Luxury Apparel Market Size 2025-2029

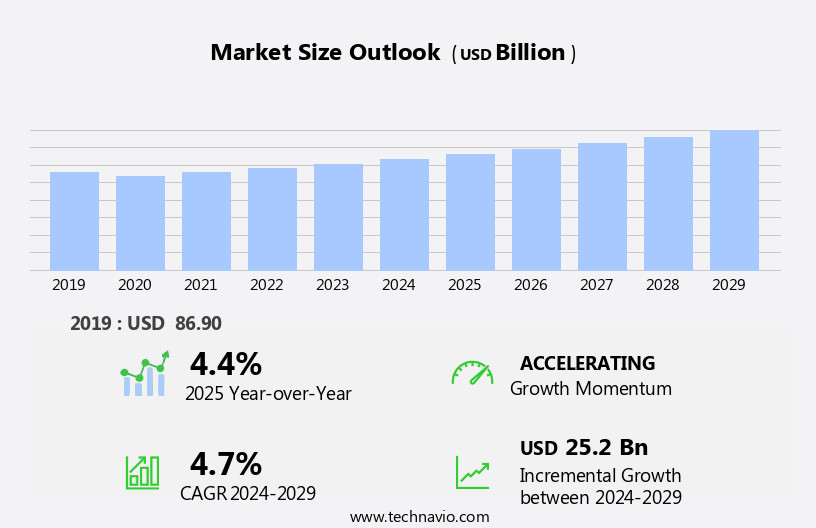

The luxury apparel market size is forecast to increase by USD 25.2 billion, at a CAGR of 4.7% between 2024 and 2029.

- The market is experiencing significant growth, driven by rising disposable income in emerging economies and the increasing popularity of luxury sportswear apparel. These factors are expanding the consumer base and fueling demand for high-end clothing. However, the market also faces challenges, such as the growing trend of purchasing resale luxury apparel products. This trend poses a threat to new product sales, as consumers increasingly opt for second-hand items to save costs while still enjoying luxury brands. To capitalize on market opportunities, companies must focus on innovation and sustainability, offering unique designs and eco-friendly materials to differentiate themselves.

- Additionally, collaborations with influencers and strategic partnerships can help expand reach and attract younger consumers. Navigating these challenges and opportunities requires a deep understanding of consumer preferences and market trends, enabling companies to make informed decisions and effectively position themselves in the market.

What will be the Size of the Luxury Apparel Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market trends shaping various sectors. Luxury fabrics, such as silk and cashmere, remain in high demand, while vintage clothing and bespoke pieces experience a resurgence in popularity. Casual wear and men's fashion segments also show growth, driven by consumer preferences for comfort and individuality. Public relations plays a crucial role in shaping brand perception, with fashion shows and social media marketing platforms providing key channels for engagement. Haute couture and formal wear continue to represent the pinnacle of craftsmanship and exclusivity. Garment construction and textile design innovations, such as circular economy initiatives and ethical sourcing, are increasingly important in addressing consumer concerns and enhancing brand loyalty.

Pricing strategies and consumer behavior analysis are essential components of successful retail channels, while trend forecasting informs product development and marketing efforts. Vintage accessories and personal styling services cater to the growing demand for unique, sustainable, and personalized offerings. Quality control and fair trade practices ensure ethical production and maintain brand reputation. The market's continuous evolution reflects the industry's adaptability and commitment to meeting evolving consumer needs and preferences.

How is this Luxury Apparel Industry segmented?

The luxury apparel industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- End-user

- Men

- Women

- Material Type

- Silk

- Wool

- Leather

- Cotton

- Product Types

- Dresses

- Suits

- Jackets

- Trousers

- Accessories

- Geography

- North America

- US

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Distribution Channel Insights

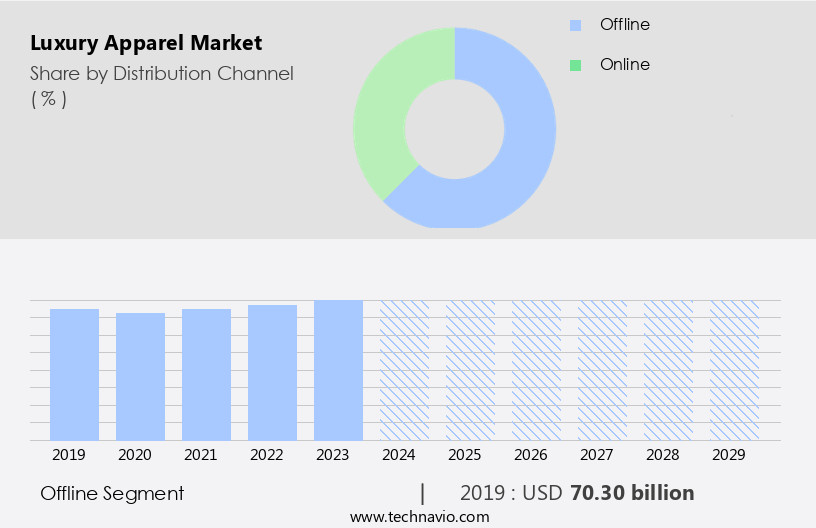

The offline segment is estimated to witness significant growth during the forecast period.

In The market, offline distribution channels continue to hold significance due to their capacity to deliver a tactile and immersive shopping experience for customers. The allure of touching fabrics, trying on garments, and receiving personalized advice from well-informed sales associates is a key draw for consumers. Furthermore, the ambiance of luxurious store interiors, refined displays, and exclusive environments add to the overall opulence of offline retail. The offline luxury apparel distribution landscape encompasses a diverse array of retail formats, including high-end department stores, luxury brand boutiques, concept stores, and flagship stores. Brands leverage this range of options to cater to distinct consumer segments and offer varying degrees of luxury experiences.

Personal care and garment construction play crucial roles in the market, with an emphasis on quality and craftsmanship. Social media marketing and fashion shows serve as essential tools for brands to showcase their latest collections and engage with their audience. Fair trade and ethical sourcing have gained prominence as consumers increasingly prioritize sustainability and social responsibility. Children's fashion, casual wear, men's and women's fashion, and formal wear each represent distinct segments within the market, catering to diverse consumer preferences. Pricing strategies and brand loyalty are essential factors influencing consumer behavior. The circular economy and the reuse of luxury fabrics, vintage clothing, and bespoke clothing are emerging trends in the market.

Textile design, trend forecasting, and quality control are essential elements in the production process. Public relations and haute couture continue to shape the luxury apparel industry, while customer preferences and formal wear segments remain key areas of focus for brands. The market is dynamic, with continuous innovation and adaptation to evolving consumer demands and trends.

The Offline segment was valued at USD 70.30 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

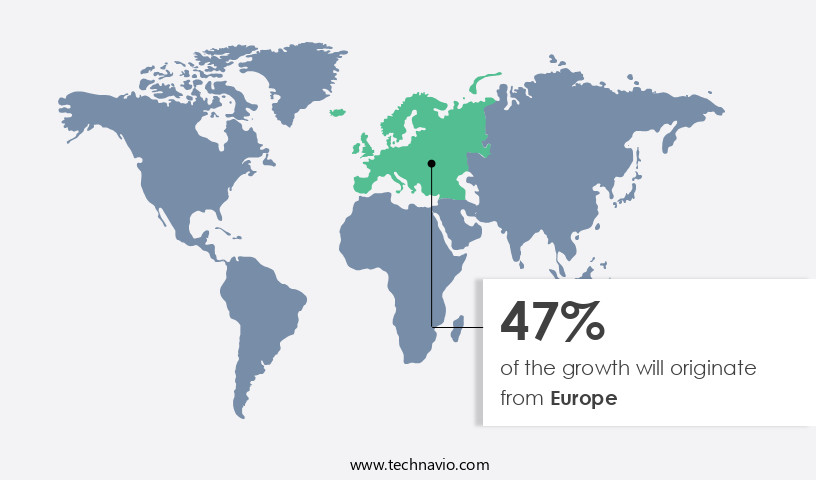

Europe is estimated to contribute 47% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is a complex and multifaceted industry catering to affluent consumers globally. Geographical segmentation plays a significant role in market division, with Europe being a major player. Europe's cultural heritage, fashion capitals, and refined consumer preferences have cemented its position in the luxury apparel sector. Notable European countries, including France, Italy, the UK, and Germany, host renowned fashion houses, luxury brands, and influential fashion events like Paris Fashion Week. Supply chain management is crucial in this market, ensuring personal care and quality control in garment construction. Social media marketing and fashion shows are essential tools for brand promotion and trend forecasting.

Fair trade practices, ethical sourcing, and sustainable initiatives, such as the circular economy, are gaining traction. Children's fashion, vintage accessories, and personal styling services cater to diverse consumer preferences. Luxury goods, including casual wear, men's and women's fashion, and formal wear, are priced strategically based on consumer behavior and brand loyalty. Brands employ public relations and haute couture to maintain their image and attract customers. Textile design, bespoke clothing, and luxury fabrics add value to the market. Consumer preferences for vintage clothing and sustainable practices continue to shape the industry.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the high-end fashion sphere, the market thrives on an unyielding desire for elegance, sophistication, and exclusivity. This market is characterized by its commitment to premium materials, intricate designs, and impeccable craftsmanship. Brands catering to this niche demographic prioritize sustainability, using eco-friendly fabrics and ethical production methods. The latest trends in luxury apparel include statement pieces, bold colors, and innovative technology. Consumers seek timeless elegance, investing in versatile wardrobe staples and limited-edition collaborations. This market also embraces customization, offering bespoke tailoring and personalized monograms. Luxury apparel transcends clothing, embodying a lifestyle of opulence and self-expression.

What are the key market drivers leading to the rise in the adoption of Luxury Apparel Industry?

- In emerging countries, the significant increase in disposable income serves as the primary catalyst for market growth.

- The market is experiencing significant growth due to the expanding economies and increasing disposable income of consumers in emerging markets. Countries such as India, Bangladesh, and South Africa are seeing economic development, resulting in a growing middle class. This demographic is seeking to distinguish themselves and demonstrate social status through high-end apparel and accessories. In China, India, Brazil, and Russia, the rapid economic growth has led to a substantial increase in the number of middle-class individuals. Effective supply chain management is crucial for luxury apparel brands to meet the rising demand. This includes efficient production processes, fair trade practices, and high-quality garment construction.

- Social media marketing has become an essential tool for luxury brands to reach their audience and showcase their latest collections. Fast fashion shows continue to be a significant platform for brands to display their latest offerings and generate buzz. Personal care and attention to detail are essential in the luxury apparel industry, ensuring a harmonious and immersive shopping experience for consumers. Children's fashion is also a growing segment in the market, with parents seeking high-quality and stylish clothing for their children. Brands are responding by offering exclusive and unique designs to cater to this market. Overall, the market is experiencing a surge in demand due to the expanding middle class in emerging economies and the desire for high-end apparel as a symbol of social status.

What are the market trends shaping the Luxury Apparel Industry?

- The growing popularity of luxury sportswear signifies a notable market trend. This fashion trend reflects a shift towards functional and stylish clothing options that cater to both athletic pursuits and everyday life.

- The market has witnessed a notable evolution, with the rise of luxury sportswear gaining prominence in the global high-end fashion sector. This shift signifies a departure from conventional luxury notions, as top brands adopt a more relaxed and athletic aesthetic. This trend is instigated by evolving consumer preferences, which prioritize comfort, functionality, and versatility in their wardrobe choices. The fusion of fashion and athleticism in luxury apparel represents a shift in the perception of luxury, which now encompasses both practicality and ease, alongside traditional elements of refinement and craftsmanship. The circular economy is also gaining traction, as consumers increasingly seek sustainable and ethical sourcing and production practices for luxury goods.

- Pricing strategies continue to play a crucial role in the market, as brands navigate the delicate balance between maintaining exclusivity and catering to consumer demands for affordability and value. Personal styling services, such as virtual consultations and customized recommendations, are also on the rise, providing consumers with a more immersive and harmonious shopping experience. Vintage accessories continue to be popular, adding a unique and authentic touch to modern luxury fashion.

What challenges does the Luxury Apparel Industry face during its growth?

- The rising preference for purchasing pre-owned luxury apparel represents a significant challenge to the industry's growth trajectory.

- The luxury apparel resale market has gained significant traction due to its affordability and alignment with consumers' values. This market offers an opportunity for individuals to acquire desirable luxury items at reduced prices, broadening access to high-end fashion. Moreover, the environmental consciousness of consumers is driving the demand for resale luxury apparel. As sustainability becomes a priority, the extended life cycle of clothing through resale reduces waste and promotes ethical and eco-friendly fashion choices. The luxury resale market encompasses various segments, including vintage clothing, bespoke pieces, and casual wear for men. Public relations plays a crucial role in the market, as authenticity and provenance are essential for maintaining the allure of luxury apparel.

- Haute couture pieces also find a place in the resale market, appealing to collectors and fashion enthusiasts. The market dynamics strike a harmonious balance between affordability and exclusivity, emphasizing the desirability of resale luxury apparel. In conclusion, recent research indicates a growing trend towards resale luxury apparel, providing an attractive alternative for consumers seeking sustainable and cost-effective fashion options.

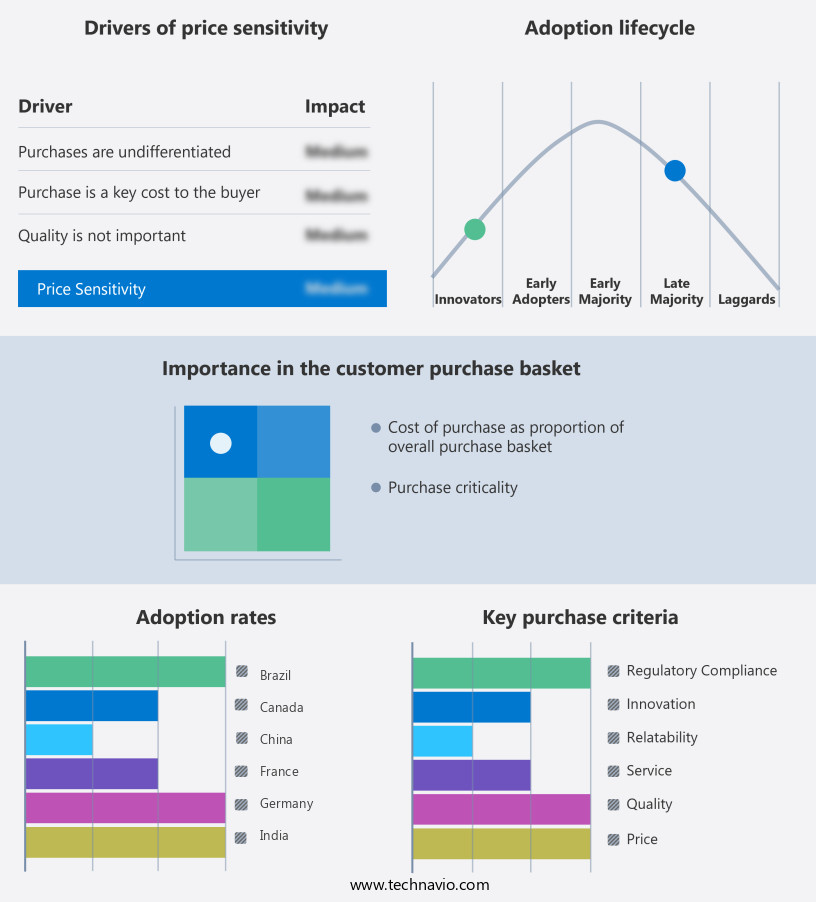

Exclusive Customer Landscape

The luxury apparel market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the luxury apparel market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, luxury apparel market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

LVMH Moët Hennessy Louis Vuitton - This esteemed company specializes in the creation and distribution of high-end apparel, featuring a diverse range of luxury products. Among these offerings are leather bodice dresses, Alexa ankle boots, and single pleat tapered trousers. Each piece is meticulously designed and crafted to provide an unparalleled experience in fashion and comfort. The brand's commitment to quality and originality is evident in every stitch, ensuring a unique and sophisticated look for discerning consumers. With a focus on timeless elegance and innovative design, this company sets the standard for luxury apparel.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- LVMH Moët Hennessy Louis Vuitton

- Kering S.A.

- Chanel S.A.

- Hermès International S.A.

- Prada S.p.A.

- Gucci (Kering)

- Burberry Group Plc

- Versace (Capri Holdings)

- Dolce & Gabbana S.r.l.

- Armani Group

- Ralph Lauren Corporation

- Dior (LVMH)

- Yves Saint Laurent (Kering)

- Balenciaga (Kering)

- Bottega Veneta (Kering)

- Fendi (LVMH)

- Salvatore Ferragamo S.p.A.

- Max Mara Fashion Group

- Valentino S.p.A.

- Zegna Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Luxury Apparel Market

- In January 2024, Gucci, a leading luxury fashion house, announced the launch of its new sustainable line, "Gucci Off The Grid," which includes upcycled and recycled materials. This initiative underscores the growing consumer demand for eco-friendly luxury apparel (Gucci Press Release).

- In March 2024, LVMH Moët Hennessy Fashion Group and Rimowa, the German luggage manufacturer, formed a strategic partnership to expand Rimowa's product offerings with ready-to-wear and accessories under the LVMH umbrella (Bloomberg).

- In April 2025, Burberry, a British luxury fashion brand, raised £100 million in a funding round led by Permira, a private equity firm, to invest in digital transformation and expand its presence in Asia (Financial Times).

- In May 2025, Prada and Adidas announced their collaboration on a new line of luxury sportswear, merging Prada's design expertise with Adidas' athletic technology, marking a significant entry of Prada into the activewear market (Prada Press Release).

Research Analyst Overview

- In the market, intellectual property protection is paramount as brands leverage predictive analytics to anticipate consumer preferences and stay ahead of trends. Social commerce and size inclusivity are reshaping the industry, with e-commerce platforms integrating AR and VR technologies for immersive shopping experiences. Brands are also embracing 3D printing and data analytics to streamline supply chains and offer personalized recommendations. Exclusive distribution, influencer marketing, and celebrity endorsements continue to drive demand, while brand ambassadors and VIP services cater to loyal customers.

- Ethical labor practices, sustainability initiatives, and carbon footprint reduction are becoming essential components of luxury brand strategies. Virtual fashion shows and digital showrooms, enabled by AI and fashion technology, are transforming the in-store experience. Body positivity and wardrobe consulting services are further enhancing the personalized shopping journey. Limited editions and premium pricing remain key differentiators, as luxury retail spaces and experiences continue to evolve.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Luxury Apparel Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

187 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.7% |

|

Market growth 2025-2029 |

USD 25.2 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.4 |

|

Key countries |

US, China, Germany, Japan, UK, Australia, India, France, Brazil, UAE, Rest of World (ROW), Saudi Arabia, France, South Korea, Mexico, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Luxury Apparel Market Research and Growth Report?

- CAGR of the Luxury Apparel industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the luxury apparel market growth of industry companies

We can help! Our analysts can customize this luxury apparel market research report to meet your requirements.