Krabbe Disease Treatment Market Size 2024-2028

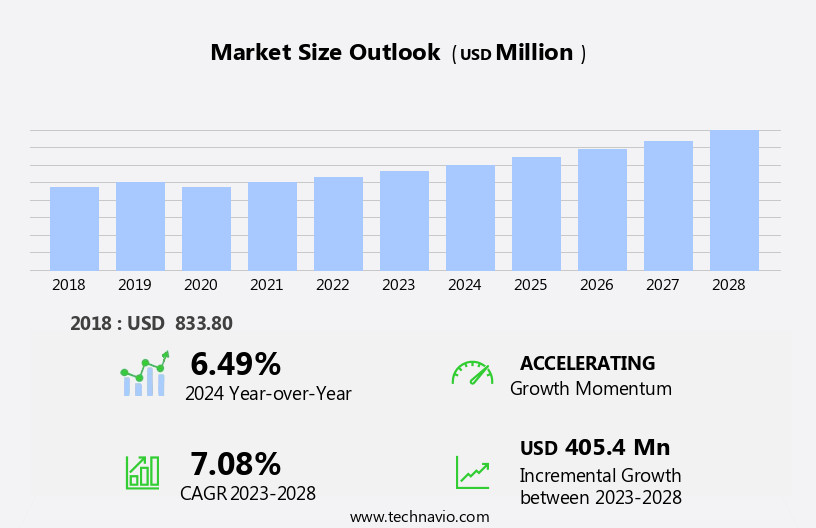

The krabbe disease treatment market size is forecast to increase by USD 405.4 million at a CAGR of 7.08% between 2023 and 2028.

- The market is characterized by several key drivers and trends that are shaping its growth trajectory. The emergence of specialized drug designations for Krabbe Disease by regulatory authorities, such as the FDA, is providing a significant boost to the market. These designations offer incentives to pharmaceutical companies, enabling them to invest more in research and development for Krabbe Disease treatments. Another trend influencing the market is the development of pharmacological chaperone therapy. This innovative approach involves using small molecules to help the body produce and transport the missing or deficient enzyme responsible for Krabbe Disease.

- This therapy holds immense potential in treating Krabbe Disease, as it can address the underlying cause of the condition. However, the market also faces challenges that need to be addressed for optimal growth. The limited patient pool for clinical trials is a significant hurdle, as Krabbe Disease is a rare condition. This makes it challenging for pharmaceutical companies to justify the high costs associated with developing and testing new treatments. To overcome this challenge, collaborations between academic institutions, patient organizations, and industry players are crucial for driving innovation and progress in the market. Companies seeking to capitalize on market opportunities and navigate challenges effectively must stay informed of regulatory developments, collaborate with stakeholders, and invest in research and development to bring innovative treatments to market.

What will be the Size of the Krabbe Disease Treatment Market during the forecast period?

- The market represents a significant opportunity in the healthcare industry, driven by the growing demand for innovative therapies to address this rare, genetic disorder that primarily affects the central nervous system. Krabbe disease, also known as globoid cell leukodystrophy, is characterized by the destruction of myelin sheaths in nerve cells, leading to various neurological symptoms such as muscle spasms, seizures, loss of hearing, and vision problems. Key market dynamics include the increasing number of diagnosed cases, driven by heightened awareness and improved diagnostic tools like eye examinations, imaging scans, and genetic testing. Novel treatments, including enzyme replacement therapies, gene therapies, and stem cell transplants, are gaining traction, offering potential for significant market growth.

- Healthcare professionals in hospitals and specialized clinics are at the forefront of providing care, while patient advocacy groups play a crucial role in raising awareness and funding for research. The market is also influenced by the ongoing advancements in medical science, which continue to uncover new imbalances and potential therapeutic targets. Supportive care, such as anticonvulsant medications and feeding difficulties management, remains essential for managing Krabbe disease symptoms. The market is expected to grow steadily, driven by the unmet medical needs of children and caregivers, and the ongoing commitment to developing effective, long-term treatments.

How is this Krabbe Disease Treatment Industry segmented?

The krabbe disease treatment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Therapy

- Anticonvulsants

- Muscle relaxants

- HSCT

- Others

- Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- Asia

- Japan

- Rest of World (ROW)

- North America

By Therapy Insights

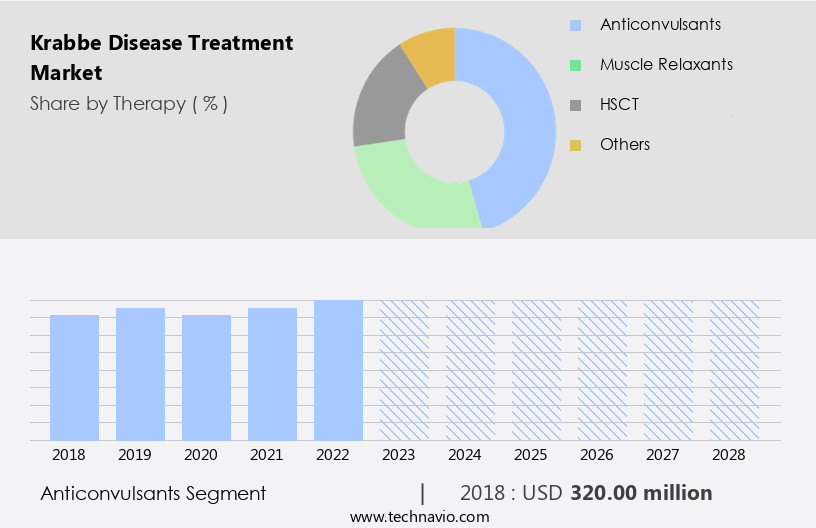

The anticonvulsants segment is estimated to witness significant growth during the forecast period.

Krabbe disease, a rare genetic disorder causing damage to the myelin sheath in the Central Nervous System, results in various symptoms including visual loss, muscle weakness, trouble walking, loss of hearing, feeding difficulties, seizures, and muscle spasms. While there are no curative treatments available for this debilitating condition, anticonvulsant medications are widely used to manage seizures and muscle relaxer drugs to alleviate muscle spasms. Ethical considerations and healthcare professionals' expertise are essential in administering these treatments. The market for Krabbe disease treatments is driven by the increasing demand for novel therapies, including gene technologies, biologics, and stem cell transplantation.

Clinics and hospitals are the primary providers of these therapies, while healthcare providers and patient advocacy groups play crucial roles in clinical trials and commercialization. Imaging scans, genetic testing, and eye examination are essential diagnostic tools in Krabbe disease diagnosis and treatment. The market for Krabbe disease treatments is expected to grow steadily due to the increasing patient pool and the need for supportive care, including rehabilitation facilities and physical therapy. Anticonvulsant agents remain a significant submarket, with phenobarbital and valproic acid being the most commonly used drugs. Drug discovery and research centers are actively involved in developing new treatments, including enzyme replacement therapies and stem cell transplants.

In , Krabbe disease is a rare genetic disorder that affects the Central Nervous System, leading to various symptoms, including visual loss, muscle weakness, trouble walking, loss of hearing, feeding difficulties, seizures, and muscle spasms. While there is no cure for the disease, anticonvulsant medications and muscle relaxer drugs are used to manage symptoms. The market for Krabbe disease treatments is expected to grow due to the increasing patient pool and the need for novel therapies, including gene technologies, biologics, and stem cell transplantation.

Get a glance at the market report of share of various segments Request Free Sample

The Anticonvulsants segment was valued at USD 320.00 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

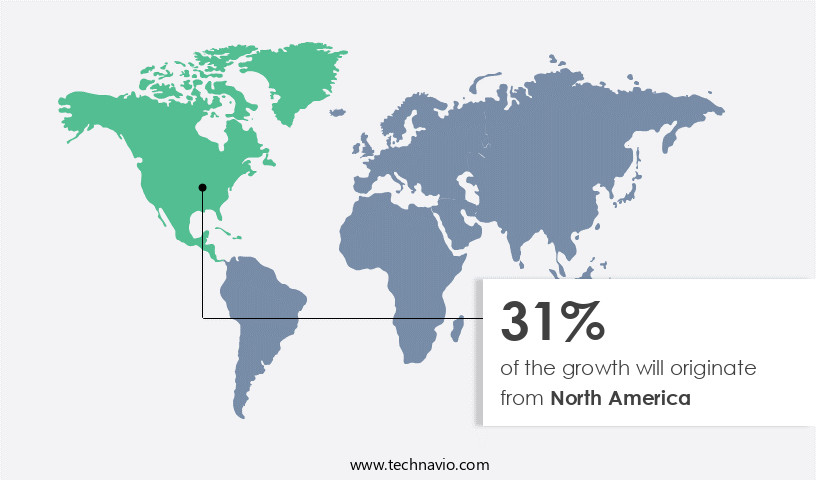

North America is estimated to contribute 31% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in North America is driven by the implementation of newborn screening (NBS) tests for early identification and management of the disease. With an incidence rate of approximately 1 in 250,000 births in the US, according to the National Institutes of Health (NIH), there is a growing demand for Krabbe disease treatments in this region. NBS testing enables early detection of potential risk factors, expanding therapeutic possibilities. However, the market growth is anticipated to be moderate due to the low prevalence of the disease. Krabbe disease is a rare genetic ailment that affects the Central Nervous System, leading to muscle weakness, trouble walking, muscle spasms, seizures, loss of sight, hearing, and feeding difficulties.

The disease is caused by a deficiency of the enzyme galactocerebrosidase, leading to the accumulation of a toxic substance called psychosine, damaging the myelin sheath of nerve cells. Standard tools for Krabbe disease treatment include anticonvulsant medications, muscle relaxer drugs, and supportive care. However, novel treatments like gene therapies, stem cell transplantation, and biologics are under clinical development. Ethical considerations and government funding are crucial factors influencing the commercialization of these novel treatments. Healthcare professionals, hospitals and clinics, research centers, laboratories, patient advocacy groups, and rehabilitation facilities are key players in the market. The market also includes hospitals, clinics, pharmacies, and e-commerce platforms.

In addition to infants, late-onset Krabbe disease affects children and adults, leading to symptoms like loss of sight, muscle weakness, and trouble walking. Diagnosis involves genetic testing, eye examination, nerve conduction studies, and imaging scans. Treatment may include anticonvulsant medication, stem cell transplantation, and rehabilitation. The market is expected to grow as research and development efforts continue to uncover new therapeutic possibilities. The market dynamics are influenced by factors like increasing patient pool, drug discovery, and clinical trials.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Krabbe Disease Treatment Industry?

- Special drug designation is the key driver of the market.

- The market is driven by the assignment of special designations to drugs and biologics intended for the safe and effective treatment of Krabbe disease. The Food and Drug Administration (FDA) offers a priority review program for facilitating fast drug approvals, granting sponsors a priority review voucher upon approval of a biologic or drug for a rare pediatric disease. This voucher enables the sponsor to receive priority review for a subsequent marketing application for a different product.

- For instance, MN-166 (ibudilast) received a rare pediatric disease designation from the FDA in January 2016 for the treatment of type 1 early infantile Krabbe disease. This designation expedites the approval process and encourages investment in research and development for Krabbe disease treatments.

What are the market trends shaping the Krabbe Disease Treatment Industry?

- Emergence of pharmacological chaperone therapy is the upcoming market trend.

- Krabbe disease, a lysosomal storage disorder caused by a mutation in the GLC gene, affects approximately 40% of diagnosed cases. This mutation impairs the enzyme's ability to fold correctly, hindering its transportation to the lysosome for substrate breakdown. The accumulation of substrate in the central nervous system results in debilitating symptoms, making existing therapeutic methods for other lysosomal disorders ineffective. Pharmacological chaperone therapy, a promising approach, utilizes small molecules that attach to misfolded GLC, facilitating its correct folding and transportation to the lysosome.

- These molecules, characterized by low molecular weight, low toxicity, and high bioavailability, demonstrate potential in efficiently penetrating the blood-brain barrier. By stabilizing the GLC enzyme, these compounds aim to mitigate the effects of Krabbe disease and improve patient outcomes.

What challenges does the Krabbe Disease Treatment Industry face during its growth?

- Limited patient pool for clinical trials is a key challenge affecting the industry growth.

- Orphan diseases, including Krabbe disease, affect a very small percentage of the population due to their low prevalence rates. This limited patient pool poses challenges in the development of treatments. Clinical trials for orphan diseases often face difficulties in enrolling sufficient participants, which can hinder the statistical significance of study results, even if the drugs are effective. The rarity of these diseases also makes it challenging to identify and recruit patients from diverse geographic locations and demographic backgrounds, increasing the risk of post-marketing adverse effects.

- Despite these challenges, ongoing research efforts aim to address the unmet medical needs of those affected by Krabbe disease and other orphan conditions.

Exclusive Customer Landscape

The krabbe disease treatment market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the krabbe disease treatment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, krabbe disease treatment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AbbVie Inc. - The company introduces Tridone as a novel anticonvulsant solution for Krabbe disease management. Tridone's efficacy lies in its unique chemical composition, making it an innovative addition to the therapeutic landscape for this debilitating condition. Krabbe disease, a rare inherited disorder, causes damage to the protective covering of nerve fibers, leading to various neurological symptoms. Tridone's anticonvulsant properties aim to mitigate seizure activity, a common symptom associated with Krabbe disease. By offering a fresh approach to addressing this complex condition, the company demonstrates its commitment to advancing healthcare through groundbreaking research and development.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AbbVie Inc.

- Acorda Therapeutics Inc.

- CENTOGENE NV

- GlaxoSmithKline Plc

- Johnson and Johnson Services Inc.

- Novartis AG

- Pfizer Inc.

- Polaryx

- Teva Pharmaceutical Industries Ltd.

- UCB SA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Krabbe disease, also known as globoid cell leukodystrophy, is a rare genetic ailment that affects the central nervous system. This condition results in the destruction of the myelin sheath, which protects nerve cells, leading to various neurological symptoms. The treatment market for Krabbe disease is characterized by a diverse range of interventions, including standard tools and novel therapies. One of the primary focuses in Krabbe disease treatment is supportive care. Healthcare professionals employ various methods to manage symptoms and improve patient quality of life. Anticonvulsant medications are commonly used to control seizures, while muscle relaxer drugs help alleviate muscle spasms and muscle weakness.

In addition, caregivers may provide physical therapy to help patients regain mobility and improve muscle function. Basic science research and clinical development are ongoing in the market. Researchers are exploring the use of gene therapies and stem cell transplantation as potential treatments. Ethical considerations are a crucial aspect of this research, as these interventions involve manipulating genetic material and transplanting cells from donors. Government funding and patient advocacy groups play a significant role in advancing Krabbe disease research and treatment. These organizations provide financial support for research projects and raise awareness about the disease, which helps increase funding from other sources.

The market also includes various diagnostic tools and services. Healthcare providers utilize genetic testing and eye examinations to diagnose the condition. Imaging scans, such as magnetic resonance imaging (MRI), are used to assess the extent of nerve damage and monitor the progression of the disease. Hospitals and clinics, as well as hospital and retail pharmacies, are essential providers of Krabbe disease treatments. These facilities offer a range of services, from administering anticonvulsant medications and enzyme replacement therapies to providing rehabilitation services and supportive care. The market is diverse and complex, with various submarkets and stakeholders. These include research centers, laboratories, e-commerce platforms, and patient pools.

Each of these entities plays a unique role in the development, distribution, and administration of Krabbe disease treatments. Despite the progress made in Krabbe disease research and treatment, there are still challenges to overcome. These include the high cost of some therapies, limited availability in certain regions, and the need for continued research to develop more effective and accessible treatments. In , the market is a dynamic and evolving landscape, driven by ongoing research, advances in medical science, and the dedication of healthcare professionals and patient advocacy groups. The market encompasses a range of interventions, from supportive care and standard treatments to novel therapies and cutting-edge research.

Despite the challenges, there is a strong commitment to improving the lives of those affected by this rare genetic disorder.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

145 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.08% |

|

Market growth 2024-2028 |

USD 405.4 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

6.49 |

|

Key countries |

US, Canada, UK, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Krabbe Disease Treatment Market Research and Growth Report?

- CAGR of the Krabbe Disease Treatment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the krabbe disease treatment market growth of industry companies

We can help! Our analysts can customize this krabbe disease treatment market research report to meet your requirements.