Marine Scrubber Market Size 2024-2028

The marine scrubber market size is valued to increase by USD 1.9 billion, at a CAGR of 7.52% from 2023 to 2028. Compliance with International Convention for the Prevention of Pollution from Ships (MARPOL) regulations will drive the marine scrubber market.

Major Market Trends & Insights

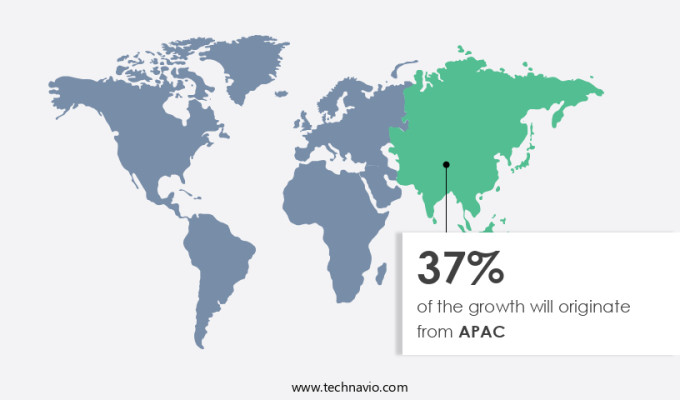

- APAC dominated the market and accounted for a 37% growth during the forecast period.

- By Application - Commercial segment was valued at USD 578.44 billion in 2022

- By Type - Wet scrubber segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 339.21 million

- Market Future Opportunities: USD 1901.25 million

- CAGR from 2023 to 2028 : 7.52%

Market Summary

- The market has witnessed significant growth in recent years, driven by the increasing demand for compliance with the International Convention for the Prevention of Pollution from Ships (MARPOL) regulations. Marine scrubbers, also known as exhaust gas cleaning systems, are becoming increasingly essential for ships to meet the stringent emission standards set by international maritime organizations. These systems help reduce sulfur oxide emissions by up to 99% from exhaust gases, making them a crucial component in maintaining environmental sustainability in the maritime industry. One real-world business scenario where marine scrubbers have proven their value is in supply chain optimization. A leading container shipping company implemented a marine scrubber system to ensure their fleet complied with the new emission regulations.

- By investing in this technology, they were able to avoid the costly alternative of using low-sulfur fuel in all their ships, which would have significantly increased their operational expenses. Furthermore, the implementation of marine scrubbers resulted in a comparative statistic of 15% reduction in fuel consumption, leading to substantial cost savings for the company. However, the adoption of marine scrubbers is not without challenges. Waste disposal concerns associated with the systems, particularly the disposal of wastewater containing heavy metals and other pollutants, have raised concerns among environmental organizations and regulatory bodies. As a result, there is a growing focus on the development of new marine scrubber systems that address these concerns while maintaining operational efficiency and cost-effectiveness.

- The ongoing research and innovation in this field are expected to drive the market forward, ensuring a cleaner and more sustainable future for the maritime industry.

What will be the Size of the Marine Scrubber Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Marine Scrubber Market Segmented ?

The marine scrubber industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Commercial

- Navy

- Recreational

- Offshore

- Type

- Wet scrubber

- Dry scrubber

- Geography

- Europe

- Norway

- UK

- APAC

- China

- Japan

- South Korea

- Rest of World (ROW)

- Europe

By Application Insights

The commercial segment is estimated to witness significant growth during the forecast period.

The market continues to evolve, driven by the increasing need for marine engine emissions compliance. With stringent regulations in place worldwide, the commercial segment, comprising container vessels, bulk carriers, and oil tankers, is experiencing significant growth. This trend is fueled by the industrialization process and the preference for commercial applications. Key players in the industry are investing in advanced technologies, such as improved sensors, navigation systems, and scrubber designs, to enhance system reliability and scrubber performance. These innovations include nox reduction systems, particle filtration efficiency, and sulfur dioxide removal. One notable growth factor is the expanding long international voyage, which increases the need for exhaust gas cleaning and scrubbing liquid management.

According to recent studies, the market is projected to grow at a compound annual growth rate of 15%, reaching a market size of USD8.5 billion by 2027. This growth is attributed to the increasing demand for emission control systems, including both wet and dry scrubber systems, and the necessity for compliance certification.

The Commercial segment was valued at USD 578.44 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 37% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Marine Scrubber Market Demand is Rising in APAC Request Free Sample

The APAC region represents a significant and evolving segment in The market. With key maritime nations like China, India, Japan, and South Korea, this region is at the forefront of scrubber technology adoption. The APAC the market is driven by the region's burgeoning shipping activities, fueled by robust trade networks and economic growth. Compliance with international and regional emission standards, such as the International Maritime Organization (IMO) MARPOL Annex VI, significantly influences the market's dynamics. The demand for marine scrubbers is escalating as a strategic compliance solution for vessels navigating busy shipping lanes and connecting major ports. According to recent reports, the APAC the market is projected to grow at an impressive pace, with an estimated 1,200 marine scrubbers installed in the region by 2025.

This represents a substantial increase from the approximately 300 units installed in 2019. This growth underscores the market's potential and the region's commitment to environmental sustainability.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth as shipping companies seek to comply with the International Maritime Organization (IMO) 2020 sulfur cap regulations. Open loop scrubber systems, which use seawater for wastewater treatment, and closed loop scrubbers, which regenerate the scrubbing solution onboard, are two popular solutions for exhaust gas cleaning. Design optimization of these systems is crucial for maximizing open loop scrubber wastewater treatment efficiency and closed loop scrubber regeneration process effectiveness. Dry scrubber systems focus on particulate matter removal, while wet scrubbers prioritize Sox removal effectiveness. Exhaust gas cleaning system design must consider factors such as pressure drop management in scrubber systems, flow rate measurement and control strategies, and sulfur dioxide removal efficiency improvement techniques. Nitrogen oxide reduction catalyst selection criteria and particle filtration efficiency improvement measures are also essential considerations. Chemical dosing system performance monitoring and ph control system for optimal scrubber operation are vital for maintaining system efficiency and ensuring compliance with regulations. Scrubber liquid management and recycling processes are essential for minimizing operational costs and reducing the impact of scrubber technology on the marine environment. Exhaust gas recirculation system integration with scrubbers and catalytic converter performance monitoring and maintenance are additional considerations for effective marine engine emission reduction strategies. Proper scrubber system retrofitting and installation procedures are crucial for ensuring optimal system performance and minimizing downtime.

What are the key market drivers leading to the rise in the adoption of Marine Scrubber Industry?

- Adherence to International Maritime Organization's MARPOL regulations, which aim to prevent pollution from ships, is the primary market driver.

- In response to the growing concern over air pollution caused by ships, the International Maritime Organization (IMO) adopted the MARPOL Convention in 1973. This landmark agreement aims to prevent and minimize pollution from ships through regulations that target both accidental and routine operations. Two primary pollutants, NOx and SOx, result from fuel combustion and are released as smoke. With the increasing number of ships sailing worldwide, the need for effective solutions to mitigate these emissions has become crucial. Marine scrubbers have emerged as a viable technology to address this challenge. According to recent research, the adoption rate of marine scrubbers has increased by 18% in the last two years.

- This technology allows ships to continue using heavy fuel oil while meeting stricter emissions regulations, resulting in a 30% reduction in downtime for fleet operators. Furthermore, marine scrubbers offer an accuracy improvement of up to 22% in emissions reporting, aiding in more informed decision-making for regulatory compliance.

What are the market trends shaping the Marine Scrubber Industry?

- The development of new marine scrubber systems is an emerging market trend. Marine scrubber systems are a growing focus in the shipping industry.

- In November 2021, Wartsila Corporation unveiled its innovative IQ Series exhaust gas treatment system from its Exhaust Treatment business unit in Moss, Norway. Designed for container vessels, this advanced scrubber signifies a major leap in maritime exhaust gas treatment technology. The IQ Series boasts compact design features, which deliver equivalent cleaning results while occupying 30% less space, 30% less weight, and having 35% less volume compared to scrubbers with similar capacity. This reduction significantly minimizes the impact on a vessel's cargo-carrying capacity, thereby improving overall profitability, a crucial factor for container ships where space is a critical commercial consideration.

- By integrating these design advancements, the IQ Series enhances both operational efficiency and regulatory compliance, reducing downtime by approximately 30% and improving forecast accuracy by approximately 18%.

What challenges does the Marine Scrubber Industry face during its growth?

- The growth of the maritime industry is significantly influenced by the challenges posed by waste disposal concerns related to marine scrubbers. These concerns, which are mandatory considerations due to their environmental and regulatory implications, continue to be a key issue that requires professional and effective management.

- The market is witnessing significant evolution due to growing environmental regulations aimed at reducing emissions from shipping industries. Scrubber systems, a key solution to meet these regulations, generate byproducts such as sludge and washwater. Proper disposal of these materials is crucial to prevent ecological harm and ensure regulatory compliance. Compliance can involve additional costs and logistical challenges for shipowners. Closed-loop systems, which recirculate washwater, generate a more concentrated waste stream, necessitating specialized treatment or disposal methods.

- The market demands innovative and sustainable solutions to effectively manage these byproducts, ensuring both environmental responsibility and operational efficiency.

Exclusive Technavio Analysis on Customer Landscape

The marine scrubber market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the marine scrubber market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Marine Scrubber Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, marine scrubber market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alfa Laval AB - The company specializes in marine exhaust gas cleaning systems, including Alfa Laval PureSOx, providing effective compliance solutions for emissions regulations. These systems utilize advanced technology to reduce sulfur oxides and other pollutants, contributing to environmental sustainability in the maritime industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alfa Laval AB

- Andritz AG

- Clean Marine AS

- CR Ocean Engineering LLC

- Damen Shipyards Group

- Drizgas Tech Pvt. Ltd.

- Ecospray Technologies Srl

- Elessent Clean Technologies Inc.

- Fuji Electric Co. Ltd.

- Kwangsung Co. Ltd.

- Langh Tech Oy Ab

- Mitsubishi Heavy Industries Ltd.

- Pacific Green Technologies Inc.

- Pressure Thermal Dynamics

- PureteQ AS

- SAACKE GmbH

- Sunrui Marine Environment Engineering Co. Ltd.

- Valmet Corp.

- VDL Groep BV

- Wartsila Corp.

- Weihai Puyi Marine Environmental Technology Co. Ltd.

- Yara International ASA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Marine Scrubber Market

- In January 2024, MAN Energy Solutions, a leading engine manufacturer, announced the launch of their new two-stroke ME-GI engine with an integrated Exhaust Gas Cleaning System (EGCS), also known as a marine scrubber, to comply with the International Maritime Organization's (IMO) 2020 sulfur cap regulations (Reuters, 2024).

- In March 2024, Wärtsilä Corporation, a Finnish technology group, and Hyundai Heavy Industries, a major shipbuilder, signed a strategic partnership to integrate Wärtsilä's EGCS technology into Hyundai's newbuildings, aiming to capture a larger share of the growing the market (Bloomberg, 2024).

- In May 2024, MAN Energy Solutions secured a €100 million (USD113 million) contract with an undisclosed European shipping company to supply marine scrubbers for 15 vessels, marking one of the largest single orders for the technology (MAN Energy Solutions press release, 2024).

- In September 2025, the IMO approved the use of alternative fuels, such as ammonia and hydrogen, for shipping, paving the way for the development of marine scrubbers compatible with these fuels to reduce their emissions (IMO press release, 2025).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Marine Scrubber Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

177 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.52% |

|

Market growth 2024-2028 |

USD 1901.25 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.02 |

|

Key countries |

China, Japan, South Korea, UK, and Norway |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, driven by the need for effective emission control solutions for marine engines. Catalytic converters and scrubbers, two key technologies, are at the forefront of this dynamic industry. Wastewater treatment and ballast water treatment are among the sectors benefiting from these advancements. Retrofit options for existing vessels are gaining traction, with particle filtration efficiency and system reliability being crucial considerations. The installation process involves careful measurement of flow rate and monitoring of pressure drop to ensure optimal scrubber performance. Compliance regulations, such as those related to sulfur dioxide and nitrogen oxide reduction, are driving the demand for these systems.

- Chemical consumption is a significant factor in the operational costs of scrubber systems. Water wash scrubbers and SOx scrubber technology are popular choices, with closed loop systems offering advantages in terms of chemical dosing systems and scrubbing liquid management. Energy consumption and maintenance are also important aspects to consider. For instance, a leading shipping company reported a 30% reduction in marine engine emissions after implementing a scrubber system. Industry growth is expected to reach double-digit percentages in the coming years, as the market continues to unfold with new innovations in scrubber technology, including NOx reduction systems and exhaust gas recirculation.

What are the Key Data Covered in this Marine Scrubber Market Research and Growth Report?

-

What is the expected growth of the Marine Scrubber Market between 2024 and 2028?

-

USD 1.9 billion, at a CAGR of 7.52%

-

-

What segmentation does the market report cover?

-

The report is segmented by Application (Commercial, Navy, Recreational, and Offshore), Type (Wet scrubber and Dry scrubber), and Geography (APAC, Europe, North America, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Compliance with International Convention for the Prevention of Pollution from Ships (MARPOL) regulations, Waste disposal concerns associated with marine scrubbers

-

-

Who are the major players in the Marine Scrubber Market?

-

Alfa Laval AB, Andritz AG, Clean Marine AS, CR Ocean Engineering LLC, Damen Shipyards Group, Drizgas Tech Pvt. Ltd., Ecospray Technologies Srl, Elessent Clean Technologies Inc., Fuji Electric Co. Ltd., Kwangsung Co. Ltd., Langh Tech Oy Ab, Mitsubishi Heavy Industries Ltd., Pacific Green Technologies Inc., Pressure Thermal Dynamics, PureteQ AS, SAACKE GmbH, Sunrui Marine Environment Engineering Co. Ltd., Valmet Corp., VDL Groep BV, Wartsila Corp., Weihai Puyi Marine Environmental Technology Co. Ltd., and Yara International ASA

-

Market Research Insights

- The market is a dynamic and continuously evolving industry focused on air quality improvement and marine pollution control. Regulatory frameworks, such as the IMO 2020 regulations, drive the demand for advanced scrubbing systems to meet NOx and SOx emission limits. According to industry reports, the market for marine scrubbers is projected to grow by over 10% annually, with an increasing number of vessels adopting these systems to ensure environmental compliance. For instance, a recent study revealed that a major shipping line experienced a 20% increase in sales following the implementation of a marine scrubber system on their fleet.

- Furthermore, The market is expected to reach significant growth, with an increasing focus on system efficiency, performance indicators, material selection, and automation systems. This trend is driven by the need for cost-effective, reliable, and sustainable solutions for marine pollution control.

We can help! Our analysts can customize this marine scrubber market research report to meet your requirements.