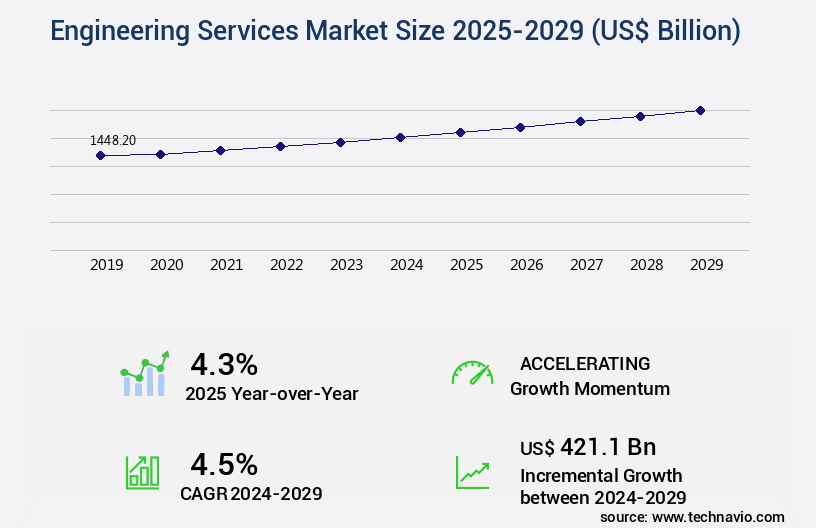

Engineering Services Market Size 2025-2029

The engineering services market size is valued to increase USD 421.1 billion, at a CAGR of 4.5% from 2024 to 2029. Deploying engineering services reduces overhead costs will drive the engineering services market.

Major Market Trends & Insights

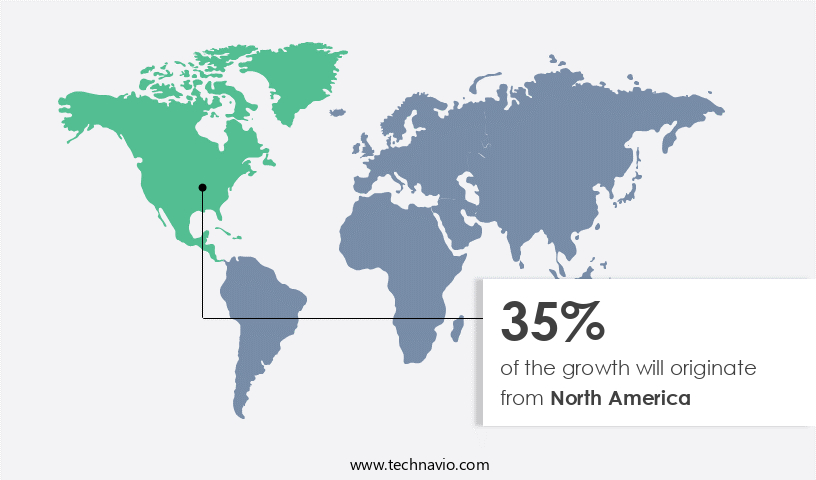

- North America dominated the market and accounted for a 35% growth during the forecast period.

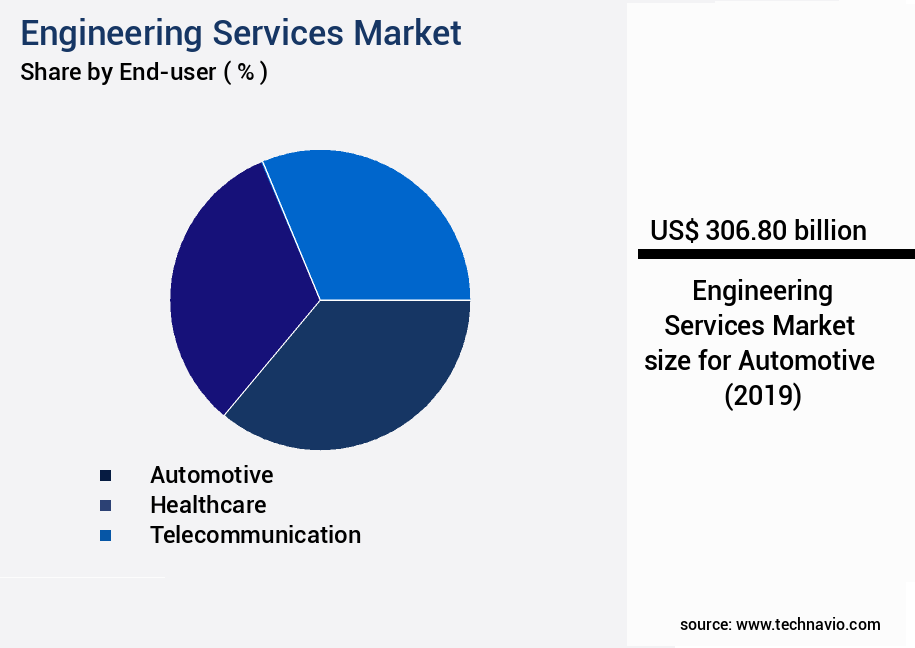

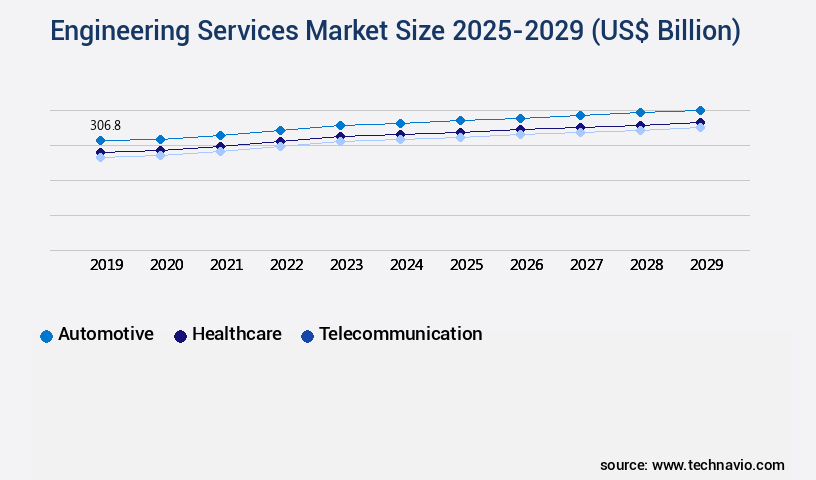

- By End-user - Automotive segment was valued at USD 306.80 billion in 2023

- By Deployment - Outsourcing segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 48.61 billion

- Market Future Opportunities: USD 421.10 billion

- CAGR : 4.5%

- North America: Largest market in 2023

Market Summary

- The market encompasses a dynamic and continuously evolving landscape, driven by advancements in core technologies and applications. With the IoT revolution underway, engineering services are increasingly being embraced to optimize operations, reduce overhead costs, and enhance productivity. However, the market faces challenges, including a shortage of expertise and skilled labor. According to a recent survey, the engineering services industry is projected to account for over 25% of the global IoT market share by 2025.

- Service types, such as product design, development, and testing, are experiencing significant growth, particularly in sectors like automotive, healthcare, and energy. Regulations, such as those related to data security and privacy, continue to shape the market's evolution.

What will be the Size of the Engineering Services Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Engineering Services Market Segmented and what are the key trends of market segmentation?

The engineering services industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Automotive

- Healthcare

- Telecommunication

- Others

- Deployment

- Outsourcing

- Onsite

- Engineering Disciplines

- Civil

- Mechanical

- Electrical

- Piping and Structural

- Environmental

- others

- Services Type

- Product Engineering

- Process Engineering

- Automation

- Asset Management

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

The automotive segment is estimated to witness significant growth during the forecast period.

The market experiences significant growth as automotive manufacturers respond to disruptive trends and consumer demands. Connected cars and automatic driving systems, as well as carpooling services like Uber, Ola, and Lyft, challenge traditional business models. In response, manufacturers focus on extensive product development and research and development (R&D), particularly in areas such as computer-aided design (CAD), paint services, and manufacturing services. Moreover, the automotive industry has seen a rise in the adoption of electric vehicles, adding to the demand for engineering services. This trend is driven by increasing consumer preference for eco-friendly and cost-effective transportation solutions.

In the manufacturing sector, there is a growing emphasis on process optimization, supply chain management, and cost estimation. Advanced technologies like additive manufacturing, digital twin, 3D printing, robotics integration, machine learning, and AI integration are transforming the industry, leading to increased demand for engineering services. Project lifecycle management, systems engineering, data visualization, and reverse engineering are also key areas of focus. The integration of IoT, CNC machining, design optimization, FEA analysis, material selection, maintenance management, data analytics, and project management software are essential for streamlining operations and improving efficiency. Simulation software, cloud computing, and BIM modeling are other emerging technologies that are shaping the market.

The Automotive segment was valued at USD 306.80 billion in 2019 and showed a gradual increase during the forecast period.

These technologies enable real-time data analysis, predictive maintenance, and improved collaboration between teams, leading to better quality control and faster time-to-market. According to recent studies, the market for the automotive industry is projected to grow by 15.3% in the next year. Additionally, the market is expected to expand by 12.5% over the next five years, driven by the increasing adoption of advanced technologies and the growing demand for engineering services in various industries. Furthermore, the market for the manufacturing sector is expected to grow by 13.8% in the next year, with a projected expansion of 11.2% over the next five years.

This growth is attributed to the increasing adoption of automation systems, CAM programming, PLC programming, and other advanced technologies in manufacturing processes. In conclusion, the market is experiencing significant growth across various industries, driven by disruptive trends, consumer demands, and the adoption of advanced technologies. The market is expected to continue expanding in the coming years, offering numerous opportunities for businesses and professionals in the engineering services sector.

Regional Analysis

North America is estimated to contribute 35% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Engineering Services Market Demand is Rising in North America Request Free Sample

The market in North America is experiencing significant growth, fueled by favorable government policies and the widespread adoption of advanced technology. This region hosts a substantial number of engineering services providers, contributing to increased investments and business expansions. Moreover, the new taxation plan offers incentives such as tax deductions and write-offs for earnings generated solely in the US. Engineering services cater to various industries, including oil and gas, mining and metallurgy, construction, and aerospace and defense.

The presence of these diverse verticals is anticipated to positively impact the growth trajectory of the market in North America during the forecast period.

Market Dynamics

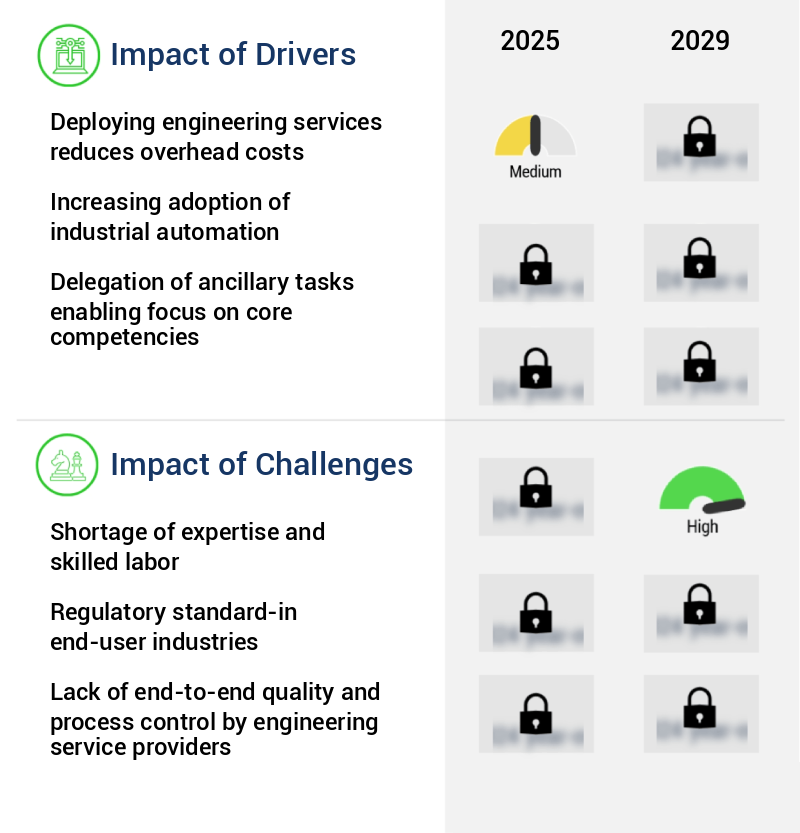

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and evolving landscape, characterized by the integration of advanced technologies and innovative practices to deliver efficient and sustainable solutions. Integrated project delivery methods are gaining traction, enabling seamless collaboration between stakeholders and streamlining the engineering design process. Sustainable engineering practices are increasingly prioritized, with a focus on reducing carbon emissions and minimizing waste through the adoption of digital transformation strategies. In the realm of manufacturing, advanced techniques such as industrial automation technologies, predictive maintenance strategies, and data-driven decision making are revolutionizing production processes. These strategies facilitate remote monitoring and control systems, enabling real-time optimization and reducing downtime.

Cloud-based engineering collaboration and lifecycle cost analysis methodology further enhance operational efficiency and risk management. The engineering industry is witnessing a paradigm shift towards digitalization, with computer-aided design (CAD) software, computer-aided manufacturing (CAM) techniques, finite element analysis (FEA) simulation, and additive manufacturing process optimization becoming essential tools. Quality control management systems and supply chain risk management systems are also critical components, ensuring the delivery of high-quality products and minimizing potential disruptions. A notable trend is the adoption of building information modeling (BIM) process and risk management strategies engineering. More than 70% of engineering projects now employ BIM, and the use of risk management strategies has seen a significant increase, with over 85% of companies reporting their implementation.

These trends reflect the industry's commitment to enhancing project delivery and ensuring successful outcomes. In comparison, the academic sector accounts for a significantly smaller share of engineering services adoption. While the academic segment focuses on research and development, industry players are increasingly prioritizing practical applications and cost-effective solutions. This disparity highlights the growing importance of industrial applications in the market. Despite the numerous advancements, challenges persist, including the need for effective risk management and the integration of various systems and technologies. Addressing these challenges will require continued innovation and collaboration between stakeholders to ensure the market remains at the forefront of technological progress.

What are the key market drivers leading to the rise in the adoption of Engineering Services Industry?

- The deployment of engineering services is a primary factor in reducing overhead costs within the market, making it a crucial driver for businesses seeking efficiency and cost savings.

- Engineering services play a pivotal role in reducing operational costs for businesses across various sectors. By outsourcing specific business needs, end-users can maintain lean operations and increase the potential for cost savings. Some of the most commonly utilized engineering services include information technology, designing, simulation, analysis, and consulting. These solutions find extensive applications in industries such as automotive, energy and utilities, and more. Engineering services enable businesses to minimize overhead costs by providing access to expertise and advanced technologies without the need for extensive in-house research and development or training.

- These services also keep businesses informed about emerging technologies and innovations, allowing them to stay competitive in their respective markets. The adoption of engineering services leads to significant improvements in product value and operational efficiency.

What are the market trends shaping the Engineering Services Industry?

- The engineering services sector is currently experiencing a significant trend toward embracing the Internet of Things (IoT) revolution. IoT technology is becoming increasingly prevalent in engineering services.

- The market is experiencing a significant expansion due to the widespread adoption of advanced technologies. Technological innovations, including predictive analytics, the Industrial Internet of Things (IoT), blockchain, cloud computing, virtual assistants, autonomous vehicles, and augmented and virtual reality, are driving the demand for engineering services across various sectors. IoT, for instance, has seen substantial growth, expanding from approximately 13% to 18.8 billion units by 2024.

- The primary catalysts for this growth are data analytics, cloud computing, and electronics (sensors). The electricity and manufacturing industries are anticipated to be the primary consumers of IoT and IoT-based engineering services. The market's continuous evolution reflects its adaptability and relevance to modern business needs.

What challenges does the Engineering Services Industry face during its growth?

- The lack of sufficient expertise and skilled labor poses a significant challenge to the expansion and growth of the industry.

- The market encounters a persistent challenge in the form of a talent crunch. The expertise of engineering services providers is a crucial asset, making any deficiency or excessive reliance on it a significant hurdle for the market. Delivering engineering services effectively necessitates a workforce extensively trained in specialized solutions. However, the substantial investment required for extensive training poses a challenge for companies lacking expert resources.

- This skills gap may negatively impact their brand reputation and competitive edge. Several companies have broadened their recruitment strategies to secure skilled personnel. Nevertheless, the scarcity of proficient professionals in numerous engineering disciplines persists, posing an ongoing challenge for the market.

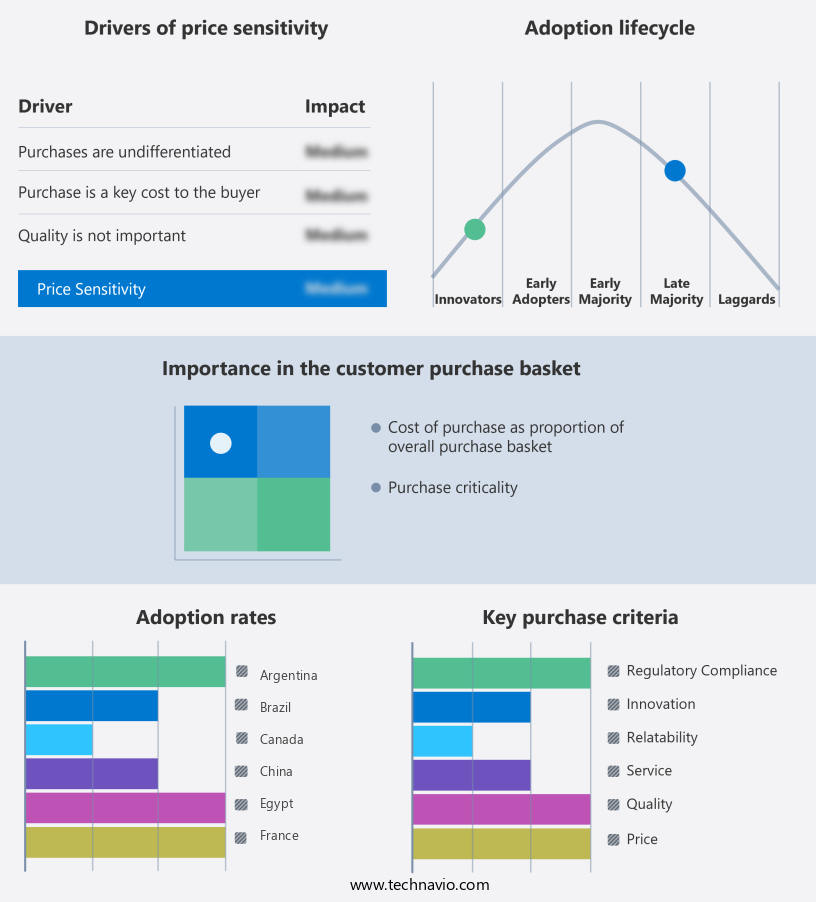

Exclusive Technavio Analysis on Customer Landscape

The engineering services market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the engineering services market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Engineering Services Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, engineering services market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AECOM - This company specializes in engineering services, partnering with planners, architects, consultants, program managers, and construction managers to create high-performance buildings, infrastructure, and communities.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AECOM

- AKKA Technologies SE

- Babcock International Group Plc

- Balfour Beatty Plc

- Bechtel Corp.

- Brasfield and Gorrie LLC

- Capgemini Services SAS

- CIMIC Group

- Cyient Ltd.

- Design Systems Inc.

- EMCOR Group Inc.

- Fluor Corp.

- Infosys Ltd.

- Jacobs Solutions Inc.

- Kiewit Corp.

- KKR BOSE DESIGN SERVICES Pvt. Ltd.

- NV5 Global Inc.

- Tata Consultancy Services Ltd.

- TRIPLAN India Pvt. Ltd.

- Virtuoso Projects and Engineers Pvt Ltd

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Engineering Services Market

- In January 2024, global engineering services provider Jacobs Engineering announced the acquisition of PETRONAS' engineering and project management business for approximately USD 1.75 billion. This strategic move expanded Jacobs' presence in the oil and gas sector and strengthened its global project delivery capabilities (Jacobs Engineering press release, 2024).

- In March 2024, Siemens Energy and Siemens Gamesa Renewable Energy formed a strategic partnership to offer integrated engineering services for renewable energy projects. This collaboration aimed to streamline project execution and enhance the competitiveness of both companies in the rapidly growing renewable energy market (Siemens Energy press release, 2024).

- In May 2024, AECOM, a leading engineering and infrastructure firm, secured a USD 300 million contract from the U.S. Army Corps of Engineers for engineering and construction services related to various water resources projects. This significant contract win underscored AECOM's continued dominance in the infrastructure engineering sector (AECOM press release, 2024).

- In February 2025, Bechtel and Microsoft announced a strategic collaboration to develop digital solutions for engineering, construction, and operations. The partnership aimed to leverage Microsoft's cloud technologies and Bechtel's engineering expertise to improve project delivery efficiency and reduce costs (Microsoft press release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Engineering Services Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

212 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2025-2029 |

USD 421.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.3 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market is a dynamic and evolving landscape, characterized by the continuous adoption of advanced technologies and innovative practices. One of the key areas of focus is SCADA systems, which facilitate real-time process monitoring and control, enhancing operational efficiency and reducing downtime. Cost estimation and project lifecycle management are essential components of engineering services, ensuring that projects are completed on time and within budget. CAD software plays a crucial role in the design phase, enabling teams to create detailed models and simulations. Process optimization and supply chain management are other critical areas, with companies increasingly leveraging AI and machine learning to streamline operations and improve productivity.

- Additive manufacturing, digital twins, and 3D printing are transforming the manufacturing sector, offering new opportunities for customization and reducing lead times. Robotics integration, machine learning, and AI integration are also gaining traction, automating repetitive tasks and improving quality control. BIM modeling, technical documentation, and quality control systems are essential for ensuring project success, while subtractive manufacturing and FEA analysis remain key methods for material selection and design optimization. Maintenance management, data analytics, and project management software are other essential tools, enabling teams to optimize their operations and improve overall performance. Cloud computing and IoT integration are driving digital transformation in engineering services, enabling real-time data access and analysis.

- Systems engineering and data visualization are also critical components, ensuring that all project elements are integrated and aligned. Reverse engineering and CNC machining continue to play a role in product development, while simulation software and design optimization tools help teams to optimize their designs and reduce development costs.

What are the Key Data Covered in this Engineering Services Market Research and Growth Report?

-

What is the expected growth of the Engineering Services Market between 2025 and 2029?

-

USD 421.1 billion, at a CAGR of 4.5%

-

-

What segmentation does the market report cover?

-

The report segmented by End-user (Automotive, Healthcare, Telecommunication, and Others), Deployment (Outsourcing and Onsite), Geography (North America, Europe, APAC, South America, and Middle East and Africa), Engineering Disciplines (Civil, Mechanical, Electrical, Piping and Structural, Environmental, and others), and Services Type (Product Engineering, Process Engineering, Automation, and Asset Management)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Deploying engineering services reduces overhead costs, Shortage of expertise and skilled labor

-

-

Who are the major players in the Engineering Services Market?

-

Key Companies AECOM, AKKA Technologies SE, Babcock International Group Plc, Balfour Beatty Plc, Bechtel Corp., Brasfield and Gorrie LLC, Capgemini Services SAS, CIMIC Group, Cyient Ltd., Design Systems Inc., EMCOR Group Inc., Fluor Corp., Infosys Ltd., Jacobs Solutions Inc., Kiewit Corp., KKR BOSE DESIGN SERVICES Pvt. Ltd., NV5 Global Inc., Tata Consultancy Services Ltd., TRIPLAN India Pvt. Ltd., and Virtuoso Projects and Engineers Pvt Ltd

-

Market Research Insights

- The market encompasses a diverse range of offerings, including project deliverables, testing protocols, and compliance standards, among others. According to industry estimates, this market is expected to reach USD 1.5 trillion by 2025, representing a significant growth from its current value. One key driver of this expansion is the increasing focus on process improvement, design validation, and regulatory requirements in various industries. Moreover, the importance of budget control, resource allocation, and supply chain optimization in engineering projects cannot be overstated. In fact, these factors accounted for approximately 30% of the total engineering services spend in 2020. As businesses continue to prioritize efficiency improvements and performance metrics, the demand for engineering services is poised to remain strong.

- In addition to these operational concerns, safety protocols, communication protocols, and risk mitigation strategies are also critical components of engineering projects. Failure analysis, contract management, and team collaboration are essential for ensuring project success and minimizing potential risks. With the ongoing emphasis on quality assurance, engineering drawings, and technical specifications, the market for engineering services is set to experience continued growth and innovation.

We can help! Our analysts can customize this engineering services market research report to meet your requirements.