Smart Lighting Market Size 2025-2029

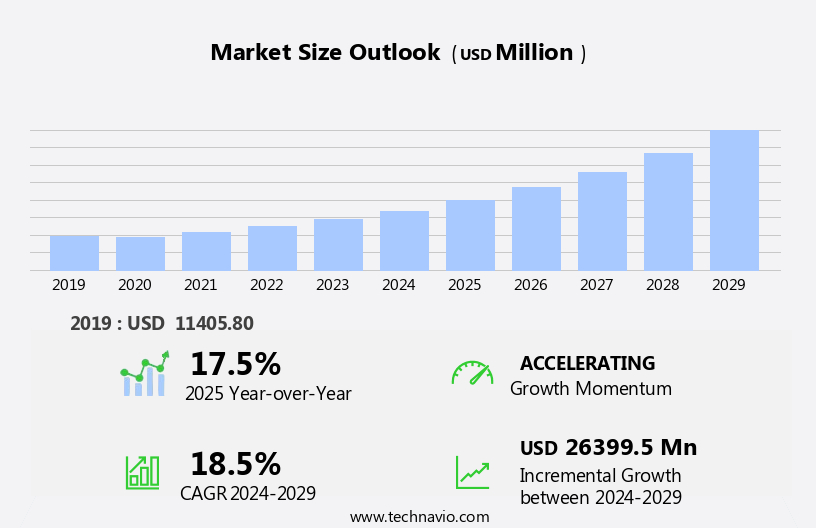

The smart lighting market size is forecast to increase by USD 26.4 billion at a CAGR of 18.5% between 2024 and 2029.

- The market is experiencing significant growth, driven by the integration of Internet of Things (IoT) technology and the increasing adoption of energy-efficient LED lighting solutions. The ability of smart lighting systems to offer energy savings, enhance user experience, and provide advanced features such as occupancy sensing and color tuning, is fueling market expansion. However, technological challenges related to LEDs, including high upfront costs and complex installation processes, remain key barriers to widespread adoption. Additionally, the need for interoperability and standardization across various smart lighting solutions is crucial for market growth.

- Companies seeking to capitalize on this market opportunity should focus on addressing these challenges through innovative business models, partnerships, and technological advancements. By offering cost-effective solutions, simplified installation processes, and ensuring compatibility with various IoT platforms, companies can effectively navigate the competitive landscape and capture a larger market share.

What will be the Size of the Smart Lighting Market during the forecast period?

- The market encompasses various applications, including lighting visualization, security, safety, biodynamic lighting, energy monitoring, adaptive lighting, comfort, remote management, maintenance optimization, effects, integration, atmosphere, aesthetics, asset management, retrofits, human-centric lighting, circadian lighting, mesh networking, dynamic lighting, ambiance, personalization, power over ethernet, simulation tools, management platforms, and control software. These solutions cater to diverse business needs, enhancing energy efficiency, ensuring safety, and promoting comfort and productivity. The integration of advanced technologies, such as mesh networking and dynamic lighting, enables real-time monitoring and optimization of lighting systems.

- Smart lighting solutions also offer personalization features, allowing businesses to tailor lighting conditions according to their specific requirements. Energy management is a significant trend, as these systems enable businesses to monitor and reduce energy consumption. Furthermore, the adoption of human-centric and circadian lighting solutions is gaining traction, as they mimic natural light patterns to improve employee well-being and productivity.

How is this Smart Lighting Industry segmented?

The smart lighting industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Commercial

- Residential

- Public infrastructure

- Others

- Component

- Hardware

- Software

- Services

- Connectivity

- Wired

- Wireless

- Distribution Channel

- Online

- Offline

- Product Type

- Smart Bulbs

- Smart Fixtures

- Smart Controls

- Technology

- LED

- Zigbee

- Wi-Fi

- Bluetooth

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- The Netherlands

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South America

- Rest of World (ROW)

- North America

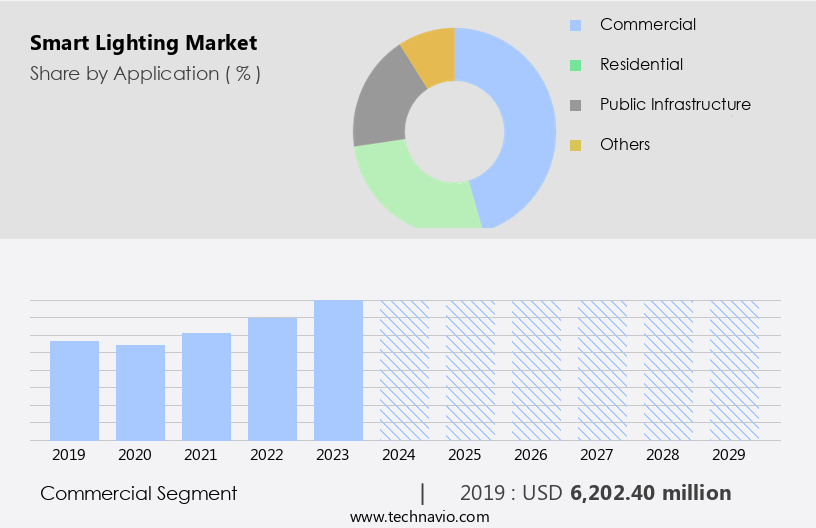

By Application Insights

The commercial segment is estimated to witness significant growth during the forecast period.

In the realm of commercial lighting, establishments such as restaurants, bars, hotels, industrial facilities, offices, and malls are embracing smart lighting solutions. The commercial segment holds a significant market share due to the increasing regulatory pressure on energy usage and CO2 emissions. These businesses are integrating smart lighting systems to optimize energy consumption, enhance control, and align with the Internet of Things (IoT) ecosystem. Smart lighting systems offer numerous advantages, including energy savings and a long lifespan, resulting in substantial cost reduction. Advanced features like dimmability, timers, occupancy sensors, daylighting, and smartphone optimization provide unparalleled control over lighting.

Furthermore, LED technology, the backbone of smart lighting, generates less heat compared to traditional bulbs, ensuring optimal temperature and energy efficiency. Industrial facilities benefit from the flexibility of accent lighting, while offices utilize task lighting to improve productivity. Retail spaces leverage ambient lighting to create an inviting shopping experience. Energy efficiency and cost reduction are crucial factors driving the adoption of smart lighting in various sectors. The integration of data analytics, voice control, and cloud connectivity further enhances the functionality of these systems. Government regulations mandating energy efficiency and the increasing trend towards smart cities are also contributing to the growth of the market.

Smart lighting systems are being used in outdoor settings, including street lighting, for improved safety and energy savings. In the hospitality industry, personalized lighting experiences cater to guests' preferences, while commercial lighting control systems ensure uniformity and adherence to lighting standards. In conclusion, the market for smart lighting is thriving due to its energy efficiency, cost savings, and advanced features. The integration of IoT, data analytics, and voice control further enhances the value proposition of smart lighting systems. Commercial establishments across various industries are adopting these solutions to meet regulatory requirements, reduce energy consumption, and create optimal lighting experiences.

Get a glance at the market report of share of various segments Request Free Sample

The Commercial segment was valued at USD 6.2 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

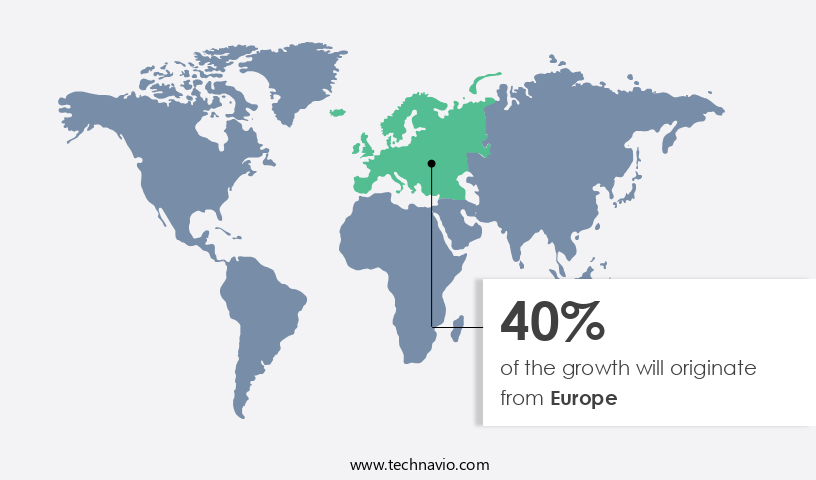

Europe is estimated to contribute 40% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market is witnessing significant growth due to the increasing adoption of IoT technology, LED lighting, and wireless lighting systems. Smart lighting networks enable energy savings, task optimization, and enhanced user experience through features such as app control, voice command, and motion sensing. In Europe, the market is driven by the maturity of smart building concepts and the replacement of outdated infrastructure in countries like Germany, the UK, France, Belgium, Denmark, Italy, and the Netherlands. Smart homes and commercial buildings are integrating lighting systems with data analytics and home automation for improved energy efficiency, cost reduction, and personalization.

However, the higher cost of smart lighting compared to traditional lighting remains a challenge for property owners and operators. Lighting trends include color-changing lights, dimmable lights, accent lighting, and lighting automation for ambiance and security purposes. The market is also witnessing innovation in lighting technology, lighting integration, and lighting regulations to ensure energy efficiency and safety standards are met. Industrial and retail sectors are adopting smart lighting for energy savings and improved aesthetics. Smart city initiatives are also driving the market growth through the implementation of connected lighting and energy-efficient street lighting systems.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Smart Lighting Industry?

- Emergence of smart lighting is the key driver of the market. Smart lighting is a technology that offers energy savings through the automated control of cooling, heating, and lighting systems. This innovation enables users to manage appliances remotely and reduce electricity expenses by determining the optimal times for lights to be turned on or off. Different smart lighting networks offer various features, such as automatic activation when someone enters a room or adjusting color under specific conditions.

- These networks operate autonomously, allowing users to program lights to respond to their commands. Sensors are commonly integrated into smart lights, enabling them to identify people and objects and provide illumination as needed. By automating lighting control, smart lighting networks contribute to energy efficiency and cost savings.

What are the market trends shaping the Smart Lighting Industry?

- Advent of IoT is the upcoming market trend. IoT technology is transforming the way consumers and businesses engage with their physical environments through advanced smart lighting solutions. The integration of wired and wireless technologies, as well as sensor innovations, is fueling the adoption of IoT in this sector. Smart lighting systems, including smart bulbs and luminaires, provide enhanced control and interactivity compared to conventional lighting. IoT enables these fixtures to generate data, which can be utilized to optimize energy usage and gain insights into building occupancy and the utilization of other systems.

- The emergence of smart device applications and cloud-connected lighting systems is further propelled by IoT architectures, which are essential for developing next-generation IoT smart lighting solutions for residential and commercial applications.

What challenges does the Smart Lighting Industry face during its growth?

- Technological challenges related to LEDs is a key challenge affecting the industry growth. LED lighting, a technology known for its energy efficiency and long lifespan, faces certain challenges due to its technical specifications. One limitation is thermal degradation, which affects the lumen output of an LED over time and is determined by its color and operating environment. Moisture is another challenge, as LEDs can be installed both indoors and outdoors. When installed outdoors, moisture may enter the unit and cause a short circuit, necessitating LED replacement. Installation issues also arise, as most LEDs cannot run on high voltage and require step-down voltage for optimal performance.

- This presents challenges in industrial areas with voltage fluctuations, as LEDs are sensitive to such fluctuations. These challenges, while significant, do not deter the ongoing adoption and growth of LED lighting in various applications.

Exclusive Customer Landscape

The smart lighting market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the smart lighting market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, smart lighting market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acuity Brands

- Cree Lighting

- Eaton Lighting

- GE Lighting

- Govee

- Honeywell International

- Legrand

- Leviton Manufacturing

- LIFX

- Lutron Electronics

- Nanoleaf

- Osram Licht AG

- Savant Systems

- Schneider Electric

- Sengled

- Signify (Philips Lighting)

- Tuya Smart

- Wipro Lighting

- Yeelight

- Zumtobel Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing significant growth as businesses and individuals seek to enhance their lighting systems with IoT technology. LED lighting, a key component of this market, continues to gain popularity due to its energy efficiency and customizable features. Lighting networks enable the integration of various lighting types, including wireless and remote-controlled options, into a unified system. Lighting customization is a major trend in the market, with lighting experience playing a crucial role in shaping consumer preferences. App control and voice command functionality offer convenience and flexibility, while lighting analytics provide valuable insights into energy usage and usage patterns. Lighting design is also evolving, with a focus on ambiance and creating a seamless lighting experience.

Lighting infrastructure is undergoing a transformation, with smart sensors and data analytics playing an increasingly important role. Smart buildings and connected lighting systems are becoming the norm, allowing for energy savings and cost reduction. Industrial lighting is also adopting smart technology, with regulations driving the need for energy efficiency and automation. Smart home applications are also driving demand for smart lighting, with home automation and energy savings being key benefits. Outdoor lighting, including street lighting and security lighting, is also being upgraded with smart technology for improved efficiency and safety. Lighting innovation continues to advance, with color-changing lights, motion sensing, and dimmable lights offering new possibilities for customization and energy savings.

Lighting automation and task lighting are also gaining popularity, with retail lighting and hospitality lighting applications benefiting from these advancements. The market for lighting technology is expected to grow significantly in the coming years, with energy efficiency and cost reduction being key drivers. Cloud connectivity and energy efficiency standards are also influencing the market's direction, with smart city initiatives and industrial applications leading the way. In conclusion, the market is experiencing significant growth, with a focus on energy efficiency, customization, and automation. IoT technology is driving innovation in LED lighting, lighting networks, and lighting analytics, with applications ranging from industrial to residential settings.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

207 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 18.5% |

|

Market growth 2025-2029 |

USD 26399.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

17.5 |

|

Key countries |

US, Germany, China, UK, France, Japan, India, Canada, Italy, and The Netherlands |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Smart Lighting Market Research and Growth Report?

- CAGR of the Smart Lighting industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the smart lighting market growth of industry companies

We can help! Our analysts can customize this smart lighting market research report to meet your requirements.