Military Cybersecurity Market Size 2024-2028

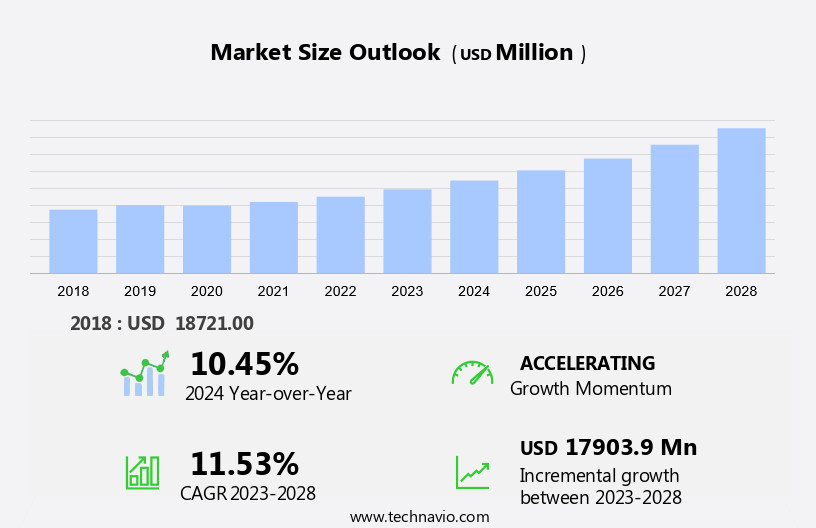

The military cybersecurity market size is forecast to increase by USD 17.9 billion at a CAGR of 11.53% between 2023 and 2028.

What will be the Size of the Military Cybersecurity Market during the Forecast Period?

How is this Military Cybersecurity Industry segmented and which is the largest segment?

The military cybersecurity industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Deployment

- On-premise

- Cloud-based

- Type

- Network security

- Data security

- Identity and access management

- Cloud security

- Geography

- North America

- US

- APAC

- China

- India

- Europe

- UK

- Middle East and Africa

- South America

- North America

By Deployment Insights

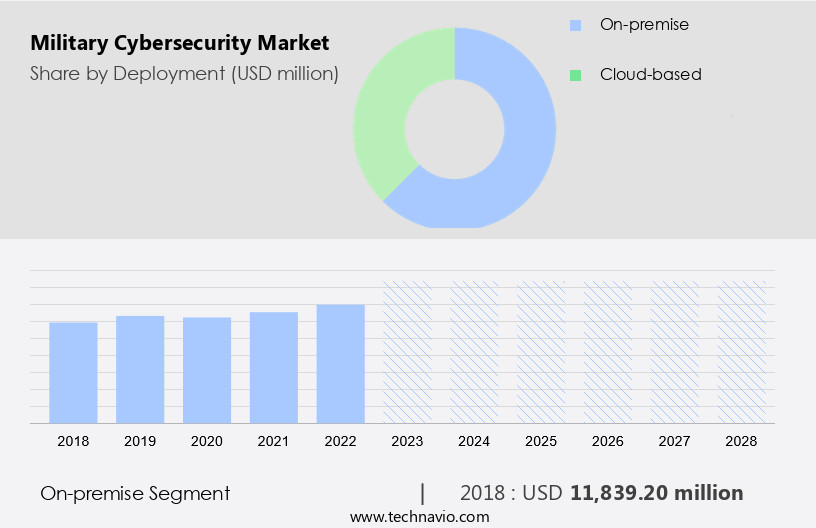

The on-premise segment is estimated to witness significant growth during the forecast period. The market encompasses solutions designed to safeguard military systems, networks, and infrastructure from cyber threats. These threats include unauthorized access, state-sponsored attacks, and cyber warfare. Military organizations invest significant defense budgets in cybersecurity measures to protect sensitive data and ensure national security. On-premises security systems, which run on an organization's own hardware infrastructure, held the largest market share in 2023. The advantages of on-premises systems include data protection and control, as data is stored locally without third-party interference. However, the shift towards cloud computing and cloud-based storage solutions has led to a decline in demand for on-premises systems. Military cybersecurity solutions encompass various technologies such as network security, endpoint security, application security, data security, cloud security, professional services, training and education, and more.

Other essential components include threat intelligence, incident response, machine learning, quantum-resistant cryptography, cyber-physical systems, autonomous defense, blockchain, space operations, security solutions, and communication networks. Intelligence and surveillance, supply chain security, defense security norms, and unmanned vehicles are also critical areas of focus. Military cybersecurity is a dynamic and evolving field, requiring continuous innovation and adaptation to emerging threats.

Get a glance at the market report of various segments Request Free Sample

The On-premise segment was valued at USD 11.84 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

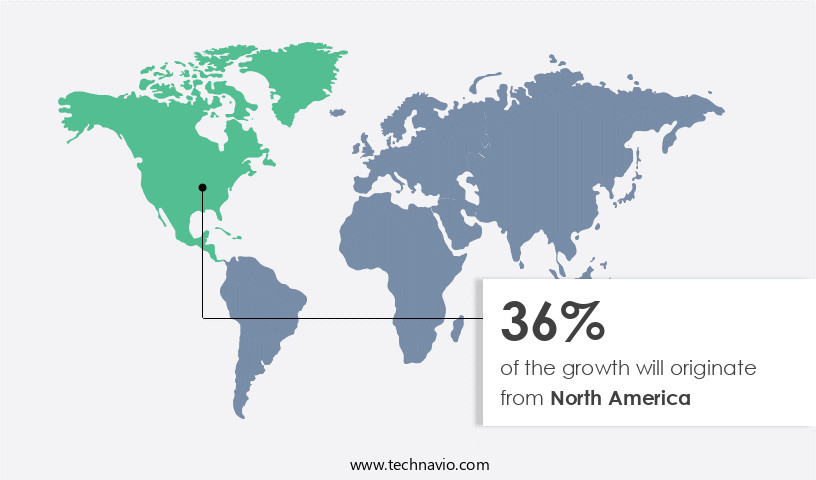

North America is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

Military cybersecurity is a critical concern for North American countries, including the US, Canada, and Mexico, due to the increasing number of cyber threats targeting defense organizations and other industries. Advanced cyberattacks, such as state-sponsored attacks and unauthorized access, pose significant risks to military infrastructure and national security. Cybersecurity measures, including network security, endpoint security, application security, data security, cloud security, professional services, training, and education, are essential to safeguard military systems and networks. Defense budgets continue to prioritize cybersecurity, with investments in cloud computing, cybersecurity companies, threat intelligence, incident response, machine learning, quantum-resistant cryptography, cyber-physical systems, autonomous defense, blockchain, space operations, and security solutions.

The adoption of modern cybersecurity technologies, such as encryption, access controls, and national security protocols, is crucial to mitigate risks and protect sensitive information. The proliferation of connected devices and the Internet of Things (IoT) market have led to an exponential increase in security-related data, making it imperative for organizations to adopt robust cybersecurity solutions.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of market?

Increase in adoption of cloud-based services is the key driver of the market.Military organizations are increasingly adopting cloud-based services for various applications, including authentication processes, video management, biometric information storage, and Big Data computing. The flexibility and scalability of cloud solutions enable military forces to meet their evolving needs. However, ensuring cloud data security is crucial for these agencies, given the vast amounts of sensitive information they handle daily. The lack of in-house security infrastructure in several defense agencies necessitates the adoption of cloud-based services. Additionally, the rise in workforce mobility necessitates the implementation of cloud services for functions such as resource management and enterprise communication to ensure secure remote access to data.

Cyber threats, including unauthorized access, state-sponsored attacks, and cyber warfare, pose significant risks to military networks and infrastructure. Defense budgets allocate resources towards implementing cybersecurity measures, such as threat intelligence, incident response, machine learning, quantum-resistant cryptography, and blockchain, to safeguard military systems and data. Network security, endpoint security, application security, data security, cloud security, professional services, training and education, and deployment modes are essential components of military cybersecurity. Communication networks, intelligence and surveillance, supply chain security, defense security norms, cloud-based storage solutions, unmanned vehicles, defense personnel, and defense budgets are other areas requiring attention. Cyberattacks, hacking, import/export analysis, encryption, access controls, national security, and security services are critical cybersecurity technologies for military organizations.

What are the market trends shaping the Military Cybersecurity market?

High adoption of Al and machine learning is the upcoming market trend.Military cybersecurity is a critical concern for defense organizations as the threat landscape continues to evolve, with unauthorized access and state-sponsored attacks posing significant risks to military systems and networks. Military infrastructure, including communication networks, intelligence and surveillance, and cyber-physical systems, is increasingly reliant on technology, making robust cybersecurity measures essential. Defense budgets are being allocated towards advanced security solutions such as machine learning, quantum-resistant cryptography, and blockchain. Cloud computing is also a growing area of focus, with cloud-based storage solutions and security services becoming increasingly popular. Cybersecurity companies are providing threat intelligence, incident response, and professional services to help defense organizations stay ahead of emerging threats.

Supply chain security is another critical area, with the potential for vulnerabilities in third-party suppliers posing a significant risk. Military cybersecurity also extends to space operations and unmanned vehicles, where secure communication and data protection are vital. Defense personnel require ongoing training and education to stay up-to-date with the latest cybersecurity trends and technologies. Deployment modes, including on-premises and cloud-based, are being considered to ensure flexibility and scalability. Defense security norms continue to evolve, with a focus on access controls, encryption, and data security. Cyberattacks, including hacking and import/export analysis, can have serious consequences for national security. As the use of technology in military applications continues to expand, it is crucial that effective cybersecurity measures are in place to protect against potential threats.

What challenges does the market face during its growth?

System integration and interoperability issues is a key challenge affecting the industry growth.The military sector's adoption of advanced technologies, including cloud computing and cybersecurity solutions, is expanding, posing challenges such as system integration and interoperability. Defense organizations confront difficulties integrating network security solutions into their existing IT infrastructure. To address this issue, companies must offer unified IT solutions that can seamlessly integrate with military systems. Network security solutions are crucial for military organizations to safeguard against cyber threats, including unauthorized access and state-sponsored attacks. However, technical glitches during operations can result in substantial costs and reduced efficiency. Hacking, server errors, and other malfunctions are significant concerns. To ensure a low error rate and high accuracy, companies must rigorously test network security solutions before market introduction.

Cybersecurity measures, such as threat intelligence, incident response, machine learning, and quantum-resistant cryptography, are essential for securing military networks, cyber-physical systems, and communication networks. Defense budgets allocate substantial resources to cybersecurity, driving growth In the market for security solutions, including network security, endpoint security, application security, data security, cloud security, professional services, training and education, and deployment modes. Military cybersecurity also encompasses supply chain security, intelligence and surveillance, and defense security norms. Cloud-based storage solutions, unmanned vehicles, and defense personnel are other areas requiring robust security. companies must comply with defense budgets and national security regulations while offering advanced security technologies, such as blockchain, to meet the evolving needs of military organizations.

Exclusive Customer Landscape

The military cybersecurity market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the military cybersecurity market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, military cybersecurity market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Airbus SE - The company provides advanced military cybersecurity solutions, encompassing offerings such as CyberRange, Ectp cryp BLUE, and SEI Gateway. These solutions cater to the evolving cybersecurity needs of military organizations, ensuring robust defense against cyber threats through innovative training platforms, encryption technologies, and security gateways. By leveraging cutting-edge technology and a deep understanding of military cybersecurity requirements, the company empowers clients to safeguard their critical infrastructure and maintain operational readiness.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Airbus SE

- BAE Systems Plc

- Booz Allen Hamilton Holding Corp.

- Broadcom Inc.

- CACI International Inc.

- Cisco Systems Inc.

- Digital Management LLC

- Fortinet Inc.

- General Dynamics Corp.

- GovCIO

- Intel Corp.

- International Business Machines Corp.

- Leidos Holdings Inc.

- Lockheed Martin Corp.

- ManTech International Corp.

- NetCentrics Corp.

- Northrop Grumman Corp.

- RTX Corp.

- SAIC Motor Corp. Ltd.

- Thales Group

- Viasat Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Military cybersecurity refers to the protection of military networks, systems, and infrastructure from cyber threats. With the increasing reliance on technology in military operations, the importance of robust cybersecurity measures has become paramount. Military organizations face various cyber threats, including unauthorized access, state-sponsored attacks, and cyber warfare. Cybersecurity measures have become a critical component of military defense budgets. Cloud computing has emerged as a popular solution for military organizations due to its flexibility and cost-effectiveness. However, it also introduces new risks, such as data breaches and supply chain vulnerabilities. Cybersecurity companies offer various solutions to mitigate these risks.

Threat intelligence and incident response services help military organizations stay informed about potential threats and respond effectively to cyberattacks. Machine learning and quantum-resistant cryptography are among the advanced technologies being used to enhance military cybersecurity. Cybersecurity measures extend beyond traditional network security to include endpoint security, application security, data security, and cloud security. Professional services, such as training and education, play a crucial role in ensuring that military personnel are equipped with the necessary skills to defend against cyber threats. Deployment modes, communication networks, and intelligence and surveillance systems are also essential components of military cybersecurity. Supply chain security is a growing concern, with the potential for vulnerabilities In the import/export process.

Defense organizations are implementing strict security norms to mitigate these risks. Cloud-based storage solutions offer military organizations the ability to store and access data from anywhere. However, they also introduce new risks, such as data breaches and unauthorized access. Defense personnel require continuous training to stay up-to-date with the latest cybersecurity threats and countermeasures. Military cybersecurity is a dynamic field, with new threats and technologies emerging constantly. Defense budgets continue to prioritize cybersecurity measures to protect military networks, systems, and infrastructure from cyber threats. Cybersecurity technologies, such as blockchain and autonomous defense, are being explored to enhance military cybersecurity capabilities.

Space operations and cyber-physical systems are also areas of focus for military cybersecurity. In conclusion, military cybersecurity is a critical component of modern military operations. Military organizations face various cyber threats, and robust cybersecurity measures are essential to protect military networks, systems, and infrastructure. Defense budgets continue to prioritize cybersecurity, and cybersecurity companies offer various solutions to mitigate risks and enhance military cybersecurity capabilities. The field is dynamic, with new threats and technologies emerging constantly, requiring continuous training and education for military personnel.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

183 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.53% |

|

Market growth 2024-2028 |

USD 17903.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

10.45 |

|

Key countries |

US, China, India, Russia, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Military Cybersecurity Market Research and Growth Report?

- CAGR of the Military Cybersecurity industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the military cybersecurity market growth of industry companies

We can help! Our analysts can customize this military cybersecurity market research report to meet your requirements.