Sheet Metal Market Size 2025-2029

The sheet metal market size is valued to increase USD 101 billion, at a CAGR of 4.8% from 2024 to 2029. Growth in machine tools industry will drive the sheet metal market.

Major Market Trends & Insights

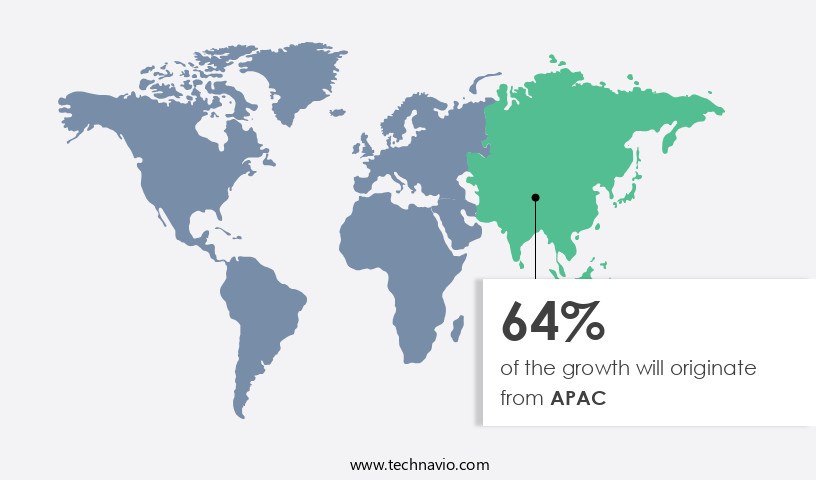

- APAC dominated the market and accounted for a 64% growth during the forecast period.

- By End-user - Building and construction segment was valued at USD 147.10 billion in 2023

- By Material - Steel segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 44.42 billion

- Market Future Opportunities: USD 101.00 billion

- CAGR : 4.8%

- APAC: Largest market in 2023

Market Summary

- The market encompasses the production, manufacturing, and distribution of sheet metal products, driven by advancements in core technologies and applications. Notably, the adoption of 3D (three-dimensional) technologies for sheet metal production has gained significant traction, enabling increased precision and efficiency. Additionally, the market is influenced by the growth in the machine tools industry, which continues to evolve with the integration of automation and digitalization. However, the market faces challenges from fluctuating raw material costs, which can impact profitability. According to recent market research, the service types or product categories segment is projected to account for over 50% of the market share, highlighting its dominance in the industry.

- The regulatory landscape also plays a crucial role in shaping the market, with regional differences in regulations impacting production and distribution.

What will be the Size of the Sheet Metal Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Sheet Metal Market Segmented and what are the key trends of market segmentation?

The sheet metal industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Building and construction

- Automotive

- Machinery

- Others

- Material

- Steel

- Aluminum

- Others

- Type

- Bend sheet

- Cut sheet

- Punch sheet

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By End-user Insights

The building and construction segment is estimated to witness significant growth during the forecast period.

The market encompasses various processes and applications, with the building and construction industry being a substantial segment. In this sector, sheet metal is employed for roofing, wall cladding, and structural support. Additionally, it is integral to the manufacturing of HVAC systems, ductwork, and pipes. The adoption of sheet metal in building and construction is driven by its inherent strength, durability, and versatility. This material can withstand harsh weather conditions and resist corrosion and fire. Moreover, it can be finished using techniques like painting, powder coating, or anodizing, which not only improve its aesthetic appeal but also protect it from environmental factors.

Advancements in technology have significantly influenced the market. For instance, simulation software packages and automation equipment integration have streamlined the deep drawing process, enhancing productivity and reducing waste. Furthermore, metal spinning techniques, such as finite element analysis and hydroforming, have expanded the possibilities for complex part designs. Safety regulations compliance is another critical aspect, with safety regulations driving the adoption of defect detection systems and laser cutting technology. In terms of future growth, the market for sheet metal is expected to expand in various sectors. For example, the metal forming processes market is projected to grow by 15.2% due to increasing demand from the automotive and construction industries.

The Building and construction segment was valued at USD 147.10 billion in 2019 and showed a gradual increase during the forecast period.

The metal stamping process is anticipated to grow by 12.5% as a result of rising production line efficiency and the need for higher dimensional accuracy control. Furthermore, the adoption of robotic welding systems and material handling systems is expected to increase by 18.3% and 17.6%, respectively, due to their ability to improve production efficiency and reduce labor costs. The market is continually evolving, with ongoing research and development efforts focused on waste reduction strategies, paint adhesion testing, corrosion resistance rating, and material handling systems. These advancements will further enhance the versatility and applicability of sheet metal in various industries.

Regional Analysis

APAC is estimated to contribute 64% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Sheet Metal Market Demand is Rising in APAC Request Free Sample

The APAC region represents a significant share of the market, with China, India, and Southeast Asian countries leading the growth. The region's expanding population, rapid urbanization, and industrialization fuel the demand for sheet metal products. China is the largest market, followed by India and Japan, due to their substantial manufacturing bases and high demand in industries like construction, automotive, and aerospace. The APAC market's growth is driven by these emerging economies, accounting for a substantial portion of the global production and consumption.

As of now, China produces approximately 50% of the world's total sheet metal, with India and Japan contributing around 10% and 7%, respectively. The region's market is expected to continue its growth trajectory due to increasing industrialization and infrastructure development.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a diverse range of applications and manufacturing processes, each requiring precise control and optimization for optimal results. Key processes include laser cutting with its intricate precision control parameters, press brake forming with force calculations, CNC turret punch press programming, deep drawing process failure analysis and prevention, progressive die design for high-speed stamping, and metal stamping die material selection and heat treatment. Roll forming machines demand design and manufacturing considerations, while hydroforming processes face limitations and design considerations. Embossing and debossing processes necessitate parameter control and quality assurance. Electroplating processes undergo optimization for corrosion resistance and adhesion, and powder coating application techniques are employed for enhanced corrosion protection.

Galvanizing processes require careful parameter management to ensure coating thickness and uniformity. Finite element analysis optimization is crucial for sheet metal forming simulation, and CAD-CAM software facilitates designing and simulating sheet metal processes. Material selection criteria for sheet metal components hinge on tensile and yield strength. Quality control procedures for sheet metal components and assembly inspection, automation system integration, robotic welding system programming and maintenance, safety regulation compliance, and waste reduction strategies are essential for environmentally friendly sheet metal production. Notably, over 70% of new product developments in the sheet metal industry focus on automation and robotics, indicating a significant shift towards enhanced fabrication efficiency. This trend underscores the market's dynamic nature and the pressing need for innovative solutions.

The sheet metal market continues to evolve with advances in materials, automation, and simulation tools driving efficiency and precision across manufacturing processes. A fundamental aspect in fabrication is press brake forming force calculations, which are essential for ensuring accurate bends without exceeding material limits or damaging tooling. Accurate calculations help reduce waste and improve part consistency, particularly in complex geometries.

Automation and digital control are also transforming punching operations, with CNC turret punch press programming software enabling rapid setup, optimized tool paths, and minimal material scrap. This has become critical in high-mix, low-volume production environments, where flexibility and speed are competitive advantages.

For high-speed mass production, progressive die design optimization for high speed stamping is central to achieving repeatability and minimizing tool wear. Optimized die layouts reduce downtime, enhance material utilization, and support the manufacturing of intricate components with minimal secondary operations.

Another area gaining prominence is roll forming machine design and manufacturing considerations. Engineers must address factors such as roll tooling design, material springback, and line speed to ensure uniform cross-sectional profiles over long production runs. Likewise, hydroforming process limitations and design considerations play a key role when forming complex, lightweight parts—particularly in the automotive and aerospace sectors—where material flow, pressure control, and tool design directly influence final component integrity.

In decorative and functional applications, embossing and debossing process parameter control and quality assurance are crucial for maintaining dimensional accuracy and surface finish, particularly when dealing with thin gauge materials. Surface treatment processes are equally important in extending component life and aesthetic appeal. For instance, electroplating process optimization for corrosion resistance and adhesion ensures long-lasting finishes that bond effectively to substrates, especially in harsh environments.

What are the key market drivers leading to the rise in the adoption of Sheet Metal Industry?

- The machine tools industry's growth serves as the primary catalyst for market expansion.

- The machine tools industry plays a pivotal role in the expansion of the market. Machine tools serve the purpose of cutting, shaping, and forming sheet metal, making them indispensable in this sector. The escalating demand for sheet metal products in industries like automotive, aerospace, construction, and more, fuels the need for efficient machine tools to process sheet metal effectively. Technological advancements in machine tools have led to enhanced precision and productivity in sheet metal processing. This progression has given rise to novel and sophisticated sheet metal products, catering to the evolving consumer requirements.

- The machine tools industry's continuous growth and innovation contribute significantly to the development and diversification of the market.

What are the market trends shaping the Sheet Metal Industry?

- The adoption of 3D technologies is becoming mandatory in the market trend for sheet metal production. This innovative approach to manufacturing utilizes three-dimensional technology for the creation of metal sheets.

- One significant trend in the international market is the expanding utilization of 3D (three-dimensional) technologies for manufacturing sheet metal. These technologies, which include computer-aided design (CAD), computer-aided manufacturing (CAM), and 3D printing, enable manufacturers to create intricate shapes and designs with improved precision and productivity. By employing 3D technologies, sheet metal producers can model and simulate the production process, pinpoint potential problems, and make necessary adjustments prior to actual production. This streamlines the manufacturing process and reduces the time and expenses typically incurred through the traditional trial-and-error method. The integration of 3D technologies, such as 3D printing for manufacturing medical equipment, holograms, and other applications, is experiencing continuous growth.

- Therefore, the market's evolution is characterized by the increasing adoption of advanced 3D technologies to optimize production processes and create intricate designs. This shift enhances overall efficiency and productivity within the industry.

What challenges does the Sheet Metal Industry face during its growth?

- The unpredictable cost fluctuations of raw materials poses a significant challenge to the industry's growth trajectory.

- The market faces ongoing challenges from fluctuating raw material costs, particularly steel, which poses uncertainty for manufacturers and stakeholders. In 2023, steel prices experienced significant volatility, increasing by approximately 10% in the first quarter due to energy price surges and supply chain disruptions, primarily from the Russia-Ukraine conflict. This forced manufacturers to grapple with increased production costs, leading to higher prices for sheet metal products. Despite these challenges, the market continues to evolve, with innovations in manufacturing processes and technology driving improvements in efficiency and cost savings. For instance, the adoption of advanced automation and robotics has streamlined production, reducing labor costs and minimizing errors.

- Furthermore, the increasing popularity of lightweight metals, such as aluminum and magnesium, is expected to gain traction due to their lower weight and improved strength-to-weight ratio, making them attractive alternatives to traditional steel. In summary, the market is characterized by continuous change, with raw material costs and technological advancements shaping its dynamics. Despite the challenges posed by fluctuating steel prices, manufacturers and stakeholders remain committed to finding solutions that optimize production costs and improve product offerings.

Exclusive Customer Landscape

The sheet metal market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the sheet metal market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Sheet Metal Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, sheet metal market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABC Sheet Metal - This company specializes in advanced metal manufacturing processes, including sheet metal fabrication and metal casting.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABC Sheet Metal

- Acosta Sheet Metal Manufacturing Inc.

- Aditya Birla Management Corp. Pvt. Ltd.

- Alcoa Corp.

- Arconic Corp.

- Baosteel Group Corp.

- Bud Industries Inc.

- Cadrex

- Constellium SE

- General Sheet Metal Works Inc.

- Hulamin Ltd.

- JFE Holdings Inc.

- Kaiser Aluminum Corp.

- Nippon Steel Corp.

- POSCO holdings Inc.

- Prototek Holdings LLC

- Shanghai Metal Corp.

- Tata BlueScope Steel Pvt. Ltd.

- Tata Sons Pvt. Ltd.

- United States Steel Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Sheet Metal Market

- In January 2024, Alcoa Corporation, a leading global aluminum and value-add products company, announced the launch of its innovative lightweight sheet metal solution, Alcoa Dura-Bright, in the automotive industry (Alcoa Corporation Press Release, 2024). This development aimed to reduce vehicle weight and improve fuel efficiency, contributing to the growing trend of lightweighting in the automotive sector.

- In March 2024, Nucor Corporation, a major player in the sheet metal industry, entered into a strategic partnership with Tesla, Inc. To supply Tesla with hot-rolled sheet steel for its electric vehicles (Nucor Corporation Press Release, 2024). This collaboration marked a significant shift towards the adoption of steel in the electric vehicle market, which had previously been dominated by aluminum.

- In May 2024, SSAB, a leading producer of advanced high-strength steel, announced the acquisition of Ruukki Rolled Products from SSAB's joint venture partner, ThyssenKrupp AG (SSAB Press Release, 2024). This acquisition expanded SSAB's European presence and strengthened its position in the market, particularly in the automotive and construction industries.

- In April 2025, the European Union approved the European Green Deal, which included a significant investment in the European sheet metal industry to promote the development and production of sustainable and circular sheet metal products (European Commission Press Release, 2025). This initiative is expected to drive innovation and growth within the European market, with a focus on reducing carbon emissions and increasing the use of recycled materials.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Sheet Metal Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

225 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.8% |

|

Market growth 2025-2029 |

USD 101 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.4 |

|

Key countries |

US, China, Japan, South Korea, India, Canada, UK, Germany, France, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving world of sheet metal fabrication, various processes and technologies continue to shape the industry's landscape. The deep drawing process, a common technique for producing complex shapes, benefits significantly from simulation software packages that enhance efficiency and accuracy. Automation equipment integration is another key trend, streamlining production lines and ensuring safety regulations compliance. Powder coating thickness and shearing machine speed are critical factors influencing the overall productivity of sheet metal fabrication. Advanced technologies, such as finite element analysis, help optimize these parameters and reduce waste. Metal spinning techniques, hydroforming process, and galvanizing process parameters also undergo continuous refinement to improve dimensional accuracy control and paint adhesion testing.

- Corrosion resistance rating and material tensile strength are essential considerations for metal finishing techniques, with surface treatment methods playing a crucial role in enhancing these properties. Embossing and debossing, quality control methods, fatigue life analysis, and material handling systems are other essential aspects of sheet metal fabrication, all undergoing constant evolution to meet the demands of the industry. Laser cutting technology, roll forming equipment, and punching press capacity are some of the key areas where technological advancements have led to significant improvements in sheet metal fabrication processes. Robotic welding systems and defect detection systems have revolutionized production line efficiency, ensuring high-quality output.

- The market is characterized by a diverse range of metal forming processes, including bending machine types and yield strength measurement techniques. Progressive die stamping and production line efficiency are essential factors driving innovation in this sector. The integration of advanced technologies, such as part design optimization and defect detection systems, has led to substantial improvements in sheet metal fabrication processes. In conclusion, the market is a vibrant and ever-evolving landscape, with continuous advancements in technology, processes, and regulations shaping its future. From deep drawing processes to sheet metal fabrication, each aspect of this industry undergoes constant refinement to meet the evolving needs of businesses and consumers alike.

What are the Key Data Covered in this Sheet Metal Market Research and Growth Report?

-

What is the expected growth of the Sheet Metal Market between 2025 and 2029?

-

USD 101 billion, at a CAGR of 4.8%

-

-

What segmentation does the market report cover?

-

The report segmented by End-user (Building and construction, Automotive, Machinery, and Others), Material (Steel, Aluminum, and Others), Type (Bend sheet, Cut sheet, and Punch sheet), and Geography (APAC, Europe, North America, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Growth in machine tools industry, Fluctuating cost of raw materials

-

-

Who are the major players in the Sheet Metal Market?

-

Key Companies ABC Sheet Metal, Acosta Sheet Metal Manufacturing Inc., Aditya Birla Management Corp. Pvt. Ltd., Alcoa Corp., Arconic Corp., Baosteel Group Corp., Bud Industries Inc., Cadrex, Constellium SE, General Sheet Metal Works Inc., Hulamin Ltd., JFE Holdings Inc., Kaiser Aluminum Corp., Nippon Steel Corp., POSCO holdings Inc., Prototek Holdings LLC, Shanghai Metal Corp., Tata BlueScope Steel Pvt. Ltd., Tata Sons Pvt. Ltd., and United States Steel Corp.

-

Market Research Insights

- The market encompasses the production and processing of various types of metal components through techniques such as coating, forming, and joining. According to industry data, the global market for sheet metal components is projected to reach USD 500 billion by 2025. This growth is driven by increasing demand for lightweight and high-strength materials in the automotive and construction industries. Press brake programming and hydroforming are common forming techniques used in sheet metal manufacturing. While press brakes can form complex shapes with high precision, hydroforming has the advantage of producing large, complex parts with minimal material waste.

- For instance, hydroforming can reduce part weight by up to 50% compared to traditional manufacturing methods. However, hydroforming has limitations in terms of maximum part size and complexity. Strength testing methods, tolerance analysis, and welding process parameters are crucial aspects of sheet metal manufacturing, ensuring the quality and reliability of final products. Automated inspection systems and safety compliance standards help maintain consistency and minimize errors in production. Material selection criteria, punching tool selection, and part weight reduction are essential factors in the design and manufacturing process, with material flow optimization and waste management practices playing a significant role in improving efficiency and reducing costs.

We can help! Our analysts can customize this sheet metal market research report to meet your requirements.