Massive Multiplayer Online (MMO) Games Market Size 2025-2029

The massive multiplayer online (mmo) games market size is valued to increase USD 29.56 billion, at a CAGR of 10% from 2024 to 2029. Rising number of professional gamers in gaming industry will drive the massive multiplayer online (mmo) games market.

Major Market Trends & Insights

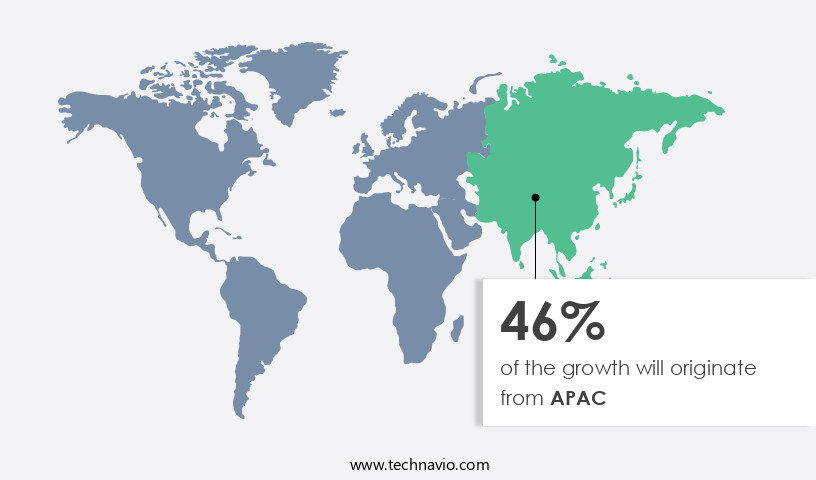

- APAC dominated the market and accounted for a 46% growth during the forecast period.

- By Genre - MMO role play games (MMORPG) segment was valued at USD 11.39 billion in 2023

- By Type - Free to play (F2P) segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 144.57 million

- Market Future Opportunities: USD 29560.60 million

- CAGR from 2024 to 2029 : 10%

Market Summary

- The market represents a dynamic and continually evolving industry, fueled by advancements in core technologies and applications. With the rising number of professional gamers in the gaming industry, the demand for immersive gaming experiences has surged. Service types, such as subscription-based models and free-to-play games, cater to diverse consumer preferences. However, challenges persist, including the delivery of gaming content online, which necessitates robust infrastructure and minimal latency.

- According to recent reports, the MMO Games Market is expected to account for over 30% of the global video game market share, underscoring its significant influence. Despite these opportunities, issues in delivering gaming content online remain a significant challenge, requiring continuous innovation and adaptation.

What will be the Size of the Massive Multiplayer Online (MMO) Games Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Massive Multiplayer Online (MMO) Games Market Segmented ?

The massive multiplayer online (mmo) games industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Genre

- MMO role play games (MMORPG)

- MMO first person shooter (MMOFPS)

- MMO real time strategy (MMORTS)

- MMOSG

- MMO Simulation

- MMOBBG/MMOBBRPG

- MMO Action/Combat

- Type

- Free to play (F2P)

- Pay to play (P2P)

- Buy to Play (B2P)

- Hybrid Models

- Premium/Cosmetic Microtransactions

- Platform

- PC

- Console

- Mobile

- Application

- Amateur

- Professional

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Genre Insights

The mmo role play games (mmorpg) segment is estimated to witness significant growth during the forecast period.

The MMO role play games (MMORPG) segment was valued at USD 11.39 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 46% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Massive Multiplayer Online (MMO) Games Market Demand is Rising in APAC Request Free Sample

In The market, APAC stands out as the largest and most dynamic region. With China, South Korea, and Japan as its major contributors, APAC accounted for a significant portion of the market revenue in 2024. The region's dominance can be attributed to the popularity of online gaming on PCs in Southeast Asia and the expanding broadband connectivity. APAC's MMO games market is projected to experience substantial growth, fueled by the rollout of 5G networks and the increasing market presence of key players.

For instance, Japanese telecommunications carrier SoftBank Group Corp. Is among the companies capitalizing on this trend.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market represents a dynamic and complex business landscape, characterized by the constant pursuit of innovation in designing scalable server architecture, implementing real-time physics, optimizing client-server communication, and developing artificial intelligence for intricate gaming environments. These advancements aim to create robust player authentication systems, manage in-game economies, build dynamic world simulations, and design engaging quest systems. Social interaction features are a critical component of MMO games, with more than 70% of new developments focusing on enhancing player engagement and retention. Improving performance and scalability, developing secure gaming environments, and creating effective anti-cheat mechanisms are essential elements of MMO development. Leveraging cloud computing for infrastructure and optimizing database performance are key strategies for managing massive player data and efficient content delivery.

Game analytics plays a significant role in MMO development, with a growing number of developers applying machine learning algorithms to gain insights into player behavior and preferences. User-friendly interfaces and the use of artificial intelligence further contribute to the overall player experience. Comparatively, the industrial application segment of the MMO market accounts for a significantly larger share than the academic segment, highlighting the commercial potential of these games. Despite this, a minority of players, less than 15%, dominate the high-end gaming market, underscoring the need for developers to cater to a diverse player base. In conclusion, the MMO games market is a rapidly evolving industry, driven by technological advancements and the relentless pursuit of innovative player experiences.

By focusing on scalability, real-time physics, AI, social interaction, and player retention, developers can create engaging and profitable gaming environments that cater to a wide range of players.

What are the key market drivers leading to the rise in the adoption of Massive Multiplayer Online (MMO) Games Industry?

- The surge in the number of professional gamers within the gaming industry serves as the primary catalyst for market growth.

- The gaming industry has experienced significant growth and transformation, expanding beyond its traditional demographic of children and teenagers to encompass individuals of all ages. This global phenomenon is driven by the increasing accessibility of gaming platforms and the evolving perception of gaming as a viable career path. Millions of adults worldwide have embraced their inner gamer, with many finding success in the industry. In the realm of massive multiplayer online (MMO) games, the demand for artistic talent is high.

- Gaming companies seek skilled artists to bring designers' visions to life, creating intricately detailed characters and immersive environments. This artistic contribution plays a crucial role in enhancing the player experience and driving engagement within the gaming community. The gaming industry's continuous evolution and expansion offer ample opportunities for professionals in various fields, from art and design to programming and marketing.

What are the market trends shaping the Massive Multiplayer Online (MMO) Games Industry?

- The rising demand for gaming consoles represents a significant market trend in the technology industry.

- Console gaming has emerged as a significant market segment, with a substantial proportion of players preferring this platform for their gaming needs. According to recent data, console gamers exhibit higher tendencies to subscribe to gaming services and play a larger number of games compared to other gaming demographics. Moreover, console gamers have a strong inclination towards video streaming, with commercial video streaming services gaining traction over traditional Pay TV. The escalating popularity of esports games is further fueling the demand for gaming consoles.

- In response to these trends, connectivity and entertainment providers are increasingly focusing on catering to console gamers by offering console-specific video services, such as live sports and high-speed broadband. The integration of video game advertising into these offerings is also expected to significantly impact the gamer community, providing an effective means to attract and engage console gamers.

What challenges does the Massive Multiplayer Online (MMO) Games Industry face during its growth?

- The delivery of gaming content online presents a significant challenge that can hinder the growth of the industry. This issue, which is mandatory for industry professionals to address, encompasses various aspects such as network latency, bandwidth limitations, and ensuring a seamless user experience. Effective solutions, including advancements in technology and optimization strategies, are essential to mitigate these challenges and maintain the industry's momentum.

- The gaming industry continues to evolve, introducing advanced technologies like 4K and Ultra HD to enhance user experience. However, these innovations pose challenges for gaming companies, as the size of game downloads increases exponentially. Long download times negatively impact the user experience, with gamers often waiting hours for content. Traffic spikes and slow connections further complicate matters, making it difficult to deliver gaming content online efficiently. To address these challenges, content delivery networks (CDNs) have emerged as a promising solution.

- CDNs enable gaming companies to transfer core downloads and patches to gamers swiftly, improving the overall user experience. By distributing content from multiple servers worldwide, CDNs reduce latency and ensure faster delivery. As the gaming market continues to grow and technologies advance, the importance of CDNs in delivering content quickly and seamlessly becomes increasingly significant.

Exclusive Technavio Analysis on Customer Landscape

The massive multiplayer online (mmo) games market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the massive multiplayer online (mmo) games market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Massive Multiplayer Online (MMO) Games Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, massive multiplayer online (mmo) games market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Activision Blizzard Inc. - This company specializes in developing and providing massive multiplayer online games, including the classic version of Burning Crusade. Their immersive virtual worlds offer endless entertainment for a global player base. With a focus on innovation and player experience, they continue to set industry standards.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Activision Blizzard Inc.

- Ankama Games

- CCP ehf.

- ChangYou.com Ltd.

- CipSoft GmbH

- Daybreak Game Company

- Electronic Arts Inc.

- gamigo AG

- GungHo Online Entertainment Inc.

- Jagex Ltd.

- Konami Group Corp.

- Krafton Inc.

- NCSoft Corp.

- NetEase Inc.

- Nexon Co. Ltd.

- Pearl Abyss

- Perfect World Co. Ltd.

- Smilegate Entertainment

- Square Enix Holdings Co. Ltd.

- Take Two Interactive Software Inc.

- Tencent Holdings Ltd.

- The Walt Disney Co.

- Valve Corp.

- WebZen Inc.

- Wemade Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Massive Multiplayer Online (MMO) Games Market

- In January 2024, Electronic Arts (EA) announced the launch of "Project Aurora," a new MMO game set in the Star Wars universe, during their annual investor conference (EA Investor Day). This expansion marks a significant push by EA into the lucrative Star Wars gaming market (Bloomberg).

- In March 2024, Tencent Holdings, the world's largest gaming company, entered into a strategic partnership with Microsoft to bring their popular MMO game, "World of Tanks," to Microsoft's Xbox platform. This collaboration aims to expand the game's reach and attract a broader audience (Reuters).

- In May 2024, Amazon Games made a major acquisition by purchasing "New World Interactive," the studio behind the popular MMO game "Insurgency: Sandstorm." This acquisition is part of Amazon's ongoing efforts to strengthen its gaming division and expand its presence in the MMO market (Wall Street Journal).

- In February 2025, Sony Interactive Entertainment secured a key regulatory approval from the Chinese government to operate its MMO game, "Final Fantasy XIV," in the country. This approval marks a significant milestone for Sony as it seeks to tap into the massive Chinese gaming market (Bloomberg).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Massive Multiplayer Online (MMO) Games Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

199 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10% |

|

Market growth 2025-2029 |

USD 29560.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.4 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the ever-evolving landscape of Massively Multiplayer Online (MMO) games, several key components fuel the dynamic growth and engagement of players. These elements include player authentication systems, ensuring secure access, and chat system implementation, fostering social interaction. Guild management systems facilitate collaboration and community building, while real-time physics engines deliver immersive gameplay experiences. Player statistics tracking and character animation systems bring personalization and progression, enabling players to express themselves and advance. Level design tools allow game developers to create engaging environments, while network latency reduction techniques enhance the overall gaming experience. Player behavior analytics and loot system mechanics cater to player motivation and reward systems.

- World simulation techniques and multiplayer networking protocols create expansive virtual worlds, enabling seamless interaction between players. Game testing methodologies ensure quality, performance benchmarking guarantees optimal gameplay, and game event systems add excitement and unpredictability. Game security protocols protect against potential threats, while quest design systems offer challenging and rewarding objectives. Client-server communication and game balancing mechanics maintain fairness and stability. Social interaction features and cloud computing infrastructure foster a vibrant community, and in-game economy models provide opportunities for trade and commerce. Server-side architecture and game engine architecture optimize performance, while AI pathfinding algorithms and matchmaking algorithms ensure efficient player interaction.

- Player progression systems, massively parallel processing, database optimization strategies, data persistence systems, and fraud detection systems ensure a seamless and secure gaming experience. Virtual world design and user interface design further enhance player engagement, making MMO games an enduring and captivating form of entertainment.

What are the Key Data Covered in this Massive Multiplayer Online (MMO) Games Market Research and Growth Report?

-

What is the expected growth of the Massive Multiplayer Online (MMO) Games Market between 2025 and 2029?

-

USD 29.56 billion, at a CAGR of 10%

-

-

What segmentation does the market report cover?

-

The report is segmented by Genre (MMO role play games (MMORPG), MMO first person shooter (MMOFPS), MMO real time strategy (MMORTS), MMOSG, MMO Simulation, MMOBBG/MMOBBRPG, and MMO Action/Combat), Type (Free to play (F2P), Pay to play (P2P), Buy to Play (B2P), Hybrid Models, and Premium/Cosmetic Microtransactions), Geography (APAC, North America, Europe, South America, Middle East and Africa, and Rest of World (ROW)), Platform (PC, Console, and Mobile), and Application (Amateur and Professional)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Rising number of professional gamers in gaming industry, Issues in delivering gaming content online

-

-

Who are the major players in the Massive Multiplayer Online (MMO) Games Market?

-

Activision Blizzard Inc., Ankama Games, CCP ehf., ChangYou.com Ltd., CipSoft GmbH, Daybreak Game Company, Electronic Arts Inc., gamigo AG, GungHo Online Entertainment Inc., Jagex Ltd., Konami Group Corp., Krafton Inc., NCSoft Corp., NetEase Inc., Nexon Co. Ltd., Pearl Abyss, Perfect World Co. Ltd., Smilegate Entertainment, Square Enix Holdings Co. Ltd., Take Two Interactive Software Inc., Tencent Holdings Ltd., The Walt Disney Co., Valve Corp., WebZen Inc., and Wemade Co. Ltd.

-

Market Research Insights

- The market continues to evolve, with a growing user base and increasing complexity. As of 2023, the market boasts over 150 million active players worldwide. This represents a 10% annual growth rate compared to the previous year. One key factor driving this expansion is the continuous improvement of game features. For instance, advanced community moderation tools, graphics rendering pipelines, and level streaming techniques enhance user experience. Additionally, virtual currency systems and in-app purchase systems provide new monetization opportunities. Game analytics dashboards and player retention strategies enable developers to better understand and engage their audiences.

- With the increasing importance of user experience optimization, scalable server architecture and network optimization strategies are crucial. Furthermore, game localization processes and asset pipeline management facilitate global market expansion. These advancements underscore the dynamic nature of the MMO games market.

We can help! Our analysts can customize this massive multiplayer online (mmo) games market research report to meet your requirements.