Marine Coatings Market Size 2025-2029

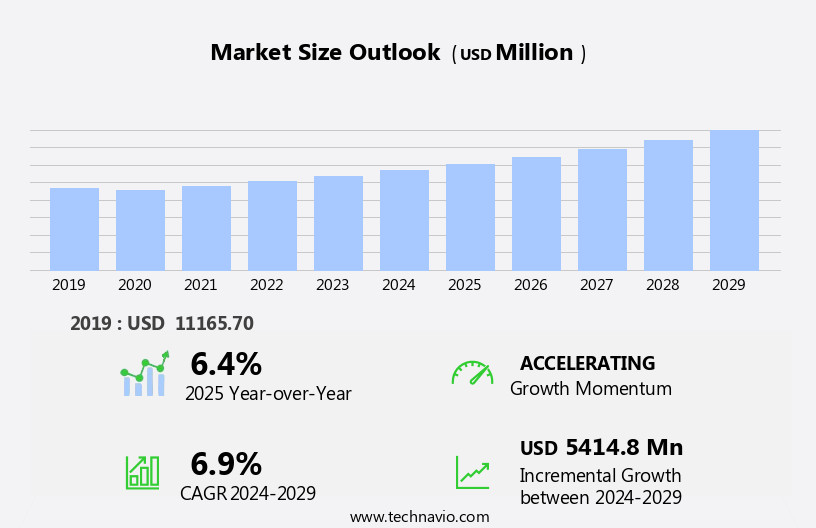

The marine coatings market size is forecast to increase by USD 5.41 billion at a CAGR of 6.9% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the expanding shipbuilding industry. This sector's upward trajectory is fueled by increasing global trade and infrastructure development, leading to an increased demand for new vessels and the need for robust marine coatings to ensure their longevity. Another key trend shaping the market is the shift toward eco-friendly coatings, as environmental regulations become more stringent. This trend is expected to continue as stakeholders prioritize sustainability and compliance. However, the market faces challenges as well. Fluctuating raw material prices pose a significant hurdle for manufacturers, as they must navigate the volatility to maintain profitability.

- Additionally, the market is driven by the expansion of the shipbuilding industry and the increasing preference for eco-friendly coatings that enhance fuel efficiency and reduce environmental impact. The anti-fouling segment, which includes foul-release coatings, holds a significant market share due to the need for water resistance in various applications, from cruise ships and yachts to leisure boats and containers. Moreover, the regulatory hurdles impact adoption, as new regulations require stricter testing and certification processes for marine coatings. Supply chain inconsistencies also temper growth potential, as disruptions can lead to delays and increased costs. Companies seeking to capitalize on market opportunities must stay informed of these challenges and adapt their strategies accordingly. Effective supply chain management, price risk mitigation, and regulatory compliance are essential for success in the market.

What will be the Size of the Marine Coatings Market during the forecast period?

- The market in the US is driven by the increasing demand for corrosion protection in harsh environments, particularly in the shipbuilding industry. New ship constructions, including general cargo ships, bulk carriers, and container ships, require multi-component coatings for water resistance and abrasion resistance. Seaborne commerce activity, a significant contributor to international trade and maritime trade, also drives market growth. Platform supply vessels and Naval Vessels operating in harsh environments, such as offshore engineering projects and Crude Oil tankers, also require advanced coatings solutions for fouling prevention and VOC emissions reduction. Maintenance and repair of existing ships in US ports further boosts market demand.

- Eco-friendly coating alternatives, including bio-based coatings, are gaining popularity due to their visual appeal and reduced environmental impact. The US ship builders and maintenance companies continue to invest in research and development of innovative coatings to meet the evolving needs of the maritime industry. The offshore engineering industry and seaborne trade along sea routes also contribute to market growth.

How is this Marine Coatings Industry segmented?

The marine coatings industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Coastal

- Deepsea

- Containers

- Offshore house

- Others

- Type

- Epoxy

- Polyurethane

- Others

- Technology

- Solvent-borne

- Water-borne

- Others

- Product

- Anti-fouling coatings

- Anti-corrosion coatings

- Foul release coatings

- Others

- Geography

- North America

- US

- Europe

- France

- Germany

- Italy

- The Netherlands

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Application Insights

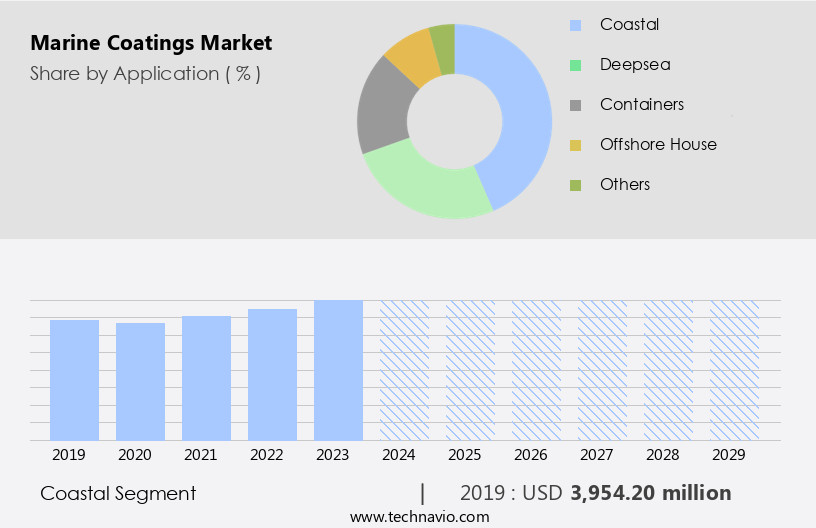

The coastal segment is estimated to witness significant growth during the forecast period.

Marine coatings play a crucial role in protecting valuable assets used in the oil and gas, shipping, and coastal industrial sectors from the corrosive marine environment. These coatings, often applied in thick films, utilize various additives to ensure sag resistance and effective coverage. Fumed Silica is a commonly used additive, providing benefits such as anti-settling, anti-sag properties, and enhanced chemical resistance, corrosion resistance, and scratch resistance to the cured polymer coating. In deep-water exploration, ultra-deep water, and harsh environments, the demand for advanced coatings solutions is on the rise. Bio-based coatings, with their eco-friendly appeal, are gaining traction in the market.

Additionally, the energy sector, including LNG carriers and crude oil tankers, relies heavily on marine coatings for water resistance and fuel consumption efficiency. Maintenance companies and shipbuilding industries are key players in the market, ensuring the continuous upkeep of ships, pipe laying vessels, drill ships, and other offshore vessels. The international shipping trade, with its extensive maritime activities, further fuels the demand for marine coatings. Marine containers, cruise vessels, and platforms supply vessels also require regular maintenance and coatings applications for optimal performance. As the focus on reducing VOC emissions continues, the market for foul release coatings and multi-component coatings is expected to grow.

The coastal infrastructure, including ports and harbors, also benefits from marine coatings, ensuring the longevity of structures and reducing maintenance costs.

The Coastal segment was valued at USD 3.95 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

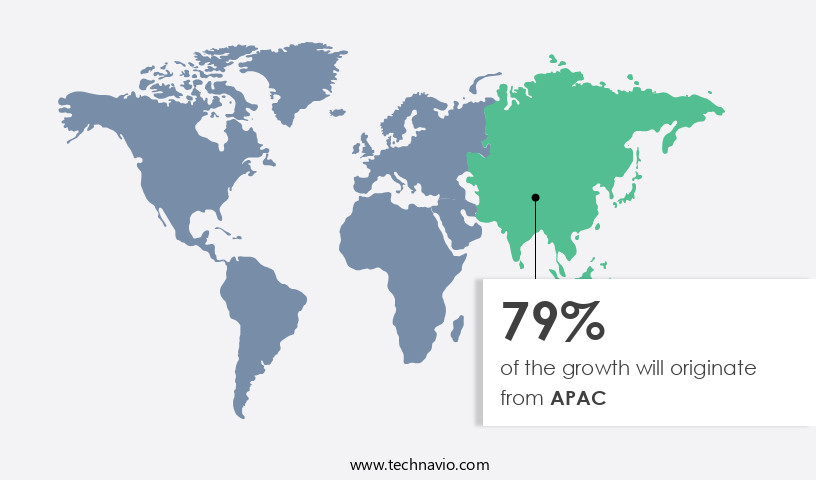

APAC is estimated to contribute 79% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is significantly driven by the shipbuilding industry, with China, South Korea, and Japan being the leading players. APAC is the largest producer of ships globally, with South Korea holding a considerable market share in the region. The construction and expansion of logistics infrastructure in APAC are anticipated to stimulate growth in the maritime industry, boosting trade and increasing the demand for transport and logistics services. The in manufacturing and commerce activities is expected to fuel the need for seaborne trading, leading to increased marine industry growth. Deep-water exploration, oil prices, and the energy sector are other key factors influencing the market.

Corrosion resistance, water resistance, and foul release coatings are essential for ships operating in harsh environments, including deep sea and ultra-deep water. The use of advanced coatings solutions, such as multi-component coatings and eco-friendly coating alternatives, is increasing due to their ability to enhance the performance and longevity of ships' steel hulls. The leisure boats segment, including yacht ships and cruise vessels, is also a significant market for marine coatings. Aesthetics and visual appeal are essential factors for this segment, as these vessels are often used for leisure and tourism purposes. The offshore engineering industry, including pipe laying vessels, drill ships, and offshore platforms, also relies on marine coatings for their durability and resistance to harsh conditions.

The maritime shipping industry's growth is further driven by international trade, with container ships and bulk carriers transporting goods between different countries. The maintenance and repair of these vessels are crucial to ensure their longevity and efficiency, making maintenance companies an essential market for marine coatings. The fossil fuels industry, including crude oil tankers and LNG carriers, also relies on marine coatings for their cargo containment and protection. The market in APAC is driven by the shipbuilding industry, logistics infrastructure development, and the energy and fossil fuels sectors. The use of advanced coatings solutions, including anti-corrosion and anti-fouling coatings, is essential for ships operating in harsh environments.

The leisure boats segment and the offshore engineering industry are also significant markets for marine coatings. The growth of the marine industry is expected to continue, driven by increasing global trade and commerce activities.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Marine Coatings market drivers leading to the rise in the adoption of Industry?

- The shipbuilding industry's expansion serves as the primary catalyst for market growth. The market has experienced significant growth, driven primarily by the expansion of the global shipbuilding industry. Prior to 2010, industry growth was minimal. However, the in foreign direct investment, the rise of seaborne trade, and the growth of multinational corporations led to a rapid expansion of the shipbuilding sector. This, in turn, fueled demand for marine coatings, particularly in the construction of general cargo ships, bulk carriers, tankers, and cruise ships. Marine coatings are essential for various maritime applications, including coastal infrastructure, fossil fuels transportation, petrochemicals, and energy sector projects. They provide crucial corrosion resistance and foul release properties, ensuring the longevity and efficiency of vessels and infrastructure.

- In the deep sea and ultra-deep water environments, marine coatings play a vital role in maintaining the integrity of ships and infrastructure. Moreover, the leisure boats segment also contributes to the market's growth. With an increasing focus on eco-friendly solutions, coating producers are developing innovative, sustainable alternatives to traditional marine coatings. International trade and exports further expand the market's reach, as marine coatings are in high demand in various industries and regions, including the Gulf countries and ship manufacturing hubs.

What are the Marine Coatings market trends shaping the Industry?

- The market trend is evolving towards the use of green marine coatings. Marine coatings play a crucial role in the naval vessels, platform supply vessels, cargo ships, and crude oil tankers that facilitate seaborne commerce activity and support the offshore engineering industry. These coatings ensure water resistance and abrasion resistance in harsh environments, enhancing the durability and efficiency of these vessels. However, recent environmental regulations necessitate that marine coatings not only maintain existing performance but also incorporate eco-friendly properties. Many marine coatings contain chemicals harmful to marine flora and fauna, such as benzene and zinc, which are used in anti-corrosion coatings. Strict regulations have been implemented to limit the use of such chemicals to safeguard the marine environment.

- In response, research and development efforts are underway to create environmentally friendly alternatives to these harmful chemicals. The shipbuilding industry, ports, and maritime trade are significant contributors to the global market for marine coatings. The demand for these coatings is driven by the need for increased sailing efficiency and the desire to reduce emissions, particularly volatile organic compounds (VOCs), in line with environmental regulations. As the world imports of various goods continue to grow, the demand for marine coatings is expected to increase, ensuring their continued importance in the global economy.

How does Marine Coatings market faces challenges face during its growth?

- The volatility of raw material prices poses a significant challenge to the industry's growth trajectory. Marine coatings manufacturers face significant challenges due to the volatile prices of raw materials used in their production. Primary raw materials, such as benzene, toluene, ethylene, and naphthalene, are derived from crude oil and natural gas. The prices of these petrochemicals are subject to instability in the global oil market, particularly in the Middle East, which can impact manufacturing costs. This volatility hinders the ability of marine coatings manufacturers to plan production and maintain consistent pricing for their customers. Primary raw materials, such as benzene, toluene, ethylene, and naphthalene, are essential for creating anti-corrosion coatings.

- Moreover, the market is driven by various sectors, including leisure travellers, ultra-deep-water exploration, international shipping trade, harbors, FPSO vessels, offshore vessels, seaborne trade, and coastal structures. The anti-fouling segment, in particular, is a significant market, with applications in marine containers, cruise vessels, and other types of vessels. The demand for marine coatings is driven by the need to preserve the visual appeal and efficiency of these structures, as well as to reduce fuel consumption. Despite these growth opportunities, the industry must navigate the challenges of raw material prices to remain competitive.

Exclusive Customer Landscape

The marine coatings market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the marine coatings market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, marine coatings market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Akzo Nobel NV - The company offers marine coatings such as Sea Hawk coatings.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Akzo Nobel NV

- Axalta Coating Systems Ltd.

- Baril Coatings BV

- BASF SE

- Berger Paints

- Boero Bartolomeo S.p.A.

- Chugoku Marine Paints Ltd.

- Endura Manufacturing Co. Ltd.

- Hempel AS

- Jotun AS

- Kansai Paint Co. Ltd.

- KCC Co. Ltd.

- MCU Coatings International

- Nippon Paint Holdings Co. Ltd.

- PPG Industries Inc.

- Protexion

- RPM International Inc.

- Seal for Life Group

- The Sherwin Williams Co.

- Wacker Chemie AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Marine Coatings Market

- In February 2023, Hempel A/S, a leading marine coatings manufacturer, announced the launch of its innovative antifouling coating, Hempaguard X7, which reportedly reduces fuel consumption by up to 5% compared to conventional coatings (Hempel.Com). This new product development aims to address the growing demand for energy-efficient solutions in the shipping industry.

- In July 2024, AkzoNobel and Chugoku Marine Paints, two major marine coatings players, entered into a strategic partnership to expand their combined market presence in Asia. This collaboration will enable both companies to leverage each other's expertise and resources, strengthening their positions in the competitive market (AkzoNobel.Com).

- In March 2025, PPG Industries completed the acquisition of AkzoNobel's Specialty Coatings business, significantly expanding its marine coatings portfolio. This deal, valued at approximately USD4.3 billion, will enable PPG to increase its market share and offer a broader range of coatings solutions to its customers (PPG.Com).

- In October 2025, the International Maritime Organization (IMO) introduced new regulations on the use of low-flashpoint marine fuels, which will increase the demand for high-performance marine coatings that can protect ships from the adverse effects of these fuels. This regulatory development is expected to drive growth in the market over the coming years (IMO.Org).

Research Analyst Overview

The market exhibits a dynamic and evolving landscape, shaped by various factors including the price of oil, the demand for different types of ships, and the need for advanced coatings solutions to address corrosion and other challenges. Ships, a significant segment of the maritime industry, require regular maintenance to ensure their longevity and efficiency. This need is particularly acute for oil prices, which can impact the profitability of shipping operations. For instance, fluctuations in oil prices can influence the demand for oil tankers, which transport crude oil from reserves to refineries and markets. Moreover, the market for yacht ships and other luxury vessels is driven by different factors, such as aesthetics and eco-friendly considerations.

Maintenance companies catering to this segment offer bio-based coatings and advanced solutions to meet the unique demands of these vessels. Pipe laying vessels and drill ships are essential components of the offshore engineering industry, which is experiencing growth due to deep-water exploration and production of petrochemicals. Corrosion resistance is a critical factor in the selection of coatings for these vessels, as they operate in harsh environments. Container ships and LNG carriers are key players in international trade, transporting goods and energy resources across the globe. Coatings for these vessels must provide water resistance and abrasion resistance to ensure safe and efficient transportation.

The energy sector's focus on fossil fuels and renewable energy sources influences the market in various ways. For instance, the demand for anti-corrosion coatings remains strong in the oil and gas industry, while eco-friendly coating alternatives gain popularity in the renewable energy sector. The maritime shipping activities, including cargo ships, tankers, and cruise vessels, contribute significantly to seaborne commerce activity. Coatings play a crucial role in ensuring the visual appeal, fuel consumption efficiency, and safety of these vessels. The offshore infrastructure, including offshore platforms, FPSO vessels, and bridges, also requires coatings for protection against corrosion and fouling.

These coatings must provide excellent resistance to harsh environments and meet stringent regulatory requirements. The coatings industry responds to these market dynamics by producing innovative solutions, such as multi-component coatings and foul release coatings, to address the unique challenges of different ship types and operating conditions. Coating producers also focus on developing eco-friendly alternatives to traditional coatings to meet the growing demand for sustainable solutions. The maritime trade, including exports and imports, is a significant driver of the market. Harbors and ports play a crucial role in facilitating this trade and require coatings for their infrastructure, such as docks and marine containers, to ensure their durability and functionality.

The market is a dynamic and evolving landscape, shaped by various factors, including the demand for different types of ships, oil prices, and the need for advanced coatings solutions to address corrosion and other challenges. The market responds to these trends by producing innovative solutions and eco-friendly alternatives to meet the unique demands of different ship types and operating conditions.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Marine Coatings Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

252 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.9% |

|

Market growth 2025-2029 |

USD 5.41 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.4 |

|

Key countries |

China, Japan, South Korea, India, US, Germany, France, UK, The Netherlands, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Marine Coatings Market Research and Growth Report?

- CAGR of the Marine Coatings industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the marine coatings market growth and forecasting

We can help! Our analysts can customize this marine coatings market research report to meet your requirements.