Nootropics Market Size 2025-2029

The nootropics market size is forecast to increase by USD 3.58 billion at a CAGR of 13.5% between 2024 and 2029.

- The market is experiencing significant growth, driven by several key factors. Firstly, the rising urban population and increasing demand for cognitive enhancement solutions are fueling market expansion. With the global urban population projected to reach 68% by 2050, the need for productivity-enhancing supplements is expected to increase. Additionally, the growing trend towards online retail and diet supplements has made Nootropics more accessible to consumers, enabling greater market penetration. Despite this promising outlook, the market faces several challenges. One of the most significant hurdles is the low penetration in developing regions, particularly in Asia and Africa. However, as awareness of the benefits of cognitive enhancement supplements spreads, there is a significant opportunity for market expansion in these regions.

- Furthermore, regulatory challenges and negative media attention surrounding Nootropics can impact market growth. Companies seeking to capitalize on market opportunities must navigate these challenges effectively by investing in research and development, building strong regulatory relationships, and implementing effective marketing strategies to counteract negative perceptions. Overall, the market presents a compelling investment opportunity for companies willing to navigate regulatory complexities and capitalize on the growing demand for cognitive enhancement solutions.

What will be the Size of the Nootropics Market during the forecast period?

- The market encompasses a diverse range of products designed to enhance cognitive abilities, often referred to as "smart drugs." This market has experienced significant growth due to increasing consumer interest in cognitive health and productivity. According to market research, global consumer spending on nootropics is projected to reach billions of dollars by 2026. The market caters to various demographics, including students, professionals, and older adults seeking to mitigate age-related cognitive decline. Nootropics are also being explored as potential treatments for neurodegenerative diseases such as Alzheimer's, Parkinson's, and Huntington's diseases.

- Omega-3 fatty acids, a common dietary supplement, are also gaining popularity as nootropics due to their cognitive benefits. Overall, the market is poised for continued expansion as consumers and researchers explore the potential of these substances to enhance brain function and improve quality of life.

How is this Nootropics Industry segmented?

The nootropics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

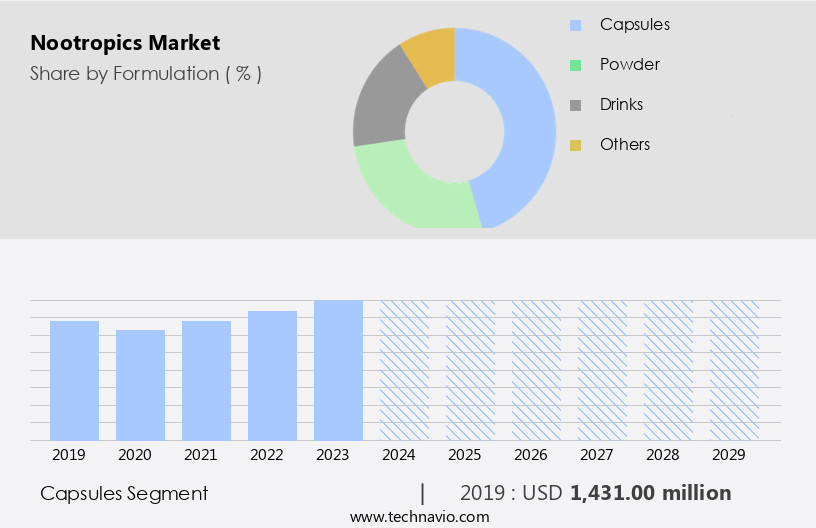

- Formulation

- Capsules

- Powder

- Drinks

- Others

- Distribution Channel

- Offline

- Online

- By Type

- Over-the-counter (OTC)

- Prescription, Natural

- Others

- Material Type

- Memory Enhancement

- Attention and Focus

- Mood and Depression

- Longevity and Anti-aging

- Sleep and Recovery

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Asia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Formulation Insights

The capsules segment is estimated to witness significant growth during the forecast period. Key ingredients, such as Omega-3 fatty acids, Ginkgo biloba, and Panax ginseng, are commonly used in these products. Healthcare providers and meal-replacement companies, like Soylent Nutrition, also offer nootropics as part of their offerings. To maintain cognitive ability and brain function, consumers are turning to nootropics for memory enhancement, mental performance, and productivity enhancement. While natural ingredients and plant-based nootropics are popular, independent testing and ethical concerns are important considerations for consumers.

Get a glance at the market report of share of various segments Request Free Sample

The Capsules segment was valued at USD 1.43 billion in 2019 and showed a gradual increase during the forecast period.

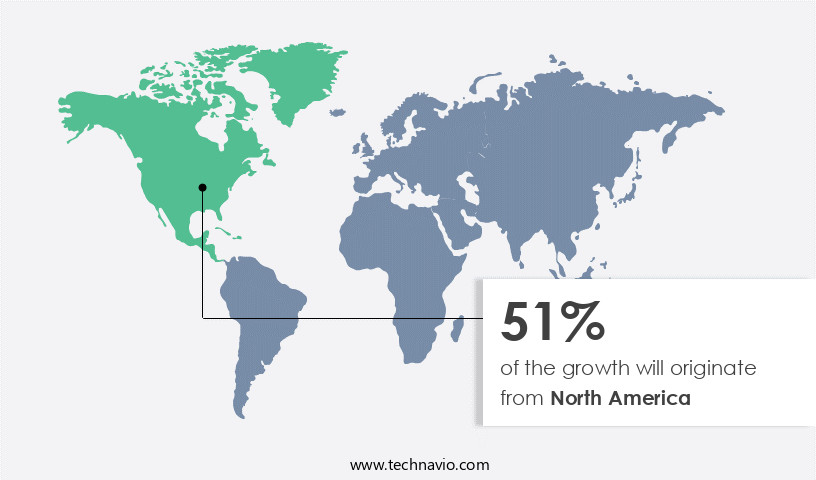

Regional Analysis

North America is estimated to contribute 51% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American market for nootropics, which includes products like Alpha Brain, Smart Drugs, and cognitive enhancers, emerged as the largest in 2024. Factors driving this growth include increased health and wellness spending, a growing healthcare sector, and greater consumer awareness of brain health. The US, in particular, leads the region in spending on brain health supplements due to heightened awareness of their benefits. As cultural values shift and interest in advanced brain health products grows, demand for nootropics in forms such as capsules is anticipated to rise. Major retailers in the US, including Walmart, Target, CVS, and Walgreens, now offer a wide selection of nootropic supplements.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Nootropics Industry?

- Rising urban population is the key driver of the market. The global urban population has experienced significant growth, with over half of the world's population now residing in urban areas, according to The World Bank Group. This urbanization has resulted in lifestyle changes, improved living standards, and increased disposable income. However, with aging populations, there is also a rise in health concerns such as dementia and chronic diseases like Alzheimer's. In response, health consciousness among urban residents has grown, leading to increased demand for brain health supplements. In developed nations, stable per capita disposable income, driven by the rise of double-income households, has significantly enhanced consumer purchasing power.

- Meanwhile, in developing countries, brain health supplements have become more affordable. These market dynamics have fueled the growth of the market, providing opportunities for companies to cater to the evolving health needs of urban populations. Second, the demand for productivity enhancement and mental clarity in today's fast-paced world has fueled interest in nootropics as a means of improving focus and cognitive function.

What are the market trends shaping the Nootropics Industry?

- Growing demand in online retail is the upcoming market trend. The global market for nootropic supplements is experiencing significant growth in online retail channels. Factors such as increasing internet connectivity, expanding smartphone usage, and a vast consumer base are driving this trend. Major market players are focusing on distributing these supplements via online platforms to reach a larger audience. Effective online marketing strategies enable manufacturers to offer consumers easy access to a diverse range of products. E-commerce platforms like Amazon, IndiaMart, and Alibaba provide an extensive selection of nootropic supplements at competitive prices, making them an attractive option for consumers.

- Discounts, promotions, and the availability of multiple brands further encourage bulk purchases through these channels. As a result, online sales of nootropic supplements are projected to increase substantially during the forecast period. Nootropics come in various forms, including capsules, powders, and drinks. Some nootropics are derived from natural sources such as omega-3 fatty acids, Ginkgo biloba, and Panax ginseng, while others are synthetic compounds. Natural nootropics are often marketed as plant-based or nutritional supplements, while synthetic nootropics may be sold as prescription drugs or over-the-counter supplements.

What challenges does the Nootropics Industry face during its growth?

- Low penetration in developing regions is a key challenge affecting the industry growth. Nootropic supplements have witnessed growing recognition in developed markets due to heightened awareness of their cognitive benefits. In contrast, adoption in developing and underdeveloped regions, such as Africa and the Middle East, lags significantly behind. This disparity can be attributed to affordability constraints and lower awareness levels in these regions. In areas with limited purchasing power, manufacturers often produce low-cost nootropic supplements, potentially compromising on quality.

- Moreover, consumers in these regions view these supplements as non-essential, leading to reluctance in purchasing. Furthermore, product visibility and availability are hindered by weak distribution networks and limited internet access. Despite the growing popularity of nootropics, there are ethical concerns surrounding their use. Some critics argue that the use of cognitive enhancers gives an unfair advantage to individuals and could lead to a widening gap between those who can afford them and those who cannot.

Exclusive Customer Landscape

The nootropics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the nootropics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, nootropics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accelerated Intelligence Inc. - The company provides coffee blends infused with cognitive enhancers Alpha GPC, L-Theanine, and DMAE. These ingredients promote mental clarity, focus, and sustained energy without causing crashes.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accelerated Intelligence Inc.

- Applied Food Sciences Inc.

- Careforsons LTD.

- Gaia Herbs Inc.

- Gridiron Nutrition

- Health Via Modern Nutrition Inc.

- Kraken Koffee LLC

- Mental Mojo LLC

- NEU Energy

- Nutraceutical Corp.

- Onnit Labs Inc.

- Opti-Nutra Ltd.

- Peak Nootropics

- Performance Lab Ltd.

- PowderCity.com Ltd.

- Purelife bioscience Co Ltd.

- Reckitt Benckiser Group Plc

- Roar Ambition Ltd

- truBrain Inc.

- Wolfson Holdco Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Nootropics, also known as cognitive enhancers or smart drugs, are a class of substances that are purported to enhance brain function and cognitive abilities. These substances have gained popularity in recent years due to their potential to improve mental performance, memory, focus, and overall brain health. The market has experienced significant growth as more individuals seek to optimize their cognitive abilities for professional and personal reasons. The market is driven by several factors. First, the increasing prevalence of cognitive disorders such as Alzheimer's disease, Parkinson's disease, and Huntington's disease has led to a greater focus on brain health and the search for effective interventions.

Additionally, there are concerns about the long-term safety and efficacy of nootropics, particularly those with synthetic compounds. To address these concerns, reputable companies are investing in independent testing and clinical trials to ensure the safety and efficacy of their nootropic products. Healthcare professionals are also playing a crucial role in educating consumers about the potential benefits and risks of nootropics and providing guidance on their use. In the marketplace, nootropics are available from various sources, including drug stores, healthcare professionals, and online retailers. Consumers can also explore biohacking practices and wellness products that incorporate nootropics as part of a holistic approach to brain health.

The market is driven by the growing demand for cognitive enhancement and brain health. While natural nootropics derived from sources such as omega-3 fatty acids, Ginkgo biloba, and Panax ginseng have gained popularity, synthetic nootropics remain a subject of controversy due to ethical concerns and safety issues. Reputable companies are investing in independent testing and clinical trials to ensure the safety and efficacy of their nootropic products, and healthcare professionals are playing a crucial role in educating consumers about their use. As the market continues to evolve, it is essential to prioritize ethical considerations and scientific evidence to promote the safe and effective use of nootropics for cognitive enhancement and brain health.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

184 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.5% |

|

Market growth 2025-2029 |

USD 3.58 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

11.1 |

|

Key countries |

US, China, Canada, Germany, UK, France, Italy, Japan, India, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Nootropics Market Research and Growth Report?

- CAGR of the Nootropics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the nootropics market growth of industry companies

We can help! Our analysts can customize this nootropics market research report to meet your requirements.