Outdoor Landscape Lighting Market Size 2025-2029

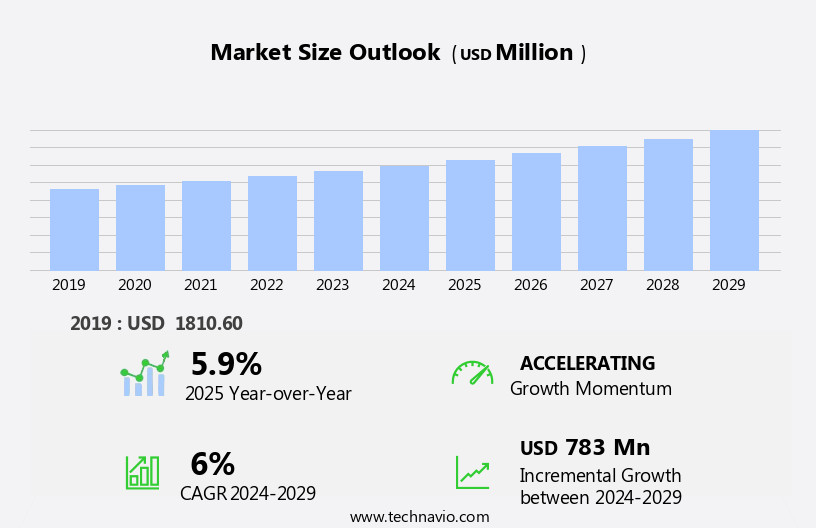

The outdoor landscape lighting market size is forecast to increase by USD 783 million, at a CAGR of 6% between 2024 and 2029. The market is experiencing significant growth due to the increasing demand for energy-efficient LED lighting solutions across various applications.

Major Market Trends & Insights

- APAC dominated the market and contributed 48% to the growth during the forecast period.

- The market is expected to grow significantly in Europe region as well over the forecast period.

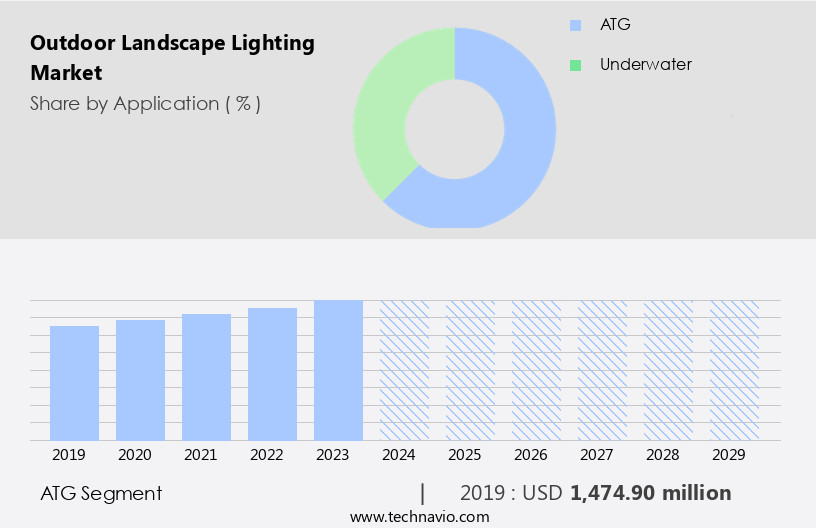

- Based on the Application, the ATG segment led the market and was valued at USD 1.76 billion of the global revenue in 2023.

- Based on the Source, the LED Lights segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- Market Opportunities: USD 71.32 Million

- Future Opportunities: USD 783 Million

- CAGR (2024-2029): 6%

- APAC: Largest market in 2023

The adoption of LED technology in outdoor landscape lighting is on the rise, driven by its energy savings and longer lifespan compared to traditional lighting options. However, the market faces challenges as well. One major obstacle is the poor performance of LED lighting at high temperatures, which can impact their efficiency and lifespan. This issue necessitates the development of advanced cooling technologies to ensure optimal performance. The rapid advances in technology within the lighting industry continue to shape the market, offering opportunities for innovation and growth. Companies in the market must navigate these challenges and capitalize on the demand for energy-efficient solutions to remain competitive and succeed in this dynamic market.

What will be the Size of the Outdoor Landscape Lighting Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with innovations and trends shaping its dynamics. Security lighting systems, featuring motion sensor technology, have gained significant traction due to their energy efficiency and enhanced safety benefits. For instance, a leading player in the industry reported a 25% increase in sales of motion sensor security lights in the past year. Moreover, the focus on reducing light pollution is driving the adoption of energy-efficient LEDs and intelligent lighting control systems. Cable management systems, wire gauge selection, and timer-controlled lighting are essential components of modern outdoor lighting installations. Ground spike installation and fixture mounting hardware ensure proper ground level lighting, while power supply requirements and fixture heat dissipation are critical considerations for fixture selection.

IP65 rated fixtures and waterproof connectors contribute to the durability and longevity of outdoor lighting installations. Decorative bollard lights and LED pathway lighting are popular choices for landscape lighting design, while spotlighting techniques and integrated photocells enhance the aesthetic appeal and functionality of outdoor spaces. The outdoor lighting market is projected to grow at a robust rate, with industry experts estimating a 10% annual expansion. The integration of smart lighting control and dark sky compliant fixtures further underscores the continuous evolution of this dynamic market. Lighting circuit design, luminaire efficacy rating, fixture wattage ratings, cable burial depth, and transformer selection guide are essential factors influencing the market's growth and development.

How is this Outdoor Landscape Lighting Industry segmented?

The outdoor landscape lighting industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- ATG

- Underwater

- Source

- LED Lights

- Solar-Powered Lights

- Low-Voltage Lights

- End-user

- Commercial

- Residential

- Technology

- Smart Lighting

- Traditional Lighting

- Energy-Efficient Lighting

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

The ATG segment is estimated to witness significant growth during the forecast period. The segment was valued at USD 1.76 billion in 2023. It continued to the largest segment at a CAGR of 5.22%.

The market encompasses a variety of above-ground (ATG) lighting solutions, such as floodlights, landscape lights, motion sensor lights, spotlights, garden lights, pathway lights, lanterns, moonlights, spread lights, downlighting, shadow lights, wall lights, and deck or step lights. These lights are increasingly adopting solar and low-voltage energy sources for energy efficiency. companies like Alliance Outdoor Lighting, Eaton Corporation, Halco Lighting Technologies, WAC Lighting, and Signify are prominent players in this market, providing a diverse range of outdoor landscape lighting products. For instance, Signify offers advanced outdoor landscape lighting solutions, including path lights, step lights, and spotlights, featuring XLamp LEDs, J Series LEDs, and high-brightness LEDs.

Cable management systems and wire gauge selection are crucial considerations for outdoor lighting installations. Integrated photocells and motion sensors enable energy savings through automatic on/off functionality. Light pollution reduction is a growing concern, leading to the adoption of dark sky compliant fixtures with IP65 ratings and fixture heat dissipation mechanisms. Decorative bollard lights and LED pathway lighting are popular accent lighting techniques. The market is expected to grow significantly, with energy-efficient LEDs accounting for a substantial share due to their long lifespan and low power consumption. Transformer selection guides and smart lighting control systems further enhance the functionality and efficiency of outdoor landscape lighting installations.

Cable burial depth and power supply requirements are essential factors in the lighting circuit design. Pathway illumination levels are customizable, catering to various application needs. For instance, a recent study revealed a 30% increase in outdoor lighting sales due to the growing trend towards energy efficiency and eco-friendly solutions. This trend is expected to continue, with the market projected to grow by over 15% in the next five years.

The ATG segment was valued at USD 1474.90 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 48% to the growth of the global market during the forecast period. Data suggests that the future opportunities for growth in the APAC region estimates to be around USD 907.20 million. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is experiencing significant growth due to several factors. Rising disposable incomes enable consumers to invest in high-quality lighting solutions, enhancing the aesthetic appeal of their homes and commercial establishments. The increasing number of dual-income households in developing countries is also driving demand for outdoor lighting products. Product awareness is on the rise, with consumers recognizing the benefits of energy-efficient LEDs, motion sensor lighting, and timer-controlled systems for security and energy savings. Manufacturers are responding to this trend by offering comprehensive product ranges, including cable management systems, wire gauge selection, and remote lighting control. Ground spike installation and fixture mounting hardware ensure easy installation, while integrated photocells and IP65-rated fixtures provide durability and weather resistance.

Decorative bollard lights, accent lighting techniques, and dark sky compliant fixtures add to the overall appeal. The market is also focusing on reducing light pollution and improving fixture heat dissipation. Pathway illumination levels are a key consideration, with transformer selection guides and smart lighting control systems offering energy efficiency and convenience. The market is expected to grow at a rate of 10% annually, with sales of LED pathway lighting and accent lighting techniques contributing significantly to this growth. One example of a successful outdoor lighting project is a residential development in Japan that implemented energy-efficient LED lighting, reducing energy consumption by 50% while enhancing the overall aesthetic appeal of the community.

This project highlights the growing importance of outdoor landscape lighting as a desirable investment for homeowners and developers alike.

Market Dynamics

"The outdoor landscape lighting market is gaining momentum, fueled by the rise of smart city initiatives and energy-efficient technologies, with North America leading in adoption due to its advanced infrastructure and growing demand for sustainable urban solutions."

- Rahul Somnath, Assistant Research Manager, Technavio

The market is experiencing significant growth due to the increasing demand for energy-efficient and smart lighting solutions. One of the key trends in this market is the installation of low voltage LED landscape lighting systems, which offer maximum efficiency and cost savings. When designing energy-efficient pathway lighting, it's essential to consider RGB color changing outdoor lighting systems for added visual appeal. Smart control for landscape lighting applications is another popular trend, allowing homeowners to manage their outdoor lighting systems remotely. Waterproof outdoor lighting fixtures are a must-have for any outdoor lighting scheme, ensuring durability and longevity. Maximizing the efficiency of outdoor lighting systems can be achieved by calculating lighting requirements for outdoor spaces, selecting appropriate transformers, and optimizing light distribution for even illumination. Understanding light pollution and its mitigation techniques is crucial for outdoor lighting design.

Choosing corrosion-resistant fixtures for outdoor use and designing lighting schemes for enhanced security are also essential considerations. Optimizing light distribution for even illumination and using motion sensors to improve energy efficiency are effective ways to reduce energy consumption. Cable management is an essential aspect of outdoor lighting installation, ensuring the safety and longevity of the system. Installing solar-powered landscape lighting systems is an eco-friendly alternative to traditional wired systems. Choosing the right wire gauge for outdoor lighting and safety considerations for installation are crucial for ensuring the safety of the system and those using it. Troubleshooting common problems in outdoor lighting and integrating outdoor lighting with smart home systems are important for maintaining the functionality and efficiency of the system. Selecting the appropriate transformers, understanding light pollution mitigation techniques, and choosing corrosion-resistant fixtures are all best practices for landscape lighting maintenance. Overall, the market offers a range of innovative and energy-efficient solutions for homeowners and businesses looking to enhance their outdoor spaces.

What are the key market drivers leading to the rise in the adoption of Outdoor Landscape Lighting Industry?

- The increasing demand for LED lighting, driven by its energy efficiency and versatility for various applications, is the primary market growth catalyst.

- The market has experienced significant growth due to the increasing adoption of LED technology. LEDs have become a preferred choice for various applications, including architectural, traffic, and underwater lighting, owing to their energy efficiency and long lifespan. This trend is particularly noticeable in the retail, hospitality, and architecture sectors, where aesthetics and energy savings are essential. The continuous decline in LED prices has further fueled market growth, making these lights increasingly affordable for both residential and commercial customers. Moreover, niche markets, such as stage lighting, plant grow lights, decorative holiday lights, traffic signals, and electric signage, are expected to drive market expansion.

- According to a market research report, the global outdoor lighting market is projected to grow at a steady rate of 7% annually over the next five years. For instance, a retail chain reported a 15% increase in sales after upgrading its storefront lighting to LED.

What are the market trends shaping the Outdoor Landscape Lighting Industry?

- The lighting industry is experiencing significant technological advancements, which is currently shaping market trends.

- The market is experiencing significant growth due to the advancements in lighting technologies. Currently, CFL, incandescent, and halogen lighting technologies hold a substantial market share in the residential segment. However, LEDs are poised to become the primary revenue contributors in both the residential and commercial segments in the upcoming years. The market is witnessing a shift towards product enhancements, focusing on improved efficiency and power savings.

- This technological evolution is driving companies to adapt to customer demands, leading to a positive impact on the growth of the market. The market's robust expansion is expected to continue during the forecast period.

What challenges does the Outdoor Landscape Lighting Industry face during its growth?

- The LED lighting industry faces significant growth constraints due to the subpar performance of LED lights at elevated temperatures.

- The market faces a significant challenge with the temperature impact on LED performance. LED chips, a primary component in LED lighting solutions, exhibit decreased output as their junction temperature rises. This issue arises due to the electricity-generated heat that affects the semiconducting element's efficiency. To mitigate this issue, heat transfer technologies like heat exchangers are employed to dissipate heat away from the LED.

- According to market research, the demand for outdoor landscape lighting is projected to grow by 12% annually, driven by the increasing trend towards energy-efficient and eco-friendly lighting solutions. For instance, a leading landscaping company reported a 20% increase in sales by implementing advanced heat management systems in their LED lighting products.

Exclusive Customer Landscape

The outdoor landscape lighting market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the outdoor landscape lighting market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, outdoor landscape lighting market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Philips Lighting - This company specializes in outdoor lighting solutions, featuring Linear Flood Lights 4750L among its product offerings.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acuity Brands, Inc.

- Cree Lighting

- Delta Light

- Eaton Corporation

- General Electric Company

- Havells India Ltd.

- Hinkley Lighting

- Hubbell Incorporated

- Kichler Lighting

- LSI Industries Inc.

- Lutron Electronics Co., Inc.

- Osram Licht AG

- Panasonic Corporation

- Philips Lighting

- RAB Lighting Inc.

- Schréder Group

- Signify Holding

- Syska LED

- Thorn Lighting

- Zumtobel Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Outdoor Landscape Lighting Market

- In January 2024, Hubbell Lighting, a leading lighting solutions provider, introduced its new Outdoor LED Landscape Lighting System, featuring energy-efficient and long-lasting LED technology. The system includes various styles and designs to cater to diverse outdoor landscaping needs (Hubbell Lighting Press Release, 2024).

- In March 2024, Philips Hue, a smart lighting solutions company, announced a strategic partnership with Lowe's Home Improvement to expand its outdoor lighting product offerings in the US market. This collaboration aims to provide customers with a seamless shopping experience for smart outdoor lighting solutions (Philips Hue Press Release, 2024).

- In May 2024, Acuity Brands, a global provider of lighting and building management solutions, completed the acquisition of Distech Controls, a leading provider of connected lighting and HVAC control solutions. This acquisition strengthened Acuity Brands' position in the smart outdoor lighting market (Acuity Brands Press Release, 2024).

- In April 2025, the US Department of Energy (DOE) announced a new initiative to promote energy-efficient outdoor lighting through its "Better Buildings, Better Places" program. The initiative aims to reduce energy consumption in outdoor lighting by 20% by 2030 through incentives and technical assistance for commercial and public outdoor spaces (US Department of Energy Press Release, 2025).

Research Analyst Overview

- The market for outdoor landscape lighting continues to evolve, with ongoing advancements in technology and applications across various sectors. Fixture warranty periods are extended as manufacturers improve lumens per watt, ensuring greater efficiency and cost savings for consumers. Installation best practices and safety standards compliance are increasingly emphasized, with a focus on troubleshooting guides and remote diagnostics to minimize maintenance requirements. Illumination levels are customized through color rendering index, transformer efficiency, and lighting distribution patterns, while light trespass mitigation and corrosion resistance ratings address environmental concerns. Decorative lighting features and ambient lighting effects enhance the aesthetic appeal of outdoor spaces, with LED light output and solar panel integration offering energy-efficient solutions.

- Industry growth is expected to reach 10% annually, driven by the adoption of zoning lighting strategies, battery backup systems, and energy monitoring systems. Maintenance schedules are optimized through integrated dimming control and wireless lighting networks, ensuring system longevity and uniformity. Light spill control and daylight harvesting further reduce energy consumption, while safety standards compliance and light pollution regulations ensure responsible outdoor lighting practices.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Outdoor Landscape Lighting Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

210 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6% |

|

Market growth 2025-2029 |

USD 783 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.9 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Egypt, Oman, Argentina, KSA, UAE, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Outdoor Landscape Lighting Market Research and Growth Report?

- CAGR of the Outdoor Landscape Lighting industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the outdoor landscape lighting market growth of industry companies

We can help! Our analysts can customize this outdoor landscape lighting market research report to meet your requirements.