Southeast Asia Lead-Acid Battery Market Size 2025-2029

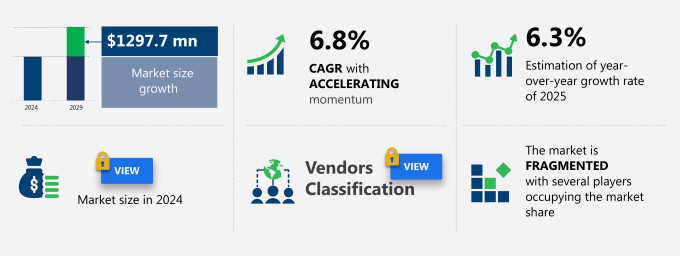

The Southeast Asia lead-acid battery market size is forecast to increase by USD 1.3 billion at a CAGR of 6.8% between 2024 and 2029.

- The lead-acid battery market is experiencing substantial growth due to several key factors. One significant trend driving market expansion is the increasing demand for lead-acid batteries In the automotive sector, as the industry continues to grow. Additionally, the rising adoption of microgrids has boosted the demand for these batteries due to their reliability and cost-effectiveness. Nickel batteries and zinc batteries are gaining traction due to their unique features, but lead batteries remain competitive. However, the market also faces challenges, including the drawbacks of lead-acid batteries such as their limited cycle life and heavy weight. Despite these challenges, the market is expected to continue growing as advancements in technology aim to address these issues and improve the overall efficiency and performance of lead-acid batteries.

What will be the Size of the market During the Forecast Period?

- The lead-acid battery market is experiencing significant growth due to increasing demand from sustainable transportation applications, such as electric and hybrid electric vehicles, and hyperscale data centers requiring power electronics. Recycling of lead batteries is a key trend, contributing to the market's sustainability and reducing environmental impact. Energy efficiency and management systems are also driving demand, particularly in electric vehicle charging infrastructure. Lead batteries continue to dominate the market, with engineering and manufacturing advancements enhancing performance and safety.

- Moreover, renewable energy storage and grid-scale energy storage applications are expanding opportunities for lead acid batteries. SLI batteries, UPS batteries, and maintenance and testing services are essential components of the market. Charging technologies, including flooded, sealed, and charging systems for solar energy, are advancing to meet the evolving needs of various industries. Safety, science, and standards are crucial considerations In the lead acid battery market, ensuring reliable and efficient energy storage solutions for the energy transition.

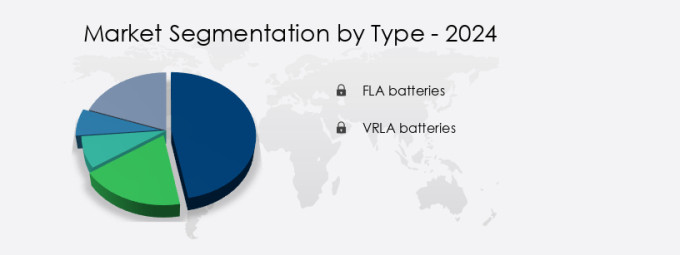

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- FLA batteries

- VRLA batteries

- Application

- Automotive

- Industrial

- Others

- Geography

- Southeast Asia

- Singapore

- Malaysia

- Thailand

- Indonesia

- Rest of Southeast Asia

- Southeast Asia

By Type Insights

- The FLA batteries segment is estimated to witness significant growth during the forecast period.

The market is primarily driven by the use of flooded lead-acid batteries in automotive, industrial, and standby power systems. These batteries, known for their affordability and reliability, are widely adopted for various energy storage applications, including automobiles, renewable energy, and backup power solutions. The expanding automotive and industrial sectors in Southeast Asia, where flooded lead-acid batteries are extensively utilized, are fueling market growth. Major manufacturers like GS Yuasa, Exide, and Century Batteries cater to the region's diverse energy storage needs by producing and supplying customized flooded lead-acid batteries. The flooded method's proven performance, economic viability, and adaptability to a broad range of applications make it the preferred technology in Southeast Asia's evolving energy landscape.

Get a glance at the market report of share of various segments Request Free Sample

Market Dynamics

Our Southeast Asia Lead-Acid Battery Market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Southeast Asia Lead-Acid Battery Market?

Significant growth in automotive market is the key driver of the market.

- The lead-acid battery market is experiencing significant growth due to the increasing demand for electric vehicles (EVs) and the expanding energy storage applications in various industries. Lead-acid batteries continue to dominate the automotive sector as the primary power source for starting, lighting, and ignition (SLI) systems in passenger cars and commercial vehicles. In the transportation industry, lead-acid batteries are also used in electric automobiles, e-bikes, and motorcycles, as well as in automotive equipment and off-grid power generation. Beyond automotive applications, lead-acid batteries are widely used in data centers and uninterruptible power supply (UPS) systems for energy storage.

- Moreover, they are also employed in material handling equipment, lighting systems, and renewable energy applications as a reliable energy source. The market for lead-acid batteries is further boosted by their long shelf life, resistance to vibration, and ability to withstand terminal corrosion. In the energy storage sector, lead-acid batteries are used for backup power in corporate offices, healthcare facilities, and other commercial applications. They are also employed in off-grid power generation and grid energy storage devices, providing stability to the electricity generation and distribution grid. With advancements in multi-stage charging technology and the use of carbon additives, the cycle life of lead-acid batteries has been extended, making them a cost-effective and efficient energy storage solution.

What are the market trends shaping the Southeast Asia Lead-Acid Battery Market?

Increase in demand for lead-acid batteries owing to rising adoption of microgrids is the upcoming trend In the market.

- The Lead-Acid battery market encompasses various applications, including electric vehicles (EVs), data centers, energy storage, vehicle manufacturing, and portable electronics. In the transportation industry, Lead-Acid batteries are extensively used in Starting, Lighting, and Ignition (SLI) systems, commercial vehicles, e-bikes, and automotive equipment. In the energy sector, these batteries are employed in uninterruptible power supply (UPS) systems, lighting, off-grid power generation, and renewable energy storage. Despite the growing popularity of Lithium-Ion batteries, Lead-Acid batteries continue to dominate the market due to their low cost, reliability, and long shelf life. However, they face challenges such as self-discharge, terminal corrosion, and vibration.

-

Moreover, they are also used in UPS systems for corporate offices, internet traffic routing, and other critical applications. Therefore, the Lead-Acid battery market is diverse and dynamic, with applications ranging from transportation to energy storage and backup power. Despite the challenges, Lead-Acid batteries continue to be a preferred choice due to their reliability, low cost, and long shelf life. The market is expected to grow due to the increasing demand for energy storage and backup power, particularly In the renewable energy sector.

What challenges does Southeast Asia Lead-Acid Battery Market face during the growth?

Drawbacks of lead-acid batteries is a key challenge affecting the market growth.

- Lead-acid batteries remain a prominent choice In the battery market due to their cost-effectiveness and mature technology, despite the risks associated with their toxic lead oxide content. The automotive industry's expansion and the growing demand for electric vehicles (EVs) have fueled the market's growth, with lead-acid batteries serving as a primary energy source for starting, lighting, and ignition (SLI) systems in passenger cars and commercial vehicles. In addition, lead-acid batteries are widely used in data centers for energy storage, uninterruptible power supply (UPS) systems, and telecommunications, as well as in material handling equipment and portable electronics. However, concerns over lead-acid batteries' self-discharge, terminal corrosion, and vibration have led to research and development efforts to improve their cycle life and efficiency.

- In addition, lithium batteries have emerged as a viable alternative in some applications due to their higher energy density and longer cycle life. Nevertheless, the high cost of lithium batteries and the need for specialized charging infrastructure limit their widespread adoption. In industries where lead-acid batteries are the most cost-effective option, such as vehicle manufacturing, healthcare, and off-grid power generation, efforts are being made to mitigate the environmental and health risks associated with lead-acid batteries. Carbon additives and multi-stage charging techniques are being used to reduce lead oxide emissions and improve battery performance. The transportation industry, including automobiles, e-bikes, and motorcycles, continues to be a significant market for lead-acid batteries due to their reliability and affordability.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

Accumulatorenwerke HOPPECKE Carl Zoellner and Sohn GmbH - The company offers lead-acid battery such as trak uplift impulse, trak uplift, and trak uplift save.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ACE Green Recycling Inc.

- C and D Technologies Inc.

- Contemporary Amperex Technology Co. Ltd.

- East Penn Manufacturing Co. Inc.

- EnerSys

- Exide Industries Ltd.

- Furukawa Electric Co. Ltd.

- Gravita India Ltd.

- GS Yuasa International Ltd.

- Hankook Tire and Technology Co. Ltd.

- Johnson Controls International Plc

- Leoch International Technology Ltd.

- Narada Asia Pacific Pte. Ltd.

- Panasonic Holdings Corp.

- PT Century Batteries Indonesia

- PT New Indobatt Energy Nusantara

- PT Selatan Jadi Jaya

- PT. Tri Mega Baterindo

- PT Trimitra Baterai Prakasa

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Lead-acid batteries have been a mainstay in various industries for decades due to their reliability and affordability. These rechargeable batteries are widely used in a range of applications, from starting internal combustion engines in passenger cars to providing backup power in data centers and powering electric vehicles (EVs) and electric bikes (e-bikes). The lead-acid battery market encompasses several types, including flooded lead-acid batteries, sealed lead-acid batteries (SLI), and absorbed glass mat (AGM) batteries. Flooded lead-acid batteries require regular maintenance, while SLI and AGM batteries are maintenance-free. Lead-acid batteries are commonly used In the transportation industry for starting, lighting, and ignition systems in passenger cars.

In addition, they are increasingly being adopted for EVs and hybrid vehicles as an energy source. The automotive sector's shift towards electrification is expected to drive the demand for lead-acid batteries In the coming years. Beyond transportation, lead-acid batteries are also used extensively in other industries. In the energy sector, they are used for energy storage in data centers, renewable energy systems, and off-grid power generation. In industrial applications, they are used for material handling equipment, uninterruptible power supply (UPS) systems, and lighting. Lead-acid batteries are also used in various commercial vehicles, including buses, trucks, and commercial aircraft.

Furthermore, in the healthcare sector, they are used for backup power in hospitals and other healthcare facilities. In addition, they are used in various off-grid applications, such as telecommunications towers and remote power systems. Despite their widespread use, lead-acid batteries have some challenges. They have a higher self-discharge rate compared to lithium-ion batteries, which can reduce their efficiency and lifespan. Terminal corrosion and vibration are also common issues that can affect their performance. The lead-acid battery market is expected to grow In the coming years due to the increasing demand for reliable and affordable energy storage solutions. The market is driven by various factors, including the growing adoption of renewable energy, the increasing demand for backup power, and the shift towards electrification In the transportation industry.

Therefore, lead-acid batteries continue to play a crucial role in various industries due to their reliability, affordability, and versatility. While they have some challenges, ongoing research and development efforts are focused on improving their performance and efficiency. The lead-acid battery market is expected to grow In the coming years, driven by the increasing demand for reliable and affordable energy storage solutions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

176 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.8% |

|

Market growth 2025-2029 |

USD 1.3 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.3 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Southeast Asia

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch