Marine Battery Market Size 2024-2028

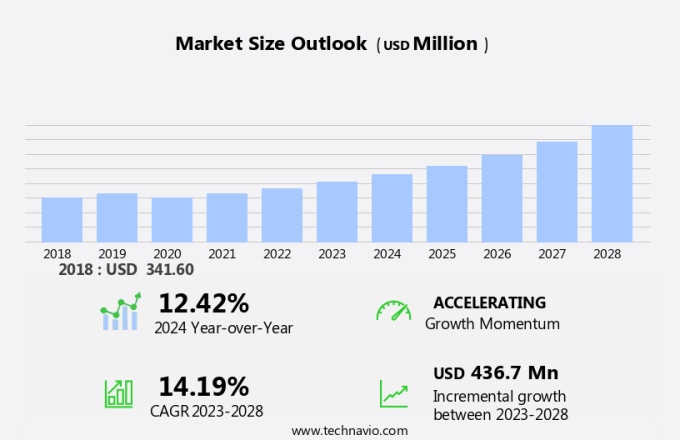

The marine battery market size is forecast to increase by USD 436.7 million at a CAGR of 14.19% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. One of the primary factors driving market expansion is the increasing demand for lithium batteries, which offer higher energy density and longer cycle life compared to traditional lead-acid batteries. Another trend is the growing preference for fully electric ships, as governments and industries push for more sustainable and eco-friendly transportation solutions. The global commercial trade of marine batteries is expected to expand, driven by the maritime transportation sector's need for reliable and efficient energy storage solutions. However, there are challenges to overcome, such as the current limitation of capacity and range of fully electric ships, which may hinder the widespread adoption of electric propulsion systems In the maritime industry. Overall, the market is poised for strong growth as these trends continue to shape the industry landscape.

What will be the Size of the Marine Battery Market During the Forecast Period?

- The market encompasses the production and trade of advanced batteries utilized in various maritime applications, including ships, ferries, water sports industry equipment, and leisure boats. This industry experiences dynamic market trends driven by the shift towards electrification in response to stringent environmental regulations and the increasing adoption of renewable energy sources. Sulfur content in marine fuels, such as exhaust cleaning systems and scrubbers, is a significant factor influencing the demand for high-performance batteries with high energy and power densities.

- Furthermore, the transition to LNG-based fuel and the emergence of full electric and hybrid ships are key growth areas.

How is this Marine Battery Industry segmented and which is the largest segment?

The marine battery industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Commercial

- Defense

- Geography

- Europe

- Germany

- Norway

- North America

- US

- APAC

- China

- Japan

- Middle East and Africa

- South America

- Europe

By Application Insights

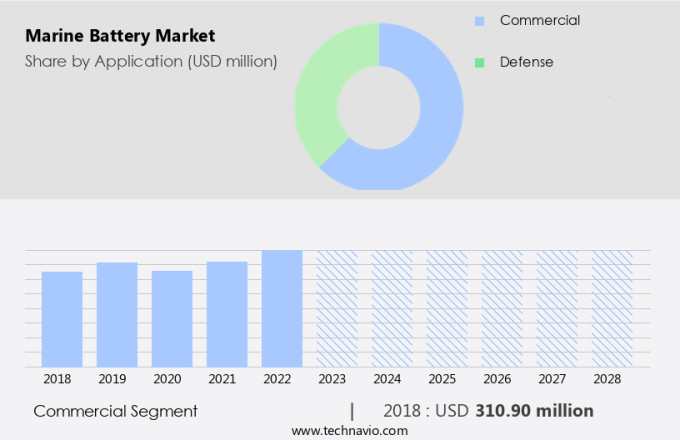

- The commercial segment is estimated to witness significant growth during the forecast period.

The commercial market is experiencing significant growth, driven by the increasing adoption of lithium batteries in various vessel types, including ferries, ro-ro boats, barges, and low-cost shipping. These batteries are also gaining traction In the leisure boating sector. The affordability of lithium batteries, resulting from advancements in manufacturing processes, is a major factor fueling this trend. The use of marine batteries enhances vessel security and contributes to the growing demand for electric and hybrid propulsion systems In the maritime transportation industry.

Furthermore, stringent environmental regulations and the shift towards renewable energy sources further boost market expansion. Energy storage systems, such as high voltage superchargers and charging infrastructure, are crucial components of this growth. The market encompasses a wide range of applications, from electric cargo ships and container ships to electric ferries and commercial vessels, as well as electric fuel for power stations and zero emission shipping. Key players in this market include ship manufacturers, shipowners, and OEMs catering to the marine battery aftermarket.

Get a glance at the Marine Battery Industry report of share of various segments Request Free Sample

The commercial segment was valued at USD 310.90 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

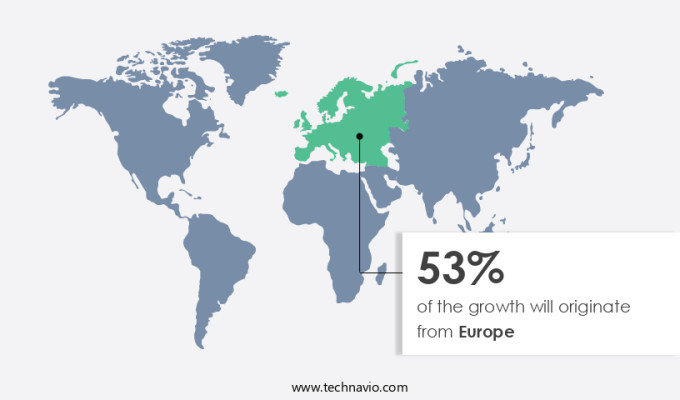

- Europe is estimated to contribute 53% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The European market dominates the global marine battery industry, driven by the growing demand for electric ships in passenger transportation, particularly in ferries, tugs, yachts, and cruise vessels. Norway, Finland, and Denmark are leading the way with the adoption of fully electric passenger ferries, replacing conventional vessels. Europe's market expansion is further fueled by advancements in fuel cell-powered autonomous electric boats and remotely operated vessels. A strong supply chain network, a large number of commercial marine operators, and market participants contribute to the region's market growth. The European market is expected to continue expanding due to the increasing focus on reducing emissions and complying with stringent environmental regulations.

Additionally, the development of advanced marine battery technology, such as high energy and power density, and hybrid propulsion systems, is driving the market forward. The maritime transportation sector, including ships, ferries, and leisure boats, is undergoing electrification, leading to the increased demand for marine batteries. Key market trends include the use of lithium, lead-acid, deep cycle, and dual-purpose batteries, as well as the integration of renewable energy and charging infrastructure. Government incentives and the commercial and defense sectors are also significant contributors to the market's growth.

Market Dynamics

Our marine battery market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Marine Battery Industry?

Rising demand for lithium batteries is the key driver of the market.

- The global marine battery industry is experiencing significant growth due to the increasing adoption of advanced marine batteries, particularly lithium batteries. These batteries are gaining popularity In the maritime transportation sector due to their lightweight and compact size, making them ideal for deployment in various types of vessels, including commercial ships, ferries, ro-ro boats, barges, leisure boats, yachts, cruise ships, and even electric cargo ships. The use of lithium batteries in marine applications is driven by their high energy density and power density, which translates to increased functionality and energy efficiency for vessels. Additionally, the rising cost-efficiency of lithium batteries, resulting from advancements in manufacturing techniques, is further fueling market expansion.

- Moreover, the growing emphasis on reducing emissions and complying with stringent environmental regulations is increasing the demand for lithium batteries In the marine industry. Their minimal maintenance requirements and quick response times make them a preferred choice for various applications, from electric propulsion systems and hybrid propulsion technology to exhaust cleaning systems, such as scrubbers, and LNG-based fuel systems. The market expansion is also influenced by the increasing adoption of electric ships, hybrid ships, and even zero-emission shipping, as well as the electrification of various water sports industries and leisure boating. Government incentives and the growing trend towards renewable energy are further driving market growth. Overall, the market is poised for continued expansion, offering significant opportunities for OEMs, aftermarket players, and other stakeholders In the industry.

What are the market trends shaping the Marine Battery Industry?

Growing demand for fully electric ships is the upcoming market trend.

- The Marine Battery Industry is experiencing significant growth due to the increasing demand for electric and hybrid ships in response to stringent environmental regulations and the shift towards renewable energy sources. The International Maritime Organization's (IMO) IMO 2020 regulation, which restricts sulfur dioxide emissions to 0.50% mass by mass, is driving the adoption of advanced marine batteries. These batteries are essential for electric propulsion systems, which are becoming increasingly popular for short voyages and in applications such as ferries, Ro-Ro boats, barges, and leisure boats. Moreover, the growing popularity of LNG-based fuel and exhaust cleaning systems like scrubbers is also fueling the demand for marine batteries. Ship manufacturers and owners are investing in battery technology to reduce their carbon footprint and comply with emissions regulations. Electric cargo ships, container ships, and even cruise ships are being developed, and the water sports industry and leisure boating sectors are also adopting electric and hybrid propulsion technology.

- Furthermore, the market for marine batteries is expected to grow further due to the increasing availability of charging infrastructure, including high voltage superchargers, and government incentives for zero-emission shipping. The energy density and power density of marine batteries are critical factors driving innovation In the industry. Both lithium and lead-acid batteries are being used in marine applications, with deep-cycle and dual-purpose batteries being popular choices. The commercial segment, including passenger transportation boats and cargo ships, is expected to dominate the market. However, the defense sector is also expected to show significant growth due to the increasing demand for electric and hybrid warships. The market is also being driven by the increasing popularity of hybrid propulsion technology and the electrification of ships, which is expected to lead to the development of more advanced battery systems In the future.

What challenges does the Marine Battery Industry face during its growth?

Limitation of capacity and range of fully electric ships is a key challenge affecting the industry growth.

- The Marine Battery Industry is witnessing significant growth due to the increasing adoption of advanced marine batteries in various applications, including electric propulsion systems, exhaust cleaning systems with scrubbers, and LNG-based fuel ships. Ship manufacturers and owners are exploring battery technology and hybrid propulsion technology to meet stringent environmental regulations and reduce emissions. The commercial segment, including container ships, ro-ro boats, barges, passenger transportation boats, and ferries, is a major consumer of marine batteries. Electric ships, although gaining popularity, face limitations due to their limited range and capacity. Hybrid propulsion technology, which combines electric and diesel power, is a promising solution. It allows ships to use batteries for short distances and diesel engines for longer voyages, thereby extending the operational range and reducing fuel consumption.

- Furthermore, the maritime transportation industry's shift towards electrification is driven by government incentives and the increasing availability of charging infrastructure, including high voltage superchargers. Energy density and power density are critical factors In the selection of marine batteries. Lithium and lead-acid batteries are popular choices due to their high energy density and power density, respectively. The water sports industry, leisure boating, and defense sectors also use marine batteries for various applications. The future of marine batteries lies In their ability to provide high energy and power density, long cycle life, and safety. The market is expected to grow further as the industry moves towards zero-emission shipping and the adoption of electric fuel, such as electric ferries and cargo ships.

Exclusive Customer Landscape

The marine battery market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the marine battery market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, marine battery market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry. The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BorgWarner Inc.

- Corvus Energy

- Echandia Marine AB

- EnerSys

- EST Floattech BV

- EverExceed Corp.

- Exide Industries Ltd.

- Forsee Power

- Freudenberg FST GmbH

- HBL Power Systems Ltd.

- Kokam Co. Ltd.

- Leclanche SA

- Lifeline Batteries Inc.

- Saft Groupe SAS

- Siemens AG

- Spear Power Systems

- Sterling PlanB Energy Systems

- The Furukawa Battery Co. Ltd.

- Toshiba Corp.

- U.S. Battery Manufacturing Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The marine battery industry is a critical component of the global commercial trade, as it powers various applications on board ships, from electric propulsion systems and diesel generators to exhaust cleaning systems and scrubbers. The demand for advanced marine batteries is driven by several factors, including the shift towards LNG-based fuel and stringent environmental regulations. Ship manufacturers and shipowners are increasingly adopting electric propulsion systems and electric ships to reduce emissions and improve fuel efficiency. These vessels, which range from container ships to ferries and passenger transportation boats, require high-performance batteries with high energy and power densities. The energy storage systems used In these applications must be able to provide sufficient power to operate the ship's systems and propulsion, as well as to store excess energy generated during sailing. Battery technology plays a crucial role In the marine industry, with both lithium and lead-acid batteries being widely used. Lithium batteries offer several advantages, including higher energy density and longer cycle life, making them an attractive option for electric ships and hybrid propulsion systems. However, lead-acid batteries remain popular for their cost-effectiveness and reliability, particularly In the aftermarket and for applications where deep cycle and dual-purpose batteries are required.

Furthermore, the maritime transportation sector is undergoing a significant transformation, with electrification and the adoption of renewable energy becoming increasingly important. Government incentives and regulations are driving the shift towards zero-emission shipping, with electric fuel and electric ferries becoming more common. The water sports industry and leisure boating are also adopting electric and hybrid propulsion systems to reduce emissions and improve performance. The market is a dynamic and evolving industry, with ongoing advancements in battery technology and charging infrastructure. High voltage superchargers and energy storage systems are becoming more common, enabling faster charging times and longer ranges for electric ships. The commercial segment, including container ships, RORO boats, and barges, is a significant market for marine batteries, with low-cost shipping and passenger transportation boats also adopting electric and hybrid propulsion systems.

In summary, the marine battery industry is a critical component of the global commercial trade, with ongoing advancements in battery technology driving the shift towards electric and hybrid propulsion systems. The demand for high-performance batteries with high energy and power densities is increasing, with both lithium and lead-acid batteries being used in various applications, from electric ships and hybrid propulsion systems to exhaust cleaning systems and scrubbers. The maritime transportation sector is undergoing a significant transformation, with electrification and the adoption of renewable energy becoming increasingly important, and government incentives and regulations driving the shift towards zero-emission shipping.

|

Marine Battery Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

137 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.19% |

|

Market growth 2024-2028 |

USD 436.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

12.42 |

|

Key countries |

Norway, US, China, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Marine Battery Market Research and Growth Report?

- CAGR of the Marine Battery industry during the forecast period

- Detailed information on factors that will drive the Marine Battery growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the marine battery market growth of industry companies

We can help! Our analysts can customize this marine battery market research report to meet your requirements.