Metal Deactivator Market Size 2024-2028

The metal deactivator market size is forecast to increase by USD 399.1 million at a CAGR of 4.54% between 2023 and 2028.

- The market is driven by the increasing need for reliable machinery and effective maintenance in various industries. This requirement is leading to a growing demand for sustainable metal deactivators that can extend the lifespan of machinery and reduce downtime. Another key trend in the market is the focus on sustainable solutions, as metal forging deactivators that are eco-friendly and have a low environmental impact are gaining popularity. However, fluctuations in crude oil prices pose a significant challenge to the market. As metal deactivators are often derived from crude oil, price volatility can impact the cost of production and, consequently, the price of the final product.

- Companies seeking to capitalize on market opportunities and navigate challenges effectively should focus on developing sustainable and cost-effective metal deactivator solutions. Additionally, they should closely monitor crude oil prices and explore alternative raw materials to mitigate price risks. Overall, the market is expected to grow steadily, driven by the need for reliable machinery and the demand for sustainable solutions, while navigating the challenges posed by crude oil price fluctuations.

What will be the Size of the Metal Deactivator Market during the forecast period?

- The market is characterized by its continuous evolution, driven by the dynamic interplay of various factors. Performance testing and quality assurance are integral components of the industry, ensuring the effectiveness of metal deactivators in various applications. Environmental regulations, a critical influence, shape the market's direction, with a focus on eco-friendly solutions such as non-toxic additives and biodegradable materials. Surface treatments, including inorganic coatings and polymer coatings, play a significant role in metal deactivation and corrosion inhibition. Wear resistance and corrosion testing are essential to assess the efficiency of these treatments and maintain product durability. Manufacturing processes, industry standards, and regulatory compliance are also key considerations.

- Metalworking fluids, lubricating oils, and hydraulic fluids benefit from metal deactivation technologies, enhancing their performance and reducing friction. In the energy sector, metal deactivators contribute to the service life extension of equipment, preventing oxidation and ensuring optimal efficiency. Food processing, metal recycling, and the petrochemical industry are among the sectors that leverage metal deactivation and corrosion inhibition technologies for their unique requirements. Spectroscopic techniques, chemical analysis, and field trials are employed to assess the effectiveness of these solutions. Advanced materials, including additive manufacturing and organic coatings, are increasingly being adopted to address the evolving needs of the market.The ongoing development of chemical additives, chelating agents, and green technology further underscores the market's continuous dynamism.

How is this Metal Deactivator Industry segmented?

The metal deactivator industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Formulation

- Oil soluble

- Water soluble

- End-user

- Automotive

- Industrial

- Aviation

- Marine

- Others

- Geography

- North America

- US

- Europe

- Germany

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Formulation Insights

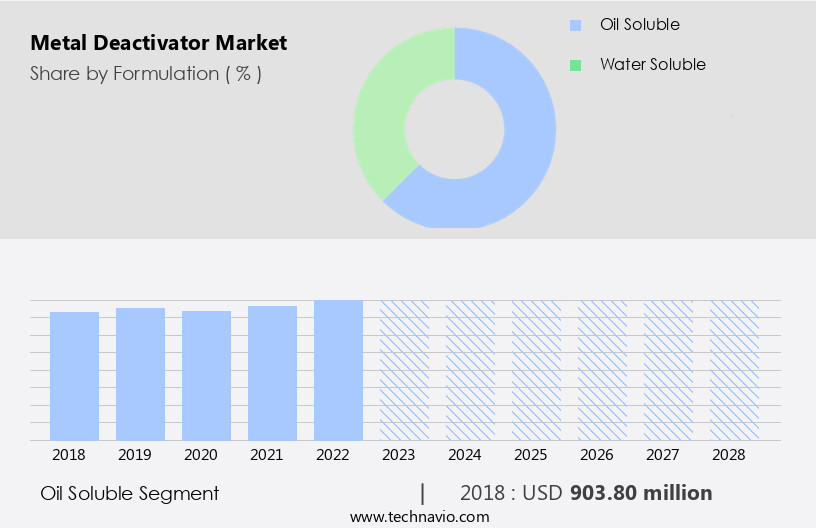

The oil soluble segment is estimated to witness significant growth during the forecast period.

The Oil soluble segment was valued at USD 903.80 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

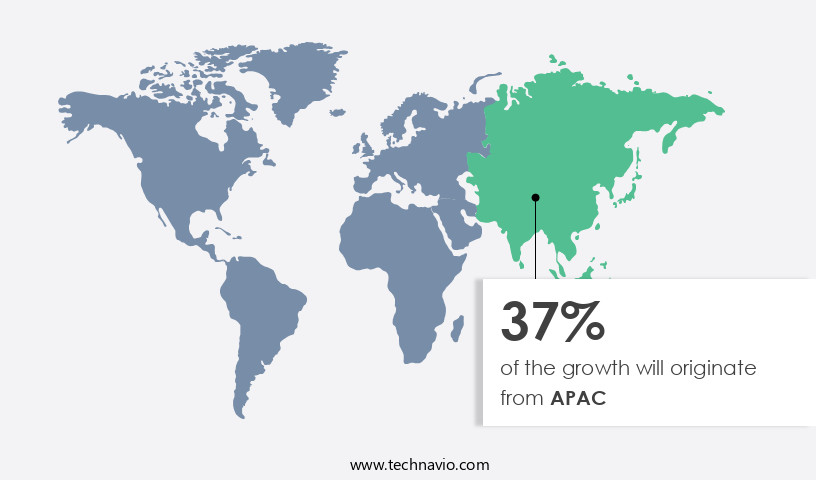

APAC is estimated to contribute 37% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in the Asia Pacific region is experiencing significant growth due to its extensive usage in various industries, including automotive, construction, and manufacturing. China, India, Japan, and South Korea are the primary contributors to the market's demand in this region, driven by their rapid industrialization and expanding business sectors. The automotive industry is the leading consumer of metal deactivators in APAC, with increasing sales of passenger and commercial vehicles in countries like China, India, and Japan. The market is characterized by its diversity, with numerous regional and local companies. Metal deactivators are essential in ensuring performance testing, lubricating oils, and quality assurance in manufacturing processes.

In the context of environmental regulations, metal deactivators play a crucial role in corrosion testing and corrosion inhibition. Surface treatments, such as metal passivation and inorganic coatings, employ metal deactivators for improved surface chemistry and regulatory compliance. Metalworking fluids, fuel additives, and hydraulic fluids also utilize metal deactivators for enhanced performance, friction reduction, and oxidation prevention. Advanced materials, such as polymer coatings and additive manufacturing, rely on metal deactivators for product durability and service life extension. The energy sector, including power generation and transmission, benefits from metal deactivators in water treatment and chemical processing. Corrosion control is another significant application area for metal deactivators, particularly in the food processing industry, where non-toxic additives are required.

Green technology and biodegradable additives are gaining popularity in the market due to their environmental benefits. Chemical analysis and metal analysis are essential in ensuring product specifications and maintaining regulatory compliance. In summary, the market in the Asia Pacific region is witnessing substantial growth due to its wide applicability across various industries and the increasing demand for performance enhancement, corrosion control, and regulatory compliance.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Metal Deactivator Industry?

- The escalating demand for dependable machinery and rigorous maintenance practices is the primary market motivator, underpinned by the importance of ensuring uninterrupted operations and productivity enhancement in industries.

- In the realm of industrial manufacturing, machine reliability is a critical factor in ensuring optimal performance and minimizing downtime. Poor lubrication, contamination, fatigue, and poor fitting are common issues that can negatively impact machine reliability. Neglecting lubrication, which accounts for about 36% of premature bearing failures, can lead to significant costs due to equipment replacement. Contamination, responsible for nearly 14% of bearing failures, is another significant concern, often resulting from poor seals or mishandling of lubricants. To address these challenges, advanced materials and chemical additives are being employed to improve product durability and reduce friction. Chemical analysis plays a crucial role in identifying the root causes of machine failures, enabling performance enhancement through targeted interventions.

- In metal processing, organic coatings and metal ions are utilized to protect against corrosion and wear. Water treatment solutions are also essential in maintaining equipment efficiency and longevity. Field trials and additive manufacturing techniques are increasingly being used to validate product specifications and improve overall performance. By focusing on these factors, manufacturers can ensure their machinery operates at peak efficiency and reliability.

What are the market trends shaping the Metal Deactivator Industry?

- The sustainable the market is experiencing increasing demand, representing a significant market trend. This trend reflects growing awareness and concern for environmental sustainability in various industries.

- The market is experiencing significant growth due to the increasing demand for sustainable solutions in various industries, particularly in fuel additives and hydraulic fluids. Environmental concerns and the need for eco-friendly alternatives are driving this trend. Sustainable metal deactivators, which are low in volatile organic compounds (VOCs) and derived from renewable resources, are gaining popularity. Strict regulations aimed at ensuring environmental sustainability are also pushing manufacturers to adopt more sustainable metal deactivator options. Compliance with these regulations not only helps companies avoid penalties but also enhances their reputation among consumers who prioritize sustainability. In the petrochemical industry, metal deactivators play a crucial role in service life extension and oxidation prevention.

- Chelating agents, a type of metal deactivator, are widely used in chemical processing to prevent corrosion and maintain equipment efficiency. Biodegradable additives, another type of sustainable metal deactivator, offer an environmentally friendly alternative to traditional metal deactivators. Overall, the market for metal deactivators is expected to continue growing as industries seek out more sustainable and compliant solutions.

What challenges does the Metal Deactivator Industry face during its growth?

- The volatility of crude oil prices poses a significant challenge to the growth of the industry.

- The market relies heavily on lubricating oils derived from crude oil processing through fractioning. The oil and gas industry serves as a significant supplier of these raw materials for metal deactivator manufacturing. However, volatility in global crude oil prices can negatively impact the cost of these raw materials, subsequently influencing the price of metal deactivator. For instance, the global crude oil prices surged in 2021 due to the accelerated COVID-19 vaccination rollout, the easing of pandemic restrictions, and the economic recovery. This led to a faster-than-anticipated increase in global petroleum demand, straining its supply. Quality assurance is crucial in the market, with industry standards mandating rigorous performance testing, corrosion testing, and corrosion inhibition.

- Surface treatments and wear resistance are essential factors in ensuring metal deactivator effectiveness. Environmental regulations also play a vital role in market dynamics, with manufacturers focusing on eco-friendly alternatives to traditional metal deactivators. In the food processing industry, metal deactivators are employed to prevent the formation of undesirable metal ions in food products, ensuring consumer safety and regulatory compliance. Manufacturing processes must adhere to stringent quality control measures to maintain the integrity of metal deactivator products. Corrosion inhibitors, a crucial component of metal deactivators, are subjected to extensive testing to ensure their effectiveness in various applications.

- Ensuring the highest standards of quality and performance is essential for market success in the competitive landscape of the metal deactivator industry.

Exclusive Customer Landscape

The metal deactivator market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the metal deactivator market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, metal deactivator market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ADEKA Corp. - The company specializes in providing metal deactivators for filled polymers, including the ADK STAB CDA-1, ADK STAB CDA-1M Blend, and ADK STAB ZS-27 Blend. These innovative solutions effectively manage metal contamination in polymer applications, enhancing product performance and durability. By utilizing advanced chemistry, these deactivators prevent detrimental reactions between metals and polymers, ensuring optimal production processes and end-product quality. With a commitment to research and development, the company continues to expand its offerings, delivering cutting-edge solutions to meet the evolving needs of various industries.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ADEKA Corp.

- Afton Chemical

- BASF SE

- Clariant AG

- Dorf Ketal Chemicals I Pvt. Ltd.

- Dow Inc.

- Eastman Chemical Co.

- Innospec Inc.

- Lanxess AG

- Mayzo Inc.

- Metall-Chemie Holding GmbH

- R.T. Vanderbilt Holding Co. Inc.

- SI Group Inc.

- Songwon Industrial Co. Ltd.

- The Lubrizol Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Metal Deactivator Market

- In February 2024, DuPont Sustainable Solutions, a leading provider of sustainable operating solutions, launched a new Metal Deactivator product named "DuPont Danisco PD-1." This innovative solution is designed to reduce metal corrosion in industrial water systems, thereby increasing equipment efficiency and reducing downtime (DuPont Press Release, 2024).

- In August 2025, BASF SE, the world's largest chemical producer, announced a strategic partnership with a leading oil and gas company, Shell, to co-develop and commercialize a new Metal Deactivator technology. This collaboration aims to provide enhanced corrosion protection for oil and gas infrastructure, contributing to the industry's sustainability efforts (BASF Press Release, 2025).

- In December 2024, Nouryon, a specialty chemicals company, completed the acquisition of the Metal Deactivator business from AkzoNobel. This acquisition strengthened Nouryon's position in the market and expanded its product portfolio, enabling the company to offer a broader range of corrosion inhibitor solutions to its customers (Nouryon Press Release, 2024).

- In March 2025, the European Union (EU) approved the use of a new Metal Deactivator, "Eco-Corr XT," produced by Solvay, for use in cooling water systems. This approval marked a significant milestone in the adoption of environmentally friendly Metal Deactivators, as Eco-Corr XT is a biodegradable and non-toxic alternative to traditional corrosion inhibitors (Solvay Press Release, 2025).

Research Analyst Overview

In the dynamic the market, two primary types of corrosion - pitting and crevice - pose significant challenges for refining processes and various industrial applications. Corrosion prevention remains a critical focus, especially in agriculture, where metal stability is essential for equipment longevity. Material science continues to advance, with corrosion mechanisms such as oxidant stability and hydrolytic stability under close scrutiny. Stainless steel and corrosion-resistant alloys are popular solutions, but surface passivation and alloy formulations must ensure both storage stability and thermal stability for optimal product performance. Pipeline protection and high-temperature applications demand metal preservation in extreme environments, where galvanic corrosion and stress corrosion cracking can lead to costly damage.

Marine environments, with their unique challenges, require metal stability and hydrolytic stability for extended shelf life. Understanding the intricacies of metal deactivator technology in these diverse applications is crucial for US business readers seeking to optimize their operations and maintain competitive edge.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Metal Deactivator Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

212 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.54% |

|

Market growth 2024-2028 |

USD 399.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.26 |

|

Key countries |

US, China, India, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Metal Deactivator Market Research and Growth Report?

- CAGR of the Metal Deactivator industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the metal deactivator market growth of industry companies

We can help! Our analysts can customize this metal deactivator market research report to meet your requirements.