Landscaping And Gardening Services Market Size 2025-2029

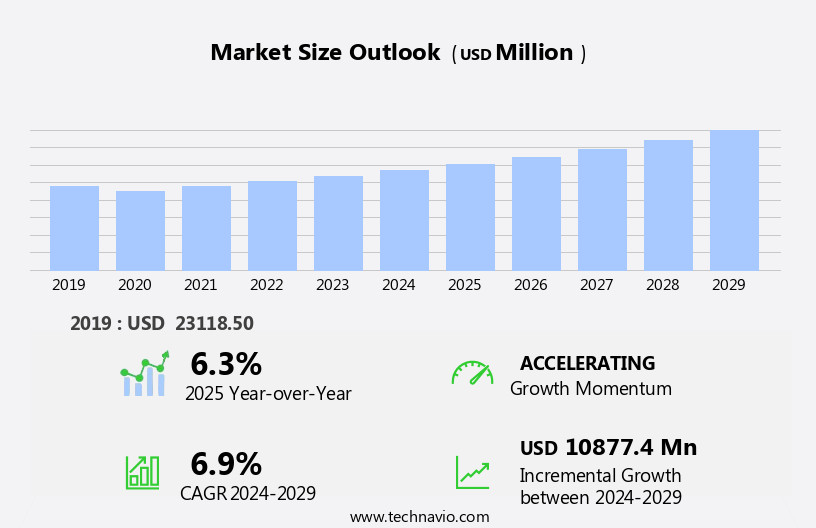

The landscaping and gardening services market size is forecast to increase by USD 10.88 billion, at a CAGR of 6.9% between 2024 and 2029.

- The market is driven by innovations in practices, with a growing trend towards smart gardening solutions that optimize water usage, automate maintenance, and enhance overall garden aesthetics. This shift towards technology-driven services caters to consumers' increasing preference for eco-friendly and efficient gardening methods. Additionally, the rising demand for smart gardening solutions, such as automated irrigation systems and weather-responsive lighting, is contributing to market growth. However, the seasonal nature of landscaping services poses a significant challenge for market participants requiring effective workforce management and strategic planning to ensure consistent revenue throughout the year. As the demand for landscaping and gardening services is heavily influenced by seasonal factors, companies must effectively manage their workforce and resources to cater to fluctuating demand.

- Additionally, ensuring consistent quality and customer satisfaction during peak periods is crucial to maintaining a strong market presence. To capitalize on opportunities and navigate challenges, market players should focus on offering flexible pricing structures, value-added services, and efficient operational models that cater to the seasonal demands of the market.

What will be the Size of the Landscaping And Gardening Services Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

In the dynamic and ever-evolving the market, various sectors continue to adapt and innovate. Drainage systems are being integrated with advanced technologies for optimal water management, while outdoor furniture designs align with the latest trends in sustainability and functionality. Professional certification programs ensure industry standards are met, and retaining walls are engineered for increased durability and safety. Commercial landscaping projects demand fuel efficiency and cost-effective irrigation systems, as well as disease diagnosis and pest control strategies. Lawn maintenance services are leveraging 3D rendering technology for client visualization, and profit margins are closely monitored through pricing strategies and labor cost management.

Residential landscaping encompasses a range of services, from planting and sod installation to tree planting and rooftop gardening. Seasonal fluctuations necessitate contract negotiation and employee training, with an emphasis on plant health and organic gardening practices. Invasive species management and erosion control are crucial for sustainable landscaping, while design tools and landscape maintenance software streamline operations. Market activities unfold continuously, with municipal landscaping projects incorporating water features and safety regulations. Hedge trimmers and equipment maintenance are essential for efficient lawn care, while soil testing and amendments ensure optimal plant growth. Integrated pest management strategies and employee safety training are vital components of a successful business model.

The market remains a vibrant and evolving industry, with ongoing innovation and adaptation across various sectors. From soil testing to customer relationship management, each aspect of the market contributes to the industry's continuous growth and development.

How is this Landscaping And Gardening Services Industry segmented?

The landscaping and gardening services industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Residential

- Commercial and industrial

- Government and institutional

- Type

- Construction and landscape management

- Landscape and garden design

- Gardening maintenance

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By End-user Insights

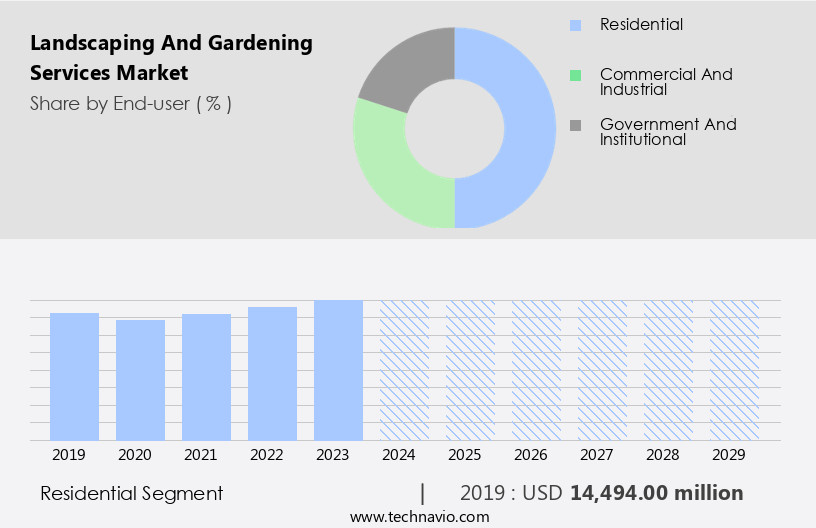

The residential segment is estimated to witness significant growth during the forecast period.

The market encompasses various entities, including project management, ground cover, landscaping equipment, risk management, lawn care, hedge trimmers, integrated pest management, safety regulations, soil testing, soil amendments, municipal landscaping, fire pits, equipment maintenance, labor costs, drainage systems, outdoor furniture, professional certification, retaining walls, commercial landscaping, fuel efficiency, irrigation systems, disease diagnosis, pricing strategies, lawn maintenance, 3D rendering, planting services, profit margins, residential landscaping, tree planting, customer relationship management, seasonal fluctuations, invasive species, landscaping software, flower planting, contract negotiation, sod installation, water features, erosion control, pest control, weed control, employee training, design tools, plant health, gardening services, rooftop gardening, disease control, outdoor kitchens, vertical gardening, landscape design, organic gardening, sustainable landscaping, landscape maintenance, turfgrass management, and shrub planting.

The residential segment, a significant portion of this market, primarily consists of single-family residential buildings and multifamily residential properties. Residential gardens, a common feature in this segment, are typically located near homes and can include various types, such as specialty gardens for plant displays or features like rock gardens or water features. These gardens are not only aesthetically pleasing but also serve essential functions, such as growing herbs and vegetables, contributing to sustainable development. As the baby boomer population ages, the demand for landscaping and gardening services in the residential sector is expected to increase.

This demographic has shown a higher engagement in lawn care, gardening, and landscaping activities. Additionally, the focus on sustainable gardening practices and the integration of technology, such as landscaping software and 3D rendering, are emerging trends in the market. Municipal landscaping, another segment of the market, caters to public spaces, parks, and government properties. Commercial landscaping, on the other hand, serves businesses and corporate offices. Both segments require specialized skills and equipment, such as heavy-duty landscaping equipment and large-scale irrigation systems. Safety regulations, risk management, and employee training are crucial aspects of the market. Ensuring the safety of employees and clients is essential, and the use of integrated pest management, disease control, and erosion control methods can help mitigate risks.

Furthermore, fuel efficiency and the implementation of sustainable landscaping practices are becoming increasingly important in the industry. In conclusion, the market is a diverse and dynamic industry that caters to various sectors, including residential, municipal, and commercial. It encompasses a wide range of services, from lawn care and gardening to landscape design and maintenance. The market is influenced by factors such as demographic trends, sustainability, technology, and safety regulations. As the industry continues to evolve, it is essential to stay informed about these trends and adapt to the changing landscape.

The Residential segment was valued at USD 14.49 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

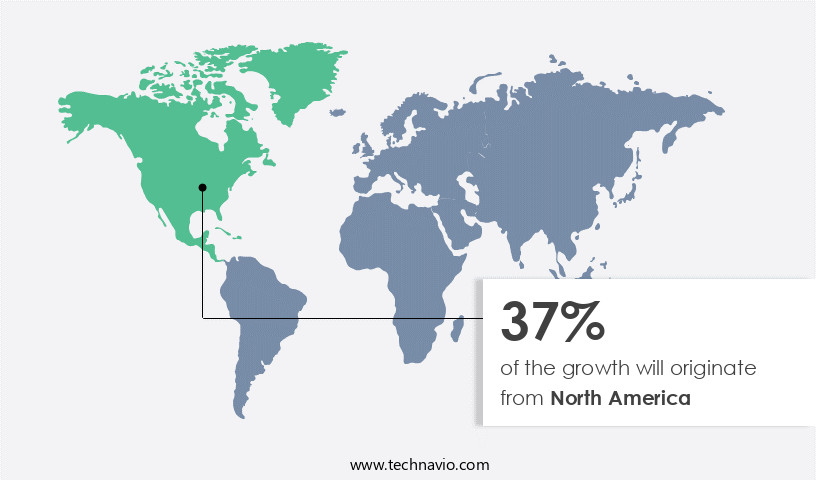

North America is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In North America, with approximately 80% of its population living in urban areas in both the US and Canada, the expansion of urban land has led to a heightened focus on landscaping services to maintain biodiversity and ecosystems. The increase in household disposable income in the US, fueled by the economic recovery from inflation, has resulted in a significant rise in spending on lawn care and gardening activities. This trend is reflected in various aspects of the market. Project management is crucial in managing large-scale commercial landscaping projects, ensuring timely completion and adherence to budgets. Ground covers, such as grasses and shrubs, are popular choices for reducing erosion and adding aesthetic value to landscapes.

Landscaping equipment, including hedge trimmers, plays a vital role in maintaining the appearance of lawns and gardens. Risk management is essential in landscaping to mitigate potential hazards, such as fire risks from fire pits and safety regulations for the use of equipment. Soil testing and amendments are integral to creating healthy environments for plants, while municipal landscaping initiatives promote community engagement and sustainability. Fuel efficiency is a growing concern in landscaping, with irrigation systems and equipment maintenance being key areas of focus. Disease diagnosis and pest control are essential for maintaining plant health, while integrated pest management strategies minimize the use of harsh chemicals.

Commercial landscaping projects require contract negotiation and customer relationship management skills, as well as seasonal fluctuations in labor costs. Landscaping software and design tools streamline project management and enhance the overall landscaping experience. Residential landscaping trends include the installation of water features, rooftop gardening, and vertical gardening, as well as the planting of flowers, shrubs, and trees. Profit margins for landscaping services can be influenced by factors such as pricing strategies, employee training, and the use of organic and sustainable landscaping practices. Turfgrass management, erosion control, and disease control are essential for maintaining the health and appearance of lawns and gardens.

The market also offers a range of gardening services, including planting, pruning, and weed control. In summary, the market in North America is dynamic and diverse, with a focus on project management, equipment, risk management, and sustainability. The market is influenced by factors such as household income, urbanization, and changing consumer preferences.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the market, professionals offer a range of outdoor design and maintenance solutions to enhance the beauty and functionality of both residential and commercial properties. These services include lawn care, tree trimming, irrigation systems, hardscaping, and garden design. Homeowners and businesses seek out landscaping services to create inviting outdoor spaces, improve curb appeal, and increase property value. Gardening services focus on the cultivation and maintenance of plants, flowers, and vegetables, ensuring vibrant and healthy landscapes. Additionally, eco-friendly and sustainable practices are increasingly popular in this market, with organic gardening and water conservation techniques gaining traction. Landscaping and gardening services also provide seasonal services, such as fall leaf removal and winter snow removal, ensuring year-round maintenance and enjoyment of outdoor spaces.

What are the key market drivers leading to the rise in the adoption of Landscaping And Gardening Services Industry?

- Innovations in landscaping and gardening practices significantly drive market growth, as advancements in these areas continually shape consumer preferences and expectations for outdoor spaces.

- The market is experiencing significant growth due to increasing awareness and regulations regarding water conservation and sustainable practices. With water making up over a third of household requirements for landscaping, efficient irrigation systems have become essential. These systems not only help preserve water but also prevent damage to hardscapes caused by excess irrigation. Additionally, the focus on sustainable landscaping practices, driven by government restrictions on water use, is further fueling market growth. Integrated pest management, risk management, and safety regulations are also crucial aspects of the industry.

- Landscaping equipment, including hedge trimmers, plays a vital role in maintaining gardens and lawns. Soil testing and amendments are integral to creating harmonious landscapes, while municipal landscaping projects and the installation of fire pits add to the market's diversity. Regular equipment maintenance and labor costs are ongoing considerations for businesses in this sector.

What are the market trends shaping the Landscaping And Gardening Services Industry?

- The increasing interest in smart gardening represents a significant market trend. This innovative approach to gardening, which leverages technology to optimize plant growth and maintenance, is gaining widespread popularity.

- The market is experiencing significant growth due to the increasing demand for advanced gardening solutions. Smart gardening practices, which incorporate technology to simplify and automate gardening tasks, are gaining popularity among end-users. These systems offer benefits such as timely notifications for watering and nutrient application, as well as weather data, encouraging more adoption during the forecast period. In response to this trend, companies are innovating to develop tools compatible with smart gardening. For instance, the development of autonomous robotic lawnmowers is expected to revolutionize the market. Additionally, other advanced solutions, such as irrigation and drainage systems, outdoor furniture, retaining walls, and planting services, are being integrated with smart technology to enhance their functionality and efficiency.

- Professional certification for landscaping and gardening professionals is another trend gaining traction in the market. This ensures that end-users receive high-quality services and expertise. Furthermore, the focus on fuel efficiency and disease diagnosis in gardening practices is driving the demand for innovative solutions. Pricing strategies are also being reevaluated to cater to the evolving needs of end-users. Three-dimensional rendering services are being used to provide clients with a more immersive and harmonious visualization of their potential landscaping projects. Overall, the market is expected to continue growing due to these trends and the increasing importance of outdoor spaces in modern living.

What challenges does the Landscaping And Gardening Services Industry face during its growth?

- The seasonal nature of the landscaping industry poses a significant challenge to its growth, as demand for services is concentrated during certain periods, leading to fluctuating revenues and operational challenges.

- Landscaping and gardening services involve tree planting, flower planting, sod installation, and various other elements to enhance the aesthetic value and functionality of outdoor spaces. This market experiences seasonal fluctuations, with demand peaking during spring and summer due to favorable weather conditions for plant growth. Conversely, during winter, demand typically decreases due to shorter days, lower temperatures, and potential damage to plants from ice and snow. To manage customer relationships effectively, landscaping businesses employ contract negotiation and design tools. Seasonal fluctuations also impact staffing requirements, necessitating employee training for diverse tasks, such as erosion control, pest control, and weed control.

- Additionally, water features and tree planting are popular landscaping elements that require specialized skills and knowledge. Landscaping software is increasingly used to streamline business operations, including project management, invoicing, and scheduling. Invasive species management is another crucial aspect of the landscaping industry, requiring ongoing research and application of effective control methods. Overall, the market presents both challenges and opportunities, requiring adaptability, professionalism, and a commitment to customer satisfaction.

Exclusive Customer Landscape

The landscaping and gardening services market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the landscaping and gardening services market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, landscaping and gardening services market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Asia Flora and Landscape Sdn. Bhd - This company specializes in comprehensive landscaping and gardening services, encompassing both hardscape and softscape design, as well as layout planning. Hardscape elements include structures such as patios, walkways, and retaining walls, while softscape refers to plantings, lawns, and other vegetation.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Asia Flora and Landscape Sdn. Bhd

- BrightView Holdings Inc.

- Chapel Valley Landscape Co.

- Clintar

- Denison Landscaping

- Fox Mowing

- Gothic Landscape Inc.

- LandCare

- Landscape Development Inc.

- Lawn Doctor Inc.

- Mainscape Inc.

- MARINA Co.

- Ruppert Landscape

- SavATree

- The Davey Tree Expert Co.

- The Scotts Miracle Gro Co.

- TruGreen L.P.

- U.S. Lawns

- Weed Man

- Yellowstone Landscape

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Landscaping And Gardening Services Market

- In January 2024, The Toro Company, a leading provider of landscaping and gardening equipment and solutions, announced the launch of its new line of electric-powered landscaping tools, marking a significant shift towards sustainable and eco-friendly offerings in the industry (Toro Company Press Release, 2024).

- In March 2024, Scotts Miracle-Gro and Plenty, a vertical farming company, entered into a strategic partnership to develop and commercialize hydroponic gardening systems for residential use, expanding the reach of Scotts Miracle-Gro's offerings beyond traditional gardening supplies (Scotts Miracle-Gro Press Release, 2024).

- In May 2024, Brickman Group, a leading landscaping and design firm, completed a successful initial public offering (IPO) on the Australian Securities Exchange, raising AUD 130 million to fund its growth initiatives and expand its market presence (ASX Market Announcements, 2024).

- In April 2025, the European Union passed new regulations requiring mandatory labeling for landscaping and gardening products containing hazardous chemicals, aiming to improve consumer safety and environmental sustainability (European Union Press Release, 2025).

Research Analyst Overview

- The market is witnessing significant advancements driven by the integration of green technologies and environmental science. Drone applications are revolutionizing plant diagnostics and environmental impact assessments, providing real-time data for nutrient management and disease prevention. Smart sprinklers and automated irrigation systems promote water efficiency and energy savings, aligning with the market's focus on sustainability. Landscape architecture is embracing virtual reality design, allowing clients to visualize their projects before implementation. Robotic mowers and recycled materials contribute to carbon footprint reduction and business development. Soil sensors and soil science advancements ensure optimal soil health and plant growth. Beneficial insects, native plants, and biological control methods are gaining popularity for natural pest control.

- Urban farming and community gardens foster local food production and waste management. Integrated pest management and sustainable materials are essential for reducing environmental impact. Plant propagation through seed starting and plant identification technologies enable efficient production and proper identification. Weather forecasting and data analytics help optimize nutrient management and energy efficiency. Wildlife habitat creation and pollinator gardens contribute to biodiversity and ecosystem health.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Landscaping And Gardening Services Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

199 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.9% |

|

Market growth 2025-2029 |

USD 10877.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.3 |

|

Key countries |

US, UK, China, Germany, Canada, France, India, Japan, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Landscaping And Gardening Services Market Research and Growth Report?

- CAGR of the Landscaping And Gardening Services industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the landscaping and gardening services market growth of industry companies

We can help! Our analysts can customize this landscaping and gardening services market research report to meet your requirements.