Laptop Touchscreen Market Size 2025-2029

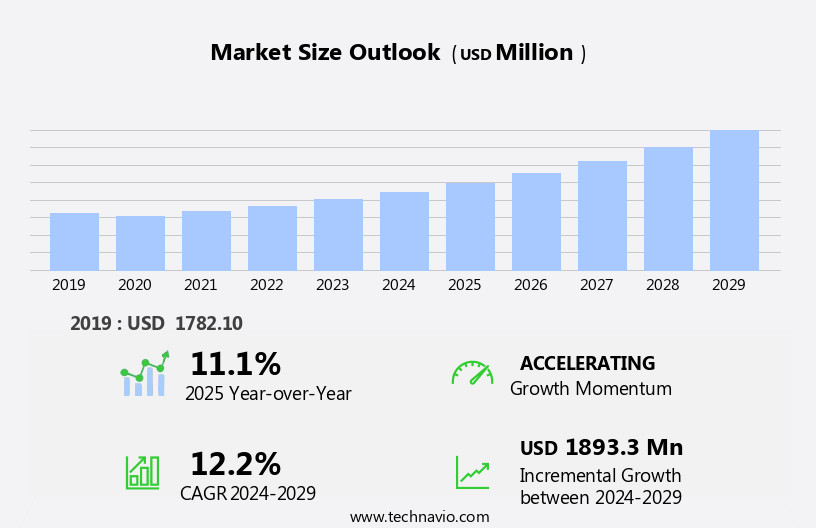

The laptop touchscreen market size is forecast to increase by USD 1.89 billion at a CAGR of 12.2% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing demand for hybrid and convertible laptops. These devices offer the convenience of a tablet and the functionality of a laptop, making them an attractive option for consumers. Additionally, the demand for slimmer and lighter touchscreen laptops continues to rise, as portability becomes a key consideration for many users. However, this market faces challenges from tablets and smartphones, which offer similar touchscreen capabilities in more compact form factors. To capitalize on opportunities and navigate these challenges effectively, companies in the laptop industry must focus on innovation, such as developing advanced touchscreen technologies and integrating productivity-enhancing features. They should also consider expanding their product offerings to cater to the diverse needs of consumers in the evolving digital landscape.

What will be the Size of the Laptop Touchscreen Market during the forecast period?

- The market is experiencing significant growth as the demand for smart devices with high-speed data transfer capabilities and interactive touchscreens continues to rise. With the increasing reliance on internet connection for productivity apps, content consumption, and remote work, the market for laptops with touchscreens is expanding. Machine learning and predictive analytics are driving innovation in this space, enabling user-specific features and speech recognition. Touchscreens are becoming increasingly popular in various industries, from creative creation to smart home appliances, due to their attractive and interactive displays. The integration of 5G technology further enhances the user experience by enabling faster data transfer and real-time interaction.

- Moreover, the flexibility of touchscreens in various environments, including outdoors and manual work, is making them a preferred choice for consumers. High-resolution displays and anti-uv coatings are essential features for laptops in this market, ensuring optimal visual experience and durability. Strategic marketing efforts are focusing on the benefits of touchscreens for productivity and convenience, making them an attractive option for consumers seeking to enhance their digital lifestyle. The integration of AI-based touchscreens and conventional displays is also gaining traction, offering a blend of traditional and advanced technology. Overall, the market is poised for continued growth as the trend towards smart devices and flexible work schedules continues.

How is this Laptop Touchscreen Industry segmented?

The laptop touchscreen industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Technology

- Capacitive

- Resistive

- SAW

- Distribution Channel

- OEM

- Aftermarket

- Application

- Consumer Laptops

- Gaming Laptops

- Business Laptops

- End-Use

- Personal Use

- Enterprise

- Education

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- US

- Canada

- Europe

- France

- Germany

- Spain

- UK

- South America

- Middle East and Africa

- APAC

By Technology Insights

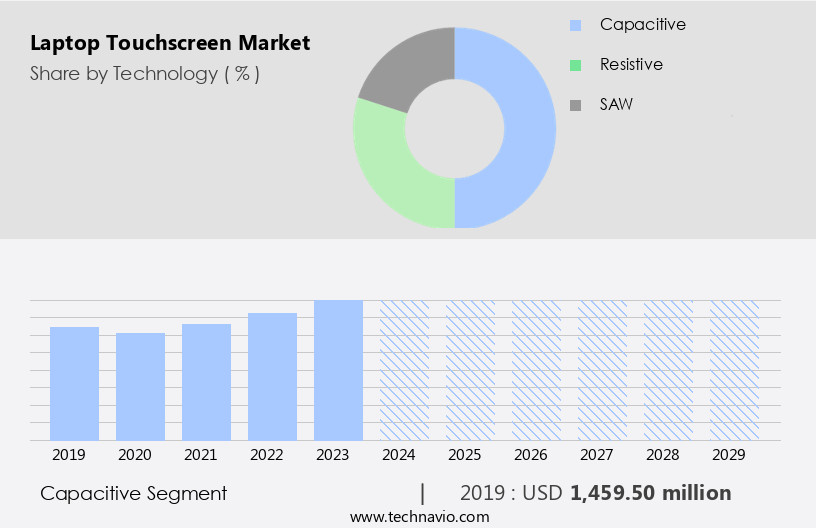

The capacitive segment is estimated to witness significant growth during the forecast period. Capacitive touchscreen technology is the primary driver of the market, accounting for a significant market share. This technology functions by detecting electrical changes in a conductive layer, typically indium tin oxide, integrated within the screen. When a conductive object, such as a fingertip, interacts with the display, it alters the field, accurately identifying the touchpoint. This feature enables multi-touch capabilities, facilitating intuitive gestures like pinching, zooming, and swiping, which are common among smartphone and tablet users. The integration of touchscreens in laptops, particularly in premium and mid-range models, underscores their importance in market expansion. This technology offers various advantages, including wireless connectivity, personalized recommendations, seamless integration with smart devices, content creation tools, and user-friendly design.

Get a glance at the market report of share of various segments Request Free Sample

The capacitive segment was valued at USD 1.46 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

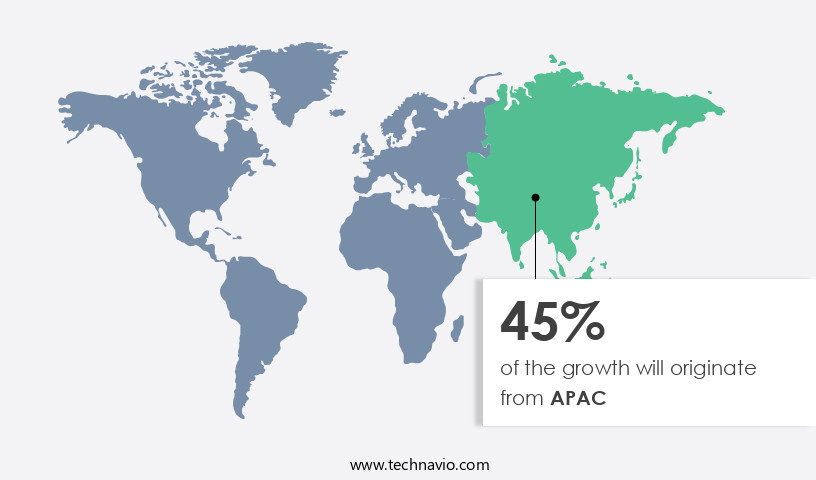

APAC is estimated to contribute 45% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The Asia-Pacific (APAC) region leads The market due to economic growth, increasing disposable incomes, and high-tech adoption, particularly in countries like China, India, Japan, and South Korea. The expanding middle class in these nations is fueling demand for premium and high-performance devices, including touchscreen laptops. In China, per capita disposable income reached approximately USD 5,511 in 2023, marking a 6.3% year-on-year increase (National Bureau of Statistics of China). This income growth is driving consumer spending on advanced technological products, including touchscreen laptops. India has also experienced significant economic progress, with per capita income rising by 35%. Touchscreens offer intuitive interfaces, personalized recommendations, wireless connectivity, and device compatibility, making them ideal for digital transformation, online entertainment, and productivity hacks.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Laptop Touchscreen Industry?

- Increasing demand for hybrid and convertible laptops is the key driver of the market. The market is experiencing significant growth due to the increasing preference for hybrid and convertible laptops. These devices offer the convenience of a tablet and the functionality of a laptop, making them a versatile solution for various sectors, including education, business, and creative industries. Leading companies, such as Microsoft, HP, Lenovo, Dell, and ASUS, have responded to this trend by introducing touchscreen-enabled convertible models.

- For example, Microsoft's Surface Pro series features a detachable keyboard, enabling users to transform their laptops into tablets for enhanced mobility. The adaptability and interactive interfaces of these devices are essential in sectors where flexibility is crucial.

What are the market trends shaping the Laptop Touchscreen Industry?

- Increasing demand for slimmer and lighter touchscreen laptops is the upcoming market trend. The market is witnessing significant growth due to the increasing preference for portable and lightweight devices. With the rise of remote work and online learning, the demand for laptops that offer high performance and mobility is on the rise. Slimmer and lighter touchscreen laptops are particularly popular among professionals, students, and frequent travelers, as they can easily be carried in bags or briefcases. Advancements in materials and manufacturing technologies have enabled the production of laptops that are both lightweight and powerful. These innovations have made it possible to reduce the size and weight of laptops without compromising performance.

- As a result, touchscreen laptops are becoming an essential tool for those who need to work or study on the go. The market is expected to continue its growth trajectory, driven by the increasing demand for portable devices and the ongoing advancements in technology. The market is poised for continued growth, offering significant opportunities for companies and investors alike.

What challenges does the Laptop Touchscreen Industry face during its growth?

- Competition from tablets and smartphones is a key challenge affecting the industry growth. The market faces significant competition from tablets and high-end smartphones, which offer comparable functionality with greater portability and affordability. These devices, such as the iPad Pro and Samsung Galaxy Tab, boast advanced touch interfaces, long battery life, and extensive application ecosystems, making them viable alternatives for casual users.

- For tasks like browsing, streaming, and light productivity, tablets and smartphones often suffice, potentially diminishing the demand for touchscreen laptops. This overlap cannibalizes the market, particularly in segments where convenience and affordability take precedence over a full-fledged laptop experience.

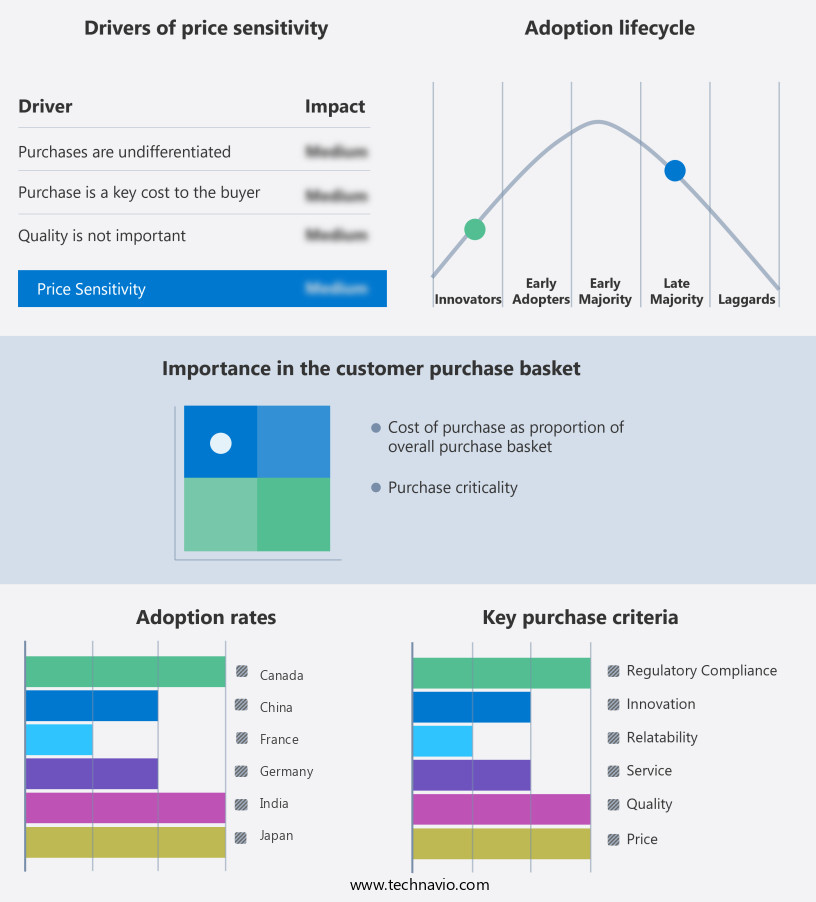

Exclusive Customer Landscape

The laptop touchscreen market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the laptop touchscreen market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, laptop touchscreen market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AUO Corp. - The company offers laptop touchscreen such as low-temperature polysilicon (LTPS) panels that improves user experience with a smoother and higher frame rate.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BOE Technology Group Co. Ltd.

- HannsTouch Solution Inc.

- Innolux Corp.

- LG Display Co. Ltd.

- MELFAS BD

- Samsung Display Co. Ltd.

- TPK Holding Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing significant growth as digital transformation continues to shape the way we work and consume content. Touchscreens offer intuitive interfaces that enable personalized recommendations, seamless integration with wireless connectivity, and compatibility with various devices. These advanced features have made touchscreens an essential component of the digital lifestyle. Touchscreens are revolutionizing the way we interact with our devices, providing a more user-friendly experience for online entertainment, content creation tools, and wearable technology trends. The increasing popularity of touchscreen displays in laptops is driven by the need for efficient and productive workspaces, remote collaboration, and smart home automation.

In addition, touchscreens offer a range of benefits for users, including data security, voice control, and user-friendly design. With touchscreens, users can navigate apps with ease, access personalized user experiences, and manage their devices more efficiently. Intelligent ecosystems are also becoming increasingly popular, offering advanced laptop features such as touchscreen display installation, maintenance, and customization. Touchscreen display design is a critical factor in the success of this market. Advanced touchscreen technology, such as capacitive displays and touch sensors, provides high definition displays and touch sensitivity, making for an intuitive experience. Anti-scratch coatings and anti-glare coatings ensure durability and readability in various lighting conditions.

Furthermore, touchscreen displays are also becoming more accessible, with solutions for outdoor use and high definition displays that offer improved visibility and clarity. Power consumption is a concern for many users, but touchscreen technology has made strides in reducing power consumption, making touchscreen laptops a viable option for creative professionals and those who require a traditional laptop setup. Touchscreen display software and hardware continue to evolve, offering new features and functionalities that enhance the user experience. The cost of touchscreen displays is also decreasing, making them more affordable for a wider range of users. Manual work reduction is another significant benefit of touchscreens, with touchscreen display solutions offering efficient display features that streamline workflows and increase productivity.

Moreover, touchscreens are also being integrated into digital signage solutions, providing new opportunities for businesses to engage with customers and promote their products and services. Touchscreens offer a range of benefits, including improved productivity, data security, and user-friendly design. The future of work is increasingly reliant on touchscreens, making them an essential component of the digital lifestyle.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

184 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 12.2% |

|

Market growth 2025-2029 |

USD 1.89 billion |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

11.1 |

|

Key countries |

China, US, South Korea, Japan, Germany, UK, Canada, France, India, and Spain |

|

Competitive landscape |

Leading Companies, market growth and forecasting , Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Laptop Touchscreen Market Research and Growth Report?

- CAGR of the Laptop Touchscreen industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the laptop touchscreen market growth of industry companies

We can help! Our analysts can customize this laptop touchscreen market research report to meet your requirements.