LCD Glass Market Size 2025-2029

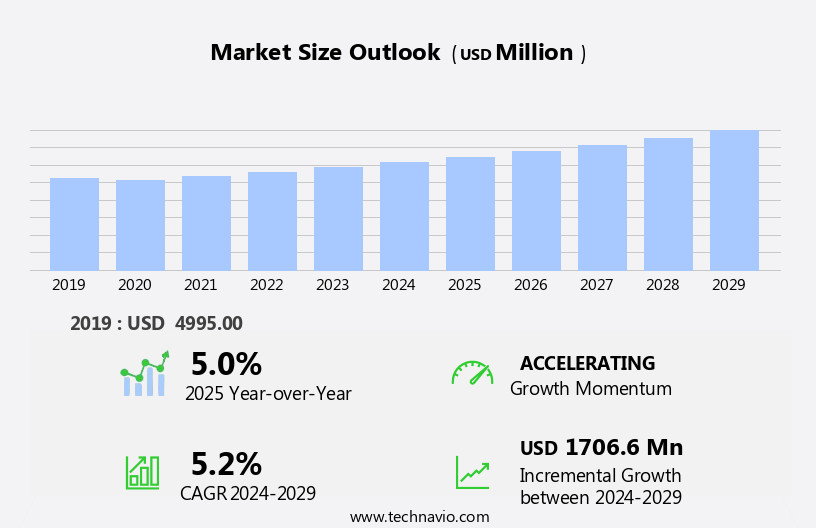

The LCD glass market size is forecast to increase by USD 1.71 billion, at a CAGR of 5.2% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing demand for consumer electronics and the rising adoption of high-resolution displays, such as 4K and 8K. This trend is driven by the advancements in technology and the growing preference for larger, clearer screens. However, the market faces challenges from alternatives, including OLED, QLED and LED displays, which offer similar features and are gaining popularity. Additionally, price competition and the need for continuous innovation to meet consumer demands are key factors influencing market dynamics. The market is expected to continue its growth trajectory, driven by these trends and the increasing demand for advanced display technologies.

What will be the Size of the Market During the Forecast Period?

- The market is a dynamic and evolving industry, characterized by continuous innovation and advancements in technology. With the increasing demand for large screens in various applications, including digital signage solutions, advanced driver-assurance systems, augmented reality, and virtual reality, the market for LCD glass is experiencing significant growth. Manufacturers are focusing on cost reduction through sustainable manufacturing processes and the use of biodegradable materials. Quality control and rigorous testing are essential to ensure the transparency and durability of LCD glass. Next-generation technologies, such as flexible electronics and engineering innovations, are driving the development of lighter, thinner, and more efficient LCD glass.

- Regulations and material science are also key considerations In the market, as manufacturers strive to meet industry standards and create high-performing, reliable products. The future of LCD glass is bright, with ongoing research and development in areas such as next-generation manufacturing processes and the integration of advanced technologies, including next-generation display technologies and engineering innovations. The market is expected to continue growing, driven by the increasing demand for high-quality, cost-effective, and sustainable display solutions.

How is this LCD Glass Industry segmented and which is the largest segment?

The LCD glass industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Material

- Soda lime

- Borosilicate

- Aluminosilicate

- Application

- LCD TVs

- Desktop monitors

- Notebook PCs

- Smartphones and tablets

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- Singapore

- North America

- US

- Europe

- Germany

- UK

- France

- South America

- Middle East and Africa

- APAC

By Material Insights

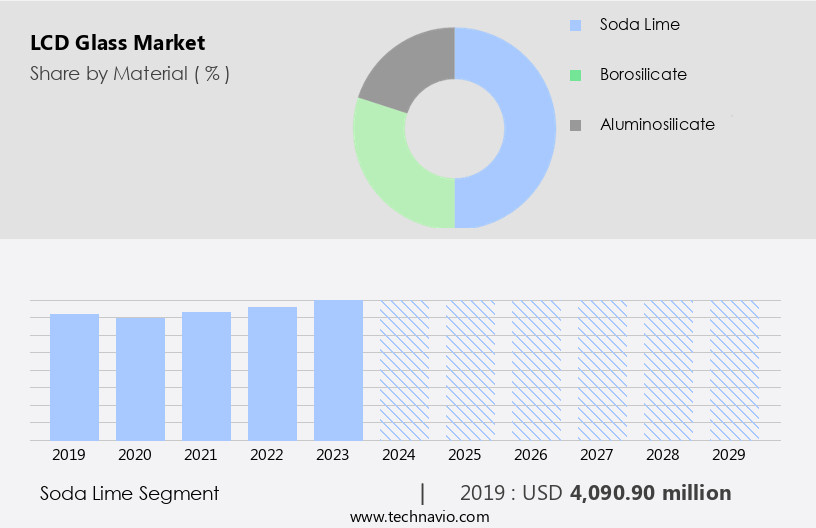

- The soda lime segment is estimated to witness significant growth during the forecast period.

The market primarily utilizes soda lime glass as the material of choice for manufacturing LCD panels due to its cost-effectiveness and ease of production. Soda lime glass, made up of silica, soda, and lime, is widely used in commercial display applications, including TVs and tablets, owing to its affordability. The production process for soda lime glass is straightforward, contributing to its extensive usage in the market. Moreover, the adoption of eco-friendly production techniques and consumer preferences for sustainable solutions have led to innovative advancements in the market. Next-generation substrates, such as flexible eco-friendly glass substrates, are gaining traction due to their environmental benefits.

The integration of the Internet of Things (IoT), remote work, and wearable technology in various industries, including electronics, healthcare, and infotainment systems, is further driving the demand for LCD glass. Advancements in materials and manufacturing techniques have resulted in cost-effective, high-performance LCD glass. Strategic partnerships between leading companies in the LCD glass industry and diagnostic equipment manufacturers have facilitated the development of advanced visual experiences. The market is expected to continue its impact on various sectors, including in-flight entertainment systems, diagnostic equipment, and consumer electronics. Sustainability remains a key focus, with the use of next-generation substrates and manufacturing techniques to reduce environmental impact.

Get a glance at the market report of share of various segments Request Free Sample

The soda lime segment was valued at USD 4.09 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

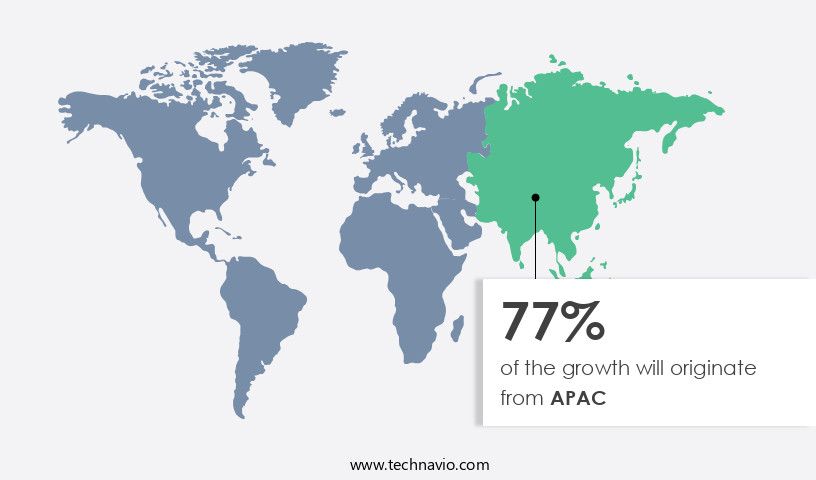

- APAC is estimated to contribute 77% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in the Asia-Pacific (APAC) region is experiencing significant growth, driven by advanced manufacturing capabilities, increasing consumer preferences for technology, and supportive government initiatives. Key countries, including China, Japan, South Korea, Taiwan, and India, are leading both production and consumption of LCD glass. China, as the world's largest market, hosts prominent panel manufacturers like BOE Technology, CSOT, and HKC, producing LCD panels for various applications such as televisions, smartphones, and monitors. The Chinese government's "Made in China 2025" initiative has bolstered domestic production, decreasing the country's reliance on imports. Innovative solutions, cost-effectiveness, and advancements in LCD glass technology continue to influence the market.

In addition, sustainability and next-generation substrates are also gaining importance, with eco-friendly glass substrates and manufacturing techniques being adopted. The Internet of Things (IoT), remote work, infotainment systems, in-flight entertainment systems, and wearable technology are among the sectors fueling the widespread acceptance of LCD glass. Strategic partnerships and collaborations between industry leaders and electronics, healthcare, and other sectors further propel market growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of the LCD Glass Industry?

Growing demand for consumer electronics is the key driver of the market.

- The market is witnessing significant growth due to the increasing consumer preference for eco-friendly, high-performance, and innovative solutions in various sectors. Production processes are evolving to incorporate next-generation substrates and manufacturing techniques, such as flexible eco-friendly glass substrates, to meet the demands of the Internet of Things, remote work, and wearable technology.

- In the electronics industry, which is valued at USD 4.3 trillion, advancements in diagnostic equipment, infotainment systems, in-flight entertainment systems, and healthcare technology are driving the need for cost-effective, energy-efficient, and thin LCD glass. Strategic partnerships between industry leaders are also contributing to the market's growth by enhancing the production capacity and expanding the application areas of LCD glass. The impact of coronavirus has led to a shift towards sustainable and cost-effective solutions, further boosting the market's potential.

What are the market trends shaping the LCD Glass Industry?

Rising adoption of 4K, 8K, and high-resolution displays is the upcoming market trend.

- The market is experiencing a notable trend towards the utilization of high-definition displays, with 4K and 8K resolutions gaining widespread acceptance. This shift is driven by the increasing consumer preference for superior visual experiences in various applications, such as consumer electronics, professional displays, and industrial monitors. The demand for high-definition content is escalating as streaming services, gaming, and digital media continue to evolve. The adoption of these advanced resolutions offers significantly higher pixel densities compared to traditional Full HD displays, resulting in clearer, more detailed images and viewing experiences. Moreover, innovative solutions in the form of eco-friendly glass substrates are gaining traction in the market.

- These next-generation substrates are manufactured using advanced techniques, contributing to sustainability and cost-effectiveness. The Internet of Things (IoT) and remote work are also fueling the demand for flexible LCD glass, particularly in the areas of infotainment systems, in-flight entertainment systems, diagnostic equipment, and wearable technology. Strategic partnerships and collaborations between industry leaders and materials suppliers are driving the innovation in LCD glass production processes. In summary, the market is witnessing significant advancements, driven by consumer preferences, cost-effectiveness, and the need for eco-friendly and flexible solutions.

What challenges does the LCD Glass Industry face during its growth?

Competition from alternatives is a key challenge affecting the industry growth.

- The market is currently undergoing transformative changes due to evolving consumer preferences and technological advancements. Eco-friendly production processes and innovative solutions are gaining traction as sustainability becomes a key consideration for businesses and consumers alike. In this context, the adoption of next-generation substrates and manufacturing techniques is paving the way for cost-effective and high-performance LCD glass. The Internet of Things (IoT) and remote work trends are driving the demand for advanced LCD glass applications in various sectors, including diagnostic equipment, infotainment systems, in-flight entertainment systems, and wearable technology. These applications require LCD glass with superior visual experiences and durability.

- Despite the challenges posed by OLED and other emerging display technologies, the market continues to thrive. Leading companies in the electronics, healthcare, and other industries are forging strategic partnerships to innovate and stay competitive. For instance, advancements in flexible eco-friendly glass substrates are opening new opportunities for LCD glass In the production of flexible displays and curved screens. The impact of coronavirus on the market has been significant, with supply chain disruptions and changing consumer behavior leading to shifts in demand. However, the market is expected to recover as the world adapts to the new normal and the demand for advanced LCD glass applications continues to grow.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AGC Inc. - The company offers LCD glass, which is produced using the float process that is suitable for production of low thermal shrinkage glass as the glass is cooled down gradually through a long annealing process.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AvanStrate Inc.

- Corning Inc.

- Nippon Electric Glass Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is currently witnessing significant advancements driven by the increasing demand for innovative solutions that cater to evolving consumer preferences. Eco-friendliness is becoming a crucial factor In the production of LCD glass, with manufacturers focusing on next-generation substrates and manufacturing techniques to reduce the environmental impact of their processes. Consumer preferences for sustainable and cost-effective products have led to the development of eco-friendly glass substrates. These substrates are not only beneficial for the environment but also offer improved visual experiences for end-users. The use of these substrates in various applications, including infotainment systems and in-flight entertainment systems, is gaining widespread acceptance.

Further, the integration of the Internet of Things (IoT) and remote work technologies has further fueled the growth of the market. Diagnostic equipment and wearable technology are some of the areas where LCD glass is being extensively used to provide real-time data and enhance user experiences. Advancements in materials and manufacturing processes continue to drive innovation In the market. Leading players are forming strategic partnerships to stay competitive and offer cost-effective solutions to their clients. The electronics and healthcare industries are some of the major sectors driving the demand for LCD glass. The present status of the market is characterized by a focus on sustainability and cost-effectiveness.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

189 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.2% |

|

Market growth 2025-2029 |

USD 1.71 billion |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

5.0 |

|

Key countries |

China, US, Taiwan, South Korea, Japan, Germany, France, Singapore, UK, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the LCD Glass industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.