Cloud-Based IT Service Management Market Size 2024-2028

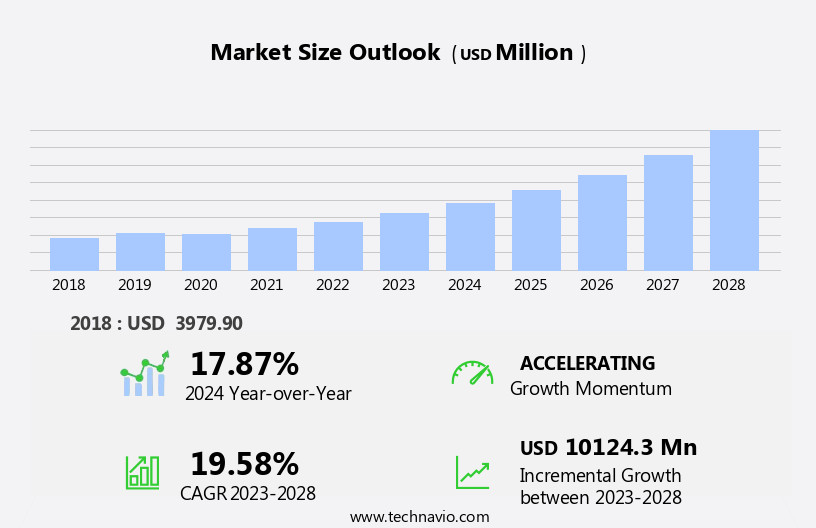

The cloud-based IT service management (ITSM) market size is forecast to increase by USD 10.12 billion, at a CAGR of 19.58% between 2023 and 2028.

- Cloud-based IT Service Management (ITSM) is experiencing significant growth due to several key drivers. These include the cost savings and scalability offered by private and hybrid cloud solutions. The digitalization of businesses is also leading to increased adoption of cloud-based ITSM tools for managing IT assets, configurations, service portfolios, and catalogs. Security and privacy concerns are another major factor, as cloud-based ITSM platforms provide strong security features that help organizations protect their IT infrastructure. IT spending is shifting towards cloud-based services, making cloud-based ITSM an attractive investment for businesses.

What will be the Size of the Cloud-Based IT Service Management (ITSM) Market During the Forecast Period?

- The market has been experiencing significant growth in recent years, driven by various macroeconomic factors. Despite the challenges posed by recessions and high inflation, organizations have continued to invest in IT initiatives to optimize their operations and improve service delivery. Cloud-based solutions, such as IT Service Management (ITSM) and IT Operations Management (ITOM), have emerged as popular choices for businesses seeking to streamline their IT processes. These solutions offer numerous benefits, including workflow automation, incident resolution, and problem management. However, the adoption of cloud-based ITSM is not without its challenges. Security concerns, particularly data security and high-profile security breaches, have become major concerns for organizations.

- Cybersecurity and data protection are essential components of any cloud-based ITSM solution. The integration of Artificial Intelligence (AI) technologies and automation in ITSM has been a game-changer. AI-driven solutions enable faster incident identification and resolution, reducing service interruptions and improving overall IT service quality. Despite the benefits, the implementation of cloud-based ITSM solutions requires careful consideration. Organizations must assess their current IT infrastructure, identify areas for improvement, and choose the right solution provider. Managed services, such as Software as a Service (SaaS) offerings, can help organizations overcome the initial investment hurdles and ensure a smooth transition to cloud-based ITSM.

How is this Cloud-Based IT Service Management (ITSM) Industry segmented and which is the largest segment?

The cloud-based IT service management (ITSM) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Component

- Solutions

- Services

- End-user

- IT and telecom

- Retail and consumer goods

- BFSI

- Healthcare and life sciences

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- APAC

- China

- South America

- Middle East and Africa

- North America

By Component Insights

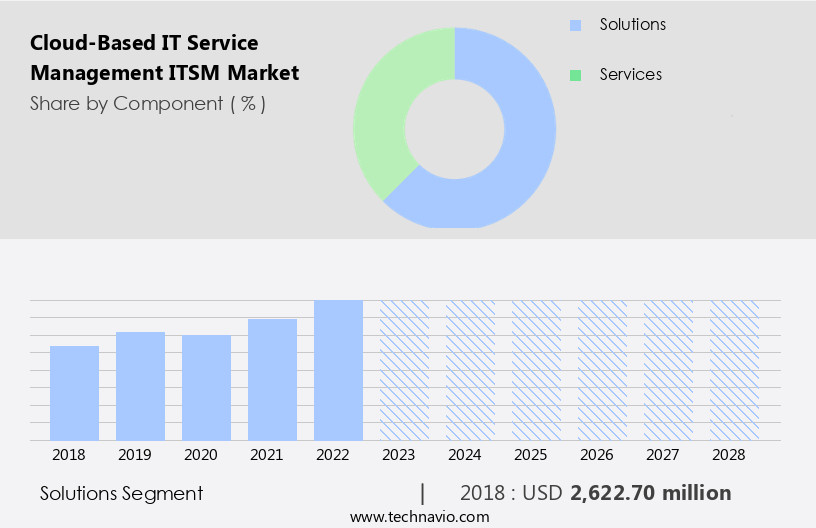

- The solutions segment is estimated to witness significant growth during the forecast period.

Cloud-based IT Service Management (ITSM) solutions have gained substantial traction in the global market, with the service solutions segment leading the way in 2022. The increasing need for organizations to manage and oversee the delivery of cloud and IT services is a primary factor fueling the demand for these solutions. Additionally, the growing number of developers seeking to ensure optimal performance and availability of services in line with Service Level Objectives (SLOs) or Service Level Agreements (SLAs) is another significant driver. Data security is a critical concern in the cloud-based ITSM market, with AI technologies playing an increasingly important role in mitigating risks.

Automation is another key trend, as it helps organizations minimize service interruptions caused by network outages and cyberattacks. Real-time analytics enables proactive issue resolution and enhances overall service quality. Digital transformation initiatives are driving the adoption of cloud-based ITSM solutions, as they offer greater flexibility, scalability, and cost savings compared to traditional on-premises solutions. The market is expected to continue its growth trajectory during the forecast period, as businesses increasingly prioritize the need for efficient IT service management in the face of evolving technology landscapes and heightened security threats.

Get a glance at the Cloud-Based IT Service Management (ITSM) Industry report of share of various segments Request Free Sample

The solutions segment was valued at USD 2.62 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

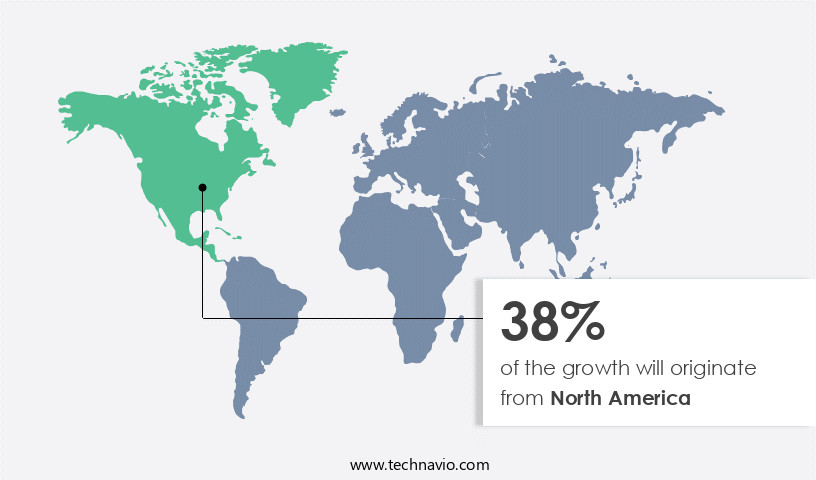

- North America is estimated to contribute 38% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market is poised for significant expansion over the coming years due to the region's high concentration of solution providers and the increasing adoption of Bring Your Own Device (BYOD) policies. As technology adoption continues to rise in North America, businesses are focusing on delivering exceptional customer experiences to gain a competitive edge. The public sector in particular is driving the growth of the cloud-based ITSM market in the region, with various government departments utilizing a range of processes, standards, and help desk tools. Advanced technologies, such as Change management, Asset management, ITIL, Integration, and Real-time visibility, are integral to cloud-based ITSM solutions, enabling organizations to effectively manage their IT services and support remote workforces.

Additionally, the integration of AI and machine learning capabilities further enhances the functionality of these solutions, providing valuable insights and automating routine tasks. Overall, the North American cloud-based ITSM market offers substantial growth opportunities as businesses and government organizations seek to optimize their IT operations and improve service delivery.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Cloud-Based IT Service Management (ITSM) Industry?

Low overhead costs, scalability, and easy usage of cloud-based ITSM solutions is the key driver of the market.

- Cloud-based IT Service Management (ITSM) solutions offer significant benefits for businesses, particularly in terms of cost savings and resource allocation. With these systems, there is no need for upfront investment in hardware and software as they are managed by service providers. This model allows small IT departments to focus on business growth rather than managing and updating the ITSM system. As technology evolves, ITSM capabilities are constantly advancing. Keeping up with the latest features and patches can be challenging for IT teams, especially in large enterprises. Cloud-based ITSM systems alleviate this issue by providing automatic updates and maintenance. Moreover, the integration complexity of multiple cloud platforms is simplified with cloud-based ITSM.

- Multi-cloud environments are becoming increasingly common, and managing them can be a daunting task. Cloud-based ITSM solutions enable seamless integration and management of various cloud services. Artificial Intelligence (AI), Machine Learning, and Predictive Analytics are increasingly being integrated into cloud-based ITSM systems. These technologies enhance the capabilities of ITSM, providing insights into potential issues and automating routine tasks. Security is a critical concern for businesses, and cloud-based ITSM solutions offer advanced security features. Service providers invest heavily in security infrastructure, ensuring that customer data is protected.

What are the market trends shaping the Cloud-Based IT Service Management (ITSM) Industry?

The growing digitalization of businesses is the upcoming market trend.

- In today's business landscape, enterprises worldwide are undergoing significant transformations, focusing on digitalizing their operations. This shift encompasses the adoption of digital processes, the exploration of new revenue streams through omnichannel platforms, enhancing customer experiences, and modernizing back-office functions. The digital transformation journey is set to revolutionize IT and business services by applying ITSM principles, methodologies, and technologies.

- Cloud-based ITSM solutions are poised to gain significant traction in this context. These solutions offer value-added services (VAS) to businesses' customers, thereby promoting a customer-centric approach. With cloud-based ITSM, enterprises can effortlessly deploy new services and processes, leveraging the principles of transparency, automation, and collaboration to ensure a seamless digital transition. Cloud adoption is a critical component of this digital transformation, as it enables businesses to scale and adapt quickly to changing market conditions.

What challenges does the Cloud-Based IT Service Management (ITSM) Industry face during its growth?

Increasing security and privacy concerns is a key challenge affecting the industry's growth.

- In the modern business landscape, safeguarding corporate data privacy and confidentiality is of paramount importance due to the increasing risks of cyber threats. Many companies are reluctant to transfer their sensitive data and business processes to cloud-based IT Service Management (ITSM) solutions, thereby limiting the market's expansion. While cloud-based ITSM solutions have made significant strides in recent times, concerns regarding their data security capabilities persist. Private Cloud and Hybrid Cloud solutions are increasingly popular for IT service desks, IT asset management, configuration management, service portfolio management, and service catalog management due to their enhanced security features.

- However, the market's growth is being challenged by these concerns. Businesses are investing heavily in IT infrastructure and spending to ensure data security. According to market research, IT spending on cloud services is projected to reach new heights, but the cloud ITSM market's growth will depend on addressing these security concerns effectively.

Exclusive Customer Landscape

The cloud-based IT service management (ITSM) market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the cloud-based IT service management (ITSM) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, cloud-based IT service management (ITSM) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alemba Ltd.

- Atlassian Corp. Plc

- BMC Software Inc.

- Broadcom Inc.

- Citrix Systems Inc.

- EasyVista SA

- Efecte Oyj

- Freshworks Inc.

- Hewlett Packard Enterprise Co.

- Hornbill Corporate Ltd.

- International Business Machines Corp.

- ITarian LLC

- Ivanti Software Inc.

- Open Text Corporation

- Microsoft Corp.

- OPGK RZESZOW S.A.

- ServiceNow Inc.

- SymphonyAI Summit

- SysAid Technologies Ltd

- Zoho Corp. Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing significant growth due to various macroeconomic factors. Recessions and high inflation have led organizations to prioritize IT initiatives that offer cost savings and efficiency gains. Cloud-based solutions, such as IT Service Management (ITSM) and IT Operations Management (ITOM), have gained popularity as they allow for workflow automation, incident resolution, and problem management. Security concerns, including data security and high-profile cyberattacks, continue to be a major driver for the adoption of cloud-based ITSM. Real-time analytics and automation help organizations mitigate service interruptions caused by network outages and cyberattacks. Digital transformation initiatives have also fueled the demand for advanced technologies like AI, machine learning, and predictive analytics in ITSM.

In addition, cloud ITSM solutions offer real-time visibility into IT services and enable remote work, making them essential for large enterprises in various industries. Integration complexity and the use of multiple cloud environments, including public, private, and hybrid clouds, have increased the need for ITSM tools that offer seamless integration and support for managed services. IT spending on cloud-based ITSM solutions is expected to grow as organizations seek to optimize their IT operations and improve service delivery. The market is witnessing significant innovation, with the integration of AI, ITIL frameworks, and SAAS offerings in ITSM solutions. Overall, the cloud ITSM market is poised for continued growth as organizations seek to enhance their IT service management capabilities and improve their digital transformation initiatives.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

185 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 19.58% |

|

Market Growth 2024-2028 |

USD 10.12 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

17.87 |

|

Key countries |

US, China, UK, Germany, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Cloud-Based IT service Management (ITSM) Market Research and Growth Report?

- CAGR of the Cloud-Based IT Service Management (ITSM) industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- A thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the cloud-based IT service management (ITSM) market growth of industry companies

We can help! Our analysts can customize this cloud-based IT service management (ITSM) market research report to meet your requirements.