North America Mechanical Electrical And Plumbing Services Market Size 2025-2029

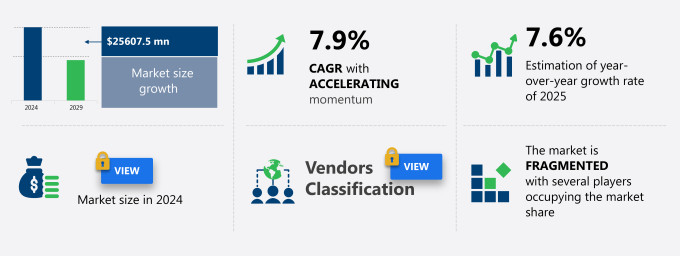

The mechanical electrical and plumbing (MEP) services market in North America size is forecast to increase by USD 25.61 billion at a CAGR of 7.9% between 2024 and 2029.

- The Mechanical, Electrical, and Plumbing (MEP) services market is experiencing significant growth, driven by key factors such as the increasing adoption of outsourcing for MEP services to reduce costs and improve efficiency. Another trend influencing market growth is the technological advancements in building management systems, enabling automation and remote monitoring of MEP systems. However, the lack of differentiation among service providers poses a challenge, as customers seek value-added services and customized solutions. To remain competitive, MEP service providers must focus on innovation, quality, and customer satisfaction. This market analysis report provides a comprehensive study of these trends and challenges, offering insights into the future growth prospects of the MEP services industry.

What will be the Size of the Market During the Forecast Period?

- The Mechanical, Electrical, and Plumbing (MEP) services market plays a crucial role in ensuring the smooth operation of buildings, providing basic amenities such as clean and fresh water, air, electricity, and other essential services. MEP systems include various components like air-conditioning systems, HVAC systems, elevators, fire protection, lighting, power distribution, communication systems, water supply, drainage, and sewage systems. Environmental standards and energy efficiency are increasingly becoming key considerations in the MEP services market. Buildings are required to adhere to stringent regulations regarding energy consumption and sustainability. MEP services providers are responding to this trend by offering energy-efficient solutions and integrating digital technologies such as Building Information Modelling (BIM) and Artificial Intelligence (AI) into their operations.

- Digitalization is transforming the MEP services market, with 3D digital models becoming a standard for designing and planning MEP systems. Facility managers and contractors benefit from these models as they enable better visualization and planning of complex systems. MEP operations are becoming more efficient and effective, reducing downtime and maintenance costs. Sustainability is another critical factor driving the MEP services market. MEP systems are being designed to minimize water usage, reduce energy consumption, and minimize waste. Environmental concerns are also driving the adoption of renewable energy sources and the integration of green technologies into MEP systems. In conclusion, the MEP services market is undergoing significant changes, driven by factors such as environmental standards, energy efficiency, sustainability, digitalization, and the integration of AI and BIM. MEP services providers are responding to these trends by offering innovative solutions that meet the evolving needs of building owners and occupants.

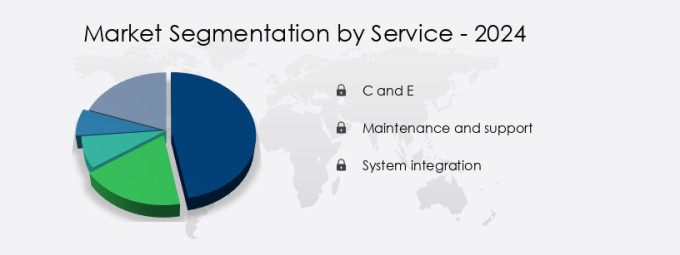

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Service

- C and E

- Maintenance and support

- System integration

- End-user

- Commercial

- Government

- Residential

- Geography

- North America

- Canada

- Mexico

- US

- North America

By Service Insights

- The C and E segment is estimated to witness significant growth during the forecast period.

The North American market for Mechanical Electrical and Plumbing (MEP) consulting and engineering services is experiencing steady growth due to the ongoing infrastructure development in the region. New construction projects require specialized engineering services to design and optimize electrical, mechanical, and civil systems during the planning phase. Existing buildings also demand consulting services to enhance energy efficiency and ensure optimal facility operations. The focus on sustainability and automation further fuels the demand for MEP engineering services in North America. Several companies in this market exclusively offer consulting and engineering services, reflecting the growing importance of this segment. This trend is expected to continue, as the need for optimized energy consumption and efficient building operations remains a priority in North America.

Get a glance at the market report of share of various segments Request Free Sample

Market Dynamics

Our North America Mechanical Electrical And Plumbing (MEP) Services Market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of North American Mechanical Electrical And Plumbing (MEP) Services Market?

Rise in adoption of outsourcing mechanical, electrical, and plumbing services is the key driver of the market.

- The Mechanical, Electrical, and Plumbing (MEP) services market in North America is witnessing significant growth as businesses increasingly outsource non-core functions to focus on their primary operations. End-users are recognizing the benefits of outsourcing services such as HVAC installation, water management, and electrical support to competent companies. The maturity of the facility management services sector in North America is driving this trend, as businesses seek to optimize their resources and improve efficiency. The commercial segment, including office buildings, retail spaces, hotels, healthcare facilities, and urban infrastructure, is a major contributor to the demand for MEP services. In the residential sector, home renovation projects require expert MEP services for clean and fresh water supply, air conditioning systems, electricity, elevators, fire protection, lighting, power distribution, communication systems, drainage, sewage systems, and environmental standards compliance.

- MEP services play a crucial role in ensuring energy consumption efficiency, compliance with building regulations, and sustainability. With the increasing digitalization of building operations, smart systems, automation, and building information modeling are becoming essential components of MEP services. Facility managers, contractors, engineers, and architects rely on precision and expertise to ensure the successful execution of MEP projects. Service contracts, bidding processes, labor costs, and commercial activities in manufacturing, multichannel retail, and other industries characterize the MEP operations market. As the construction sector continues to grow, the demand for MEP services is expected to remain strong, driven by the need for energy efficiency, sustainability, and compliance with building codes and regulations. Such factors will increase the market growth during the forecast period.

What are the market trends shaping the North America Mechanical Electrical And Plumbing (MEP) Services Market?

Technological advancements in building management systems is the upcoming trend in the market.

- In the North American market, the Mechanical Electrical and Plumbing (MEP) services sector is experiencing significant growth due to the increasing demand for advanced technology in building facilities. companies are focusing on enhancing their services by incorporating cost-effective, high-quality, and time-efficient solutions. New technologies and products are being introduced to improve basic amenities such as clean and fresh water, air, electricity, and communication systems. These innovations include HVAC systems, elevators, fire protection, lighting, power distribution, and building automation systems. The commercial segment, including office buildings, retail spaces, hotels, and healthcare facilities, is a major driver of growth in the MEP services market.

- Urbanization and industrialization are also contributing factors, leading to an increased need for MEP services in both the commercial infrastructure and residential sectors. To stay competitive, companies must continually upgrade their expertise and outsource skilled labor when necessary. This includes investing in the latest technologies, such as 3D digital models, artificial intelligence, and building information modeling. Facility managers, contractors, engineers, and architects are all seeking precision and energy efficiency in their MEP operations. Building regulations and environmental standards are also influencing the market, with a focus on sustainability and digitalization. Energy consumption is a critical concern, and companies must provide solutions that meet or exceed building codes and planning and design requirements. Such factors will increase the market trends during the forecast period.

What challenges does North America Mechanical Electrical And Plumbing (MEP) Services Market face during the growth?

Lack of service differentiation is a key challenge affecting the market growth.

- In the North American Mechanical Electrical and Plumbing (MEP) services market, competition among global companies intensifies due to limited differentiation in service offerings. Quality and performance distinctions are challenging to quantify, giving customers significant bargaining power. Slower technological advancements add to the challenge for companies, necessitating innovative strategies to distinguish their services. Despite this, reputed end-users continue to engage with global players due to company stability and reliability. The MEP services market caters to essential amenities such as clean and fresh water, air, electricity, and communication systems in various sectors. These include commercial infrastructure like office buildings, retail spaces, hotels, healthcare facilities, and urbanization projects.

- Home renovation projects also require MEP expertise for the installations and maintenance of HVAC systems, elevators, fire protection, lighting, power distribution, and water supply, drainage, and sewage systems. Adherence to environmental standards, energy consumption, and building regulations is crucial in the MEP services market. Building planning, design, and maintenance involve collaboration among facility managers, contractors, engineers, and architects. Green MEP services, building automation, smart systems, and digitalization are emerging trends in the commercial and residential segments. Energy efficiency, sustainability, and precision are key factors driving the MEP operations market. Service contracts, bidding processes, labor costs, and commercial activities such as manufacturing and multichannel retail are significant aspects of the MEP services market. Such factors will hinder the market growth during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

AECOM - The company offers mechanical electrical and plumbing services such as advanced modeling, lighting, and fire protection.

- Arup Group Ltd.

- Balfour Beatty Plc

- Carrier Global Corp.

- CBRE Group Inc.

- Comfort Systems USA Inc.

- EMCOR Group Inc.

- Encore Electric

- Faith Technologies Inc.

- Godrej and Boyce Manufacturing Co. Ltd.

- Harris Co.

- HOCHTIEF AG

- IES Holdings Inc.

- Johnson and Pace Inc.

- LIMBACHHOLDINGS INC.

- Siemens AG

- TDIndustries Inc.

- Tetra Tech Inc.

- Veolia Environnement SA

- WSP Global Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The Mechanical, Electrical, and Plumbing (MEP) services market plays a vital role in ensuring the functionality and comfort of modern buildings. This sector encompasses a range of services that cater to basic amenities such as clean and fresh water, air, electricity, and communication systems. This comprehensive overview delves into the intricacies of the MEP services market, focusing on market dynamics and industry trends. The demand for MEP services is driven by the construction and renovation of both residential and commercial structures. Home renovation projects and new constructions in the residential segment require MEP services to install HVAC systems, plumbing, and electrical systems. In the commercial segment, the demand is fueled by the construction of office buildings, retail spaces, hotels, healthcare facilities, and other commercial infrastructure. The MEP services industry is characterized by a robust construction industry, urbanization, and industrialization. The increasing trend towards smart buildings and automation is leading to the adoption of advanced technologies such as Building Information Modeling (BIM), artificial intelligence, and digitalization. These technologies enable precision in planning, design, and maintenance, ensuring energy efficiency and sustainability. The MEP services market is segmented into various sub-sectors, including HVAC systems, elevators, fire protection, lighting, power distribution, and water supply and drainage.

Moreover, each sub-service category experiences unique market dynamics, with varying growth rates and competition levels. The commercial infrastructure sector is a significant contributor to the MEP services market. Office buildings, retail spaces, and other commercial structures require complex MEP systems to ensure optimal functionality and comfort. The demand for MEP services in this sector is driven by commercial activities, such as manufacturing and multichannel retail. The residential segment also presents opportunities for MEP service providers. Homeowners and property managers seek expertise in installing and maintaining MEP systems to ensure the comfort and safety of their properties. Outsourcing MEP services to skilled labor is becoming increasingly popular due to the complexity of these systems and the need for specialized knowledge. The MEP services market is subject to various building regulations, codes, and environmental standards. These guidelines ensure the safety, energy efficiency, and sustainability of buildings. Compliance with these regulations adds to the cost of MEP services, making it essential for service providers to stay updated on the latest building codes and standards. The MEP services market is characterized by a competitive landscape, with various players, including contractors, engineers, architects, and facility managers, vying for market share. Service contracts and bidding processes are common in the industry, with labor costs being a significant factor in determining project budgets. In conclusion, the MEP services market is a dynamic and complex industry that plays a crucial role in ensuring the functionality and comfort of modern buildings.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

179 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.9% |

|

Market growth 2025-2029 |

USD 25.61 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.6 |

|

Key countries |

US, Canada, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch

_Services_Market_in_North_America_customer_landscape_abstract_2023_geo_v1.jpg)