Lime Oil Market Size 2024-2028

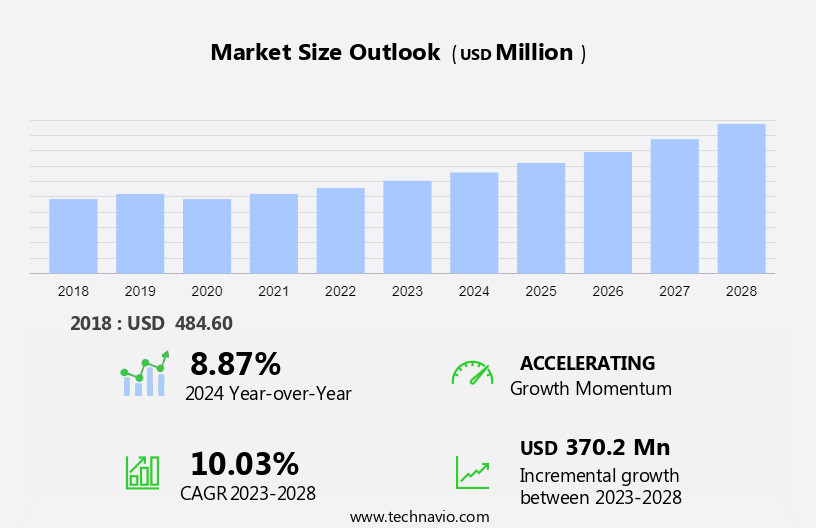

The lime oil market size is forecast to increase by USD 370.2 million at a CAGR of 10.03% between 2023 and 2028.

- The market is experiencing significant growth due to its increasing utilization in various sectors, including hair care, skincare products, oral care, and food service. In the personal care industry, lime oil's antioxidant properties make it an ideal ingredient for anti-aging products, cosmetics, and aromatherapy. Furthermore, the essential oil is widely used in mouthwash, toothpaste, and mosquito repellent. In the food industry, it is a popular choice for sauces, baked goods, and beverages. The convenience of e-commerce platforms has facilitated the easy availability for consumers, leading to an increase in demand. However, distribution challenges persist due to the need for proper packaging and storage to maintaIn the oil's quality. Additionally, the health and wellness trend has fueled the demand for natural and herbal ingredients, further boosting the market's growth. Lime oil's fatty acids and antioxidant properties make it a valuable ingredient in weight management products and blood pressure regulation. The market is expected to continue growing, with applications in sauces, snacks, and fragrances providing ample opportunities.

What will be the Size of the Market During the Forecast Period?

- The market encompasses the production and distribution of essential oils derived from the citrus lime fruit. This market caters to a diverse consumer base, including those seeking organic food and natural essential oils for aromatherapy and therapeutic applications. Lime oil's versatility extends to various industries, such as food and beverage, where it is used as a flavoring agent in processed food and beverages, as well as In the hospitality sector for enhancing culinary experiences. In the cosmetics and fragrances industry, it is a key ingredient in numerous beauty products and perfumes. The market's size is significant, driven by the increasing demand for lime oil-based products in various sectors.

- Furthermore, the organic segment of the market is experiencing strong growth due to the rising preference for natural ingredients. The distilled form segment dominates the market, with lime oil being primarily sourced from conventional sources. Lime oil's antiseptic properties make it an essential ingredient in various therapeutic applications, including the alleviation of aging symptoms and weight management. Its applications in cosmetics, fragrances, and aromatherapy further expand its reach. The market's growth is fueled by the increasing popularity of e-commerce and online retail channels, enabling B2B and B2C distribution.

How is this Lime Oil Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Food and beverage

- Personal care

- Others

- Geography

- Europe

- Germany

- UK

- North America

- US

- APAC

- China

- Japan

- South America

- Middle East and Africa

- Europe

By Application Insights

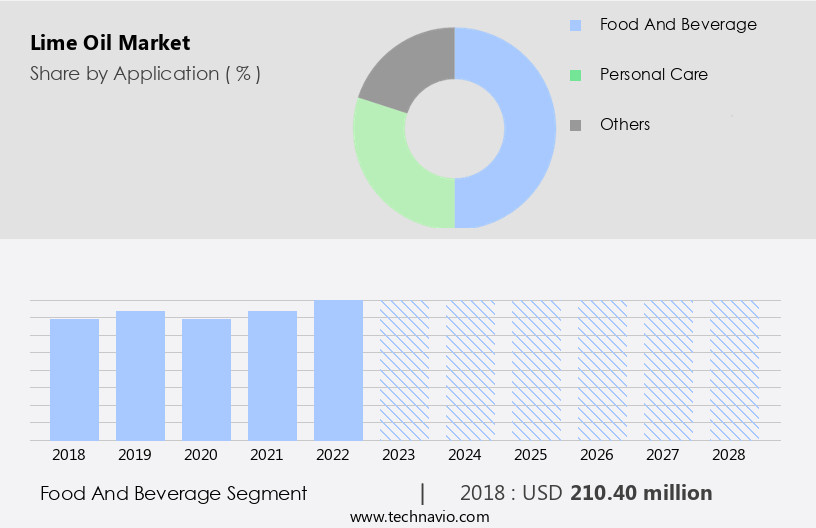

- The food and beverage segment is estimated to witness significant growth during the forecast period.

Lime oil, derived from the rutaceae plant, is a natural essential oil with various applications in food, beverages, aromatherapy, and therapeutics. The consumer base includes businesses In the food industry, hospitality establishments, and manufacturers and suppliers of beauty products, fragrances, healthcare items, oral care products, and lime oil-based products. The market is driven by the increasing demand for organic food and natural essential oils, as well as the growing preference for aromatherapy and therapeutic uses. Lime oil's antiseptic, antiviral, astringent, aperitif, bactericidal, disinfectant, febrifuge, haemostatic, restorative, tonic, and food processing properties make it a versatile ingredient.

Get a glance at the Lime Oil Industry report of share of various segments Request Free Sample

The food and beverage segment was valued at USD 210.40 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

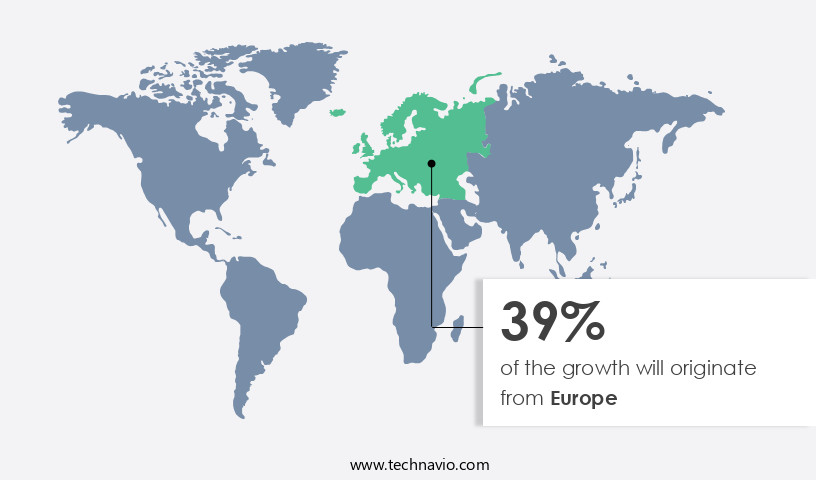

- Europe is estimated to contribute 39% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The European market holds a significant share In the global lime oil consumption, driven by the region's large consumer base preferring organic food and natural essential oils. Lime oil, derived from the rutaceae plant, is widely used in aromatherapy and therapeutics due to its antiseptic, antiviral, astringent, and antibacterial properties. European countries like the UK, Germany, Italy, France, Greece, Switzerland, the Netherlands, Belgium, Luxembourg, Russia, and Portugal exhibit substantial potential for lime oil products. The primary production occurs in southern Europe, particularly in Spain, Italy, Portugal, and Greece. The increasing health consciousness and rising demand for lime oil-based products in Northern European markets, such as the UK, France, and Germany, have fueled growth since 2010.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Lime Oil Industry?

Rising use of lime oil in different sectors is the key driver of the market.

- The market is experiencing growth due to the expanding use of this essential oil in various sectors. The rising consumer preference for organic food and natural essential oils is driving the demand in the food industry, particularly in flavor blending for beverages and processed food. In the healthcare sector, lime oil's therapeutic properties, including its antiseptic, antiviral, astringent, and antibacterial properties, make it a valuable ingredient in medicinal uses, oral care products, and antiaging creams.

- Additionally, it is widely used in cosmetics, fragrances, and toiletries for its refreshing scent and skin benefits. Manufacturers and suppliers are focusing on producing and supplying purified lime oil to meet the increasing demand from businesses and retailers In the B2B and B2C distribution channels. Despite the availability of adulterated lime oil In the market, consumers continue to seek out natural and authentic lime oil for its numerous health and wellness benefits.

What are the market trends shaping the Lime Oil Industry?

Increasing prominence of private-label brands is the upcoming market trend.

- The global market for lime oil, a natural essential oil derived from lime peels, has witnessed significant growth due to increasing consumer preference for organic food and natural ingredients. This trend is driving manufacturers and suppliers to produce and distribute lime oil in various forms, including for aromatherapy and therapeutic uses. The demand is not limited to the healthcare industry but also extends to the food, cosmetics, and fragrance sectors. Lime oil is known for its antiseptic, antiviral, astringent, and antibacterial properties, making it an essential ingredient in oral care products, antiaging creams, soaps, and toiletries.

- Moreover, in food processing, lime oil is used as a flavor blending agent and a preservative. Its medicinal uses include treating infections, wound healing, and inflammatory skin problems such as acne and arthritis. The market can be segmented into the conventional source segment, which includes lime oil extracted from the rind of the fruit, and the distilled form segment, which undergoes a more refined process to produce purified lime oil. The market caters to both B2B and B2C distribution channels, with retailers and businesses selling lime oil-based products through various channels, including e-commerce and online retail. Manufacturers and suppliers are constantly innovating to meet the growing demand for natural essential oils, ensuring the authenticity and purity of their products.

What challenges does the Lime Oil Industry face during its growth?

Distribution challenges is a key challenge affecting the industry growth.

- Lime oil, derived from the peels of the Rutaceae plant, holds significant value in various industries, including food, cosmetics, and healthcare. The consumer base for natural essential oils, such as lime oil, is expanding, particularly In the organic food sector and aromatherapy. Lime oil is known for its antiseptic, antiviral, astringent, and antibacterial properties, making it an essential ingredient in food processing for preservation and in medicinal uses for disinfection. In the cosmetics industry, lime oil is utilized in fragrances, personal care, soapmaking, and toiletries. It is a key ingredient in antiaging creams, antiaging cosmetics, and oral care products, such as toothpaste and mouthwash.

- Furthermore, it is also used as a mosquito repellent and In the production of citrus essential oils. Manufacturers and suppliers face challenges In the market, including the need to produce high-quality, purified lime oil to meet consumer demand for natural and organic products. The conventional source segment and distilled form segment are the major segments In the market. The B2B and B2C distribution channels are crucial for reaching businesses and retailers. Retail stores, including supermarkets and hypermarkets, play a significant role In the distribution of lime oil. However, manufacturers face challenges in meeting the expectations of retailers, such as maintaining competitive prices and providing innovative merchandising units to reduce replenishment costs. Ensuring a consistent supply is also crucial to prevent declines in retailer revenues.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aromaaz International

- CIFAL HERBAL Pvt. Ltd.

- CITRICOS VEGA HERMANOS S.A. DE C.V.

- Citrojugo

- Citrolim S.A. de C.V.

- doTERRA International LLC

- Givaudan SA

- GRUPO TECNAAL

- Inovia International Ltd.

- Lionel Hitchen Ltd.

- Natures Natural India

- Penny Price Aromatherapy Ltd.

- Phoenix Aromas and Essential Oils LLC

- Plant Therapy

- SpringThyme Oils Ltd.

- Statfold Seed Oils LTD.

- The Lebermuth Co. Inc.

- Ultra International Ltd.

- VedaOils

- Young Living Essential Oils LC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a wide range of applications, primarily In the realms of aromatherapy, therapeutics, and food industries. This market caters to a diverse consumer base with a growing preference for natural and organic products. The demand for is driven by its versatile properties, including its antiseptic, antiviral, astringent, and antibacterial qualities. It is derived from the rutaceae plant, specifically from its peels. The production process involves careful extraction to preserve the oil's therapeutic properties. Two primary segments exist withIn the market: the conventional source segment, which includes oils derived from processed food or industrial sources, and the distilled form segment, which consists of oils extracted through steam distillation.

In addition, lime oil finds extensive use in various sectors, including food, healthcare, cosmetics, and fragrances. In the food industry, it is used for flavor blending in a multitude of dishes, particularly In the beverage and culinary arts. Its zesty, refreshing aroma and taste make it a popular choice for both consumers and businesses. In the healthcare sector, it is valued for its medicinal uses. It is known to have antiseptic, antiviral, and anti-inflammatory properties, making it an effective ingredient in various healthcare products. It is used in oral care products such as toothpaste and mouthwash, as well as in topical applications for skin problems and antiaging creams.

Furthermore, the cosmetics industry also benefits from the use of lime oil. Its antiseptic and astringent properties make it an excellent addition to soaps, lotions, and other toiletries. Furthermore, its refreshing fragrance is a popular choice for perfumes and colognes. The market is also expanding In the e-commerce and online retail sectors, as consumers increasingly seek the convenience of purchasing products from the comfort of their own homes. B2B and B2C distribution channels cater to the varying needs of businesses and individual consumers. Despite the numerous benefits of lime oil, it is essential to ensure the purity and authenticity of the product.

In addition, adulterated lime oil can negatively impact the quality and effectiveness of the final product. Therefore, it is crucial for manufacturers and suppliers to prioritize the production of high-quality, purified lime oil. Lime oil's therapeutic properties extend beyond its traditional uses. It is known to have antiseptic, antiviral, and restorative effects, making it a valuable ingredient in various applications. For instance, it is used in wound healing, blood coagulation, and infections. Additionally, it is believed to help alleviate symptoms of aging, such as hair loss and skin ageing, as well as muscle weakness. The market's continued growth is fueled by the ongoing research and development of new applications for this versatile essential oil.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

143 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.03% |

|

Market growth 2024-2028 |

USD 370.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.87 |

|

Key countries |

US, UK, China, Germany, and Japan |

|

Competitive landscape |

Leading Companies, market growth and forecasting , Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the Lime Oil industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.