Lateral Flow Assay Components Market Size 2024-2028

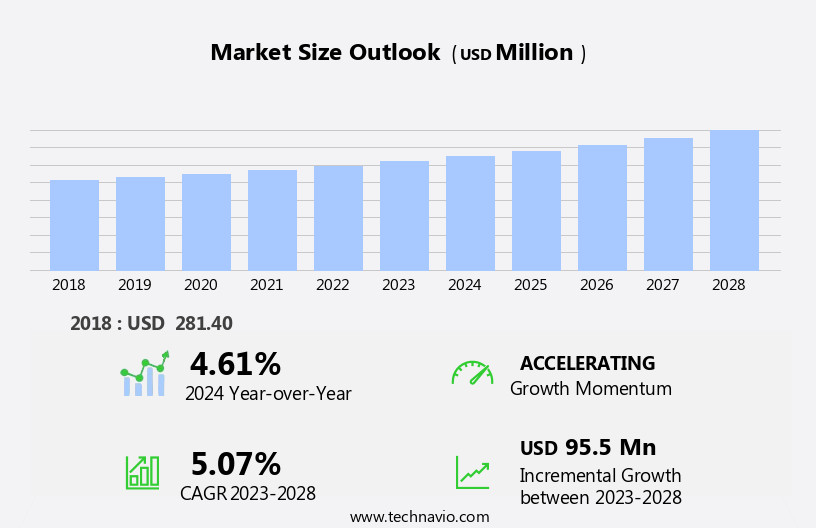

The lateral flow assay components market size is forecast to increase by USD 95.5 million at a CAGR of 5.07% between 2023 and 2028.

What will be the Size of the Lateral Flow Assay Components Market During the Forecast Period?

How is this Lateral Flow Assay Components Industry segmented and which is the largest segment?

The lateral flow assay components industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Technique

- Sandwich assays

- Competitive assays

- Multiplex detection assays

- End-user

- Medical device manufacturing companies

- Medical device contract manufacturing companies

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- Asia

- China

- Rest of World (ROW)

- North America

By Technique Insights

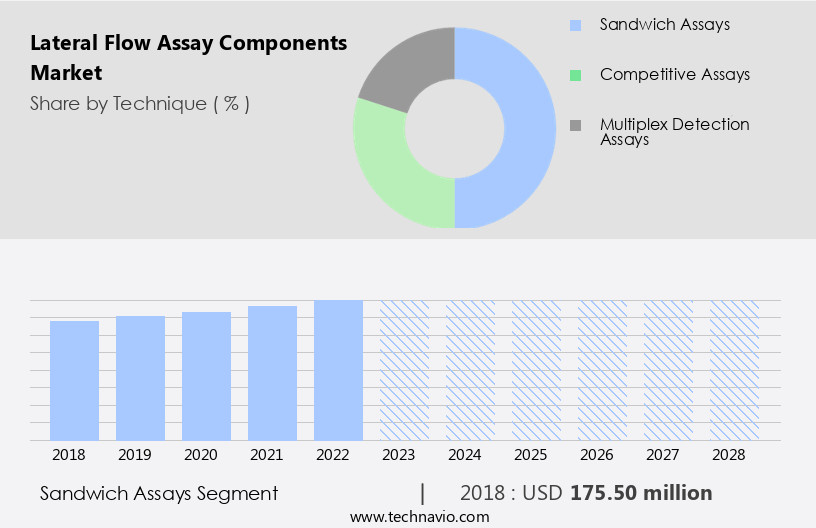

- The sandwich assays segment is estimated to witness significant growth during the forecast period.

The Lateral Flow Assay (LFA) components market encompasses technologies utilized In the development of rapid diagnostic tests for various applications, including cardiovascular diseases, infectious diseases, pregnancy, HIV, chronic diseases, and biomarker detection. These tests offer advantages such as portability, rapid diagnosis, and simplicity, making them suitable for home-based use and clinical testing. LFA components consist of lateral flow membranes, rapid test kits, and infectious disease testing. Membranes include nitrocellulose membranes and pore size variants, while pads include sample pads, conjugate pads, absorbent pads, and clinical testing applications. The assay technique is applicable to various sectors, including women's health, veterinary diagnostics, drug development, food safety, animal health, and environmental testing.

Sandwich assays and multiplex detection assays are common techniques used in LFA components. The market caters to diverse industries, including healthcare, food and beverage, diagnostic technique, and agriculture. LFA components provide solutions for drug testing, food microbiology, biowarfare, and behavioral health. Despite challenges like low biomolecule affinity and cross reactivity, LFA components offer advantages such as short analysis time and saliva diagnostics, making them a valuable tool in numerous industries.

Get a glance at the Lateral Flow Assay Components Industry report of share of various segments Request Free Sample

The Sandwich assays segment was valued at USD 175.50 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

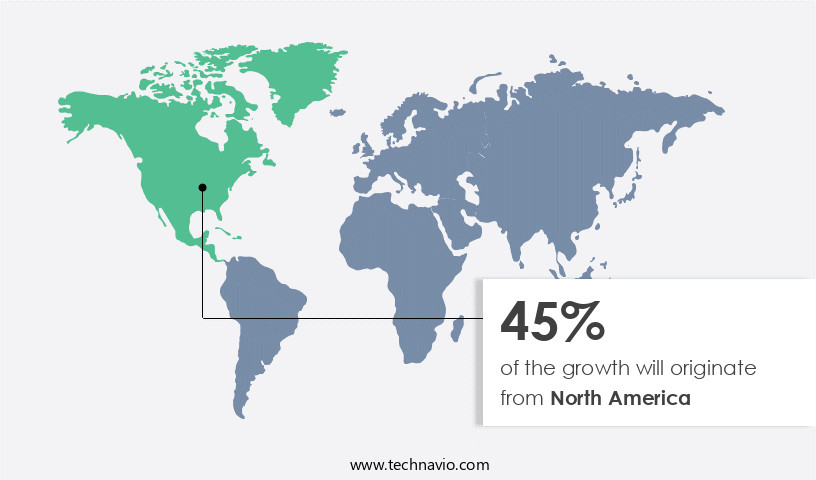

- North America is estimated to contribute 45% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Lateral Flow Assay (LFA) components market in North America holds a significant share due to the region's advanced healthcare infrastructure, high prevalence of chronic diseases like Lyme disease and tuberculosis, and a substantial number of LFA components manufacturers. According to the US Centers for Disease Control and Prevention (CDC), approximately 35-64 million influenza infections occurred In the US between October 2023 and May 25, 2024, resulting in around 390,000-820,000 hospitalizations. This underscores the importance of rapid diagnostic tools, including LFA, in addressing infectious diseases. Additionally, the increasing adoption of home-based devices, portability, and rapid diagnosis in various sectors such as cardiovascular diseases, infectious diseases, women's health, HIV, and chronic diseases, further propels market growth.

LFA components include lateral flow membranes, rapid test kits, nitrocellulose membranes, pore size, and various pads (sample, conjugate, absorbent). These components support a range of applications, including infectious disease testing, biomarker detection, drug testing, food safety, animal health, and clinical testing. LFA is also utilized in veterinary diagnostics, drug development, sandwich assays, multiplex detection assays, and various diagnostic techniques. In sectors like cardiac marker testing, influenza testing, hepatitis, tuberculosis, HIV testing, HPV testing, chlamydia testing, gonorrhoea testing, syphilis testing, myoglobin testing, and pregnancy testing, LFA offers advantages such as simplified manner, rapid antigen testing, and ELISA tests. Industries like food and beverage, healthcare, and the veterinary sector benefit from LFA's ability to provide quick and accurate results, contributing to its increasing popularity.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Lateral Flow Assay Components Industry?

Rising efforts in research and development is the key driver of the market.

What are the market trends shaping the Lateral Flow Assay Components Industry?

Growing demand for point-of-care (POC) testing is the upcoming market trend.

What challenges does the Lateral Flow Assay Components Industry face during its growth?

Increase in regulations and inconsistency in test results is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The lateral flow assay components market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the lateral flow assay components market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, lateral flow assay components market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Abbott Laboratories - The lateral flow assay market encompasses various components essential for the successful execution of this diagnostic technique. One such component is DIGIVAL, a versatile offering from the company. DIGIVAL is a critical element in lateral flow assays, contributing to the detection and visualization of targeted analytes through a colorimetric or chromogenic reaction. This component enhances the sensitivity and specificity of the assay, ensuring accurate and reliable results. DIGIVAL's role In the lateral flow assay process includes the conjugation of specific antibodies or probes, which subsequently bind to target antigens or biomolecules. The binding event triggers a cascade of reactions, leading to the production of a visible signal. As a result, DIGIVAL plays a pivotal role In the lateral flow assay process, contributing to its efficiency and overall performance.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- Ahlstrom Holding 3 Oy

- AXIVA SICHEM Pvt. Ltd.

- Becton Dickinson and Co.

- Bio Rad Laboratories Inc.

- Bio Techne Corp.

- Cytodiagnostics Inc.

- DxDiscovery Inc.

- F. Hoffmann La Roche Ltd.

- Geno Technology Inc.

- Hologic Inc.

- Merck KGaA

- Nupore Filtration System

- Perkin Elmer Inc.

- Porex Corp.

- QIAGEN NV

- Quidelortho Corp.

- Sartorius AG

- Siemens AG

- Thermo Fisher Scientific Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Lateral flow assays (LFAs) have gained significant attention in various industries due to their simplicity, portability, and rapid results. These diagnostic tools have become increasingly popular for the detection of biomolecules in various fields, including healthcare, food and beverage, veterinary diagnostics, and research. Lateral flow assays consist of several components that work together to provide accurate and reliable results. Membranes, pads, and conjugates are essential components of LFAs. Membranes serve as the foundation of the assay, providing a platform for the movement of fluids and the capture of biomolecules. Pads, including sample pads, absorbent pads, and conjugate pads, play a crucial role In the sample preparation and reaction process.

The membranes used in LFAs are typically made of materials like nitrocellulose or cellulose acetate. The pore size and surface properties of these membranes can significantly impact the assay's performance, with smaller pores allowing for greater specificity and larger pores enabling faster analysis times. The shelf life of membranes is also an essential consideration, as prolonged storage can impact their performance. The pads used in LFAs serve various functions. Sample pads absorb the sample and deliver it to the test area, while absorbent pads absorb excess fluid and prevent backflow. Conjugate pads contain gold or silver nanoparticles conjugated with specific antibodies or probe DNA, which react with target biomolecules In the sample.

The use of LFAs in clinical testing has revolutionized the diagnosis of various diseases, from cardiovascular diseases and infectious diseases to women's health issues and pregnancy testing. Rapid antigen testing and sandwich assays have become essential tools for the detection of infectious diseases, such as influenza, hepatitis, tuberculosis, HIV, HPV, chlamydia, gonorrhoea, syphilis, myoglobin, and others. In the veterinary sector, LFAs have become essential for the diagnosis of various diseases, including cardiac marker testing and infectious disease testing. These assays offer a simplified manner for veterinarians to diagnose diseases in animals, enabling quick treatment and improving animal health.

LFAs have also found applications in drug development, biomarker detection, food safety, animal health, and other industries. The ability to detect low biomolecule affinity and the absence of cross reactivity makes LFAs an attractive option for various applications. Despite their advantages, LFAs face challenges, including issues related to pretreatment of samples and analysis time. Ongoing research and development efforts aim to address these challenges and improve the performance and accuracy of LFAs. In summary, lateral flow assays have become an essential diagnostic tool in various industries, offering rapid, portable, and accurate results. The components of LFAs, including membranes, pads, and conjugates, play a crucial role In the assay's performance.

Ongoing research and development efforts aim to improve the performance and accuracy of LFAs, addressing challenges related to sample pretreatment and analysis time.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

169 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.07% |

|

Market growth 2024-2028 |

USD 95.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.61 |

|

Key countries |

US, Germany, UK, China, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Lateral Flow Assay Components Market Research and Growth Report?

- CAGR of the Lateral Flow Assay Components industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the lateral flow assay components market growth of industry companies

We can help! Our analysts can customize this lateral flow assay components market research report to meet your requirements.