Battery For Energy Storage Systems (ESS) Market Size 2025-2029

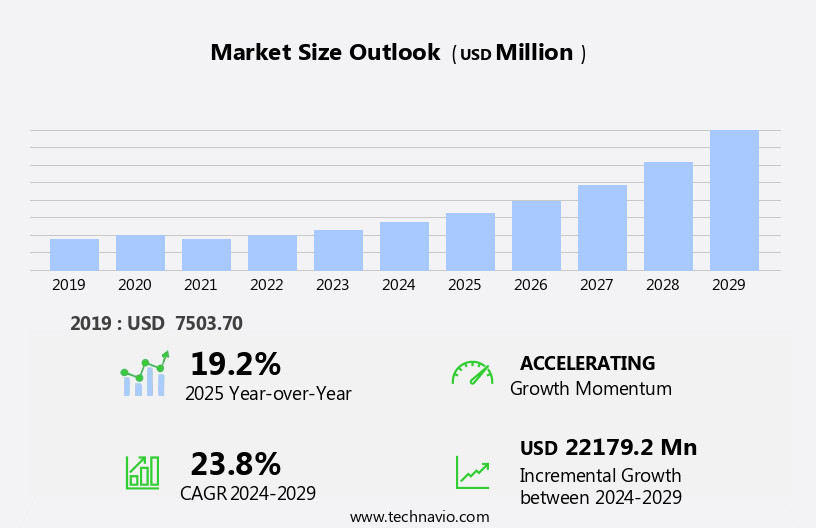

The battery for energy storage systems market size is forecast to increase by USD 22.18 billion, at a CAGR of 23.8% between 2024 and 2029. As governments and businesses invest heavily in solar, wind, and other clean power systems, the need for reliable and renewable energy storage solutions has become critical to ensure power consistency and grid stability. One of the most significant trends in this space is the expanding adoption of microgrids, especially in remote or off-grid areas, which rely on energy storage to balance energy generation and consumption.

Market Dynamics

- Rising global investments in renewable energy sources to ensure stable and clean energy supply

- Widening adoption of microgrids, driving demand for efficient energy storage systems

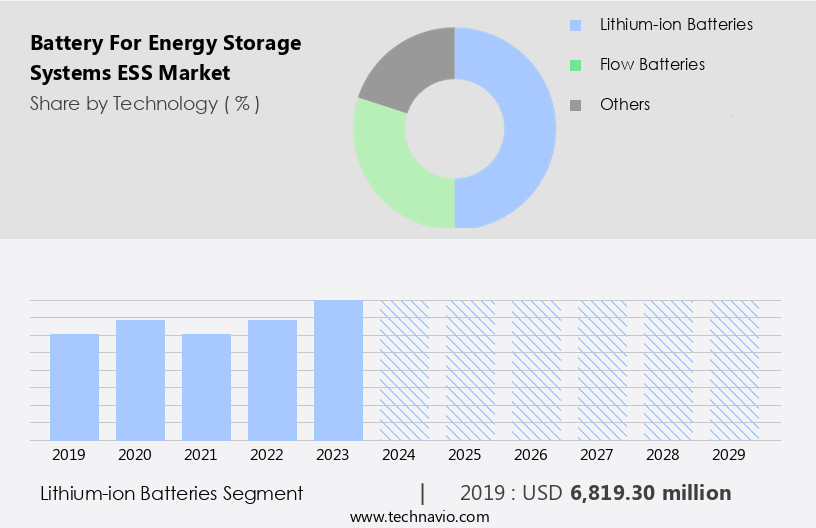

- Increasing reliance on lithium-ion batteries segment was valued at USD 6.82 billion in 2019, with steady growth during the forecast period

- North America emerged as the second-largest regional market, contributing USD 2.90 billion in 2023

- Growing use of energy storage for grid stability, peak shaving, and load balancing

- Government initiatives promoting energy transition and sustainability

However, the market also faces notable challenges. The widening demand-supply gap for lithium driven by surging battery demand in both renewable and electric vehicle sectors is leading to supply chain strain and price volatility. This dynamic threatens to slow market momentum unless companies diversify material sourcing and explore alternatives to lithium-based technologies. Addressing this challenge will require increased R&D in battery innovation, cost reduction strategies, and sustainable sourcing. To stay competitive, industry players are focusing on improving battery efficiency, exploring advanced chemistries, and establishing circular material recovery systems. With continued innovation and supportive regulation, the clean energy technologies and storage market is positioned to play a crucial role in the global transition to low-carbon energy.

What will be the Size of the Battery For Energy Storage Systems (ESS) Market during the forecast period?

The battery market for energy storage systems (ESS) continues to evolve, driven by the increasing integration of renewable energy sources and the need for voltage support, carbon emission reduction, climate change mitigation, and fire suppression systems. The market dynamics are shaped by various factors, including environmental regulations, round-trip efficiency, frequency regulation, power electronics, peak shaving, electrochemical performance, and energy management software. Project financing, energy efficiency, battery management systems, and system design are crucial elements in the ESS market. Sodium-sulfur batteries and flow batteries are gaining popularity in commercial storage applications, while utility-scale storage and grid-scale storage are becoming increasingly important for renewable energy integration.

Thermal management, microgrid applications, and grid interconnection are also key areas of focus, as ESS becomes more integral to the smart grid. Demand response, cost of storage, data analytics, and second-life applications are other emerging trends in the market. Electrochemical performance, depth of discharge, and cycle life are critical factors in the selection of batteries for various applications, including wind energy, solar energy, and electric buses. Energy arbitrage, electric vehicles, and operational costs are also important considerations. Safety standards, discharge rate, and remote monitoring are essential aspects of ESS, ensuring reliable and efficient energy storage solutions. The market is continually unfolding, with new developments and innovations shaping the landscape.

How is this Battery For Energy Storage Systems (ESS) Industry segmented?

The battery for energy storage systems (ess) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Technology

- Lithium-ion batteries

- Flow batteries

- Others

- Connectivity

- On-grid

- Off-grid

- Battery

- Lithium-ion batteries

- Advanced lead-acid batteries

- Flow batteries

- Others

- Lithium-ion batteries

- Advanced lead-acid batteries

- Flow batteries

- Others

- Ownership

- Customer owned

- Third-party owned

- Utility owned

- Customer owned

- Third-party owned

- Utility owned

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- Australia

- China

- Japan

- South Korea

- Rest of World (ROW)

- North America

.

By Technology Insights

The lithium-ion batteries segment is estimated to witness significant growth during the forecast period.

The market experiences substantial growth due to the integration of smart grids and voltage support. Environmental regulations and the push for carbon emission reduction and climate change mitigation drive market expansion. Fire suppression systems are another critical factor, as they ensure safety during energy storage. Round-trip efficiency and frequency regulation are essential for grid stability, leading to increased demand for power electronics and battery management systems. Sodium-sulfur batteries and flow batteries are gaining popularity in commercial storage applications due to their long cycle life and energy storage capacity. Utility-scale storage and grid-scale storage are key areas of focus for renewable energy integration, microgrid applications, and demand response.

Thermal management is crucial for maintaining optimal battery performance. Renewable energy sources, such as wind and solar, require energy storage for efficient energy arbitrage and grid interconnection. Project financing and energy efficiency are essential considerations for the market's growth. Second-life applications for batteries in electric buses and electric vehicles offer opportunities for cost savings. Operational costs, battery chemistry, safety standards, and remote monitoring are essential factors in the market. Discharge rate, depth of discharge, and cycle life are critical electrochemical performance indicators. Data analytics plays a significant role in optimizing energy storage systems. In the lithium-ion battery segment, Li-ion batteries account for a significant market share due to their high energy density and energy storage capacity.

Among various types of Li-ion batteries, Li-ion titanate batteries, lithium iron phosphate batteries, and lithium nickel manganese cobalt batteries are gaining popularity for their improved safety and longer cycle life. The market's future growth is expected to be driven by advancements in battery technology, energy storage capacity, and cost reduction.

The Lithium-ion batteries segment was valued at USD 6.82 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 41% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is experiencing significant growth due to increasing energy demands driven by population growth and rising living standards. Countries in the region, including South Korea, Japan, and Australia, are focusing on renewable energy sources to meet this demand and reduce carbon emissions, mitigate climate change, and comply with environmental regulations. Renewable energy sources, such as wind and solar, require energy storage systems for voltage support, frequency regulation, and grid interconnection. Power electronics, battery management systems, and energy management software are crucial components of ESS, enabling peak shaving, demand response, and energy arbitrage. Utility-scale and commercial storage, including sodium-sulfur batteries and flow batteries, are gaining popularity for their high energy storage capacity and long cycle life.

Thermal management and safety standards are essential considerations for ESS design, ensuring efficient operation and safe discharge rates. Project financing and energy efficiency are also critical factors in the ESS market. Second-life applications of batteries, such as electric buses and electric vehicles, offer opportunities for cost savings and reduced operational costs. Remote monitoring and data analytics enable optimized performance and maintenance of ESS. The market's evolution includes the integration of ESS into smart grids, microgrids, and grid-scale applications, providing resilient and sustainable energy solutions.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global battery energy storage systems market is undergoing rapid advancements driven by the increasing demand for reliable grid solutions and renewable energy integration. As the market evolves, lithium-ion battery pack thermal management strategies and advanced battery management system algorithms for ESS play a critical role in ensuring performance and safety. Real-time monitoring and control of battery energy storage are becoming standard practices, enabling optimization of charging strategies for fast charging applications and predictive maintenance using battery state of health data. Safety critical design considerations for large-scale ESS are being prioritized to address operational risks.

A direct comparison of battery system efficiency reveals that second life applications for electric vehicle batteries can reduce costs by approximately 30% compared to new battery systems. Furthermore, the implementation of advanced battery materials for improved energy density has shown a performance enhancement of 18.5% over conventional chemistries. These figures highlight the market's transition toward cost optimization strategies for battery energy storage systems without compromising performance.

The market’s momentum is also supported by electrochemical modeling for battery degradation prediction and sustainable battery recycling and waste management solutions. Improvements in cycle life, integration with smart grid technologies, and life cycle assessment of battery energy storage technologies continue to shape product development

What are the key market drivers leading to the rise in the adoption of Battery For Energy Storage Systems (ESS) Industry?

- Transitioning the energy mix from fossil fuels to sustainable and renewable energy resources is a critical market trend, as increasing numbers of organizations prioritize reducing carbon emissions and embracing eco-friendly energy solutions. This shift is not only essential for addressing environmental concerns but also for future-proofing businesses against potential regulatory changes and market demands. By investing in renewable energy resources, companies can not only contribute to a more sustainable future but also potentially reap financial benefits through cost savings and government incentives.

- The global energy landscape has undergone significant transformation, with renewable energy sources gaining prominence due to increasing concerns over greenhouse gas (GHG) emissions from fossil fuels. Renewables, including solar, biomass, and wind, now account for a substantial share of the global energy mix. Governments worldwide have implemented regulations mandating the use of renewable energy resources, further driving this trend. One of the key applications of energy storage systems (ESS) is in electric vehicles (EVs) and hybrid electric buses. Second-life applications of batteries from EVs offer an attractive opportunity for cost savings and increased efficiency. Energy arbitrage, the practice of buying energy at low prices during off-peak hours and selling it back during peak hours, is another significant application of ESS.

- Battery chemistry, safety standards, discharge rate, and remote monitoring are essential factors influencing the ESS market. Residential storage applications have gained popularity due to the increasing adoption of solar panels and the need for backup power during grid outages. The market is expected to grow as the focus on sustainable energy sources continues to increase. Operational costs, including battery replacement and maintenance, are critical considerations for ESS market participants. Understanding these factors and optimizing battery performance is crucial for market success. The future of ESS lies in innovation, with advancements in battery chemistry, safety standards, and remote monitoring technologies expected to drive growth.

What are the market trends shaping the Battery For Energy Storage Systems (ESS) Industry?

- Microgrids are gaining increasing popularity in the energy market. This trend is driven by the growing need for reliable and decentralized power sources.

- Microgrids, which are small-scale electricity systems that can operate independently or in collaboration with the main power grid, are gaining significance in the energy storage market due to their ability to support smart grid integration and voltage stability. With increasing environmental regulations and the need for carbon emission reduction, microgrids are being adopted to mitigate climate change by integrating renewable energy sources such as solar and wind power. These systems can provide frequency regulation and peak shaving capabilities, ensuring power reliability and efficiency.

- Moreover, microgrids can include fire suppression systems and offer round-trip efficiency, making them an attractive solution for both grid operators and consumers. Power electronics play a crucial role in managing the energy flow within these systems. As the demand for cleaner and more sustainable energy sources grows, the market for battery energy storage systems in microgrids is expected to expand.

What challenges does the Battery For Energy Storage Systems (ESS) Industry face during its growth?

- The lithium industry faces significant growth challenges due to the expanding disparity between surging demand and limited supply.

- Lithium-ion batteries have emerged as the dominant technology in energy storage systems (ESS), accounting for over three-quarters of global electrochemical energy storage in 2023. Their popularity stems from advancements in energy and power density, safety, cost, and battery cycle life. In the transportation sector, the shift towards electric vehicles (EVs) has fueled the demand for larger batteries and stationary storage, making lithium-ion batteries the preferred choice. Beyond consumer electronics, such as laptops and smartphones, lithium-ion batteries are increasingly used in commercial storage applications, including utility-scale storage and microgrids. Project financing for renewable energy integration and thermal management systems further boosts the adoption of these batteries.

- Battery management systems, sodium-sulfur batteries, flow batteries, and ac coupling are integral components of advanced ESS designs. As the energy storage market evolves, ac coupling and microgrid applications are gaining traction, offering improved energy efficiency and grid stability. In the context of energy storage, lithium-ion batteries offer a harmonious balance of performance and cost-effectiveness, making them a valuable asset in the transition towards a more sustainable energy future.

Exclusive Customer Landscape

The battery for energy storage systems (ess) market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the battery for energy storage systems (ess) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, battery for energy storage systems (ess) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB Ltd. - The company specializes in providing advanced batteries for energy storage systems (ESS), supporting rigorous testing protocols such as HIL testing, SIL testing, and power HIL testing. Our offerings ensure optimal performance and reliability, enabling clients to effectively store and manage energy. These batteries undergo stringent testing procedures to meet the highest industry standards, ensuring unwavering dependability. Our commitment to innovation and quality sets US apart, as we continuously strive to exceed expectations and deliver superior solutions for various energy storage applications.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- AEG Power Solutions BV

- Corvus Energy

- dSPACE GmbH

- East Penn Manufacturing Co. Inc.

- Exergonix Inc.

- General Electric Co.

- Hitachi Ltd.

- LG Corp.

- Mitsubishi Heavy Industries Ltd.

- NEC Corp.

- Panasonic Holdings Corp.

- Philadelphia Scientific LLC

- Samsung SDI Co. Ltd.

- Siemens Energy AG

- SolarEdge Technologies Inc.

- TDK Corp.

- Tesla Inc.

- The AES Corp.

- Toshiba Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Battery For Energy Storage Systems (ESS) Market

- In February 2024, Tesla, a leading energy storage solutions provider, unveiled its new Megapack energy storage system, designed to deliver up to 3 GWh of energy storage capacity per train, making it one of the largest battery systems in the world (Tesla Press Release, 2024). This development underscores Tesla's commitment to advancing large-scale energy storage solutions.

- In May 2024, LG Chem and TotalEnergies, two prominent players in the energy storage industry, announced a strategic collaboration to produce batteries for electric vehicles (EVs) and energy storage systems (ESS) in Europe (TotalEnergies Press Release, 2024). This partnership aims to strengthen their positions in the European market and meet the growing demand for sustainable energy solutions.

- In January 2025, Contemporary Amperex Technology Co. Limited (CATL), the world's largest lithium-ion battery manufacturer, secured a USD2 billion investment from the China Development Bank to expand its production capacity and accelerate the development of advanced battery technologies (Reuters, 2025). This significant funding round positions CATL to lead the global battery market and drive technological advancements in energy storage systems.

- In March 2025, the European Union announced the "Battery Regulation," a new set of rules to ensure the sustainable production and recycling of batteries, including those for ESS (European Commission, 2025). This regulatory initiative supports the EU's green transition and creates a level playing field for manufacturers, fostering innovation and competitiveness in the ESS market.

Research Analyst Overview

- The energy storage market is experiencing significant growth, driven by the increasing demand for reliable and sustainable energy solutions. Energy storage technologies, including advanced battery technologies, play a crucial role in this sector, with commercial battery storage applications becoming increasingly prevalent. However, the industry faces challenges such as battery degradation, energy density limitations, and regulatory requirements. Battery testing is essential to ensure the performance and safety of energy storage systems. Energy storage research continues to address these challenges, leading to innovations in battery storage solutions and power conversion efficiency. Battery recycling is also gaining importance as a means to mitigate environmental concerns and reduce energy storage costs.

- Energy storage policy and regulations are key factors influencing the deployment of energy storage systems. Grid-scale battery storage, for instance, is critical for grid stability and renewable energy integration. Residential battery storage, on the other hand, offers benefits such as energy independence and cost savings. Despite these opportunities, energy storage solutions face competition from traditional energy sources and emerging technologies. Battery life, energy density, and cost remain critical factors in the competitiveness of energy storage systems. The energy storage industry is continuously evolving, with ongoing developments in battery pack technology and energy storage solutions.

- In summary, the energy storage market is dynamic and complex, with various trends and challenges shaping its growth. Battery testing, energy storage research, energy storage policy, battery recycling, and energy storage cost are crucial factors influencing the industry's development. Energy storage solutions, including advanced battery technologies, offer significant benefits but also face challenges related to battery degradation, power conversion efficiency, and regulatory requirements.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Battery For Energy Storage Systems (ESS) Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

204 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 23.8% |

|

Market growth 2025-2029 |

USD 22179.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

19.2 |

|

Key countries |

China, US, Australia, UK, Germany, Japan, Canada, South Korea, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Battery For Energy Storage Systems (ESS) Market Research and Growth Report?

- CAGR of the Battery For Energy Storage Systems (ESS) industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the battery for energy storage systems (ess) market growth of industry companies

We can help! Our analysts can customize this battery for energy storage systems (ess) market research report to meet your requirements.