Mixed Martial Arts Equipment Market Size 2025-2029

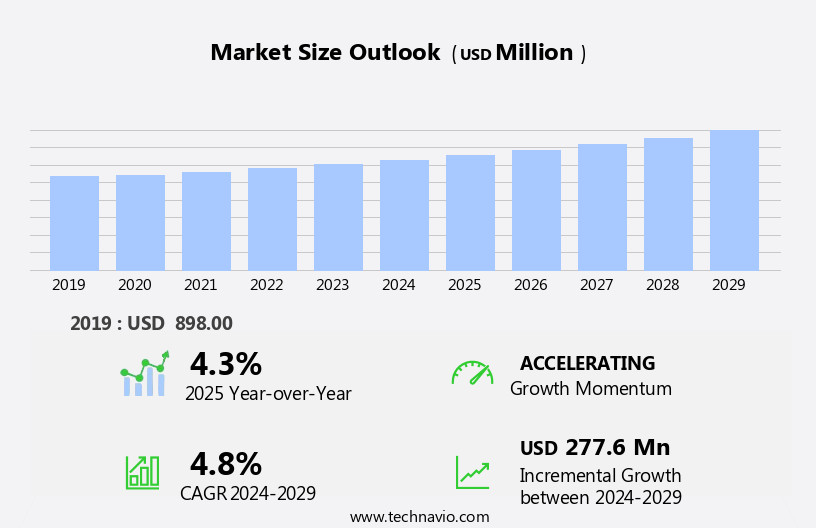

The mixed martial arts equipment market size is forecast to increase by USD 277.6 million at a CAGR of 4.8% between 2024 and 2029.

- The Mixed Martial Arts (MMA) Equipment Market is experiencing significant growth due to several key trends. The increasing popularity of women in MMA is driving market expansion, as more females are taking up the sport and requiring specialized equipment. Additionally, the number of fitness centers and health clubs offering MMA classes is on the rise, providing a larger customer base for equipment suppliers. MMA gloves are distinct from those used in other combat sports like boxing, featuring open-fingered or half-fingered designs made primarily of leather and synthetic materials like polyurethane, neoprene, and polyvinyl chloride. Furthermore, the growing interest in alternative sports, particularly among the younger demographic, is fueling market growth. These trends are expected to continue, making the MMA Equipment Market an attractive investment opportunity.

What will be the Size of the Mixed Martial Arts Equipment Market During the Forecast Period?

- The global mixed martial arts (MMA) equipment market encompasses a diverse range of training and protection gear utilized by players engaged in this high-intensity combat sport. Key product categories include punching bags, gloves, shorts, shin guards, hand wraps, ankle pads, elbow pads, knee pads, headgear, mouthguards, grappling dummies, rash guards, walkout gear, water bottles, gym bags, custom gloves, and wraps. This market experiences growth due to the increasing popularity of MMA as a recreational sport and the associated health benefits, such as improved heart health, stress reduction, and mitigation of chronic diseases. Consumers seek out high-quality training equipment and protection gear to enhance their performance and ensure safety during intense workouts.

- The MMA equipment market is expected to continue expanding, driven by the ever-evolving nature of the sport and the ongoing demand for innovative, effective, and protective gear.

How is this Mixed Martial Arts Equipment Industry segmented and which is the largest segment?

The mixed martial arts equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- MMA gloves

- Protective gear

- Training equipment

- Distribution Channel

- Offline

- Online

- End-user

- Individual

- Organization

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- APAC

- China

- India

- Japan

- South America

- Brazil

- Middle East and Africa

- North America

By Product Insights

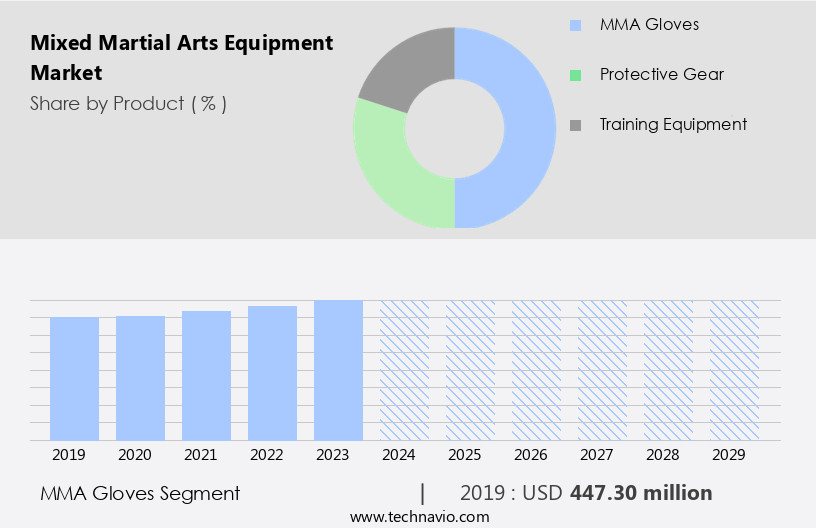

- The MMA gloves segment is estimated to witness significant growth during the forecast period.

The MMA equipment market encompasses a range of training and protection gear used in mixed martial arts (MMA), a full-contact combat sport. The MMA gloves segment dominates the market due to their essential role In the sport. These gloves protect knuckles and wrists, minimizing the impact of punches on opponents. Durability is crucial for MMA gloves, as they must withstand the power and force exerted during training and competition.

Other equipment includes punching bags, shorts, shin guards, hand wraps, ankle pads, elbow pads, knee pads, headgear, mouthguards, grappling dummies, rash guards, walkout gear, water bottles, gym bags, custom gloves, and wraps. Consumers, including players, fitness enthusiasts, and professional fighters, utilize this equipment for recreational sports, health benefits, such as heart health, stress reduction, and combating chronic diseases, and for training in professional camps, advanced facilities, and fitness centers. Advertising campaigns, celebrity endorsements, the e-commerce sector, connected devices, and performance measurement tools, including real-time tracking, power measurement, speed measurement, and punch measurement, further drive market growth.

Get a glance at the market report of share of various segments Request Free Sample

The MMA gloves segment was valued at USD 447.30 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

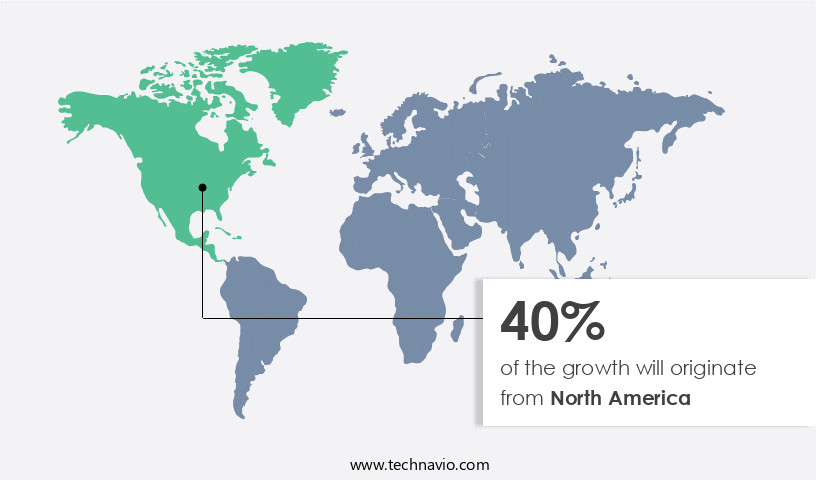

- North America is estimated to contribute 40% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The Mixed Martial Arts (MMA) equipment market in North America is the largest globally, driven by the popularity of MMA as a sport, particularly among males aged 18-36 In the US. With over 70,000 martial arts schools and over 4.5 million participants, the market generates annual revenue of over USD 450 million from the sale of equipment. The Ultimate Fighting Championship (UFC), a leading MMA league, significantly contributes to the demand for training equipment and protection gear, including MMA gloves, punching bags, mouth guards, headgear, shin guards, hand wraps, ankle pads, elbow pads, and knee pads. Fitness centers, professional training camps, advanced training facilities, and players also contribute to the market's growth.

Consumers seek MMA equipment for recreational sports, health benefits such as heart health, stress reduction, and combating chronic diseases, as well as for professional training. The market is further boosted by advertising campaigns, celebrity endorsements, the e-commerce sector, and the integration of connected devices for performance measurement, real-time tracking, power measurement, speed measurement, and punch measurement.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Mixed Martial Arts Equipment Industry?

Growing popularity of women MMA is the key driver of the market.

- Mixed Martial Arts (MMA) has witnessed a notable rise in female participation, with an increasing number of women competing professionally and recreationally. Various organizations conduct championships, such as the UFC Women's Featherweight, Bantamweight, Flyweight, and Strawweight Championships, to promote women's involvement In the sport. MMA equipment, including punching bags, gloves, shorts, shin guards, hand wraps, ankle pads, elbow pads, knee pads, headgear, mouthguards, grappling dummies, rash guards, walkout gear, water bottles, gym bags, custom gloves, and wraps, caters to both players and consumers. These equipment cater to training needs, as well as offer protection during competitions. MMA's popularity is driven by its health benefits, such as heart health improvement, stress reduction, and the prevention and management of chronic diseases.

- The trend towards combating sedentary lifestyles further fuels the demand for MMA equipment. Advanced training facilities, professional training camps, fitness centers, advertising campaigns, and celebrity endorsements contribute to the market's growth. The e-commerce sector, connected devices, performance measurement, real-time tracking, power measurement, speed measurement, and punch measurement also play a significant role In the market's expansion.

What are the market trends shaping the Mixed Martial Arts Equipment Industry?

Number of fitness centers and health clubs is the upcoming market trend.

- The combat sport of Mixed Martial Arts (MMA) has witnessed significant growth, driven by the increasing number of fitness centers and health clubs worldwide. To attract and retain members, these establishments offer exclusive packages, including discounted annual or monthly memberships. These premium offerings provide additional benefits, such as free workouts for a month. The rise in fitness centers and health clubs is a primary factor contributing to the expanding MMA player base. As of 2023, over 113,300 gyms, health clubs, and fitness centers were operational In the US alone. MMA training equipment, including punching bags, gloves, shorts, shin guards, hand wraps, ankle pads, elbow pads, knee pads, headgear, mouth guards, grappling dummies, rash guards, walkout gear, water bottles, gym bags, custom gloves, and wraps, is in high demand to cater to the growing number of MMA players.

- Consumers are drawn to MMA due to its health benefits, such as heart health improvement, stress reduction, and the prevention and management of chronic diseases. Sedentary lifestyles have become a major concern, making recreational sports like MMA increasingly popular. The e-commerce sector, connected devices, and advertising campaigns, including celebrity endorsements, further fuel the market's growth. Performance measurement tools, such as real-time tracking, power measurement, speed measurement, and punch measurement, are also gaining traction, enhancing the overall training experience.

What challenges does the Mixed Martial Arts Equipment Industry face during its growth?

Rising popularity of alternative sports is a key challenge affecting the industry growth.

- The market caters to players and consumers engaged in combat sports, offering training equipment and protection gear. Key product categories include punching bags, gloves, shorts, shin guards, hand wraps, ankle pads, elbow pads, knee pads, headgear, mouthguards, grappling dummies, rash guards, walkout gear, water bottles, gym bags, custom gloves, and wraps. The market faces competition from other combat sports like boxing, judo, wrestling, fencing, kickboxing, Muay Thai, Savate, Capoeira, Sanda, Tae Kwon Do, HMB, Sambo, Brazilian jiu-jitsu, Kyokushin, and kudo. The popularity of outdoor sports, such as cricket, football, hockey, baseball, basketball, tennis, and swimming, also impacts the market. Consumers increasingly opt for fitness activities like yoga and cardio exercises, such as aerobics, walking, jogging, cycling, rope skipping, and dancing, which offer health benefits like heart health improvement, stress reduction, and chronic disease management.

- The market includes advanced training facilities, professional training camps, fitness centers, advertising campaigns, and celebrity endorsements. The e-commerce sector, connected devices, performance measurement, real-time tracking, power measurement, speed measurement, and punch measurement are emerging trends.

Exclusive Customer Landscape

The mixed martial arts equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the mixed martial arts equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, mixed martial arts equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Adidas AG - The company offers Mixed martial arts equipment such as ADIDAS HYBRID 80, ADIDAS TILT 350, ADIDAS ADILIGHT UNIFORM, ADIDAS WTF CHEST GUARD, and others.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adidas AG

- Blitz Corp. Ltd.

- Century LLC

- Combat Brands LLC

- FAIRTEX EQUIPMENT CO. LTD.

- Hayabusa Fightwear Inc.

- King Martial Arts Supplies

- KWON Inc.

- MRX Products Inc.

- Outslayer Fight Gear

- Proforce Inc.

- RDX Inc.

- Revgear Sports Co.

- SportsDirect.com Retail Ltd.

- Tiger Claw

- TITLE Boxing

- Twins Special LLC

- Venum

- Zebra Athletics

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a wide range of products designed to enhance the training and performance of players participating in various combat sports. This market caters to both recreational consumers and professional athletes, with an emphasis on providing equipment that offers superior protection and performance. Combat sport equipment includes punching bags, gloves, shorts, shin guards, hand wraps, ankle pads, elbow pads, knee pads, headgear, and other protective gear. These items are essential for fighters, as they help minimize injuries and optimize training sessions. Additionally, combat sport equipment caters to the fitness community, with consumers seeking equipment to improve their overall health and wellness.

The benefits of combat sport training extend beyond physical fitness. Regular participation in combat sports has been linked to improved heart health, stress reduction, and the prevention and management of chronic diseases. With increasingly sedentary lifestyles becoming a global concern, combat sport equipment provides an effective solution for individuals looking to incorporate physical activity into their daily routines. Professional training camps and advanced training facilities are significant contributors to the combat sport equipment market. These institutions rely on high-quality equipment to provide their athletes with the best possible training experience. Fighters, in particular, require specialized gear that can withstand the rigors of intense training sessions.

Fitness centers and gyms also play a crucial role In the market, offering combat sport classes and equipment rentals to their members. These establishments provide an accessible and convenient solution for individuals looking to try combat sports without investing In their own equipment. Advertising campaigns and celebrity endorsements have significantly influenced the market's growth. High-profile athletes and influencers In the combat sports world have lent their endorsement to various brands, driving consumer interest and sales. The e-commerce sector has emerged as a significant distribution channel for combat sport equipment, allowing consumers to purchase items online from the comfort of their own homes.

Connected devices, such as performance measurement tools and real-time tracking systems, have also gained popularity among combat sport enthusiasts, providing valuable insights into their training progress and performance metrics. Power measurement, speed measurement, and punch measurement technologies have become increasingly important In the combat sport equipment market. These advanced features allow athletes to monitor and analyze their training data, enabling them to optimize their performance and achieve better results. Institutions, offline retail stores, and online retail stores all play a role In the distribution of combat sport equipment. Each channel offers unique advantages, catering to different consumer preferences and shopping behaviors.

Custom gloves, wraps, clothes, and other personalized equipment have gained popularity in recent years, allowing consumers to express their individuality and enhance their training experience. Rash guards, grappling dummies, mouth guards, headgear, and walkout gear are just a few examples of the diverse range of combat sport equipment available In the market. Water bottles, gym bags, and other essential accessories complete the combat sport equipment landscape, ensuring that athletes and fitness enthusiasts have all the tools they need to train effectively and safely. Overall, the market continues to evolve, driven by advancements in technology, consumer preferences, and the growing popularity of combat sports.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

209 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.8% |

|

Market growth 2025-2029 |

USD 277.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.3 |

|

Key countries |

US, Canada, Germany, UK, France, Italy, China, Brazil, India, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Mixed Martial Arts Equipment Market Research and Growth Report?

- CAGR of the Mixed Martial Arts Equipment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the mixed martial arts equipment market growth of industry companies

We can help! Our analysts can customize this mixed martial arts equipment market research report to meet your requirements.