Medical Foam Market Size 2025-2029

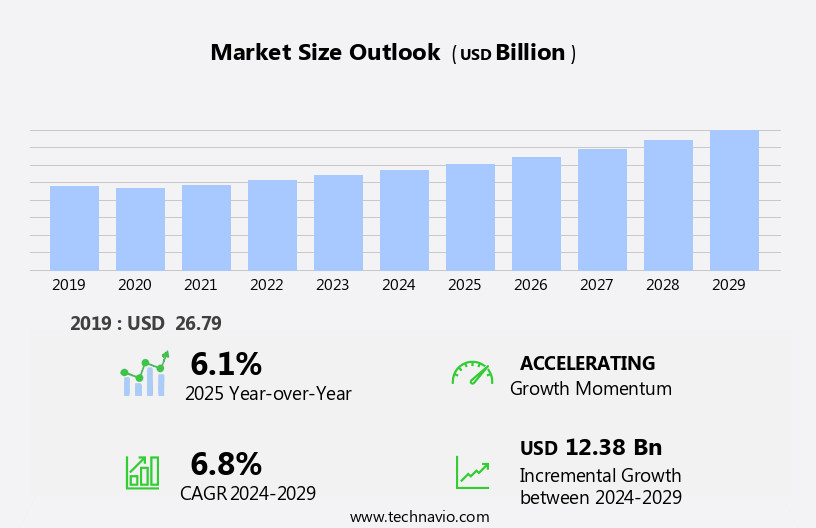

The medical foam market size is forecast to increase by USD 12.38 billion at a CAGR of 6.8% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing demand for medical foam in wound care applications and orthopedics. Wound care is a key area where medical foam is gaining popularity for its ability to provide a protective barrier against infection and promote healing. The orthopedic sector is another major contributor to the market's growth, with medical foam being used in the production of orthopedic implants and devices. However, the market faces regulatory and compliance barriers that pose challenges for market participants. These regulations require stringent quality control measures and adherence to safety standards, which can increase production costs and limit market entry for new players.

- Companies seeking to capitalize on market opportunities in the market must navigate these challenges effectively by investing in research and development to meet regulatory requirements and maintain a strong focus on product quality. Additionally, strategic partnerships and collaborations can help companies overcome regulatory hurdles and expand their market reach.

What will be the Size of the Medical Foam Market during the forecast period?

- The market continues to evolve, driven by the diverse applications of this versatile material across various sectors. From healthcare providers to manufacturing industries, medical foam plays a pivotal role in delivering comfort, safety, and functionality. In healthcare, medical foam is utilized in creating cushioning solutions for wheelchairs, beds, and surgical beds, ensuring patient comfort and preventing pressure ulcers. The elderly population, with their unique needs, fuels the demand for lightweight, durable, and high-quality foam-based products. Implantable devices and respiratory devices benefit from medical foam's biocompatibility and cushioning abilities. The flexible foam sector also leverages foam for sound absorption, upholstery, and padding in various applications.

- Manufacturing processes involve polymer foam fabrication using polymers like polyurethane and polyolefin. Toluene diisocyanate (TDI) and other polymeric isocyanates are essential components in medical foam creation. Sustainability is a growing concern, leading to the exploration of eco-friendly alternatives to petroleum-based foams. polyurethane foam, a significant market player, faces competition from sustainable options like synthetic latex and phosgene-free foam. The market dynamics are influenced by various factors, including oil prices, safety concerns, and ecological impact. The ongoing manufacturing process involves material sourcing, quality standards, and advanced foam technologies, ensuring continuous innovation and improvement.

How is this Medical Foam Industry segmented?

The medical foam industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Flexible foam

- Rigid foam

- Spray foam

- Application

- Bedding and cushioning

- Device and components

- Packaging

- Others

- Product

- Polyurethane

- Polystyrene

- Polyolefin

- Polyvinyl chloride

- Others

- Geography

- North America

- US

- Canada

- South America

- Argentina

- Brazil

- Middle East and Africa

- UAE

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

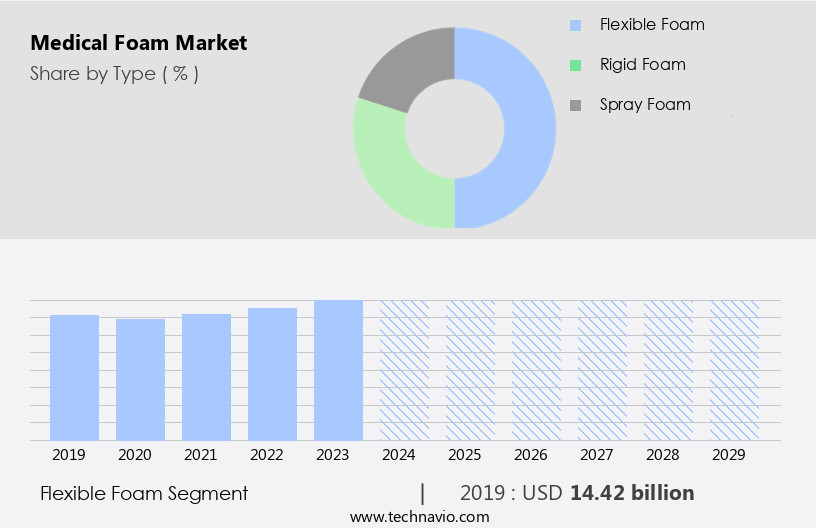

The flexible foam segment is estimated to witness significant growth during the forecast period.

Flexible medical foam, a type of foam with remarkable properties such as flexibility and resilience, dominates The market. This foam is extensively used in the healthcare industry due to its ability to absorb energy, offer cushioning, and maintain its shape. Its applications span from medical devices and surgical beds to orthopedic products and wheelchair upholstery. The flexible foam sector can be segmented into various sub-categories, including polyurethane (PU), silicone, polyethylene, and polyvinyl chloride (PVC), based on composition, characteristics, and applications. PU foam, derived from petroleum, is a common type that provides excellent heat retention and biocompatibility, making it suitable for beds and cushioning in wheelchairs.

However, concerns regarding the ecological impact and sourcing of raw materials like toluene diisocyanate (TDI) and polyols have led to the exploration of sustainable alternatives, such as polyolefin foam and other advanced foam technologies. The aging population's increasing need for pressure ulcer prevention and patient comfort, as well as the rising demand for lightweight structures in medical devices, further fuel the market's growth. Additionally, the medical foam industry's manufacturing processes involve polymer foam fabrication, ensuring high-quality standards and safety measures. Despite the benefits, challenges such as the potential health risks associated with phosgene, a byproduct of TDI production, and the fluctuating oil prices remain.

The market continues to evolve, addressing these challenges and adhering to stringent regulations while catering to the diverse needs of healthcare providers and patients.

The Flexible foam segment was valued at USD 14.42 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

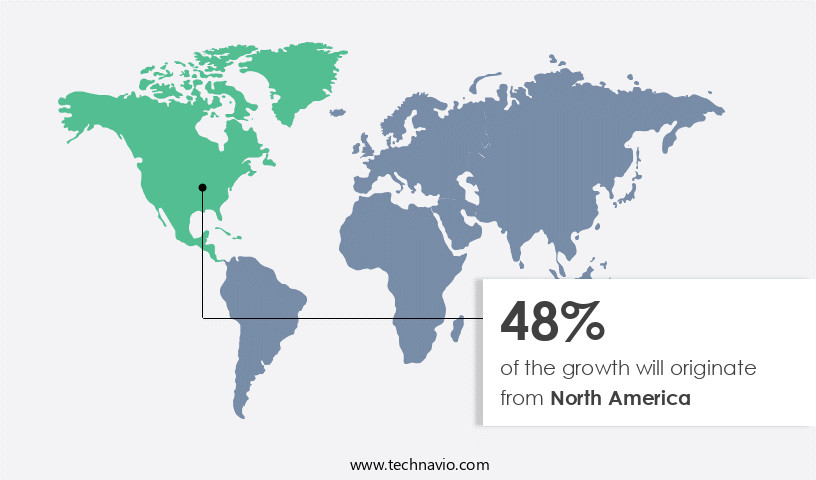

North America is estimated to contribute 48% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American market is a significant global player, with the US and Canada as key contributors. This market's growth is driven by the region's advanced healthcare system, which prioritizes technology and infrastructure advancements. Chronic diseases and an aging population increase the demand for medical foam products, used in various applications, including wound dressings, prosthetics, orthotics, medical bedding, mattresses, and patient positioning solutions. Medical foam comes in various types, such as synthetic latex, polyurethane, and polyolefin. Biocompatibility is crucial for medical foam, ensuring safety and patient comfort. Phosgene, a byproduct of TDI, is a concern for manufacturers, necessitating stringent safety measures during medical foam creation.

Wheelchairs, upholstery, and packaging solutions are other sectors utilizing medical foam for cushioning, sound absorption, and lightweight structures. Pressure ulcers are a significant issue, with medical foam's cushioning abilities essential in preventing their development. Sustainable alternatives to petroleum-based foam, like those derived from plant-based materials, are gaining popularity due to environmental concerns and increasing oil prices. Manufacturing and material sourcing are crucial aspects of the medical foam industry, with quality standards ensuring the production of safe and effective products. Medical foam is also used in implantable devices, respiratory devices, and surgical beds, highlighting its versatility. Polymeric isocyanates, such as TDI, are used in polymer foam fabrication.

However, concerns regarding the ecological impact and potential health risks associated with these chemicals persist. In conclusion, the North American the market is a thriving industry, driven by the region's advanced healthcare system and the increasing need for medical foam products due to chronic diseases and an aging population. The market's diversity, with applications ranging from wound care to orthopedic support, ensures its continued growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Medical Foam Industry?

- The significant surge in demand for medical foam in various wound care applications serves as the primary market driver.

- The market is experiencing significant growth due to its increasing application in wound care. This material is favored for wound care products due to its superior absorbency, effective fluid management, and soft cushioning properties. In healthcare, wound care is a crucial aspect, and the demand for efficient wound treatment solutions is escalating. Medical foam plays a vital role in promoting faster healing by absorbing exudate from wounds and maintaining a moist environment, which is essential for the overall healing process. The material's biocompatibility ensures a reduced risk of infection and enhances patient comfort. Synthetic latex foam and polyolefin foam are popular types of medical foam used in various applications, including beds, upholstery, wheelchairs, and padding.

- Additionally, medical foam is increasingly being used for sound absorption in healthcare settings. Adhering to stringent quality standards is essential to ensure the safety and effectiveness of medical foam products for healthcare providers and their patients.

What are the market trends shaping the Medical Foam Industry?

- The orthopedic industry is experiencing a rising demand for medical foam due to its increasing use in various applications. This trend is expected to continue in the upcoming market. A significant market development is the escalating need for medical foam in orthopedics.

- Medical foam is a vital component in orthopedic applications due to its unique characteristics and advantages. The demand for medical foam materials is growing rapidly in this sector, particularly for products designed to address orthopedic conditions or injuries. These foams offer superior cushioning, shock-absorption, and pressure distribution, making them ideal for various orthopedic procedures and devices. Polyurethane foam, memory foam, latex foam, viscoelastic foam, and polyethylene foam are commonly used medical foam materials. Their properties enable them to provide comfort, stability, and protection to patients. For instance, polyurethane foam is known for its excellent cushioning and durability, while memory foam conforms to the body shape for customized support.

- Latex foam offers elasticity and breathability, while viscoelastic foam responds to body heat for optimal pressure relief. Polyol, a key ingredient in foam production, can be derived from sustainable alternatives, such as castor oil, providing an eco-friendly alternative to petroleum-based foams like polystyrene. Advanced foam technologies continue to emerge, offering enhanced heat retention and other performance benefits. Medical foam materials are used in various applications, including arthritis aids, powered wheelchairs, and bedding, among others. Manufacturers prioritize material sourcing to ensure the highest quality and safety standards.

What challenges does the Medical Foam Industry face during its growth?

- Compliance and regulatory barriers pose a significant challenge to the growth of the industry. These obstacles necessitate adherence to stringent rules and regulations, which can impede innovation and growth. However, navigating these challenges requires a deep understanding of the regulatory landscape and a commitment to maintaining the highest standards of compliance. By staying informed and proactive, businesses can mitigate risks and position themselves for long-term success.

- Medical foam is a versatile material utilized in numerous medical applications, including wound dressings, prosthetics, and packaging. Its desirable characteristics, such as resilience, lightweight structure, and moisture resistance, make it an optimal choice for healthcare applications. However, regulatory compliance poses a significant challenge for manufacturers in The market. To ensure the safety and efficacy of medical foam in healthcare products, they must adhere to stringent safety and performance standards. This regulatory requirement adds complexity and cost to the production process. Additionally, the increasing elderly population and the growing prevalence of pressure ulcers necessitate the development of advanced medical foam solutions for improved patient care.

- Furthermore, the ecological impact of medical foam, particularly with regard to the use of materials like polyurethane foam and the production process involving toluene diisocyanate, is a concern for both manufacturers and consumers. Despite these challenges, the market continues to evolve, driven by the demand for safer, more effective, and more sustainable foam solutions.

Exclusive Customer Landscape

The medical foam market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the medical foam market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, medical foam market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - The company specializes in providing a range of advanced medical foam products, including Foam Tape 1773, Foam Tape 1772, and Foam Tape 1774W.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Advanced Medical Solutions Group Plc

- Avery Dennison Corp.

- BASF SE

- Draka Interfoam B.V.

- DuPont de Nemours Inc.

- Foamtec International WCC

- Freudenberg and Co. KG

- General Plastics Manufacturing Co. Inc.

- Global Medical Foam Inc.

- H.B. Fuller Co.

- Huntsman Corp.

- Recticel Group

- Rogers Corp.

- Sekisui Chemical Co. Ltd.

- Transcontinental Inc.

- Trelleborg AB

- UFP Technologies Inc.

- Vita Holdings Ltd.

- Zotefoams plc

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Medical Foam Market

- In February 2024, Medtronic plc, a global healthcare solutions company, announced the launch of its new foam dressing, Tegaderm Foam Plus, designed for the management of complex wounds. This innovative product offers advanced adhesive technology and improved conformability, addressing the unmet needs of patients with chronic or difficult-to-heal wounds (Medtronic Press Release, 2024).

- In October 2025, Smith & Nephew, a leading medical technology company, entered into a strategic partnership with Foamalatec GmbH, a German foam manufacturer. This collaboration aimed to expand Smith & Nephew's product portfolio by integrating Foamalatec's advanced foam technology into their wound care offerings (Smith & Nephew Press Release, 2025).

- In March 2024, 3M, a multinational conglomerate, completed the acquisition of Acelity, a leading wound care company, for approximately USD6.7 billion. This acquisition significantly strengthened 3M's position in the market by adding Acelity's extensive portfolio of advanced wound care products (3M Press Release, 2024).

- In June 2025, the U.S. Food and Drug Administration (FDA) approved ConvaTec Group plc's new foam dressing, XiaFoam, for the treatment of Stage II and III pressure ulcers. This approval marked a significant milestone for ConvaTec, as XiaFoam's unique formulation offers enhanced exudate absorption and reduced risk of skin damage (ConvaTec Press Release, 2025).

Research Analyst Overview

The market encompasses the manufacturing and fabrication of various types of foam used in healthcare applications, including synthetic latex foam, polyol-based foam, and petroleum-based foam. This sector caters to the demand for cushioning in respiratory devices, implantable devices, beds, wheelchairs, and medical devices. With the aging population's growth, the market for medical foam experiences significant traction, particularly in the areas of skin breakdown prevention and pressure ulcer management. Polymer foam fabrication processes utilize raw materials such as toluene diisocyanate (TDI) and phosgene, while benzene and toluene are employed as solvents. Healthcare providers and manufacturers face challenges in material sourcing due to fluctuating oil prices, which impact the cost of petroleum-based foam production.

As a result, there is a growing interest in alternative, eco-friendly foam solutions. Medical foam plays a crucial role in the comfort and functionality of various healthcare products, from cushioning in beds and wheelchairs to padding in arthritis aids and respiratory devices. By addressing the needs of an aging population and the challenges of material sourcing, the medical foam industry continues to evolve and adapt to meet the demands of the healthcare sector.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Medical Foam Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

224 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.8% |

|

Market growth 2025-2029 |

USD 12.38 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.1 |

|

Key countries |

US, China, Japan, Canada, Germany, UK, France, India, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Medical Foam Market Research and Growth Report?

- CAGR of the Medical Foam industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the medical foam market growth of industry companies

We can help! Our analysts can customize this medical foam market research report to meet your requirements.