies to offer their customers Sharia-compliant financial services. The fintech upheaval has disrupted traditional banking models, and Islamic banking is no exception. Wealth management companies are offering innovative solutions, such as cellular banking and smart cards, to cater to the needs of the Islamic banking market. These solutions offer convenience and accessibility to customers, which is essential in today's digital age. Data security is also playing a crucial role in the growth of the market. The market is experiencing significant growth, driven by the increasing issuance of smart cards by Islamic banks and the adoption of blockchain technology.

Governments and regulatory bodies are recognizing the importance of Islamic banking and are implementing regulations to ensure its growth and stability. This regulatory support is attracting more financial institutions to enter the Islamic banking market, leading to increased demand for software solutions. The market is becoming increasingly saturated, with several software providers and fintech companies offering solutions. However, data protection remains a significant concern for financial institutions. Software providers must ensure that their solutions offer robust data protection features to attract and retain customers. The market is witnessing significant growth and innovation, driven by the increasing demand for advanced technology solutions, regulatory initiatives, and fintech upheaval.

Financial institutions are seeking to enhance their operational efficiency and effectiveness by integrating smart technologies into their Islamic banking operations. The retail sector is a significant contributor to the growth of the market, and the use of cloud-based solutions, AI, and blockchain technology is gaining traction. Data protection remains a crucial concern, and software providers must offer robust solutions to attract and retain customers.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

198 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.4% |

|

Market growth 2025-2029 |

USD 4.39 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

11.6 |

|

Key countries |

Saudi Arabia, United Arab Emirates, South Africa, Egypt, Nigeria, China, Japan, India, Qatar, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Islamic Banking Software Market Research and Growth Report?

- CAGR of the Islamic Banking Software industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Middle East and Africa, APAC, Europe, North America, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the islamic banking software market growth of industry companies

We can help! Our analysts can customize this islamic banking software market research report to meet your requirements.