Mexico Coffee Market Size 2025-2029

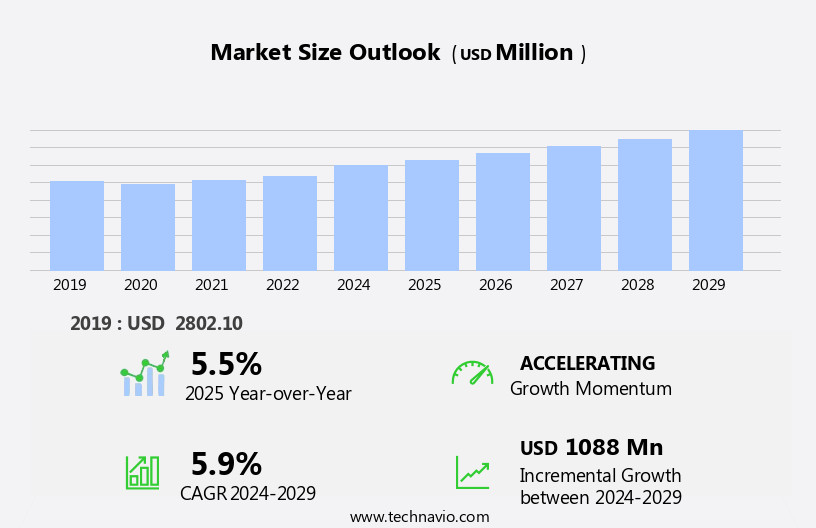

The Mexico coffee market size is forecast to increase by USD 1.08 billion at a CAGR of 5.9% between 2024 and 2029.

- The Mexican coffee market exhibits significant growth potential, driven by the increasing popularity of coffee among millennials and the rising demand for organic coffee. Mexico is the world's seventh-largest coffee producer, and its unique climate and terrain provide ideal conditions for cultivating high-quality beans. However, the market is not without challenges. Adverse environmental conditions, such as droughts and pests, can negatively impact production. Moreover, the global trend towards sustainability and ethical sourcing is increasing consumer awareness and demand for certified coffee.

- To capitalize on these opportunities, companies must focus on sustainable farming practices, invest in research and development, and build strong relationships with consumers and stakeholders. By addressing these challenges and leveraging market trends, businesses can effectively navigate the Mexican coffee market and secure long-term growth. Additionally, the rising popularity of coffee and non-alchoholic beverages among millennials, who are more health-conscious and prefer functional beverages, is contributing to market expansion. Furthermore, fluctuating prices of coffee beans, which can impact the market, are being closely monitored by industry players.

What will be the size of the Mexico Coffee Market during the forecast period?

- The Mexican coffee market exhibits a vibrant and dynamic landscape, with an estimated production volume of over 500,000 metric tons annually. Mexico's unique climate and diverse terroir contribute to the production of high-quality beans, renowned for their distinct sweetness and aroma intensity. Coffee in Mexico is grown using various drying methods, including sun-drying and mechanical drying, ensuring a consistent and product. Sustainability is a growing trend in the Mexican coffee industry, with an increasing focus on bird-friendly coffee farming and eco-friendly processing methods. The market also caters to diverse consumer preferences, with offerings ranging from traditional roasts to innovative light and medium profiles.

- Coffee is a staple beverage in Mexico, often enjoyed as part of the morning routine, paired with meals, or as a source of relaxation. Coffee production in Mexico is a significant contributor to the country's economy, with exports reaching major global markets. The industry continues to evolve, incorporating advancements in technology and innovation to enhance the overall coffee experience. Coffee is a versatile beverage, enjoyed in various forms, from black coffee to lattes, and is often paired with food, literature, and art. Coffee beans offer numerous health benefits, including antioxidants and unique flavor profiles. The Coffee Market in Mexico is renowned for its distinctive coffee flavor profiles, shaped by diverse coffee growing regions with favorable climate and rich soil. Cultivation highlights unique coffee bean varieties, while post-harvest techniques, such as coffee fermentation, washing, and various drying methods, ensure quality and consistency. Producers closely monitor coffee defects through rigorous sensory analysis to meet high standards. Precision in coffee roasting degree, time, and temperature brings out characteristic aromas and flavors. Effective brewing focuses on optimal coffee extraction yield, extraction rate, and balanced brew strength. By embracing traditional methods and modern practices, Mexican coffee caters to global demand, offering a captivating coffee experience unmatched elsewhere.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Arabica

- Robusta

- Blends

- Distribution Channel

- Supermarkets/hypermarkets

- Online stores

- Convenience/grocery stores

- End-User

- Household

- Commercial (Cafes, Restaurants)

- Institutional

- Geography

- North America

- Mexico

- North America

By Type Insights

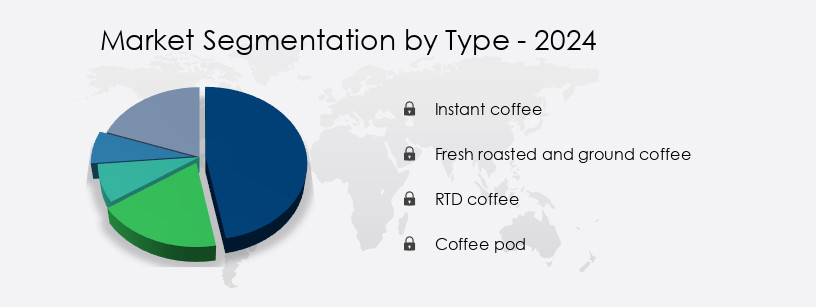

The instant coffee segment is estimated to witness significant growth during the forecast period. The Mexican coffee market caters to various segments, with instant coffee holding a significant share due to its convenience and affordability. This preference is driven by the country's fast-paced lifestyle and the increasing demand for on-the-go coffee consumption. Instant coffee offers a wide array of options, including standard, flavored, and specialty blends, catering to diverse consumer preferences. Additionally, its extended shelf life makes it a popular choice among budget-conscious and time-pressed individuals. Blockchain technology is revolutionizing the online industry by ensuring transparency and traceability in the production and distribution of healthy foods, including functional coffee. Innovative flavors and personalized nutrition are also driving demand for functional coffee. Adaptogens and nootropics, natural substances known for their health benefits, are increasingly being added to functional coffee blends. Health and wellness are top priorities for consumers, leading to the popularity of vegetable eating habits and health tracking technology.

Coffee Baristas play a crucial role in enhancing the coffee experience, providing expert knowledge and personalized recommendations. The Mexican coffee market is a vibrant and diverse landscape, shaped by various factors, including consumer preferences, lifestyle, and innovation. Instant coffee holds a substantial share due to its convenience and affordability, but the market offers a wide array of options catering to diverse tastes and preferences. Sustainability, quality, and traceability are essential considerations, while innovation and technology continue to drive the market forward. Coffee Culture thrives through various channels, ensuring a rich and engaging coffee experience for all.

Get a glance at the market share of various segments Request Free Sample

The Instant coffee segment was valued at USD 1 billion in 2019 and showed a gradual increase during the forecast period. Coffee certifications, such as Rainforest Alliance, UTZ, and Fair Trade, ensure coffee traceability and coffee quality. Coffee processing, coffee roasting, and coffee grading maintain the integrity of coffee beans, while coffee distributors ensure their timely delivery to coffee retailers. Coffee terroir and coffee origin contribute to the unique coffee body, coffee finish, and coffee aroma, making each coffee experience distinct. Coffee addiction is a global phenomenon, with Mexico being no exception. Coffee drinks, such as drip coffee, pour-over, espresso, and cold brew, cater to various preferences. Coffee capsules and coffee travel mugs offer added convenience, while coffee filters ensure a clean and consistent brew

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Mexico coffee market size and forecast projects growth, driven by coffee market trends 2025-2029. B2B coffee supply solutions leverage sustainable coffee production technologies for quality. Coffee market growth opportunities 2025 include coffee for cafes and organic coffee products, meeting demand. Coffee supply chain software optimizes operations, while coffee market competitive analysis highlights key producers. Sustainable coffee farming practices align with eco-friendly coffee trends. Coffee regulations 2025-2029 shapes coffee demand in Mexico 2025. Premium coffee solutions and coffee market insights boost adoption. Coffee for retail and customized coffee blends target niches. Coffee market challenges and solutions address sourcing, with direct procurement strategies for coffee and coffee pricing optimization enhancing profitability. Data-driven coffee market analytics and specialty coffee trends drive innovation.

What are the key market drivers leading to the rise in adoption of Mexico Coffee Market?

- Rising popularity of coffee among millennials is the key driver of the market. The Mexican coffee market experiences significant growth due to the evolving consumer preferences towards high-quality and specialized coffee products. Young consumers, in particular, show a strong affinity towards flavored coffee and premium brands. Improved economic conditions and increasing job opportunities have made these offerings more accessible to this demographic. Millennials, who represent a considerable portion of the population, are willing to spend more on beverages, especially those with unique flavors and brands. Manufacturers are responding to this trend by focusing on the preferences of millennials and tailoring their offerings accordingly.

- The expanding cafe culture and proliferation of specialty coffee shops in urban areas further fuel the demand for premium coffee. Overall, the market dynamics in Mexico reflect a growing appreciation for coffee and a shift towards higher-end offerings. The Coffee Market in Mexico thrives on direct trade and shadegrown coffee, emphasizing organic farming practices and Rainforest Alliance certified beans. Mexican coffee, cultivated using advanced agronomic techniques, flourishes in diverse coffee growing regions like Chiapas and Oaxaca, with ideal coffee altitude, climate, and soil.

What are the market trends shaping the Mexico Coffee Market?

- Rising demand for organic coffee is the upcoming trend in the market. The organic the market and globally is witnessing significant growth due to increasing consumer preference for healthier and environmentally friendly beverage options. Organic coffee, which is free from chemicals, pesticides, and hormones, is gaining popularity for its superior nutritional value and safety. This trend is driven by growing awareness regarding the potential health risks associated with conventional coffee and the benefits of organic coffee. Coffee producers are responding to this demand by increasing their production of organic coffee. Coffee shops and cafe chains are also expanding their organic coffee offerings to cater to this market.

- Despite being more expensive than conventional coffee, the sales of organic coffee are growing at a faster rate. This trend is expected to continue as consumers become more health-conscious and environmentally aware. Organic coffee production involves using natural farming methods that do not involve the use of synthetic fertilizers, pesticides, or genetically modified organisms. This approach is not only better for the environment but also results in a superior taste and aroma of the coffee beans. The organic coffee market is expected to continue its growth trajectory in the coming years, offering significant opportunities for businesses in the sector. Farmers combat coffee pests and diseases while ensuring quality through meticulous coffee harvesting, picking, pulping, fermentation, washing, and drying methods. Rigorous coffee grading standards and sensory analysis highlight unique coffee flavor profiles and bean varieties. Sustainable coffee processing methods and precise roasting profilesâincluding degree, time, and temperatureâenhance aroma intensity, flavor notes, and complexity. Mexican coffee pairs beautifully with food, wine, spirits, chocolate, and desserts, enriching socializing experiences.

What challenges does Mexico Coffee Market face during the growth?

- Adverse environmental conditions is a key challenge affecting the market growth. Coffee production faces various challenges due to natural disasters and unpredictable weather conditions. Natural calamities, such as drought, flood, frost, and earthquakes, pose significant risks to coffee crops, particularly in mountainous regions where they are grown. Seasonal wind shifts can lead to prolonged and excessive rainfall, causing landslides and mudflows. Additionally, human intervention, including animal husbandry and agriculture, puts pressure on the natural habitat. Untimely rainfall and frost can lead to the outbreak of coffee rust, a fungal disease that causes plant defoliation and disrupts the plant's ability to bear fruit. Arabica coffee beans are more susceptible to dust and fungal spores.

- These factors can significantly impact coffee production and prices in the global market. Despite these challenges, the coffee market continues to grow, driven by increasing consumer demand for high-quality coffee. The industry is expected to experience steady growth due to factors such as changing consumer preferences, expanding distribution channels, and technological advancements in coffee production and processing. The coffee market is subject to various external factors that can impact production and prices. Natural disasters, weather conditions, and human intervention pose significant challenges, while consumer demand and technological advancements offer opportunities for growth.

How can Technavio assist you in making critical decisions?

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

Alfa Corporativo S.A. de C.V.:- The company offers coffee under its brand ElCazo Mexicano.

- Alfa Corporativo S.A. de C.V.

- Associated British Foods Plc

- Cafesca

- Fresh Roasted Coffee LLC

- JDE PEETs NV

- Keurig Dr Pepper Inc.

- Louis Dreyfus Co. BV

- LUIGI LAVAZZA SPA

- Melitta Group Management GmbH and Co. KG

- Nestle SA

- Sabormex SA de CV

- Starbucks Corp.

- Strauss Coffee BV

- The J.M. Smucker Co.

- Volcanica Coffee

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market presents an intriguing landscape for businesses seeking to tap into the growing demand for this popular beverage. Coffee production in Mexico has a rich history, with the country ranking among the top 15 global producers. The industry's dynamics are shaped by various factors, including consumer preferences, production methods, and sustainability practices. Coffee consumption in Mexico is diverse, with a range of brewing methods and coffee types preferred. Traditional brewing techniques such as the French press and pour-over continue to hold appeal, while modern coffee machines, including espresso machines, have gained popularity. Coffee culture in Mexico is deeply rooted, with coffee houses and cafes offering a space for socializing and enjoying a cup of coffee. Mexico's coffee market is a vibrant sector, renowned for its rich, complex flavors and diverse bean varieties. Coffee production in Mexico involves several intricate processes, including coffee picking, where ripe cherries are carefully selected, and coffee pulping, which separates the beans from the fruit.

Following pulping, the beans undergo fermentation, washing, and drying methods to prepare them for roasting. However, these processes can be affected by various factors such as coffee defects, which may impact the sensory analysis and flavor profile of the final product. Mexico's coffee growing regions, each with unique climates and soils, contribute to the distinct flavor profiles of its bean varieties. Climate and soil conditions play a significant role in coffee cultivation, while diseases pose a constant challenge to farmers. Coffee roasting profiles, including roasting degree, time, and temperature, significantly impact the extraction yield and rate. Sensory analysis is crucial in determining the roast level that best showcases the beans' unique characteristics. Mexico's coffee industry faces various challenges, including climate change, competition from other coffee-producing countries, and coffee diseases. Despite these hurdles, the country's dedication to producing high-quality beans continues to make it a significant player in the global coffee market.

The Mexican coffee market offers opportunities for innovation, with specialty coffee and single-serve coffee gaining traction. Coffee roasters and distributors are experimenting with different roast profiles and coffee blends to cater to the evolving tastes of consumers. Coffee shops and cafes are also offering unique coffee drinks, such as cold brew and coffee cocktails, to attract customers. Sustainability is a growing concern in the Mexican coffee industry, with an increasing focus on fair trade coffee and sustainable coffee production. Coffee growers and producers are adopting sustainable practices to ensure the long-term viability of coffee production and to meet the demands of consumers who prioritize ethical and environmentally friendly products.

Coffee marketing and branding are essential components of the Mexican coffee market. Coffee companies are investing in digital marketing and social media to reach consumers and build brand loyalty. Coffee merchandise, such as coffee mugs, cups, and accessories, are popular items for coffee enthusiasts and make excellent branded gifts. Coffee processing and quality are critical factors in the Mexican coffee market. Coffee processing techniques, such as coffee milling and coffee grading, play a significant role in determining coffee quality. Coffee certification programs, such as organic coffee and coffee certifications, provide assurance to consumers that the coffee they are purchasing meets specific quality and sustainability standards.

Coffee innovation continues to drive growth in the Mexican coffee market. Coffee automation, such as coffee capsules and coffee subscription boxes, offer convenience and consistency for consumers. Coffee technology, such as coffee grinders and coffee machines, are continually improving to enhance the coffee-making experience. The Mexican coffee market presents a dynamic and growing opportunity for businesses. The market is shaped by various factors, including consumer preferences, production methods, sustainability practices, and innovation. Coffee companies that can effectively navigate these dynamics and offer high-quality, sustainable, and innovative coffee products are well-positioned to succeed in this market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

152 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.9% |

|

Market growth 2025-2029 |

USD 1.08 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.5 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Mexico

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch