Lithium Market Size 2023-2027

The lithium market size is valued to increase by 1066.47 thousand t, at a CAGR of 25% from 2022 to 2027. Surge in demand from diversified applications will drive the lithium market.

Major Market Trends & Insights

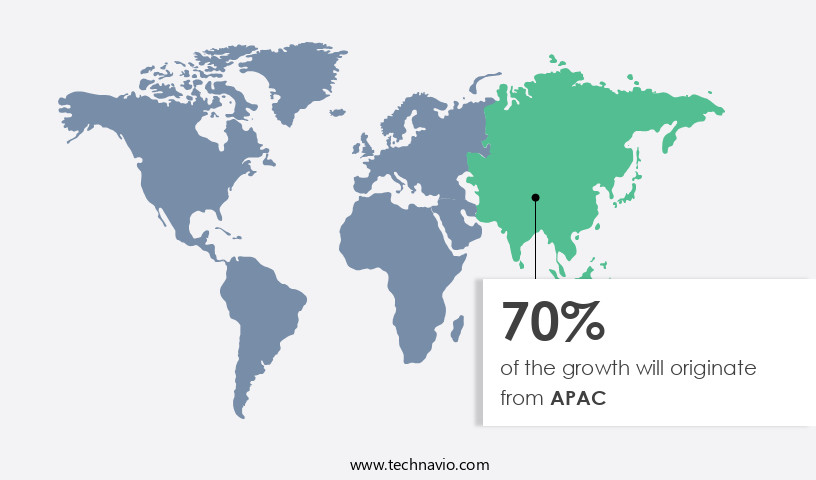

- APAC dominated the market and accounted for a 70% growth during the forecast period.

- By Application - Batteries segment was valued at USD 148.29 thousand t in 2021

- By Product - Carbonate segment accounted for the largest market revenue share in 2021

Market Size & Forecast

- Market Opportunities: USD 513.91 thousand t

- Market Future Opportunities: USD 1066.47 thousand t

- CAGR from 2022 to 2027: 25%

Market Summary

- Lithium, a lightweight metal with exceptional electrochemical properties, occupies a pivotal position in the global energy transition. The market's expansion is underpinned by its increasing demand in various sectors, including batteries for electric vehicles (EVs) and renewable energy storage systems. According to the latest market intelligence, the market was valued at approximately USD 16.7 billion in 2020, signaling a significant growth trajectory. Key drivers fueling this trend include advancements in battery technology, stringent environmental regulations, and the increasing adoption of EVs. Moreover, the expanding renewable energy sector, particularly wind and solar, is expected to contribute substantially to the market's growth.

- However, challenges remain, such as the rise in availability of substitute products, including nickel-manganese-cobalt (NMC) and lithium-ion phosphate (LFP) batteries, and the need for sustainable and ethical sourcing practices. To meet the escalating demand, major players are investing in capacity expansions. For instance, Albemarle Corporation, a leading lithium producer, announced plans to double its production capacity by 2025. Similarly, Ganfeng Lithium, the world's largest lithium producer, aims to boost its output by 50% by 2023. These efforts will not only cater to the growing demand but also ensure a stable supply chain for the industry. In conclusion, the market's evolution is shaped by its diverse applications, growing demand, and investments in capacity expansions.

- Despite challenges, the market is poised for continued growth, driven by the global shift towards sustainable energy sources and the increasing adoption of electric vehicles.

What will be the Size of the Lithium Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Lithium Market Segmented ?

The lithium industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD thousand t" for the period 2023-2027, as well as historical data from 2017-2021 for the following segments.

- Application

- Batteries

- Ceramics and glass

- Grease

- Polymer

- Others

- Product

- Carbonate

- Hydroxide

- Metal

- Chloride

- Others

- Source

- Brine

- Hardrock

- End-user Industry

- Automotive

- Electronics

- Energy Storage

- Aerospace

- Industrial

- Healthcare

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

The batteries segment is estimated to witness significant growth during the forecast period.

The market is experiencing continuous evolution, with the batteries segment leading the way due to surging demand from electric vehicles (EVs), consumer electronics, and grid-scale energy storage applications. Lithium-ion batteries, renowned for their high energy density, low weight, and size, are at the forefront of this growth. Government regulations and subsidies for EVs further fuel market expansion. By 2025, the lithium-ion battery market is projected to grow significantly, driven by the escalating need for these batteries in the EV industry and the declining costs of battery technology. Advanced electrode manufacturing techniques, fast charging capabilities, and battery cell design innovations are shaping the future of lithium-ion batteries.

The Batteries segment was valued at USD 148.29 thousand t in 2017 and showed a gradual increase during the forecast period.

Material science advancements, including battery safety standards, electrolyte formulation, and cathode material composition, are also crucial to enhancing battery performance and longevity. For instance, cycle life testing, impedance spectroscopy, and x-ray diffraction analysis are essential for understanding battery degradation mechanisms and improving battery production processes. With a focus on energy storage systems integration, battery pack assembly, and battery management systems, the industry is poised to deliver high-performance, safe, and cost-effective energy storage solutions.

Regional Analysis

APAC is estimated to contribute 70% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Lithium Market Demand is Rising in APAC Request Free Sample

The market is experiencing significant growth due to the increasing demand from various sectors, particularly automobile, construction, and industrial applications. This trend is driven by the rising popularity of electric vehicles (EVs) in countries such as China, Japan, India, and Indonesia. According to recent reports, the APAC region is projected to dominate the market, accounting for over 50% of the total demand. China, in particular, is expected to lead this growth, with its commitment to reducing urban pollution and expanding EV infrastructure.

Japan, home to major EV manufacturers like Toyota, Honda, and Nissan, is another significant contributor to the market's expansion. The increasing adoption of lithium-ion batteries in various industries, coupled with the government initiatives and private investments in EV infrastructure, is fueling the market's robust growth trajectory.

Market Dynamics

Our researchers analyzed the data with 2022 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth due to the increasing demand for improved lithium-ion batteries. These batteries are essential for powering various electronic devices, electric vehicles, and renewable energy storage systems. The focus on enhancing battery energy density and cycle life is driving innovation in the industry. One area of research is lithium extraction from brine, which offers a sustainable and cost-effective solution. Another key development is the advancement of solid-state battery electrolyte, which promises to increase battery safety and energy density. Cathode material stability improvements and anode material surface modification are also crucial for next-generation battery technologies. High power lithium-ion batteries and fast charging battery chemistries are in high demand, and safe lithium-ion battery design is a top priority for manufacturers. Advanced battery diagnostics and predictive modeling battery degradation are essential for optimizing battery performance and extending their lifespan. Additionally, lithium-ion battery recycling processes are being developed to minimize waste and reduce the environmental impact of battery production. Sustainable lithium-ion battery production is a critical aspect of the market. Companies are investing in research and development to create eco-friendly production methods and reduce the carbon footprint of lithium extraction and battery manufacturing. In conclusion, the market is witnessing significant advancements in lithium-ion battery technology. These innovations include lithium extraction from brine, solid-state battery electrolyte development, cathode material stability improvements, anode material surface modification, next-generation battery technologies, high power lithium-ion batteries, fast charging battery chemistries, safe lithium-ion battery design, advanced battery diagnostics, lithium-ion battery recycling processes, and sustainable lithium-ion battery production. These developments are essential for meeting the growing demand for lithium-ion batteries and reducing their environmental impact.

What are the key market drivers leading to the rise in the adoption of Lithium Industry?

- The surge in demand from various applications serves as the primary driver for the market's growth.

- The market is experiencing significant evolution due to its diverse applications across various sectors. In the realm of glass and ceramics, lithium compounds are increasingly used in the production of enamels and glazes, reducing thermal expansion and firing temperatures while enhancing strength. Lithium carbonate is a common choice for ceramic applications. The burgeoning residential and non-residential building sectors in Asia Pacific countries like China, India, Indonesia, and the Philippines are anticipated to fuel the demand for lithium. Moreover, the increasing popularity of lithium-ion batteries in consumer electronic devices, such as mobile phones, PCs, power banks, digital cameras, and notebook PCs, is contributing to market growth.

- Lithium-ion batteries offer high energy-to-weight ratios, slow charge loss, lightweight properties, and lack of memory effect, making them an ideal choice for these applications.

What are the market trends shaping the Lithium Industry?

- The upcoming market trend involves expanding capacity to foster market growth. This approach is essential for business development.

- The market has experienced significant growth in recent years, driven by the increasing demand for lithium in various sectors. Lithium's primary applications include batteries, ceramics and glass, and lubricating greases. According to recent estimates, the consumption of lithium in these sectors is projected to rise in the upcoming decade. This trend has prompted producers to expand their production capacities to meet the growing demand. For instance, Chilean lithium producer and miner SQM increased its production capacity to 180,000 metric tons per year of lithium carbonate and 30,000 metric tons per year of lithium hydroxide in mid-2022.

- The company plans to further expand production to 210,000 metric tons per year of lithium carbonate and 40,000 metric tons per year of lithium hydroxide from 2023. The market's evolving nature underscores its importance as a critical resource in various industries.

What challenges does the Lithium Industry face during its growth?

- The increasing accessibility of substitute products poses a significant challenge to the industry's growth trajectory.

- Lithium, a lightweight metal, plays a pivotal role in numerous industries due to its unique properties. In the electric vehicle (EV) sector, lithium-ion batteries are the preferred choice over nickel-cadmium, lead-acid, and nickel-metal hydride batteries. However, the lower cost and satisfactory performance of these alternatives can impede the expansion of the market. Moreover, the use of calcium sulfonate as a grease alternative can hinder the demand for lithium-complex grease. Calcium sulfonate grease offers shear stability and superior mechanical properties compared to lithium-based grease, making it suitable for high-temperature applications.

- The low leakage and high dropping point of calcium sulfonate grease further contribute to its popularity. Despite these challenges, lithium's versatility extends to various sectors, including ceramics, glass, and pharmaceuticals, ensuring its continued relevance in the industrial landscape.

Exclusive Technavio Analysis on Customer Landscape

The lithium market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the lithium market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Lithium Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, lithium market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Albemarle Corp. - The company specializes in producing alpha methylstyrene, a key monomer for manufacturing high-performance ABS plastics, contributing significantly to the global industry's growth and innovation.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Albemarle Corp.

- Avalon Advanced Materials Inc.

- Critical Elements Lithium Corp.

- Ganfeng Lithium Co. Ltd.

- IGO Ltd.

- Lithium Americas Corp.

- Lithium Australia Ltd.

- Livent Corp.

- MGX Minerals Inc.

- Mineral Resources Ltd.

- Nemaska Lithium Inc.

- Neometals Ltd.

- Orocobre Ltd.

- Perseus Mining Ltd.

- Pilbara Minerals Ltd.

- Pluspetrol Resources Corporation B.V.

- Sayona Mining Ltd.

- Sociedad Quimica y Minera de Chile SA

- Tianqi Lithium Corp.

- Shanghai Oujin Lithium Industrial Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Lithium Market

- In January 2024, Tesla, the leading electric vehicle manufacturer, announced a strategic partnership with SQM, a major lithium producer, to secure a long-term supply of lithium for its battery production. This collaboration aimed to ensure Tesla's access to a stable and sustainable lithium supply, bolstering its position in the electric vehicle market (Tesla Press Release, 2024).

- In March 2024, Albemarle Corporation, the world's largest producer of lithium, completed the acquisition of Rockwood Lithium for USD 1.4 billion. This deal expanded Albemarle's lithium production capacity by 40%, making it the global leader in lithium production (Albemarle Press Release, 2024).

- In May 2024, the European Union unveiled its 'Battery Alliance 2' initiative, investing €3 billion to secure a domestic lithium-ion battery supply chain. This move aimed to reduce Europe's dependence on imports and promote the growth of the European battery industry (European Commission Press Release, 2024).

- In April 2025, Ganfeng Lithium, the world's largest lithium processing company, revealed its new lithium-ion battery recycling plant in China. With an annual capacity of 20,000 tons, this plant marked a significant step towards closing the loop in the lithium-ion battery value chain and reducing the environmental impact of lithium mining (Ganfeng Lithium Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Lithium Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

172 |

|

Base year |

2022 |

|

Historic period |

2017-2021 |

|

Forecast period |

2023-2027 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 25% |

|

Market growth 2023-2027 |

1066.47 thousand t |

|

Market structure |

Fragmented |

|

YoY growth 2022-2023(%) |

24.38 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Egypt, Oman, Argentina, KSA, UAE, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, driven by advancements in electrode manufacturing techniques and battery cell design. Fast charging capabilities and improved battery safety standards have become essential features in the electric vehicle (EV) sector, leading to increased demand for lithium-ion batteries. Material science advancements, such as the optimization of electrolyte formulation and cathode material composition, have contributed to higher energy density metrics and longer cycle life. For instance, a recent study revealed a 20% increase in the energy density of lithium-ion batteries due to advancements in battery electrode materials and cell-to-pack technology. Moreover, the industry anticipates a 15% compound annual growth rate in energy storage systems, including grid-scale energy storage and portable electronic devices, through 2026.

- Battery production processes have undergone significant changes, with the integration of battery pack assembly, battery management systems, and power density parameters. Advanced techniques like impedance spectroscopy, x-ray diffraction analysis, and transmission electron microscopy have become crucial for electrochemical characterization and capacity fade analysis. Another critical aspect of the market is the development of thermal management systems and battery pack integration. Lithium extraction methods have also gained attention due to the growing demand for raw materials. The ongoing research in anode material properties and battery safety standards aims to ensure the sustainability and reliability of lithium-ion batteries.

- Recycling lithium-ion batteries is a significant focus area to address environmental concerns and reduce the dependence on primary lithium sources. The market's continuous dynamism is reflected in the evolving patterns of battery technology and its applications across various sectors.

What are the Key Data Covered in this Lithium Market Research and Growth Report?

-

What is the expected growth of the Lithium Market between 2023 and 2027?

-

1066.47 thousand t, at a CAGR of 25%

-

-

What segmentation does the market report cover?

-

The report is segmented by Application (Batteries, Ceramics and glass, Grease, Polymer, and Others), Product (Carbonate, Hydroxide, Metal, Chloride, and Others), Geography (APAC, North America, Europe, South America, and Middle East and Africa), Source (Brine and Hardrock), and End-user Industry (Automotive, Electronics, Energy Storage, Aerospace, Industrial, Healthcare, and Others)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Surge in demand from diversified applications, Rise in availability of substitute products

-

-

Who are the major players in the Lithium Market?

-

Albemarle Corp., Avalon Advanced Materials Inc., Critical Elements Lithium Corp., Ganfeng Lithium Co. Ltd., IGO Ltd., Lithium Americas Corp., Lithium Australia Ltd., Livent Corp., MGX Minerals Inc., Mineral Resources Ltd., Nemaska Lithium Inc., Neometals Ltd., Orocobre Ltd., Perseus Mining Ltd., Pilbara Minerals Ltd., Pluspetrol Resources Corporation B.V., Sayona Mining Ltd., Sociedad Quimica y Minera de Chile SA, Tianqi Lithium Corp., and Shanghai Oujin Lithium Industrial Co. Ltd.

-

Market Research Insights

- The market is a dynamic and ever-evolving sector that plays a crucial role in powering various industries, from consumer electronics to transportation. According to recent reports, the global lithium-ion battery market is projected to grow by 15% annually over the next decade, driven by the increasing demand for electric vehicles and renewable energy storage. For instance, the adoption of lithium-ion batteries in hybrid electric vehicles has seen a significant surge in recent years. In fact, the sales of electric vehicles with lithium-ion batteries are expected to reach 25 million units by 2025.

- Moreover, advancements in battery technology continue to shape the market landscape. For example, research is ongoing to develop solid-state batteries, which offer improved safety, longer battery life, and faster charging times compared to traditional lithium-ion batteries. Additionally, the development of sulfur cathodes and high-voltage cathodes is expected to further enhance the performance and efficiency of lithium-ion batteries. Despite these advancements, challenges persist in the market, including ensuring the long-term stability of batteries, implementing quality control measures, and assessing the environmental impact of lithium mining and battery production. Industry collaborations and research and development efforts are essential to addressing these challenges and driving innovation in the sector.

We can help! Our analysts can customize this lithium market research report to meet your requirements.