Manufacturing Operations Management (MOM) Software Market Size 2024-2028

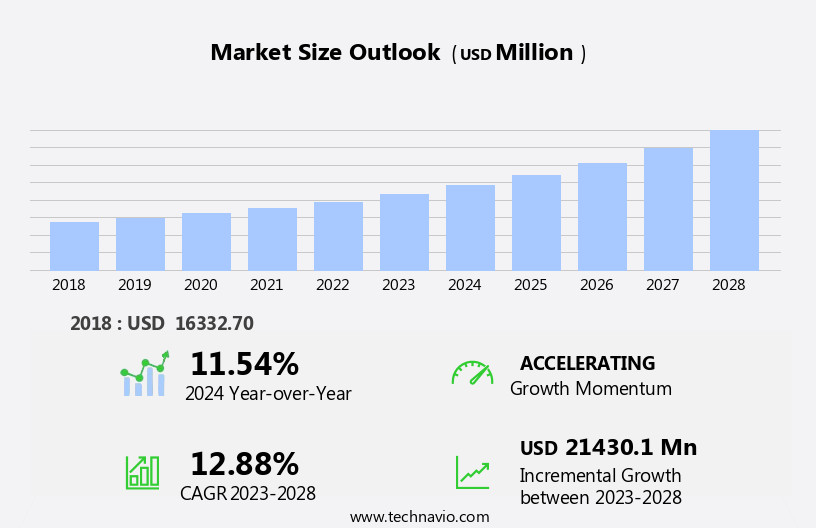

The manufacturing operations management (mom) software market size is forecast to increase by USD 21.43 billion at a CAGR of 12.88% between 2023 and 2028.

What will be the Size of the Manufacturing Operations Management (MOM) Software Market During the Forecast Period?

How is this Manufacturing Operations Management (MOM) Software Industry segmented and which is the largest segment?

The manufacturing operations management (mom) software industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Automotive

- Food and beverages

- Chemical

- Pharmaceutical

- Others

- Deployment

- On-premises

- Cloud

- Geography

- North America

- Canada

- US

- Europe

- Germany

- APAC

- China

- Japan

- South America

- Middle East and Africa

- North America

By End-user Insights

- The automotive segment is estimated to witness significant growth during the forecast period.

The market plays a crucial role in enhancing operational efficiency and profitability In the automotive industry. This sector focuses on optimizing production processes, improving product quality, and ensuring inventory management. Key features of MOM software include digitized technologies, planning and scheduling, execution systems, and advanced analytics using AI and machine learning. Inventory management is essential to minimize damage and losses, while real-time data and advanced analytics help in reducing fuel consumption and optimizing raw material usage. Customer satisfaction is ensured through on-time order fulfillment and accuracy. MOM software also aids in employee training and digital adoption, addressing the need for organizational efficiency and social distancing In the current scenario.

MOM software solutions are available as SaaS, cloud-based, on-premise, and hybrid models. Notable software segments include manufacturing execution systems, AI-based process optimization, and datadriven process optimization. Strategic partnerships between companies like SymphonyAI Industrial, iBASEt, Cyient, and Plex Systems contribute to the growth of this market. The market is witnessing technological advancements, including IoT architectures, edge computing, supervisory control, and advanced analytics. However, concerns regarding data theft, cyberattacks, and privacy are significant challenges. Despite these concerns, the benefits of MOM software, such as increased production efficiency, streamlined processes, and improved profitability, make it an indispensable tool for industrial manufacturing and R&D activities.

Get a glance at the Manufacturing Operations Management (MOM) Software Industry report of share of various segments Request Free Sample

The Automotive segment was valued at USD 4.6 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

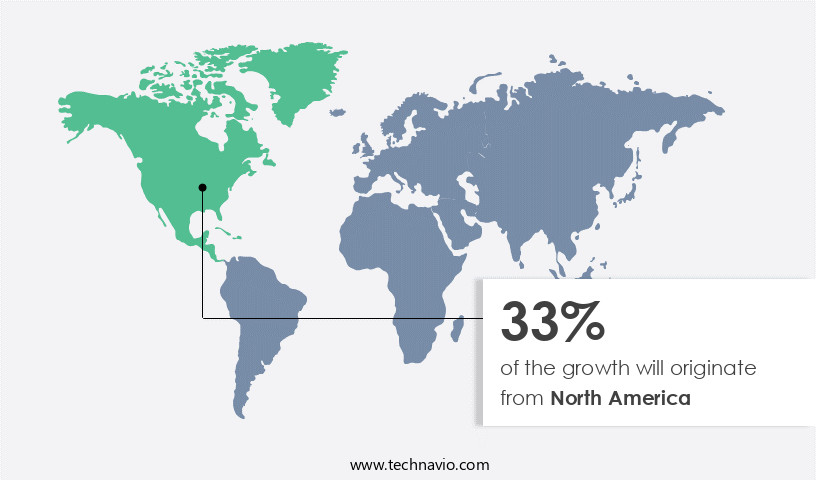

- North America is estimated to contribute 33% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American manufacturing industry's maturity in adopting cloud services and digital platforms is driving the growth of the MOM software market. Major companies In the region and the availability of cloud solution expertise are significant factors. The adoption of cloud solutions and services to lower operating costs and enhance operational efficiency is a critical trend. Leading North American manufacturing companies are extensively utilizing MOM software to scale their processes. As a result, North America is projected to dominate the MOM software market during the forecast period. This market expansion is attributed to the increasing use of cloud technologies, digitization, automation, machine learning, and interconnectivity of networks.

Additionally, the integration of advanced analytics, AI, and IoT architectures is enhancing manufacturing execution, planning, and scheduling. The focus on operational efficiency, execution systems, and enterprise-level governance is also a significant factor. Despite concerns over data theft, cyberattacks, and privacy, the shift towards SaaS solutions, such as those offered by SymphonyAI Industrial and Plex Systems, is continuing.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Manufacturing Operations Management (MOM) Software Industry?

Increasing demand for automation in industrial sectors is the key driver of the market.

What are the market trends shaping the Manufacturing Operations Management (MOM) Software Industry?

ERP and PLM integration is the upcoming market trend.

What challenges does the Manufacturing Operations Management (MOM) Software Industry face during its growth?

Threat of pirated software is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The manufacturing operations management (mom) software market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the manufacturing operations management (mom) software market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, manufacturing operations management (mom) software market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

ABB Ltd. - Manufacturing Operations Management (MOM) software enables organizations to optimize and streamline their production processes, enhancing efficiency and reducing costs. ABB, a leading technology provider, offers a comprehensive solution under the brand ABB Ability. This software suite integrates various manufacturing functions, including production planning, real-time monitoring, and performance analysis. By leveraging advanced technologies such as artificial intelligence, machine learning, and the Internet of Things (IoT), MOM software allows manufacturers to improve operational visibility, minimize downtime, and boost overall productivity. The implementation of MOM solutions can lead to significant improvements in supply chain agility, product quality, and customer satisfaction.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Aegis Industrial Software Corp.

- ARC Advisory Group

- ATS Global B.V.

- Critical Software

- Dassault Systemes SE

- Durr AG

- ECI Software Solutions Inc.

- Emerson Electric Co.

- Epicor Software Corp.

- HCL Technologies Ltd.

- iBASEt Inc.

- Panasonic Holdings Corp.

- Rockwell Automation Inc.

- Royal Cargo Inc.

- Schneider Electric SE

- sedApta S.r.l.

- Siemens AG

- SNic Solutions Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Manufacturing Operations Management (MOM) software plays a pivotal role in enhancing the productivity and efficiency of industrial manufacturing processes. This category of software solutions facilitates seamless integration of various functions, including inventory management, order taking, fulfillment accuracy, and planning and scheduling. By leveraging digitized technologies such as IoT, AI analytics, and machine learning, MOM software enables real-time data processing and advanced analytics, leading to improved operational efficiency and customer satisfaction. One of the primary functions of MOM software is inventory management. Effective inventory control is crucial for minimizing holding costs and ensuring the availability of raw materials for production.

By providing real-time visibility into inventory levels and automating reorder processes, MOM software can help reduce stockouts and overstocking, leading to significant cost savings. Product quality is another critical aspect of manufacturing operations. MOM software can help minimize product damage and defects by implementing quality control measures and providing data-driven insights for process optimization. AI-based process optimization can identify inefficiencies and suggest improvements, leading to increased production efficiency and improved product quality. MOM software also plays a vital role in ensuring efficient order taking and fulfillment. By automating order processing and providing real-time visibility into inventory levels, MOM software can help streamline processes and reduce lead times.

Fulfillment accuracy is also improved, leading to higher customer satisfaction and reduced returns. The adoption of MOM software is driven by the need for organizational efficiency and the interconnectivity of networks. With the increasing use of cloud technologies and SAAS solutions, MOM software can be accessed from anywhere, enabling remote work and social distancing. This is particularly important In the current business environment, where flexibility and adaptability are key to surviving and thriving. Technological advancements in MOM software are also driving innovation In the manufacturing industry. IIoT architectures and edge computing are enabling real-time data processing and analysis, leading to improved operational efficiency and better decision-making.

AI and machine learning are being used to optimize processes and identify inefficiencies, leading to significant cost savings and increased productivity. Despite the numerous benefits of MOM software, there are also challenges associated with its adoption. Data theft and cyberattacks are becoming increasingly common, and privacy concerns are a major issue. Companies need to ensure that their MOM software solutions are secure and comply with data protection regulations. The MOM software market can be segmented into software, services, on-premise, and cloud segments. The software segment includes the sales of MOM software solutions, while the services segment includes consulting and implementation services.

The on-premise segment refers to software that is installed and run on the company's own servers, while the cloud segment refers to software that is accessed via the internet. The automotive segment is a major user of MOM software due to the complex nature of manufacturing processes and the need for high levels of quality control. Other industries, such as food and beverage, pharmaceuticals, and electronics, also heavily rely on MOM software to optimize their manufacturing processes and improve operational efficiency. In conclusion, Manufacturing Operations Management (MOM) software is a critical tool for enhancing productivity and efficiency in industrial manufacturing processes.

By leveraging digitized technologies such as IoT, AI analytics, and machine learning, MOM software enables real-time data processing and advanced analytics, leading to improved operational efficiency, product quality, and customer satisfaction. The adoption of MOM software is driven by the need for organizational efficiency and the interconnectivity of networks, but there are also challenges associated with data security and privacy. The MOM software market is segmented into software, services, on-premise, and cloud segments, with the automotive industry being a major user.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

184 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 12.88% |

|

Market growth 2024-2028 |

USD 21430.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

11.54 |

|

Key countries |

US, China, Germany, Canada, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Manufacturing Operations Management (MOM) Software Market Research and Growth Report?

- CAGR of the Manufacturing Operations Management (MOM) Software industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the manufacturing operations management (mom) software market growth of industry companies

We can help! Our analysts can customize this manufacturing operations management (mom) software market research report to meet your requirements.