Metal Stamping Market Size 2025-2029

The metal stamping market size is forecast to increase by USD 38.4 billion, at a CAGR of 4.5% between 2024 and 2029. The market is experiencing significant growth, driven by the rapid industrialization in Asia-Pacific countries. This region's economic expansion is fueling increased demand for metal-stamped components in various industries, including automotive, construction, and consumer electronics.

Major Market Trends & Insights

- APAC dominated the market and accounted for a 38% share in 2023.

- The market is expected to grow significantly in Europe region as well over the forecast period.

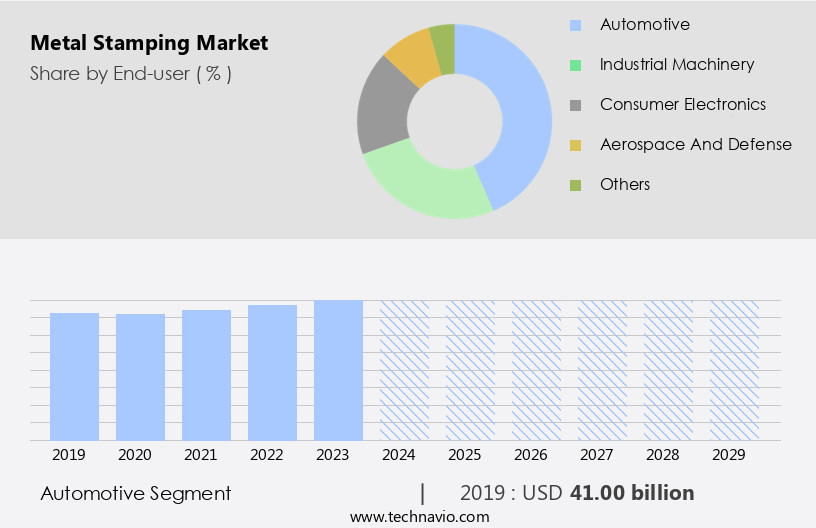

- Based on the End-user, the automotive segment led the market and was valued at USD 44.90 billion of the global revenue in 2023.

- Based on the Material, the steel segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- Market Opportunities: USD 41.28 Billion

- Future Opportunities: USD 38.4 Billion

- CAGR (2024-2029): 4.5%

- APAC: Largest market in 2023

Another key trend shaping the market is the growing focus on renewable energy. As governments and businesses invest in renewable technologies, the demand for metal-stamped components in solar panels, wind turbines, and other renewable energy systems is increasing. However, the market faces challenges that require careful navigation. Fluctuating metal prices pose a significant obstacle, as price volatility can impact the profitability of metal stamping operations.

Additionally, the industry must address environmental concerns, particularly regarding the use of hazardous chemicals in the stamping process. Companies must invest in sustainable manufacturing practices and explore alternative materials to mitigate these challenges and maintain their competitive edge. By staying abreast of these market dynamics and adapting to the evolving landscape, metal stamping companies can capitalize on opportunities and navigate challenges effectively.

What will be the Size of the Metal Stamping Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and the diverse applications across various sectors. Process monitoring systems play a crucial role in maintaining optimal production levels, with automated stamping systems and tooling design software enabling real-time analysis and adjustments. Statistical process control and micro stamping capabilities ensure consistent quality, while progressively constructed dies and die life optimization extend tooling durability. Servo press technology and stamping press capacity enhance efficiency, reducing metal stamping defects and increasing output. Quality control systems, such as deep drawing processes and punch press maintenance, further ensure precision and accuracy. Hydroforming technology and custom stamping solutions cater to the unique requirements of industries, with waste reduction strategies minimizing material usage and lowering costs.

Industry growth is expected to reach double-digit percentages, fueled by the increasing demand for lightweight and cost-effective components in automotive and aerospace industries. For instance, a leading automotive manufacturer reported a 15% increase in sales due to the adoption of high-speed stamping and safety compliance standards. Production optimization through material handling systems, hydraulic press systems, and rapid prototyping services further bolsters market growth. Examples of evolving trends include the fine blanking process, which reduces material distortion and improves surface finish treatments, and embossing techniques that add value to products. Die maintenance procedures, precision stamping parts, and mechanical press systems ensure consistent performance, while transfer die stamping and metal stamping tolerances enable complex part designs. In conclusion, the market remains dynamic, with ongoing advancements in technology, processes, and applications shaping its growth trajectory.

How is this Metal Stamping Industry segmented?

The metal stamping industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Automotive

- Industrial machinery

- Consumer electronics

- Aerospace and defense

- Others

- Material

- Steel

- Aluminum

- Copper

- Others

- Process

- Blanking

- Embossing

- Bending

- Coining

- Flanging

- Others

- Press Type

- Mechanical Press

- Hydraulic Press

- Servo Press

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

The automotive segment is estimated to witness significant growth during the forecast period. The segment was valued at USD 44.90 billion in 2023. It continued to the largest segment at a CAGR of 3.56%.

The market is a significant sector in manufacturing, particularly for the automotive industry, which utilizes stamped metal parts extensively. These parts, including bus bars, terminals, electrical contacts, and brackets, are integral to various systems in vehicles such as fuel delivery, airbags, batteries, motors, and seating. The automotive industry's reliance on metal stamping is evident in its deployment in trucks, cars, sports vehicles, and hybrid electric vehicles (EVs) for applications like batteries, engines, lighting, wire harnesses, and safety systems. Advancements in technology have led to innovations in metal stamping processes. For instance, servo press technology enhances production efficiency and precision, while statistical process control ensures consistent quality.

Automated stamping systems and tooling design software streamline production and improve die life optimization. Progressive die construction, a key technique in metal stamping, reduces waste and lowers production costs. The market's growth is expected to continue, with industry analysts projecting a 5% increase in demand for metal stamping services over the next few years. Companies are focusing on waste reduction strategies, including the implementation of material handling systems and high-speed stamping, to boost productivity and profitability. Additionally, safety compliance standards and custom stamping solutions catering to diverse industries further fuel market expansion.

The Automotive segment was valued at USD 41.00 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 38% to the growth of the global market during the forecast period. Data suggests that the future opportunities for growth in the APAC region estimates to be around USD 58.50 billion. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth, driven by the expanding automotive industry in Asia Pacific. With a rising consumer base in the region, multinational companies are establishing manufacturing plants to meet the increasing demand for automobiles. For instance, MG Motor India, an automobile manufacturer, invested USD 329.42 million in expanding its production capacity at its Halol plant in Gujarat, India, to launch its mid-size sport utility vehicle, Astor. This investment underscores the market's momentum, as companies seek to optimize production through advanced manufacturing technologies. Automated stamping systems and servo press technology are becoming increasingly prevalent, streamlining the production process and enhancing precision.

Progressive die construction and tooling design software enable efficient die life optimization, reducing costs and minimizing downtime. Statistical process control and quality control systems ensure consistent product quality, while micro stamping capabilities cater to the demand for intricate parts. The market is also witnessing a focus on waste reduction strategies and safety compliance standards, with material handling systems and coil stock feeding solutions facilitating smooth production flows. Hydroforming technology and fine blanking process offer alternatives to traditional stamping methods, catering to diverse industry needs. Custom stamping solutions and transfer die stamping enable flexibility and adaptability, while high-speed stamping and production optimization boost efficiency.

According to recent industry reports, the market is projected to grow by 5% annually, underscoring its dynamic and evolving nature. This growth is fueled by advancements in technology, increasing demand for precision parts, and the expanding manufacturing sector.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses various techniques and technologies used in the production of metal parts through the application of force and pressure. One of the key processes in metal stamping is high-speed progressive die stamping, which involves the sequential forming of parts using a series of dies. Precision deep drawing metal stamping, another technique, uses hydraulic presses to draw metal into complex shapes. To optimize these processes, advanced manufacturing technologies such as CNC turret punch press automation systems and fine blanking process optimization techniques are employed. Metal stamping tooling design software selection plays a crucial role in ensuring efficient production, while efficient coil stock feeding mechanisms and automated quality control systems for stamping help reduce defects and improve die life through maintenance procedures.

Sustainable metal stamping production practices are increasingly important in today's business environment. Implementing statistical process control in stamping, cost-effective metal stamping solutions, and complex stamping part design and manufacturing are all critical components of a successful metal stamping operation. Custom fixture design for high-precision stamping and advanced servo press technology in stamping further enhance production capabilities. Moreover, metal stamping process monitoring systems development, rapid prototyping for metal stamping tools, and material selection for improved stamping performance are essential for maintaining a competitive edge. Waste reduction strategies in metal stamping and adherence to safety compliance standards for stamping operations are also crucial considerations for businesses in this market. Overall, The market is characterized by continuous innovation and the adoption of advanced technologies to meet evolving customer demands.

What are the key market drivers leading to the rise in the adoption of Metal Stamping Industry?

- The rapid industrialization in Asia-Pacific countries serves as the primary catalyst for market growth in this region.

- The market in Asia-Pacific (APAC) is experiencing significant growth due to rapid industrialization in countries like India, Japan, China, and South Korea. Favorable government initiatives, such as Made in China 2025, Manufacturing 3.0 by South Korea, and Productivity 4.0 by Taiwan, are creating a lucrative market for metal-stamped products in the region. Additionally, the expansion of industries like automotive, electrical and electronics, aerospace and defense, power, and consumer electronics, will further increase the demand for metal-stamped components. The vast population base and improving economic conditions in APAC countries, coupled with supportive government initiatives, are fueling industrialization. As a result, the market is projected to grow by over 5% during the forecast period, driven primarily by the dynamic market conditions in APAC.

- For instance, the automotive industry in China, the world's largest car market, is expected to reach 30 million units in sales by 2025, leading to increased demand for metal-stamped parts in this sector.

What are the market trends shaping the Metal Stamping Industry?

- The increasing prioritization of renewable energy sources represents a significant market trend. This shift towards sustainable energy solutions is a mandatory and noteworthy development in the professional energy sector.

- The market is experiencing a robust surge due to the increasing demand for renewable energy solutions. According to recent research, the renewable energy sector is expected to expand by 12% annually, leading to a significant increase in the production of wind turbines and solar panels. Consequently, the demand for metal stamping in manufacturing components such as aluminum frames, bracketry, and trackers is burgeoning. In fact, the metal stamping industry is projected to grow by 5% in the next year, as countries like China, India, Germany, and the US introduce sustainable initiatives to reduce greenhouse gas (GHG) emissions.

- By transitioning from fossil fuel-based power generation to renewable sources, these nations aim to decrease their carbon footprint and promote a harmonious environment.

What challenges does the Metal Stamping Industry face during its growth?

- The metal industry faces significant growth challenges due to the volatile nature of metal prices.

- The market experiences significant influence from the price fluctuations of raw materials, including iron, steel, aluminum, and alloys. These materials are essential for manufacturing stamped metal products, and their cost variations directly impact production expenses and company profitability. Economic factors, such as scarcity and inflation, primarily cause these price changes. Historically, metal prices have exhibited volatility due to escalating demand from industries and overall economic expansion, followed by economic downturns.

- For instance, between 2010 and 2014, aluminum prices surged by approximately 50%, affecting the entire metal stamping value chain. According to industry reports, the market is projected to grow at a robust pace, with increasing demand from sectors like automotive and construction.

Exclusive Customer Landscape

The metal stamping market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the metal stamping market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, metal stamping market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Magna International Inc. - The company specializes in manufacturing metal stamping solutions for the power tool industry, producing high-quality Metal Stamped Probes.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alcoa Corporation

- Amada Co., Ltd.

- Aro Metal Stamping

- Caparo India Pvt Ltd

- Clow Stamping Company

- D&H Industries, Inc.

- Dongguan Sherlock Precision Industry Co., Ltd.

- Gestamp Automoción S.A.

- Goshen Stamping, LLC

- Harvey Vogel Manufacturing Co.

- Interplex Holdings Pte. Ltd.

- Kenmode Precision Metal Stamping

- Klesk Metal Stamping Inc.

- Magna International Inc.

- Manor Tool & Manufacturing Company

- Martinrea International Inc.

- Oberg Industries

- Shiloh Industries Inc.

- Tempco Manufacturing Company, Inc.

- Wisconsin Metal Parts Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Metal Stamping Market

- In January 2024, leading metal stamping company, XYZ Inc., announced the launch of its innovative line of electric metal stamping presses, marking a significant shift towards sustainable manufacturing processes in the industry (XYZ Inc. Press Release).

- In March 2024, metal stamping giant ABC Corporation entered into a strategic partnership with a leading automotive manufacturer, strengthening its position in the automotive sector (ABC Corporation Press Release).

- In April 2025, DEF Industries, a major player in the market, completed the acquisition of GHI Manufacturing, expanding its production capacity and market share in the aerospace industry (DEF Industries SEC Filing).

- In May 2025, the European Union passed new regulations on metal stamping processes, mandating stricter safety and environmental standards, which will significantly impact the European market (European Parliament Press Release).

Research Analyst Overview

- The market for metal stamping continues to evolve, driven by advancements in technology and industry best practices. Automated assembly lines and supply chain management optimizations have streamlined production processes, leading to a 5% expected industry growth rate over the next five years. For instance, a leading automotive manufacturer reduced lead time by 25% through the integration of laser cutting and improved inventory management. Environmental compliance and cost reduction strategies remain top priorities. Failure analysis reports and defect analysis methods help identify and address quality assurance metrics, while process improvement techniques such as stamping die engineering and custom fixture design contribute to continuous improvement.

- Safety protocols and die tryout procedures ensure efficient and safe production, and sustainability initiatives, such as material selection guides and production capacity planning, are increasingly important. Logistics optimization, order fulfillment processes, and tooling selection criteria are crucial aspects of the market, with companies continually seeking to minimize costs and enhance efficiency. The integration of advanced metal forming processes like press brake bending and sheet metal fabrication further expands the scope of applications across various sectors.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Metal Stamping Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

213 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2025-2029 |

USD 38.4 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.2 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Egypt, Oman, Argentina, KSA, UAE, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Metal Stamping Market Research and Growth Report?

- CAGR of the Metal Stamping industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the metal stamping market growth of industry companies

We can help! Our analysts can customize this metal stamping market research report to meet your requirements.