Information Technology (IT) Training Market Size 2025-2029

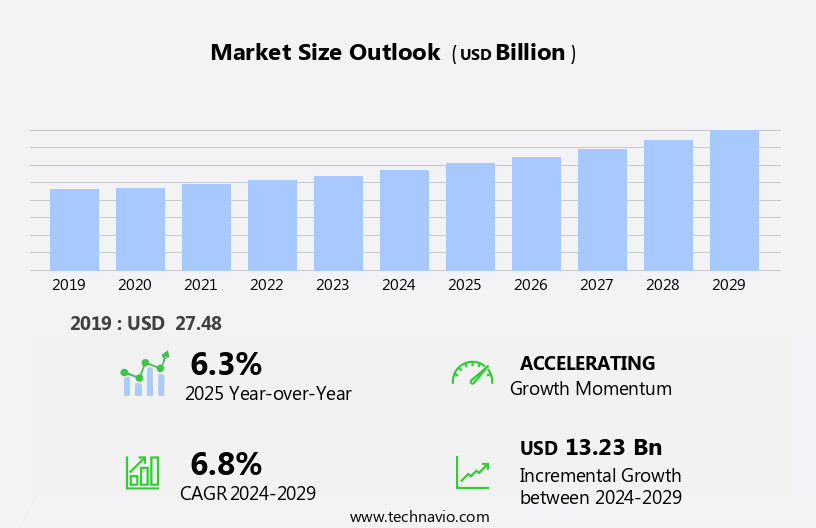

The information technology (it) training market size is forecast to increase by USD 13.23 billion, at a CAGR of 6.8% between 2024 and 2029.

- The market is experiencing significant growth and transformation, driven by the increasing adoption of advanced technologies such as artificial intelligence, machine learning, and cloud computing. These innovations are revolutionizing the way businesses operate and learn, creating a surge in demand for IT training services. Additionally, the popularity of blended learning, which combines traditional classroom instruction with online learning, is gaining traction as it offers flexibility and cost savings. Furthermore, Massive Open Online Courses (MOOCs) are increasingly being utilized to provide accessible and affordable IT training to a large number of learners. However, the market faces challenges including the need for continuous skill development due to the rapid pace of technological change and the high cost of IT training, which can be a barrier for small and medium-sized enterprises.

- To capitalize on market opportunities, companies should focus on offering flexible, affordable, and customized IT training solutions that cater to the evolving needs of businesses and individuals. Additionally, partnerships with educational institutions and technology providers can help companies stay ahead of the curve and offer cutting-edge training programs. Navigating these challenges and leveraging market trends will be key for companies seeking to succeed in the dynamic and growing IT Training Market.

What will be the Size of the Information Technology (IT) Training Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

In the dynamic and ever-evolving the market, entities provide a range of offerings to address the continuous skills development needs of organizations and individuals. These entities offer seamlessly integrated solutions, encompassing talent development, e-learning platforms, video tutorials, curriculum development, community forums, technical training, assessment tools, social learning, learning objectives, simulation training, training delivery methods, and technical support. The IT training landscape is characterized by the unfolding of market activities and evolving patterns. For instance, mobile learning has gained prominence, enabling learners to access training materials on-the-go. Instructor-led training continues to be a popular choice, while e-learning authoring tools and instructional design facilitate the creation of customized training content.

Knowledge management systems and customer service training are essential for businesses seeking to enhance their operational efficiency and customer experience. Virtual classrooms and customer support offer real-time interaction between learners and trainers, fostering a collaborative learning environment. Training evaluation and certification programs ensure the effectiveness and standardization of IT training initiatives. Performance support tools, sales training, and support services cater to the ongoing learning needs of employees. Boot camps and multimedia content provide immersive learning experiences, while collaboration tools and project management training foster teamwork and productivity. Software training, content creation, and data analytics training equip learners with the necessary skills to leverage emerging technologies.

Cloud computing training, knowledge sharing, and training materials enable organizations to access and disseminate IT knowledge effectively. Interactive content, live streaming, leadership training, blended learning, cybersecurity training, self-paced learning, and agile methodologies are some of the other IT training trends shaping the market. The IT training market is a vibrant and continuously evolving ecosystem, with entities continually innovating to meet the evolving learning needs of their clients.

How is this Information Technology (IT) Training Industry segmented?

The information technology (it) training industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Service

- Infrastructure

- Development

- Database

- Security

- Others

- End-user

- Corporate

- Schools and colleges

- Academic Instittions

- Others

- Delivery Method

- Online/E-learning

- Classroom/Instructor-led

- Blended Learning

- Organization Size

- Small Enterprises

- Medium Enterprises

- Large Enterprises

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Service Insights

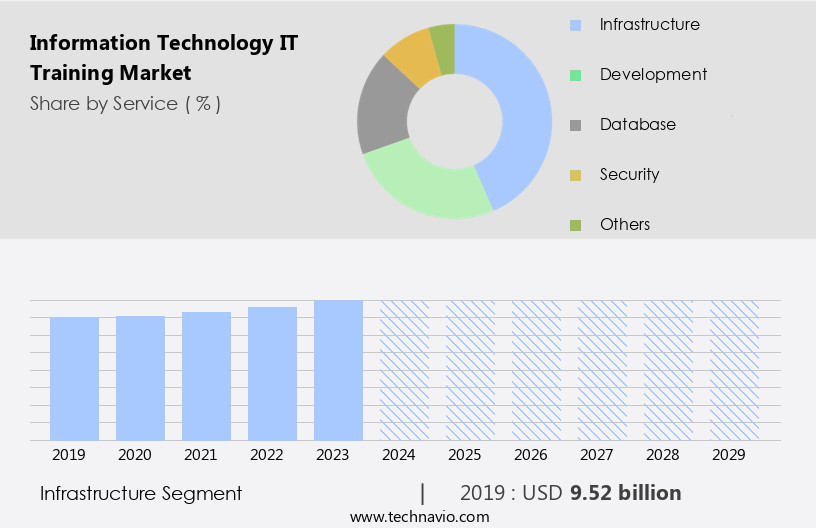

The infrastructure segment is estimated to witness significant growth during the forecast period.

The IT training market encompasses various segments, including digital marketing, mobile learning, skills gap analysis, instructor-led training, compliance training, and more. Instructor-led training continues to be popular, while e-learning platforms and authoring tools facilitate self-paced learning. Instructional design, curriculum development, and community forums foster social learning. Performance support tools, simulation training, and assessment tools ensure effective training evaluation. Certification programs and boot camps offer accelerated learning, while virtual classrooms and customer support enable remote training delivery. Elearning platforms, video tutorials, and multimedia content enhance the learning experience. Project management training, software training, and content creation are essential for talent development.

Cloud computing training, data analytics training, and big data training reflect the market's focus on advanced technologies. Interactive content, live streaming, and collaboration tools enable engaging and effective training. Agile methodologies and blended learning cater to diverse learning styles and needs. Training delivery methods include instructor-led, self-paced, and blended. Technical support, learning resources, and knowledge sharing ensure a comprehensive learning experience. Cybersecurity training is a critical component, addressing the evolving threat landscape. In the infrastructure segment, IT infrastructure management is crucial, focusing on operational efficiency, adherence to standards, and interoperability. This includes training on IT systems and equipment, corporate policies, and business processes.

Network management, storage management, and systems management are key areas of focus.

The Infrastructure segment was valued at USD 9.52 billion in 2019 and showed a gradual increase during the forecast period.

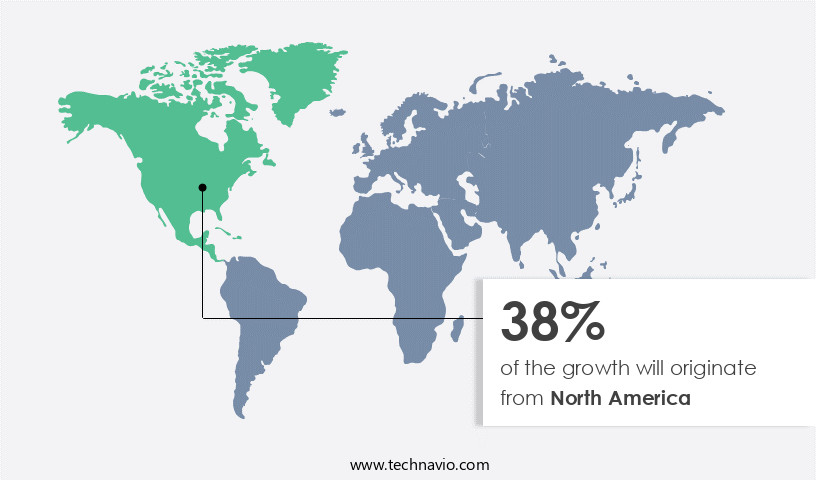

Regional Analysis

North America is estimated to contribute 38% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The IT training market in North America is thriving, driven by the region's technological advancements and the need for skilled professionals. Major tech companies, such as Apple, based in the region, push the boundaries of innovation, creating a demand for up-to-date IT skills. Advanced network infrastructure facilitates the adoption of emerging technologies like AI and blockchain, further increasing the requirement for trained personnel. In response, enterprises invest heavily in IT training to enhance operational efficiency. This trend is reflected in the significant spending on various training methods, including digital marketing, mobile learning, instructor-led, compliance, eLearning authoring tools, instructional design, knowledge management systems, customer service, virtual classrooms, customer support, training evaluation, certification programs, corporate training, online courses, performance support tools, sales training, support services, boot camps, multimedia content, collaboration tools, project management, software training, content creation, talent development, eLearning platforms, video tutorials, curriculum development, community forums, technical training, assessment tools, social learning, learning objectives, simulation training, training delivery methods, technical support, learning resources, cloud computing, knowledge sharing, training materials, data analytics, big data, interactive content, live streaming, leadership, blended learning, cybersecurity, self-paced learning, and agile methodologies.

These training solutions cater to diverse learning styles and needs, ensuring a harmonious learning experience.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and ever-evolving landscape of Information Technology (IT), staying updated with the latest skills and technologies is crucial for both individuals and organizations. The IT training market caters to this demand, offering diverse learning solutions that range from foundational IT courses to specialized technology certifications. These programs encompass various domains such as cybersecurity, cloud computing, data analytics, artificial intelligence, machine learning, programming languages, and IT infrastructure. IT training providers employ multiple delivery methods, including classroom instruction, online courses, and blended learning, ensuring flexibility for learners. Additionally, microlearning, gamification, and virtual reality technologies enhance the learning experience. IT training market trends reflect a growing focus on skills development for digital transformation, upskilling, and reskilling. With the increasing adoption of remote work and flexible learning, the IT training market is poised for significant growth.

What are the key market drivers leading to the rise in the adoption of Information Technology (IT) Training Industry?

- Artificial intelligence, machine learning, and cloud computing innovations are the primary catalysts fueling market growth in this era.

- The market is experiencing significant growth due to the integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) with cloud computing. This synergy is driving demand for IT training as organizations adopt cloud-based solutions. AI and ML optimize data management, enhance security, and automate routine operations, enabling businesses to process large data volumes efficiently. Predictive analytics and real-time decision-making are essential for maintaining competitive advantages in various sectors. Cloud computing provides the necessary infrastructure to support complex AI and ML models, offering scalability and flexibility that traditional systems cannot match. Digital marketing training, mobile learning, skills gap analysis, instructor-led training, compliance training, elearning authoring tools, instructional design, knowledge management systems, customer service training, virtual classrooms, and customer support are among the IT training areas that are gaining popularity.

- Training evaluation is crucial to ensure the effectiveness of these programs and to continuously improve them. Overall, the integration of AI, ML, and cloud computing is transforming the IT training landscape, providing businesses with the tools and knowledge they need to stay competitive.

What are the market trends shaping the Information Technology (IT) Training Industry?

- Blended learning, which combines traditional classroom instruction with online components, is currently gaining significant traction in educational markets. This trend signifies a shift towards more flexible and technology-enhanced learning experiences.

- Blended learning, a combination of traditional face-to-face training and online courses, is gaining traction in the corporate training market. This approach offers a cost-effective and personalized method for organizations to engage and educate their employees. companies in this market provide a range of blended e-learning courses, merging onsite training with online modules. Performance support tools, such as multimedia content and collaboration platforms, enhance the learning experience. Certification programs, sales training, project management, and software training are popular areas of focus. Online courses offer the flexibility to learn at one's own pace, while onsite sessions provide the opportunity for hands-on experience and interaction with trainers.

- Blended learning also allows for the integration of support services and boot camps for intensive skill development. Organizations can benefit from the flexibility, cost savings, and increased engagement offered by blended learning. The use of collaboration tools and multimedia content further enriches the learning experience, making it a preferred choice for businesses worldwide.

What challenges does the Information Technology (IT) Training Industry face during its growth?

- The increasing prevalence of Massive Open Online Courses (MOOCs) poses a significant challenge to the expansion of the education industry, as more individuals turn to these platforms for accessible and affordable learning opportunities.

- IT training market encompasses various methods and tools for talent development in the technology sector. Elearning platforms, such as mooc.Org, Coursera, FutureLearn, and Instructure, are popular choices for cost-effective and flexible training. These platforms offer a wide range of curriculum in fields like AI, Azure, big data, blockchain, cybersecurity, and programming languages. Elearning platforms provide access to video tutorials, community forums, assessment tools, and simulation training. Social learning and learning objectives are emphasized to enhance the learning experience. Technical training is delivered through various methods, including video-based instruction and interactive simulations. Technical support is available to ensure a seamless learning journey.

- Elearning platforms partner with renowned institutes and qualified lecturers to offer high-quality courses. These courses cover key IT skills and are accessible to professionals worldwide. The market's growth is driven by the need for continuous skill development in the rapidly evolving IT landscape. The use of assessment tools and social learning fosters a collaborative and engaging learning environment.

Exclusive Customer Landscape

The information technology (it) training market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the information technology (it) training market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, information technology (it) training market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ACI Learning - IT training is delivered via digital courses, interactive labs, and gamified learning experiences, enhancing skill development and professional growth for individuals. Our innovative approach boosts marketability and adaptability in the tech industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ACI Learning

- Allen Communication Learning Services

- Amazon.com Inc.

- Apple Inc.

- British Standards Institution

- CBT Nuggets LLC

- Cisco Systems Inc.

- Computer Generated Solutions Inc.

- Dell Technologies Inc.

- ESET Spol Sro

- ExecuTrain

- Firebrand Training Ltd.

- Hewlett Packard Enterprise Co.

- ILX Group

- International Business Machines Corp.

- Learning Tree International Inc.

- LearnQuest Inc.

- Microsoft Corp.

- New Horizons Computer Learning Centers Inc.

- Oracle Corp.

- SAP SE

- SDLC Training

- Simplilearn

- Skillsoft Corp.

- Tech Data Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Information Technology (IT) Training Market

- In January 2024, IBM announced the acquisition of SkillsBuild, a digital learning platform, to expand its IT training offerings and enhance its talent development services (IBM Press Release). In March 2024, Microsoft and Adobe signed a strategic partnership to integrate Microsoft Teams with Adobe Creative Cloud, allowing users to access Adobe's creative tools directly from the Microsoft platform, thereby enhancing IT training opportunities for professionals in the creative industry (Microsoft News Center).

- In April 2024, Google Cloud launched a new IT training program, "Google Cloud Skills Boost," offering free access to digital courses and labs for its customers, aiming to upskill over two million learners by 2025 (Google Cloud Blog). In May 2025, Amazon Web Services (AWS) received regulatory approval from the European Union to launch its AWS Training and Certification program in the EU region, marking its entry into the European IT training market and expanding its reach to over 20 countries (AWS Press Release).

Research Analyst Overview

- In the IT training market, behavioral learning and personalized learning are gaining traction, with interactive simulations and gamified assessments driving engagement. Content personalization and learning analytics enable tailored instruction, while third-party integrations expand functionality. VR/AR applications and serious games offer immersive learning experiences, and collaborative learning environments foster knowledge transfer. Adaptive learning and experiential learning cater to diverse learning styles, with feedback mechanisms providing data-driven insights for performance tracking.

- Learning platforms integration, API integrations, and WCAG compliance ensure accessibility and seamless user experience. Mentorship programs and community building foster learner engagement, and learning pathways and cognitive load theory optimize instructional design. Data-driven insights and progress monitoring enable continuous improvement, making IT training more effective and efficient for businesses.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Information Technology (IT) Training Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

215 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.8% |

|

Market growth 2025-2029 |

USD 13.23 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.3 |

|

Key countries |

US, Germany, Australia, India, UK, France, China, Canada, Italy, Japan, Brazil, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Information Technology (IT) Training Market Research and Growth Report?

- CAGR of the Information Technology (IT) Training industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the information technology (it) training market growth of industry companies

We can help! Our analysts can customize this information technology (it) training market research report to meet your requirements.