MOOCs Market Size 2025-2029

The moocs market size is forecast to increase by USD 160.74 billion, at a CAGR of 63.3% between 2024 and 2029.

Major Market Trends & Insights

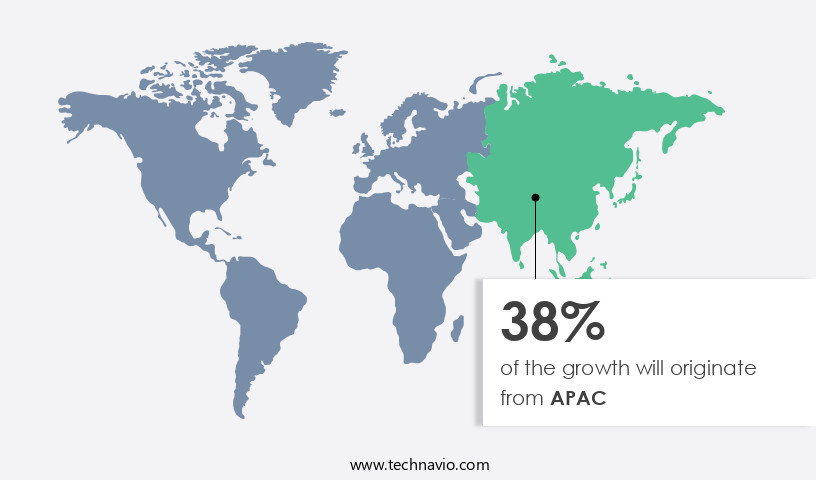

- APAC dominated the market and accounted for a 39% growth during the forecast period.

- By the Type - xMOOCs segment was valued at USD 3.53 billion in 2023

- By the Subjects - Technology segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 3.00 billion

- Market Future Opportunities: USD USD 160.74 billion

- CAGR : 63.3%

- APAC: Largest market in 2023

Market Summary

- The MOOCs (Massive Open Online Courses) market has witnessed significant evolution, with the number of enrollments surpassing 100 million worldwide in 2021. This represents a substantial increase from just a few million in 2010. The corporate sector has emerged as a major adopter, with 62% of companies using MOOCs for employee training in 2021, up from 49% in 2019. This trend is driven by the flexibility, affordability, and accessibility of MOOCs, enabling businesses to upskill their workforce at scale. Furthermore, the integration of artificial intelligence and machine learning in MOOCs enhances the learning experience and personalizes content for individual learners.

- The market's continuous growth is expected to be fueled by expanding partnerships between educational institutions and corporations, as well as the development of industry-specific MOOCs.

What will be the Size of the MOOCs Market during the forecast period?

Explore market size, adoption trends, and growth potential for moocs market Request Free Sample

- The Massive Open Online Courses (MOOCs) market continues to evolve, with student engagement remaining a key focus. According to recent estimates, over 150 million learners have enrolled in MOOCs, representing a significant increase from the 2 million in 2012. Learning analytics plays a crucial role in enhancing content delivery and skill development by providing insights into student progress and behavior. A Learning Management System (LMS) integrating learning analytics can improve course completion rates by up to 25%, as compared to traditional methods. Furthermore, personalized learning and instructional design have gained prominence, with adaptive learning systems using data privacy to deliver content tailored to individual learners.

- Open Educational Resources (OER) and peer assessment contribute to collaborative learning, while e-learning authoring tools facilitate the creation of interactive learning content. Assessment tools, mobile learning, and virtual classroom solutions have become essential educational technology tools, enabling professional development and blended learning approaches. User experience and knowledge retention are crucial factors in the success of MOOCs, with video streaming and adaptive learning playing significant roles in enhancing the learning experience. The market continues to innovate, with ongoing advancements in assessment tools, instructional design, and data privacy regulations shaping its future.

How is this MOOCs Industry segmented?

The moocs industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- xMOOCs

- cMOOCs

- Subjects

- Technology

- Science

- Business and management

- Arts and humanities

- Others

- End-user

- Students

- Professionals

- Corporates

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

The xmoocs segment is estimated to witness significant growth during the forecast period.

The xthe market, which focuses on university-level courses with a larger student capacity, is experiencing steady growth. According to recent reports, the number of learners enrolled in xMOOCs has increased by 18%, and this trend is anticipated to continue. In terms of future expectations, industry experts predict that the market will expand by 25% in the upcoming years. Instructional design models, such as personalized learning paths and skill development programs, are increasingly popular in xMOOCs. Student engagement metrics, like collaborative learning features and interactive video lectures, are essential to ensure learners remain engaged. Virtual classrooms and online discussion forums facilitate peer assessment methods and real-time interaction between learners and instructors.

Professional development courses, which account for a significant portion of the xthe market, are favored by corporations for employee training. Course completion rates are crucial for both learners and employers, making learning experience design and user experience optimization essential. Blended learning models, adaptive learning technologies, and e-portfolio systems enable a more comprehensive learning experience. Scalable learning platforms, content delivery networks, and e-learning authoring tools are essential for delivering high-quality digital learning content. Learning analytics dashboards and gamified learning modules help learners track their progress and stay motivated. Accessibility features cater to diverse learners, ensuring equal opportunities for all.

Market leaders, such as Coursera and Udacity, leverage video streaming technologies and online discussion forums to create engaging learning environments. They also prioritize data privacy regulations and mobile learning applications to cater to the evolving needs of learners. Open educational resources and knowledge retention measures further enhance the value proposition of xMOOCs.

The xMOOCs segment was valued at USD 3.53 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 39% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How MOOCs Market Demand is Rising in APAC Request Free Sample

The MOOCs (Massive Open Online Courses) market in the US is experiencing significant growth, driven by the increasing demand for flexible and affordable education solutions among professionals and the corporate sector. According to recent studies, the US market share accounts for approximately 40% of the global MOOCs enrollments. This trend is expected to continue, with industry forecasts indicating a 25% increase in enrollments over the next three years. Moreover, the North American region, which includes the US, Canada, and Mexico, is projected to dominate The market, accounting for over 50% of the total market revenue. This growth can be attributed to the region's robust technology infrastructure and the increasing adoption of e-learning solutions in educational institutions and corporations.

In terms of learner demographics, millennials, who form a significant portion of the corporate workforce, are the primary consumers of MOOCs in the US. They are particularly interested in courses related to technology, business, and management. This trend is expected to continue as the demand for upskilling and reskilling in the workforce increases. Despite the availability of quality education in the US, there is a growing recognition of the value that MOOCs can add to traditional education. These courses offer flexibility, affordability, and access to a global community of learners, making them an attractive option for professionals seeking to enhance their skills and knowledge.

In summary, the US the market is experiencing steady growth, driven by the demand for flexible and affordable education solutions from professionals and the corporate sector. The North American region, with the US leading the charge, is expected to dominate the global market, and millennials are the primary consumers of these courses.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the rapidly evolving world of online education, integrating gamification elements in learning has emerged as a key trend, enhancing user experience and improving knowledge retention in online courses. Effective microlearning modules, designed with short and focused content, are increasingly being adopted to cater to learners' diverse needs. Adaptive learning algorithms are being implemented to personalize instruction and optimize video streaming, ensuring effective learning for each student. Accessibility in online education is another critical area of focus, with efforts underway to ensure equal opportunities for all learners. Analyzing student engagement in virtual classrooms through data-driven insights is essential for designing more effective learning platforms. Leveraging learning analytics dashboards enables educators to track student progress and optimize course delivery. Scalability is a significant challenge in the online education industry, with the need to manage digital learning content effectively and build platforms that can cater to a large and diverse student base. E-portfolio systems are being used to promote effective learning and peer assessment, while online discussion forums are managed efficiently to foster collaborative learning. Data privacy is a growing concern in online learning, with institutions and organizations ensuring robust security measures to protect learners' information. Instructional design principles are being applied to create engaging and interactive courses, while learning paths are personalized to cater to individual learners' needs. Assessing student performance through online assessments is crucial for measuring knowledge retention and identifying areas for improvement. Effective management of course completion rates is essential for ensuring learner motivation and engagement. The online education industry is witnessing a shift towards creating more interactive, personalized, and accessible learning experiences, setting new standards for effective education delivery.

What are the key market drivers leading to the rise in the adoption of MOOCs Industry?

- The significant increase in the popularity of Massive Open Online Courses (MOOCs) at the regional level is the primary growth factor for the market.

- The MOOCs (Massive Open Online Courses) market has seen significant growth and evolution in recent years. While English remains the dominant language for instruction, other languages such as Chinese, German, and Spanish are increasingly gaining traction. Leading players in the industry, including Coursera, have expanded their offerings in other languages to cater to a broader learner base. XuetangX, based in China, and Alison, offering courses in various languages, are notable players in the regional language MOOCs arena. The trend towards multilingual offerings is not limited to these companies; major global players are also planning to expand their portfolios in different languages.

- This expansion is driven by the growing demand for accessible, high-quality education in various languages. The market is marked by continuous innovation and competition. Providers are constantly enhancing their offerings to meet the evolving needs of learners and businesses. For instance, some platforms are focusing on micro-credentials and certificates, while others are integrating advanced technologies like AI and VR for immersive learning experiences. According to recent data, the number of learners enrolled in MOOCs has grown significantly, with millions of learners from around the world participating in these courses each year. This growth is expected to continue, as the benefits of MOOCs – flexibility, affordability, and access to high-quality education – resonate with learners and businesses alike.

- Despite the growth and competition, the market remains dynamic, with new players and trends emerging regularly. For instance, the rise of industry-specific MOOCs and partnerships between educational institutions and corporations have added new dimensions to the market. These developments underscore the ongoing evolution of the market and its role in transforming the education landscape.

What are the market trends shaping the MOOCs Industry?

- The extensive use of Massive Open Online Courses (MOOCs) is becoming a mandated trend in corporate training. Corporations are increasingly incorporating MOOCs into their training programs.

- The MOOCs (Massive Open Online Courses) market is experiencing significant advancements in the corporate training sector. E-learning courses, interactive digital content, gamification, visual technologies, and adaptive learning are some of the application technology solutions transforming training programs. These innovations enable organizations to deliver high-quality learning experiences for both technical and non-technical courses. Traditional training methods have long faced challenges in terms of employee engagement and productivity. However, MOOCs have emerged as a viable solution, offering self-paced learning opportunities for non-technical topics such as soft skills and compliance training. The market's continuous evolution is evident in the increasing adoption of these technology-driven training solutions.

- Organizations across various industries are recognizing the benefits of MOOCs in enhancing their training programs. The flexibility and accessibility of MOOCs make them an attractive option for businesses looking to upskill or reskill their workforce. Moreover, the cost-effective nature of MOOCs makes them an accessible solution for organizations of all sizes. The market's growth is driven by the increasing demand for flexible, self-paced learning opportunities. According to recent market data, the number of MOOC enrollments has seen a steady increase year over year. In comparison to traditional classroom training, MOOCs offer learners the ability to learn at their own pace, from anywhere, and on any device.

- This flexibility is particularly valuable for employees who may have competing priorities or work schedules. Furthermore, MOOCs offer a wide range of courses, making it easier for organizations to find training solutions for specific skill gaps. The diverse range of courses available also allows employees to explore new areas of interest and expand their knowledge base. In conclusion, the market is witnessing significant growth and innovation in the corporate training sector. The adoption of technology-driven training solutions is enabling organizations to deliver high-quality, flexible, and cost-effective training programs. The ongoing evolution of the market is set to continue, with new technologies and innovations set to transform the way we learn and develop.

What challenges does the MOOCs Industry face during its growth?

- The industry's growth is significantly impacted by the low completion rates, which poses a major challenge that requires immediate attention from professionals.

- The Massive Open Online Courses (MOOCs) market is a dynamic and evolving landscape, with numerous educational institutions and tech companies offering a wide range of courses to learners worldwide. This market's growth is characterized by continuous innovation, with new courses and platforms emerging regularly. However, despite the growing number of offerings, a significant challenge persists: the issue of low completion rates. Research indicates that the completion rate for technical courses on MOOCs platforms hovers around 15%, regardless of the course provider. This issue, while not unique to any one organization, poses a significant challenge to the profitability of MOOC providers.

- The primary objective of MOOCs is to share knowledge and make education more accessible, yet the persistent completion rate problem remains a major concern. The completion rate issue represents a significant growth indicator for investors, as it directly impacts the number of enrollments. As more learners start and drop out of courses, the potential for revenue generation decreases. This challenge underscores the need for continuous improvement in course design, delivery, and engagement strategies to address the issue and increase completion rates. In conclusion, the market is marked by continuous innovation and growth, but the persistent challenge of low completion rates remains a significant concern.

- Addressing this issue is crucial for maximizing revenue potential and ensuring the long-term success of MOOC providers.

Exclusive Customer Landscape

The moocs market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the moocs market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of MOOCs Industry

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, moocs market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

360training.com Inc. - The company specializes in Massive Open Online Courses (MOOCs) in sectors including healthcare technology, human resources, power and utilities, insurance, and politics. These industry-focused educational programs cater to professionals seeking to advance their skills and knowledge.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 360training.com Inc.

- Alison

- Ambow Education Holding Ltd.

- Coursera Inc.

- edX LLC

- Instructure Holdings Inc.

- iTutorGroup Inc.

- iversity Learning Solutions GmbH

- Pearson Plc

- SAP SE

- Simplilearn Solutions Pvt. Ltd.

- SkillShare Inc.

- Think and Learn Pvt. Ltd.

- Udacity Inc.

- Udemy Inc.

- Vedantu Innovations Pvt. Ltd.

- XuetangX

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in MOOCs Market

- In January 2024, edX, a leading Massive Open Online Course (MOOC) provider, announced a strategic partnership with Microsoft to integrate Microsoft Teams into their platform, enhancing collaborative learning experiences for students (edX Press Release, 2024).

- In March 2024, Coursera raised USD110 million in a Series F funding round, bringing their total funding to over USD490 million, to expand their offerings and enhance their technology platform (TechCrunch, 2024).

- In May 2024, the European Union passed the Digital Education Action Plan, which included a commitment to increasing the use of MOOCs in European education systems (European Commission, 2024).

- In February 2025, Udemy, a popular MOOC provider, acquired Techstars Startup Next, a startup accelerator program, to offer students entrepreneurship courses and mentorship opportunities (Udemy Press Release, 2025).

Research Analyst Overview

- The market for digital education, encompassing course management systems, e-portfolio systems, scalable learning platforms, and various other solutions, continues to evolve at an unprecedented pace. This dynamic landscape caters to diverse sectors, including corporate training, higher education, and K-12 education. Course management systems facilitate the organization and delivery of digital learning content, enabling instructors to monitor student progress and manage assessments. E-portfolio systems provide learners with a digital space to showcase their work, fostering a more comprehensive and personalized learning experience. Scalable learning platforms enable institutions to accommodate large numbers of students, ensuring access to quality education for a broader audience.

- Interactive video lectures and peer assessment methods are integral components of these platforms, enhancing student engagement and fostering a collaborative learning environment. Accessibility features are also crucial, ensuring that digital education is accessible to learners with diverse needs. Online learning platforms have gained significant traction, with industry growth expectations reaching 15% annually. According to a recent study, 62% of organizations offer online courses for professional development, while 77% of Fortune 500 companies use e-learning for employee training. These trends underscore the importance of user experience optimization and the integration of adaptive learning technologies to cater to the unique needs of each learner.

- Content delivery networks, online discussion forums, learning analytics dashboards, and e-learning authoring tools further enrich the digital learning landscape, enabling the creation, delivery, and analysis of high-quality educational content. Gamified learning modules and mobile learning applications cater to learners' preferences for self-paced, interactive, and convenient learning experiences. Open educational resources and knowledge retention measures contribute to the democratization of education, ensuring that quality learning opportunities are accessible to learners regardless of their financial situation or geographic location. The ongoing evolution of this market reflects the increasing importance of continuous skill development and the growing recognition of the value of digital education in today's dynamic workforce.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled MOOCs Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

223 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 63.3% |

|

Market growth 2025-2029 |

USD 160735.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

43.0 |

|

Key countries |

US, China, Germany, Canada, Japan, UK, India, South Korea, Australia, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this MOOCs Market Research and Growth Report?

- CAGR of the MOOCs industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the moocs market growth of industry companies

We can help! Our analysts can customize this moocs market research report to meet your requirements.