Mobile Phone Market Size 2025-2029

The mobile phone market size is forecast to increase by USD 213.9 billion at a CAGR of 6.8% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing adoption of smartphones. According to recent data, sales of mobile phones, particularly smartphones, through e-commerce platforms have surged, indicating a strong consumer demand. This trend is expected to continue as more consumers shift towards online shopping for convenience and accessibility. However, the market faces challenges related to security and privacy concerns with smartphone usage. With the increasing amount of personal data being stored and transmitted through mobile devices, there is a growing need for robust security measures to protect against cyber threats. Companies in the market must prioritize addressing these concerns through innovative solutions and transparent communication with consumers to build trust and maintain market competitiveness.

- Effective strategies for navigating these challenges include investing in advanced security features, implementing data protection policies, and providing clear and concise information to consumers about their privacy practices. By focusing on these key drivers and challenges, companies can capitalize on market opportunities and position themselves for long-term success in the market.

What will be the Size of the Mobile Phone Market during the forecast period?

- The market continues to evolve at an unprecedented pace, with technological advancements and shifting consumer preferences shaping its dynamics. Optical and digital zoom capabilities enhance photographic experiences, while artificial intelligence (AI) and machine learning algorithms elevate user experience (UX) through personalized recommendations and seamless interactions. Mobile gaming gains traction, fueled by improved graphics and processing power. Fingerprint sensors and biometric authentication offer enhanced security, and image stabilization ensures crisp, clear images. Mobile hardware innovations, such as high refresh rates, push the boundaries of performance. The integration of AI, biometric authentication, and UX design continues to redefine mobile design, as mobile data, network, and advertising industries adapt to meet evolving consumer demands.

- Camera technology, mobile payments, app development, and streaming services further expand the market's reach, with augmented reality (AR) and virtual reality (VR) applications poised to revolutionize industries. Mobile marketing and wireless charging solutions cater to the growing need for convenience and connectivity. The mobile landscape remains a dynamic and ever-evolving ecosystem, with continuous innovation and adaptation shaping its future.

How is this Mobile Phone Industry segmented?

The mobile phone industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Type

- Smartphone

- Feature phone

- Price-Range

- Budget

- Mid-Range

- Premium

- Operating System

- Android

- iOS

- Others

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Distribution Channel Insights

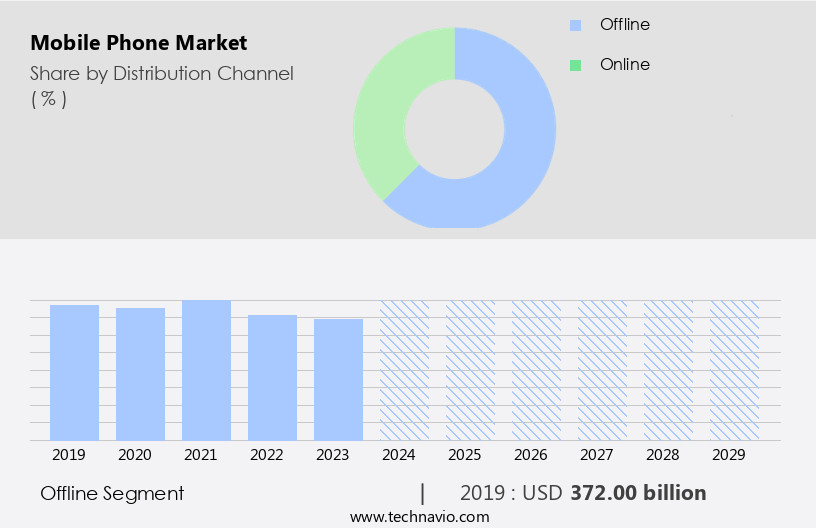

The offline segment is estimated to witness significant growth during the forecast period.

In the dynamic the market, various entities shape consumer behavior and market trends. Social media platforms serve as a powerful tool for mobile marketing, enabling brands to engage with customers and promote their latest offerings. Mobile security remains a top priority, with mobile software providers continuously releasing updates to safeguard against threats. Mobile tariffs vary, offering consumers diverse pricing plans, including pay-as-you-go and monthly subscriptions. Feature phones cater to budget-conscious consumers, while fast charging and long battery life are desirable features for power users. Mobile operating systems, such as Android and iOS, dominate the market, providing a seamless user experience (UX) through mobile design and intuitive mobile apps.

Virtual reality (VR) and augmented reality (AR) technologies offer immersive experiences, while optical zoom and digital zoom enhance camera capabilities. Artificial intelligence (AI) and machine learning integrate into mobile hardware, improving functionality and convenience. Biometric authentication, including fingerprint sensors and facial recognition, adds an extra layer of security. Mobile gaming, streaming services, and mobile payments cater to diverse consumer preferences. App development continues to evolve, with mobile advertising and data privacy becoming increasingly important considerations. Mobile service providers offer various plans, including mobile subscriptions, wireless charging, and mobile network options. Fitness trackers and mobile development tools cater to niche markets.

Mobile hardware advancements, such as high refresh rates, are driving innovation. Data privacy concerns persist, with consumers seeking transparency and control. Overall, the market is a vibrant ecosystem, where these entities interplay to meet the evolving needs of consumers.

The Offline segment was valued at USD 372.00 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

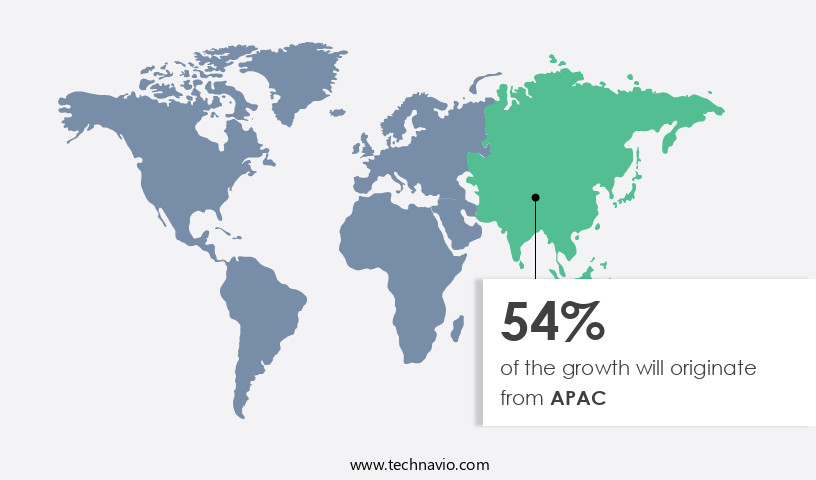

APAC is estimated to contribute 54% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is experiencing notable growth, with China, Japan, India, South Korea, and Indonesia being the primary contributors to revenue. The expanding urban population in the region has led to an increase in disposable income, enhancing the buying power of smartphone consumers. Factors such as the advancement of telecom infrastructure and the availability of budget-friendly smartphones are further fueling market expansion. Major global mobile phone manufacturers have a strong presence in the region, with manufacturing facilities in China, Taiwan, South Korea, Japan, and India. Social media and mobile apps have transformed communication and entertainment, driving demand for advanced mobile devices.

Mobile security concerns have led to the development of robust mobile software and biometric authentication systems. Mobile tariffs continue to evolve, with unlimited data plans and pay-as-you-go options becoming increasingly popular. Feature phones still hold a significant market share, particularly in rural areas and developing economies. Fast charging and long battery life are essential features for consumers, while mobile hardware innovations such as high refresh rates, optical and digital zoom, and image stabilization enhance the user experience. Virtual reality and augmented reality technologies are gaining traction in gaming and entertainment applications. Artificial intelligence and machine learning are being integrated into mobile devices for enhanced functionality and personalization.

Mobile marketing and advertising are becoming essential components of businesses' digital strategies. Streaming services and mobile payments are on the rise, with contactless transactions and mobile wallets gaining popularity. Mobile design and accessibility are crucial factors in ensuring a seamless user experience. Data privacy and security are becoming increasingly important concerns for consumers. Fitness trackers and mobile health apps are growing in popularity, with mobile development and app development being key areas of investment. Mobile network providers are constantly improving their networks to offer faster speeds and better coverage. Mobile subscriptions are on the rise, with unlimited data plans and flexible contracts becoming more common.

Wireless charging and mobile service providers are also key trends in the market. As the market continues to evolve, it is essential for businesses to stay informed about the latest trends and innovations to remain competitive.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Mobile Phone Industry?

- The increasing prevalence of smartphone usage serves as the primary catalyst for market growth.

- The market has witnessed substantial growth due to the widespread adoption of smartphones worldwide. Major contributors to this market expansion include China, India, the US, and Indonesia, where increasing disposable incomes and expanding internet coverage in rural areas fuel the demand for these devices. This trend has led to a diverse range of offerings from companies, with new products continually entering the market. For instance, in September 2024, Apple Inc. Introduced the iPhone 16 series, featuring advanced technologies such as augmented reality (AR) and wireless charging.

- Mobile marketing, mobile development, and fitness trackers have also gained traction, enhancing the user experience. Meanwhile, mobile service providers offer various plans catering to different consumer needs, including mobile subscriptions with extended battery life. companies are emphasizing immersive and harmonious designs to strike a chord with consumers, while advancements in mobile technology continue to emphasize convenience and efficiency.

What are the market trends shaping the Mobile Phone Industry?

- E-commerce mobile phone sales are experiencing significant growth, representing an emerging market trend. It is essential for businesses to adapt and capitalize on this trend to increase their mobile phone sales.

- The market continues to evolve, driven by several factors. Convenience and the assortment of mobile devices and plans, including mobile tariffs, are fueling the growth of this sector. Online sales of smartphones have seen a significant surge due to the availability of mobile software, fast charging technology, and mobile apps. Major e-commerce platforms, such as Amazon, have facilitated this trend by offering a wide range of mobile phones from various brands. In 2020, online sales accounted for approximately 45% of the total smartphone sales in India. The pandemic has further accelerated this trend, with mid-range mobile phones experiencing exponential growth in online sales from 2021.

- Brands like Xiaomi Communications Co. Ltd. Have capitalized on this trend by launching their products exclusively on e-commerce platforms to target the online customer base. Additionally, advancements in mobile technology, such as mobile security, mobile accessibility, mobile operating systems, and virtual reality (VR), continue to enhance the user experience.

What challenges does the Mobile Phone Industry face during its growth?

- The growth of the industry is significantly impacted by the complex concerns surrounding security and privacy in the use of smartphones.

- Mobile phones have become an integral part of modern life, offering advanced features to enhance user experience (UX). In the realm of mobile photography, optical zoom and digital zoom capabilities expand the boundaries of capturing moments. Artificial intelligence (AI) integration enables superior image processing and analysis, elevating the quality of photos and videos. Mobile gaming experiences are more immersive than ever before, with high refresh rates and powerful mobile hardware ensuring seamless gameplay. Biometric authentication, such as fingerprint sensors and facial recognition, provide an added layer of security.

- Image stabilization technology ensures clear and steady images, even during movement. Mobile hardware advancements also prioritize user experience (UX), with larger screens, long-lasting batteries, and sleek designs. These features contribute to the dynamic growth of the mobile market, making it a significant sector for innovation and investment.

Exclusive Customer Landscape

The mobile phone market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the mobile phone market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, mobile phone market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Apple Inc. (United States) - The iPhone brand, a leading innovator in mobile technology, introduces the latest additions to its premium line: the iPhone 16 Pro, iPhone 15 Pro Max, iPhone 14, and iPhone 13. These cutting-edge devices showcase advanced features, including superior camera systems, expansive OLED displays, and powerful processors. By continually pushing the boundaries of technology, the iPhone brand ensures its users enjoy unparalleled experiences in connectivity, productivity, and multimedia consumption.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Apple Inc. (United States)

- Samsung Electronics Co., Ltd. (South Korea)

- Huawei Technologies Co., Ltd. (China)

- Xiaomi Corporation (China)

- Oppo (China)

- Vivo (China)

- OnePlus (China)

- Google LLC (United States)

- Sony Corporation (Japan)

- Nokia Corporation (Finland)

- Motorola Solutions Inc. (United States)

- Realme (China)

- AsusTek Computer Inc. (Taiwan)

- Lenovo Group Ltd. (China)

- LG Electronics Inc. (South Korea)

- TCL Technology (China)

- ZTE Corporation (China)

- Micromax Informatics Ltd. (India)

- Tecno Mobile (China)

- HMD Global (Finland)

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Mobile Phone Market

- In February 2024, Apple Inc. Introduced the iPhone SE (3rd generation), a budget-friendly 5G smartphone, marking a strategic move to expand its market reach and cater to price-sensitive consumers (Apple Press Release, 2024). In the same year, Samsung Electronics and Google announced a partnership to develop customized Google Mobile Services for Samsung devices, enhancing user experience and strengthening their collaboration in the competitive the market (Samsung Newsroom, 2024).

- In the first quarter of 2025, Qualcomm, a leading semiconductor company, completed its acquisition of Veoneer, a Swedish automotive technology supplier, to expand its presence in the automotive industry and explore opportunities in advanced driver-assistance systems and autonomous vehicles, leveraging its mobile phone technology expertise (Qualcomm Press Release, 2025). Additionally, in the same year, the European Union passed the Digital Markets Act, imposing stricter regulations on large tech companies, including mobile phone manufacturers, to promote fair competition and protect consumer rights (European Commission, 2025).

- These developments underscore significant shifts in the market, with companies focusing on expanding their offerings, forming strategic partnerships, and adapting to regulatory changes to maintain their competitive edge.

Research Analyst Overview

In the dynamic the market, voice assistants have become an integral part of user experience, while cloud computing enables seamless data access and optimization. In-display fingerprint sensors and machine learning (ML) enhance security and personalization. Mobile antivirus solutions and data encryption ensure protection against malware and data breaches. Native app development and cross-platform development cater to diverse business needs. Wireless charging pads and fast charging technology offer convenience, while foldable phones and dual-screen phones expand display capabilities. Smart home integration and mobile payments security further expand the mobile ecosystem. Mobile web design, mobile cloud storage, and mobile network optimization ensure optimal user experience.

3D facial recognition, AI-powered camera, and computational photography elevate mobile photography, while mobile vpn and mobile network coverage ensure secure and uninterrupted connectivity. Mobile banking, mobile gaming console, mobile wallet, and mobile-first design cater to various consumer segments. Wearable technology, microsd card, mobile network optimization, mobile data plans, and mobile gaming console expand the mobile market's reach and potential. 5G mmWave and multi-core processors fuel innovation and performance advancements. Mobile esports and mobile malware highlight the market's competitive landscape and challenges. Night mode and mobile payments security address consumer demands and concerns.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Mobile Phone Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

201 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.8% |

|

Market growth 2025-2029 |

USD 213.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.0 |

|

Key countries |

US, China, Germany, Canada, India, South Korea, France, Japan, Italy, Brazil, UAE, UK, Spain, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Mobile Phone Market Research and Growth Report?

- CAGR of the Mobile Phone industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the mobile phone market growth of industry companies

We can help! Our analysts can customize this mobile phone market research report to meet your requirements.