Mobile Crane Market Size 2025-2029

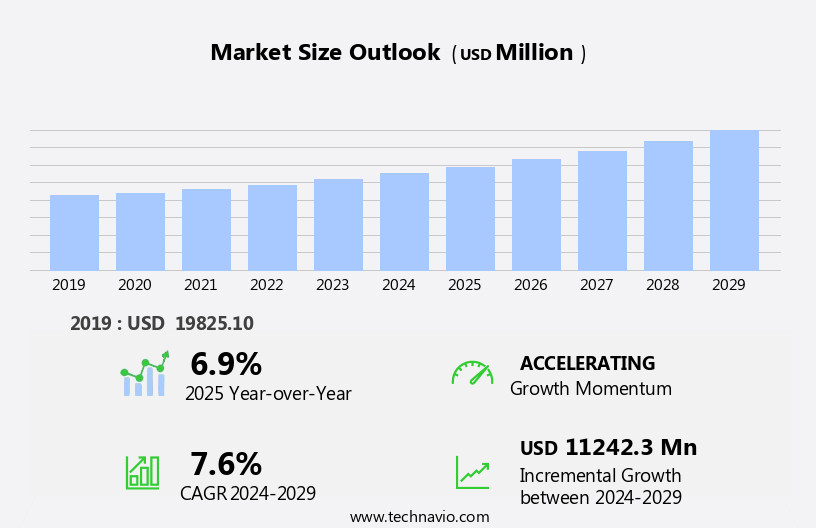

The mobile crane market size is forecast to increase by USD 11.24 billion at a CAGR of 7.6% between 2024 and 2029.

- The market is experiencing significant growth, driven by the surge in infrastructure development projects worldwide. This trend is particularly evident in emerging economies, where increasing urbanization and industrialization necessitate the construction of new roads, bridges, and buildings. Another key factor fueling market expansion is the rising adoption of telematics technology in mobile cranes, which enhances operational efficiency, safety, and productivity. However, the market faces challenges as well. Regulatory hurdles, including stringent emission norms, necessitate substantial investments in research and development to create eco-friendly mobile cranes. The market is witnessing significant growth due to the increasing demand for construction machinery in various sectors such as logistics, civil engineering, and construction materials.

- Supply chain inconsistencies, such as delays in raw material sourcing and transportation, also temper growth potential. To capitalize on the market's opportunities and navigate these challenges effectively, companies must focus on innovation, collaboration, and adaptability. By investing in advanced technologies and forging strategic partnerships, they can differentiate themselves, meet evolving customer demands, and stay competitive in the dynamic market.

What will be the Size of the Mobile Crane Market during the forecast period?

- In the dynamic US market, mobile cranes continue to play a pivotal role in heavy lifting and specialized lifting applications, particularly in the power generation sector, with the rise of renewable energy. Telescopic boom cranes, featuring boom length extensions and jib extensions, are increasingly adopted for wind energy projects. Electric cranes, known for their eco-friendliness and lower operating costs, are gaining traction in the market. Crane manufacturing involves counterweight systems, crane parts suppliers, and crane inspection to ensure high capacity and safety. Crane logistics and transportation are crucial for oversize loads and crane assembly, while crane safety regulations and operator training programs are essential for autonomous operation.

- Heavy duty cranes, such as rough terrain cranes and lattice boom cranes, cater to industrial maintenance and construction projects. Hoist technology, spreader beams, lifting magnets, and crane accessories market are integral components of crane engineering. Preventive and predictive maintenance, crane design, and crane dismantling are essential for efficient crane operation. Crane financing, crane insurance, and crane safety audits are vital aspects of the crane industry. Data analytics and telematics platforms facilitate load capacity optimization and remote diagnostics, enhancing crane performance and productivity. Crane engineering companies also offer crane assembly, crane dismantling, and crane financing services to cater to diverse client needs. Stringent emission norms and the need for greenhouse gas reduction are driving the demand for eco-friendly mobile cranes. Additionally, crane rental services have gained popularity due to their cost-effectiveness and flexibility.

How is this Mobile Crane Industry segmented?

The mobile crane industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Truck mounted crane

- Trailer mounted crane

- Crawler crane

- Application

- Construction

- Industrial

- Utilities

- Capacity

- Upto 50 ton

- Above 200 ton

- 51 to 100 ton

- 101 to 200 ton

- Product Type

- Telescopic boom

- Lattice boom

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

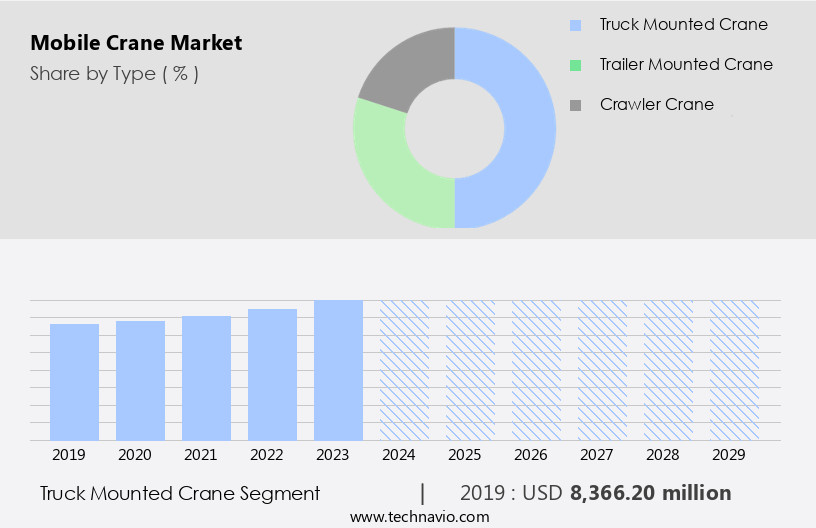

The truck mounted crane segment is estimated to witness significant growth during the forecast period. In the dynamic world of crane technology, mobile cranes continue to gain traction in various industries due to their versatility and adaptability. One prominent application lies within the realm of wind energy, where mobile cranes, particularly those with telescopic booms, are essential for installing wind turbines. The boom length and mobile crane capacity are crucial factors in this application, ensuring the heavy lifting requirements are met. Electric cranes, a subset of mobile cranes, have emerged as a popular choice due to their eco-friendly nature and lower emissions. Crane parts, a vital component of crane maintenance, are continuously innovated to enhance performance and safety. Crane rental services and fleet management play a crucial role in the market, ensuring the availability of cranes for diverse applications.

Autonomous operation and remote control are increasingly integrated into mobile cranes for improved efficiency and productivity. Rough terrain cranes and specialized lifting cranes cater to unique applications, while contract lifting services offer expert handling for complex projects. Regulatory frameworks and funding programs are also promoting the adoption of efficient fleet management solutions, including AI-powered fleet management software. Crane optimization, project management, and crane certification ensure safety standards are met and projects run smoothly. Heavy haul and material handling are other significant sectors where mobile cranes excel. Crawler cranes, hydraulic cranes, and all-terrain cranes are integral to heavy machinery operations. Safety features, including load moment indicators and outrigger systems, are essential for safe and efficient lifting. The oil and gas industry relies on mobile cranes for heavy lifting tasks, with safety regulations and emissions regulations playing a crucial role.

The Truck mounted crane segment was valued at USD 8.37 billion in 2019 and showed a gradual increase during the forecast period. The rental market offers flexibility and cost-effectiveness, while fleet management and anti-collision systems ensure optimal performance and safety. Used mobile cranes and crane accessories are valuable resources for businesses, contributing to the market's growth. Turnkey solutions and service contracts provide comprehensive support for crane operations. Infrastructure development projects require mobile cranes for their heavy lifting capabilities and ease of transportation. In conclusion, the market is characterized by continuous innovation and adaptation to meet the diverse needs of various industries. From wind energy to heavy haul and infrastructure development, mobile cranes play a pivotal role in lifting and moving heavy objects, ensuring projects are completed efficiently and safely.

Regional Analysis

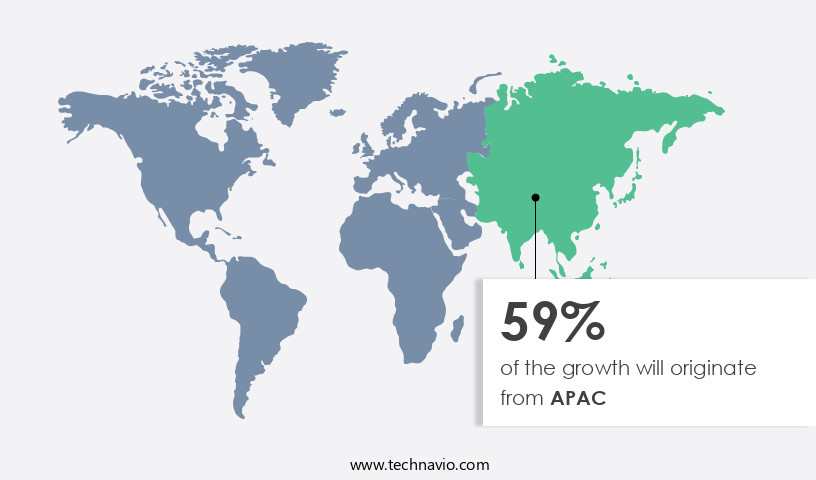

APAC is estimated to contribute 59% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. Contract lifting and project management companies are leveraging crane optimization techniques to improve productivity and reduce costs. Crane certification and safety standards are paramount in ensuring safe crane operations. The oil and gas industry and heavy machinery sectors are major consumers of mobile cranes due to their heavy lifting requirements. Safety features, such as load moment indicators and anti-collision systems, are becoming mandatory for crane operations. Emissions regulations are driving the adoption of electric and hybrid cranes in the rental market. Crane accessories and used mobile cranes are also in demand due to their cost-effective solutions.

Governments and private organizations are investing heavily in infrastructure development projects, leading to an increased demand for mobile cranes. Crane maintenance and service contracts are essential for ensuring the longevity and reliability of mobile cranes. Hydraulic cranes and crawler cranes are also used extensively in various industries for heavy lifting applications. Material handling and turnkey solutions are becoming increasingly important in the market.

The market is witnessing significant growth due to the increasing demand for heavy lifting in various sectors, including wind energy, construction projects, and infrastructure development. Telescopic booms with extended boom lengths are increasingly being utilized to enhance mobile crane capacity for heavy lifting applications. Electric cranes and hybrid cranes are gaining popularity due to their reduced emissions and improved safety features. Crane parts and fleet management solutions are essential for ensuring optimal crane performance and reducing downtime. Autonomous operation and remote control systems are being adopted to increase efficiency and safety in crane operations. Rough terrain cranes and all-terrain cranes are in high demand for specialized lifting and heavy haul applications.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Mobile Crane market drivers leading to the rise in the adoption of Industry?

- Infrastructure development plays a pivotal role in driving market growth, as increased infrastructure investment contributes significantly to economic expansion and facilitates the efficient movement of goods and services. Mobile cranes are essential equipment in infrastructure development due to their versatility in various construction activities, particularly in the infrastructure sector. The global construction industry is experiencing a revival after a prolonged downturn following the financial crisis. This recovery is driven by demographic changes leading to increased infrastructure spending across the globe. For instance, aging populations in Western Europe and Japan necessitate the construction of more medical facilities. Conversely, countries in Sub-Saharan Africa, the Middle East, and parts of APAC require more schools and improved transportation infrastructure to accommodate their growing populations. Mobile cranes come in various lifting capacities to cater to different infrastructure projects.

- Safety is a significant concern in the market, with stringent safety standards in place to ensure the safety of operators and the public. Hydraulic cranes, a common type of mobile crane, are known for their efficiency and flexibility. Emissions regulations are also becoming increasingly stringent, leading to the adoption of hybrid cranes to reduce carbon footprints. The rental market for mobile cranes is also growing, offering flexibility to businesses in managing their equipment needs. Operator training is crucial to ensure safe and efficient operation of mobile cranes.

What are the Mobile Crane market trends shaping the Industry?

- Telematics, the use of technology to gather and transmit data related to vehicle operation and driver behavior, is increasingly becoming a significant market trend. This rising adoption of telematics is driven by the need for improved fleet management, enhanced safety features, and the potential for cost savings. Telematics, a Global Positioning System (GPS)-based technology, is increasingly adopted in the market for enhancing fleet management and operational efficiency. Traditional large players have been early adopters of this technology, but its benefits, such as improved productivity and profitability, are now compelling rental companies of all sizes to integrate it into their operations. The data generated by telematics enables operators to perform comprehensive analyses of equipment usage, location, fault codes, and other features, leading to optimized performance and reduced downtime. Furthermore, the implementation of advanced crane accessories, such as anti-collision systems and load testing equipment, and turnkey solutions for material handling further augment the value proposition of telematics in the mobile crane sector.

- Service contracts are another area where telematics plays a crucial role, enabling predictive maintenance and proactive repairs, thereby reducing maintenance costs and ensuring equipment reliability. The adoption of telematics in the market is driven by the need for enhanced operational efficiency and profitability, making it an indispensable tool for infrastructure development projects and material handling applications.

How does Mobile Crane market faces challenges face during its growth?

- The stringent emission norms pose a significant challenge to the growth of the industry, requiring companies to invest heavily in research and development of compliant technologies. The mobile crane industry faces the challenge of reducing the environmental impact of its operations, particularly in terms of greenhouse gas (GHG) emissions and other air pollutants. Real-time measurement and monitoring of these emissions using portable emission measurement systems (PEMS) enable manufacturers to assess the environmental impact of construction equipment and improve sustainability. PEMS can measure CO2, nitrogen oxides, hydrocarbon, and carbon monoxide emissions in real-time, providing essential data for deriving emission rates and emission factors under various operating conditions.

- The implementation of stringent Tier 4 Pollution norms for heavy industries has resulted in the difficulty of selling non-compliant machines. This regulatory requirement adds pressure on companies to upgrade their equipment to meet the new standards, driving demand for more eco-friendly mobile cranes. By investing in advanced emission measurement systems and developing more sustainable mobile cranes, manufacturers can meet regulatory requirements and contribute to a greener construction industry.

Exclusive Customer Landscape

The mobile crane market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the mobile crane market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, mobile crane market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Action Construction Equipment Ltd. - The company specializes in providing mobile crane solutions, including the RHINO 90C model. Our offerings prioritize mobility, versatility, and superior lifting capabilities.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Action Construction Equipment Ltd.

- Altec Inc.

- Bocker Maschinenwerke GmbH

- Broderson Manufacturing Corp.

- Cargotec Corp.

- Caterpillar Inc.

- Deere and Co.

- Escorts Ltd.

- Konecranes

- Liebherr International AG

- MEDIACO LEVAGE

- Sany Group

- SENNEBOGEN Maschinenfabrik GmbH

- Shanghai Zhenhua Heavy Industries Co. Ltd.

- Tadano Ltd.

- Terex Corp.

- The Manitowoc Co. Inc.

- Tiong Woon Corp. Holding Ltd.

- Xuzhou Construction Machinery Group Co. Ltd.

- Zoomlion Heavy Industry Science and Technology Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Mobile Crane Market

- In February 2023, Terex Corporation, a leading crane manufacturer, introduced its new Terex RH 500 crawler crane, designed to offer increased lifting capacity and improved fuel efficiency. This innovative crane model is expected to cater to the growing demand for heavy-lifting equipment in the construction and infrastructure sectors (Terex Corporation Press Release, 2023).

- In May 2024, Liebherr-Werk Ehingen GmbH, a renowned crane manufacturer, announced a strategic partnership with Siemens Energy to integrate renewable energy solutions into their mobile cranes. This collaboration aims to reduce crane emissions and promote sustainable construction practices (Liebherr-Werk Ehingen GmbH Press Release, 2024).

- In October 2024, Manitowoc Crane Group, a global crane manufacturer, completed the acquisition of Demag Cranes AG, significantly expanding its product portfolio and market presence in Europe. The acquisition also allowed Manitowoc to offer a more comprehensive range of crane solutions to its customers (Manitowoc Crane Group Press Release, 2024).

- In January 2025, the European Union passed new regulations on emissions from construction machinery, including mobile cranes. The regulations set strict limits on emissions and require manufacturers to invest in research and development of cleaner technologies. This policy change is expected to drive innovation in the market and promote the adoption of electric and hybrid cranes (European Union Press Release, 2025).

Research Analyst Overview

Mobile cranes have long been a vital component of the construction and heavy lifting industries, with their versatility and mobility making them indispensable for various projects. The market for mobile cranes is a dynamic and evolving one, shaped by numerous factors that include advancements in technology, changing customer demands, and regulatory requirements. One significant trend in the market is the increasing adoption of telescopic booms, which offer greater reach and flexibility compared to fixed boom cranes. The boom length of mobile cranes is another crucial factor, as longer booms enable cranes to reach greater heights and cover larger areas. In recent years, there has been a growing demand for mobile cranes with higher capacities, driven by the increasing size and complexity of construction projects.

Another trend in the market is the rise of electric cranes, which offer several advantages over traditional hydraulic cranes. Electric cranes produce fewer emissions, making them a more environmentally-friendly option. They also offer smoother operation and lower maintenance costs, making them a popular choice for projects in urban areas and those with tight emissions regulations. Crane parts and components are another essential aspect of the market. The demand for spare parts and components is driven by the need for regular maintenance and repairs to ensure the safe and efficient operation of mobile cranes. The market for crane parts is expected to grow significantly in the coming years, driven by the increasing number of cranes in operation and the growing demand for cranes in various industries.

Autonomous operation is another trend that is gaining traction in the market. Autonomous cranes offer several advantages, including increased productivity, improved safety, and reduced labor costs. However, the adoption of autonomous cranes is still in its early stages, and several challenges need to be addressed before they become a mainstream option. Heavy lifting and specialized lifting are other areas where mobile cranes play a crucial role. Mobile cranes are often used for lifting heavy loads in construction projects, infrastructure development, and oil and gas industries. The demand for mobile cranes with higher lifting capacities and specialized features, such as anti-collision systems and load moment indicators, is expected to grow in the coming years.

Project management and crane optimization are critical aspects of the market. Effective project management and crane optimization are essential for ensuring the safe and efficient operation of mobile cranes and minimizing downtime. Crane rental companies and fleet management firms offer turnkey solutions for project management and crane optimization, helping customers maximize the productivity and utilization of their crane fleets. Crane certification and safety standards are other essential factors in the market. Crane operators must undergo rigorous training and certification programs to ensure they have the necessary skills and knowledge to operate mobile cranes safely and efficiently. Safety features, such as outrigger systems and load testing, are also crucial for ensuring the safe operation of mobile cranes.

Emissions regulations are another significant factor influencing the market. The increasing focus on reducing emissions in various industries is driving the adoption of electric and hybrid cranes, which offer lower emissions compared to traditional hydraulic cranes. The market also includes the rental market, which offers a flexible and cost-effective option for customers who require cranes for short-term projects or who do not have the resources to purchase and maintain their own cranes. The rental market is expected to grow significantly in the coming years, driven by the increasing number of construction projects and the growing demand for mobile cranes in various industries.

Heavy haul and material handling are other areas where mobile cranes are used extensively. Mobile cranes are often used for transporting heavy loads over long distances and for material handling in various industries, including construction, manufacturing, and logistics. Service contracts and used mobile cranes are other aspects of the market. Service contracts offer customers peace of mind by providing regular maintenance and repairs for their mobile cranes, ensuring they operate safely and efficiently. Used mobile cranes offer a cost-effective option for customers who do not have the resources to purchase new cranes. Crane accessories, such as outrigger pads and winches, are also an essential part of the market.

Crane accessories help improve the performance and safety of mobile cranes, making them a popular choice among customers. In conclusion, the market is a dynamic and evolving one, shaped by numerous factors, including advancements in technology, changing customer demands, and regulatory requirements. The market for mobile cranes includes various segments, including telescopic booms, electric cranes, crane parts, autonomous operation, heavy lifting, project management, crane certification, safety standards, emissions regulations, rental market, heavy haul, operator training, hybrid cranes, fleet management, anti-collision systems, load testing, turnkey solutions, material handling, service contracts, used mobile cranes, and crane accessories. Each of these segments offers significant growth opportunities, driven by the increasing demand for mobile cranes in various industries and the growing focus on safety, efficiency, and sustainability.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Mobile Crane Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

242 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.6% |

|

Market growth 2025-2029 |

USD 11.24 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.9 |

|

Key countries |

China, US, Japan, Germany, India, Canada, South Korea, France, UK, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Mobile Crane Market Research and Growth Report?

- CAGR of the Mobile Crane industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the mobile crane market growth of industry companies

We can help! Our analysts can customize this mobile crane market research report to meet your requirements.