Medicine And Engineering Integrated Education Market Size 2024-2028

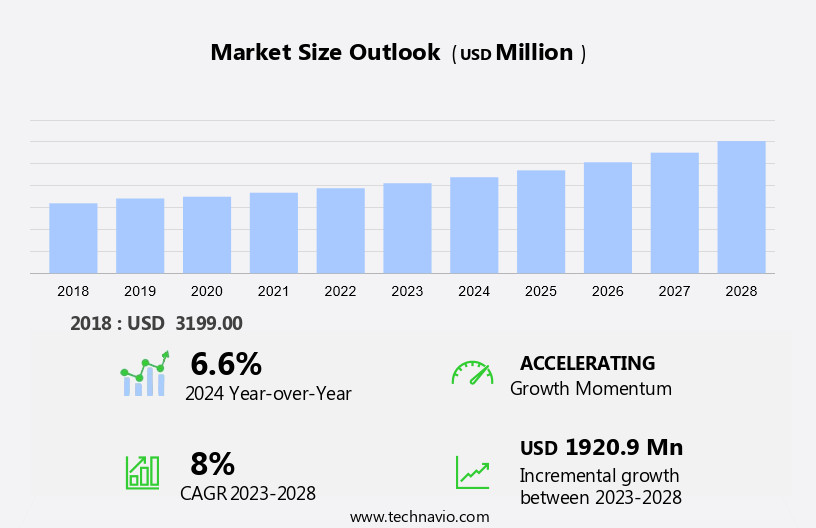

The medicine and engineering integrated education market size is forecast to increase by USD 1.92 billion at a CAGR of 8% between 2023 and 2028.

- The integrated education market at the intersection of medicine and engineering is witnessing significant growth, driven by several key factors. One of the primary drivers is the increasing adoption of this interdisciplinary approach in colleges and universities. This trend is fueled by the advancements in medical technology, which necessitate a better understanding of both fields to prepare students for the workforce. AI, VR, and AR technologies are revolutionizing medical training by offering innovative solutions to traditional teaching methods. Another growth factor is the high cost of medicine and engineering education, leading institutions to explore integrated programs to offer students more value. The report delves deeper into these trends and the challenges they present to the market. The high cost of education, for instance, may limit accessibility to this integrated learning, while the need for specialized faculty and resources can pose operational challenges. Nonetheless, the benefits of medicine and engineering integrated education, such as improved problem-solving skills and enhanced career prospects, make it a worthwhile investment for students.

What will be the Size of the Medicine And Engineering Integrated Education Market During the Forecast Period?

- The market represents a growing trend in graduate training, as both disciplines increasingly recognize the importance of interdisciplinary education in addressing complex problems facing contemporary society. This market encompasses various forms of integration, from joint degree programs to collaborative research initiatives, between medicine and engineering at the graduate level. Policy makers and educational institutions are raising awareness of the need for graduates with a deep understanding of the knowledge and skills required to tackle societal problems at the intersection of medicine and engineering. Interdisciplinary education in this context seeks to break down disciplinary boundaries, fostering collaboration between medical schools, engineering departments, and the social and behavioral sciences.

- Furthermore, integrated education in medicine and engineering addresses the need for graduates with a strong foundation in medical training and engineering principles, as well as the ability to apply these skills to real-world challenges. Relevant topics include medical ethics, cultural competency, health disparities, interprofessionalism, professionalism, empathy, altruism, clinical communication, and observation skills. This market is driven by the recognition that many of today's pressing issues, such as developing new medical technologies, addressing health disparities, and improving patient care, require a holistic approach that transcends traditional disciplinary boundaries. As a result, integrated education programs in medicine and engineering continue to gain traction and are expected to grow in popularity In the coming years.

How is this Medicine And Engineering Integrated Education Industry segmented and which is the largest segment?

The medicine and engineering integrated education industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Subjects

- Biomedical engineering

- Health informatics

- Clinical engineering

- Robotics in healthcare

- Courses

- Undergraduate programs

- Graduate programs

- Certificates and diplomas

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- APAC

- China

- India

- Japan

- South America

- Middle East and Africa

- North America

By Subjects Insights

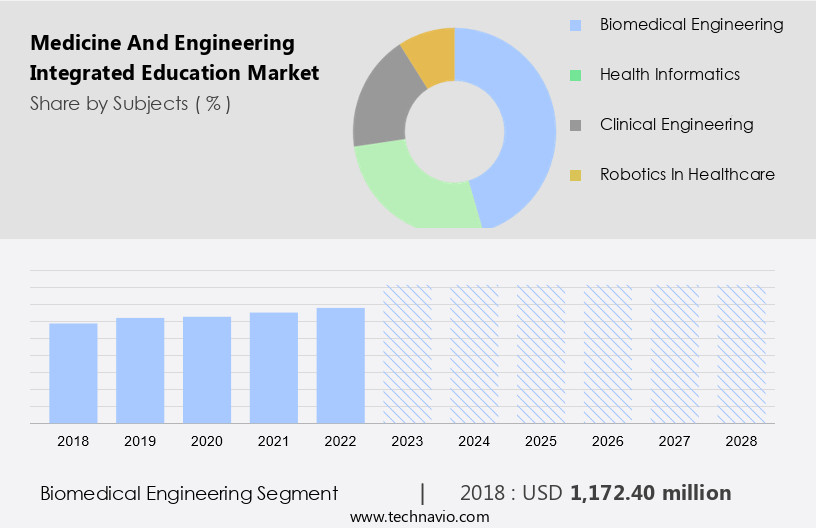

- The biomedical engineering segment is estimated to witness significant growth during the forecast period.

Biomedical engineering represents a pivotal intersection of engineering principles and medical sciences, dedicated to creating innovative healthcare solutions that tackle contemporary health issues. The interdisciplinary nature of this field bridges disciplinary boundaries, fostering collaboration between medical training and engineering education. This integration is essential for addressing complex problems, such as medical ethics, cultural competency, health disparities, and interprofessionalism, which transcend traditional medical teaching. The Institute for Biology, Engineering, and Medicine at Brown University In the US is a leading institution spearheading research collaborations in this domain. Established in October 2022, this institute was inspired by the COVID-19 pandemic, which underscored the need for a holistic approach to healthcare, combining experimentation, computational analysis, and clinical research.

Get a glance at the Medicine And Engineering Integrated Education Industry report of share of various segments Request Free Sample

The biomedical engineering segment was valued at USD 1.17 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

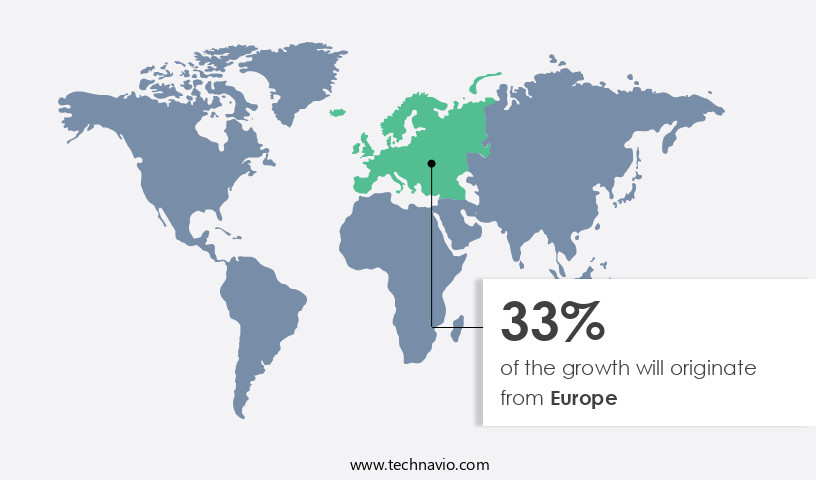

- Europe is estimated to contribute 33% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The integration of medicine and engineering education is gaining momentum in North America, driven by the increasing need for interdisciplinary professionals capable of addressing complex problems at the intersection of medical sciences and engineering technologies. This trend is fueled by the region's strong educational infrastructure and substantial investments in facilities. The US leads this industry, with universities and institutions expanding their offerings to meet the growing demand for integrated programs. For instance, UC Merced recently approved a new medical education building designed by ZGF, which will provide 203,500 square feet of space for instruction, research, and community engagement. This interdisciplinary education equips graduates with essential knowledge, skills, and awareness of contemporary problems that transcend disciplinary boundaries.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Medicine And Engineering Integrated Education Industry?

Increasing adoption of medicine and engineering integrated education in colleges is the key driver of the market.

- The integration of medicine and engineering education in graduate programs is gaining momentum due to the increasing complexity of contemporary problems in healthcare. This interdisciplinary approach ensures that graduates possess the necessary knowledge, skills, and awareness to tackle societal issues that transcend disciplinary boundaries. Policy makers recognize the importance of this integrative education in addressing medical training needs, particularly in areas such as medical ethics, cultural competency, health disparities, interprofessionalism, professionalism, empathy, and compassion fatigue. Engineering principles can enhance medical education by improving clinical communication, observation skills, and technology training. Medical students benefit from this approach during the knowledge-acquiring stage, as they learn to work in a team-oriented, systems practice environment.

- Furthermore, the economic evaluation of engineering-medicine education is based on the triple aims of better care, better health, and lower cost, which can lead to increased access, equity, and quality in healthcare. This trend is driven by the need to reform medical education and address healthcare spending and per capita expenditure, as well as healthcare inefficiency.

What are the market trends shaping the Medicine And Engineering Integrated Education Industry?

Development in medical technology is the upcoming market trend.

- The integration of engineering principles into medical education is addressing the complex problems of contemporary society by bridging disciplinary boundaries and providing interdisciplinary graduate training. This shift in education is essential as medical students face the challenge of addressing societal problems, such as health disparities, medical ethics, cultural competency, and professionalism. Engineering-medicine education is enhancing graduate education by fostering interprofessionalism, empathy, and altruism. AI-driven systems provide personalized learning experiences, real-time feedback, and adapt to individual student needs. Virtual reality simulations and machine learning models enable students to practice clinical skills in a risk-free environment, improving observation skills and decision-making abilities.

- In addition, these technologies also contribute to the triple aims of better care, better health, and lower cost by promoting quality, access, equity, and economic evaluation. The proposed curriculum for integrative graduate education in medicine and engineering includes technology training, team-approach training, and systems practice training. This approach prepares students for the demands of the healthcare industry by fostering a systems perspective and a holistic understanding of healthcare issues. The societal perspective and health economic grounds for medical education reforms are essential for addressing healthcare spending, per capita expenditure, and healthcare inefficiency.

What challenges does the Medicine And Engineering Integrated Education Industry face during its growth?

High cost of medicine and engineering integrated education is a key challenge affecting the industry growth.

- Integrated education in medicine and engineering is a specialized and costly endeavor, blending intensive medical training with advanced engineering coursework. Tuition fees for these programs can range from approximately USD 120,000 to USD 600,000 over four years, significantly higher than the average medical school education costing around USD 235,827. The additional engineering component escalates the overall expense. These high tuition costs stem from the need for specialized resources, expert faculty, and advanced facilities to deliver such comprehensive education. Policy makers recognize the importance of addressing complex problems in contemporary society through interdisciplinary education. Graduate training in medicine and engineering aims to equip students with the knowledge, skills, and awareness necessary to tackle societal issues at the intersection of these fields.

- Furthermore, this includes medical ethics, cultural competency, health disparities, interprofessionalism, professionalism, empathy, and compassion. Medical schools and engineering programs are increasingly embracing integration, incorporating social sciences, behavioral sciences, and other disciplines to better understand the societal context of medical care. The benefits of integrative graduate education include improved quality, access, equity, and economic evaluation. The triple aims of better care, better health, and lower cost are driving medical education transformation. Engineering principles offer valuable insights for addressing healthcare inefficiencies and improving healthcare spending on a per capita basis. Traditional medical teaching methods are being reevaluated, with proposed curricula emphasizing technology training, team-approach training, and systems practice training.

Exclusive Customer Landscape

The medicine and engineering integrated education market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the medicine and engineering integrated education market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, medicine and engineering integrated education market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bennett University

- Carle Illinois College of Medicine

- CBME, IIT Delhi

- Columbia University

- Duke University

- Eidgenossische Technische Hochschule Zurich

- IIT Madras

- Indian Institute of Technology Guwahati

- Institute of Science Tokyo

- Johns Hopkins Biomedical Engineering

- Korea Advanced Institute of Science and Technology

- Massachusetts Institute of Technology

- National University of Singapore

- NUS Graduate School

- shobhit institute of engineering and technology

- Stanford University

- Texas A and M University

- The University of Melbourne

- University of California

- University of Toronto

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The integration of medicine and engineering in graduate education has gained significant attention in recent years due to the complex problems that require interdisciplinary solutions. Graduate training in this interdisciplinary field is essential to prepare professionals with the necessary knowledge, skills, and awareness to address contemporary problems that transcend disciplinary boundaries. Policy makers recognize the importance of interdisciplinary education in addressing societal problems, particularly In the areas of medical training and engineering. Medical schools have begun to incorporate engineering principles into their curricula to improve the quality, access, and equity of healthcare. The awareness of the need for interdisciplinary education has led to an increasing demand for integrative graduate programs.

Moreover, these programs aim to provide students with a comprehensive understanding of medical ethics, cultural competency, health disparities, interprofessionalism, and professionalism. Moreover, engineering-medicine education is gaining traction due to its potential to improve the triple aims of better care, better health, and lower cost. The healthcare industry faces significant challenges, including inefficiency, high per capita expenditure, and economic evaluation. Medical education reforms have focused on integrating technology training, team-approach training, and systems practice training to prepare medical students for the complexities of modern healthcare. The traditional medical teaching model, which emphasizes rote memorization and clinical observation, is no longer sufficient in addressing the complex problems faced by healthcare professionals.

In addition, the proposed curriculum in interdisciplinary graduate education emphasizes the importance of empathy, altruism, clinical communication, observation skills, and compassion fatigue. These skills are crucial in providing high-quality care and preventing burnout among healthcare professionals. The societal perspective and health economic grounds of engineering-medicine education are essential in addressing healthcare spending and improving the overall efficiency of the healthcare system. Interdisciplinary education provides a unique opportunity to bridge the gap between engineering and medicine, leading to innovative solutions to complex problems.

Furthermore, interdisciplinary education provides students with the necessary knowledge, skills, and awareness to tackle societal problems and improve the quality, access, and equity of healthcare. The economic evaluation and societal perspective of engineering-medicine education are essential in addressing healthcare spending and improving the overall efficiency of the healthcare system. The proposed curriculum emphasizes the importance of empathy, professionalism, and teamwork in providing high-quality care and preventing burnout among healthcare professionals.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

200 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8% |

|

Market growth 2024-2028 |

USD 1.92 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.6 |

|

Key countries |

US, China, Germany, Canada, UK, India, Japan, France, The Netherlands, and Australia |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Medicine And Engineering Integrated Education Market Research and Growth Report?

- CAGR of the Medicine And Engineering Integrated Education industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the medicine and engineering integrated education market growth of industry companies

We can help! Our analysts can customize this medicine and engineering integrated education market research report to meet your requirements.