AI-Powered Fleet-Management Software Market Size 2024-2028

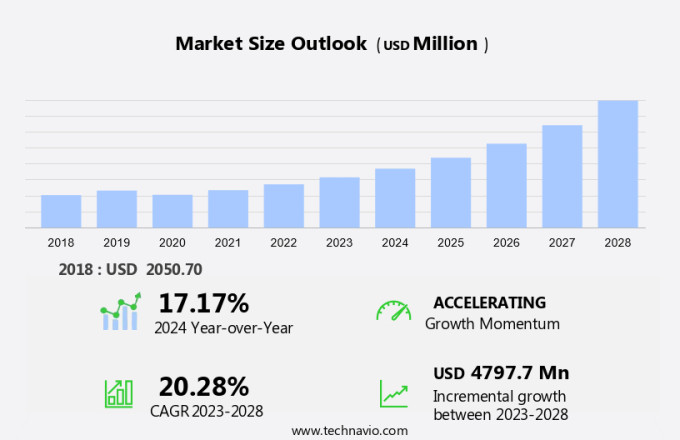

The AI-powered fleet-management software market size is forecast to increase by USD 4.80 billion, at a CAGR of 20.28% between 2023 and 2028. The market is experiencing significant growth, driven by the increasing focus on efficient use of data to enhance fleet operations and management. Cloud products are gaining popularity in the market due to their flexibility and cost-effectiveness. This trend is being fueled by the growing adoption of IoT devices and sensors in vehicles, which generate vast amounts of data that can be analyzed in real-time to optimize fleet performance and reduce operational costs. Additionally, investments in autonomous fleets are on the rise, with companies recognizing the potential of AI and machine learning to improve safety, productivity, and sustainability. However, the market also faces challenges, including data privacy concerns and the need for standardized data formats and protocols to ensure seamless integration and interoperability between fleet management systems. Overall, the market is poised for robust growth, driven by the convergence of technology trends and business needs.

What will be the Size of the Market During the Forecast Period?

For More Highlights About this Report, Request Free Sample

Market Dynamic and Customer Landscape

The market is witnessing significant growth due to the increasing need for Finance for Vehicles and Vehicle maintenance in various industries such as Logistics, Transportation, Oil & gas, Chemical, and FMCG. The integration of Artificial Intelligence (AI) in fleet management software is revolutionizing the industry by providing advanced Tracking and diagnostics capabilities. The rapid adoption of electric vehicles (EVs) and autonomous vehicles (AVs) is transforming transportation, while ongoing vaccination efforts are crucial in ensuring public health as these advanced technologies become more prevalent on the roads. The use of the Internet of Things (IoT) and GPS technology enables real-time monitoring of fleet vehicles, ensuring efficient Business operations. AI-powered fleet management software uses data from various sources, including GPS, IoT sensors, and on-board diagnostics, to provide insights into fuel usage, routine maintenance, and compliance with ELD regulations and pollution standards. The software also helps improve Road safety by providing real-time alerts for potential issues and promoting Environmentally friendly procedures. The implementation of AI and advanced analytics in fleet management software is expected to drive the market's growth in the coming years.

Key Market Driver

Growing focus on efficient use of data to enhance fleet-management is notably driving market growth. The AI-driven fleet management software market is experiencing significant growth due to the logistics industry's increasing emphasis on data-driven efficiency. Fleet operators can leverage this technology to manage their operations more effectively by accessing real-time data on fuel usage, routing, and vehicle performance through cloud-based systems. AI algorithms optimize fleet operations by automating routine tasks, such as scheduling, geocoding, and fleet tracking using GPS connectivity and geofencing.

Furthermore, AI-powered fleet management software ensures adherence to ELD regulations, pollution standards, and emission requirements. Additionally, it facilitates workforce management, inventory management, and warehouse systems to mitigate labor shortages and improve driver retention. AI-based tools enable businesses to prioritize environmentally friendly procedures and road safety while reducing fuel consumption and optimizing maintenance schedules. Thus, such factors are driving the growth of the market during the forecast period.

Significant Market Trends

Increasing investments in autonomous fleets is the key trend in the market. The logistics and transportation sectors, including oil & gas and chemical industries, are increasingly adopting AI-powered fleet-management software to optimize business operations. This software, which can be accessed via the cloud, enables real-time data management of fleet vehicles through GPS connectivity and geocoding. It facilitates fleet routing, tracking, geofencing, scheduling, and workforce management. With ELD regulations and pollution standards becoming stricter, fleet management software is essential for ensuring road safety, environmentally friendly procedures, and emission requirements.

Additionally, it helps in managing fuel usage and routine maintenance. Investments in the logistics industry, such as the USD300 million GM Co. investment in Momenta for autonomous vehicle manufacturing, will further drive the adoption of AI-powered fleet-management software. Furthermore, the integration of warehouse systems and inventory management systems can enhance the software's functionality, addressing labor shortages and driver retention through technology-driven tools. Thus, such trends will shape the growth of the market during the forecast period.

Major Market Challenge

Data privacy issue is the major challenge that affects the growth of the market. AI-driven fleet management software plays a pivotal role in optimizing business operations in the logistics and transportation sectors, particularly in industries such as oil & gas and chemical, by utilizing real-time data for fleet routing, scheduling, and workforce management. Cloud-based solutions enable GPS connectivity, geocoding, and geofencing, ensuring adherence to ELD regulations, pollution standards, and road safety. Additionally, AI-powered tools facilitate environmentally friendly procedures, emission requirements, fuel usage, and routine maintenance. In the face of labor shortages and driver retention concerns, technology-driven tools offer valuable solutions.

However, data privacy is a significant challenge as AI systems require access to sensitive information, such as fleet locations and workforce data. Companies must employ robust data anonymization techniques to protect data while leveraging AI capabilities. Inventory management systems and warehouse operations also benefit from AI integration, enhancing overall efficiency and productivity. Hence, the above factors will impede the growth of the market during the forecast period

Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

- Fleet Complete: The company offers various solutions such as fleet management, task management, asset management, safety and compliance management, and dispatch and delivery management.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AnyConnect Pvt. Ltd.

- Azuga Inc.

- FleetCor Technologies Inc.

- Geotab Inc.

- GoFleet Inc.

- Inseego Corp.

- Intelex Systems Pvt. Ltd.

- International Business Machines Corp.

- MiX Telematics Ltd.

- Motive Technologies

- NetraDyne Inc.

- Pegasus Transtech LLC

- PowerFleet Inc.

- Samsara Inc.

- ThinAir Telematics

- Trimble Inc.

- TrueLite Trace Inc.

- Verizon Communications Inc.

- VIA TECHNOLOGIES Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Segmentation

By Deployment

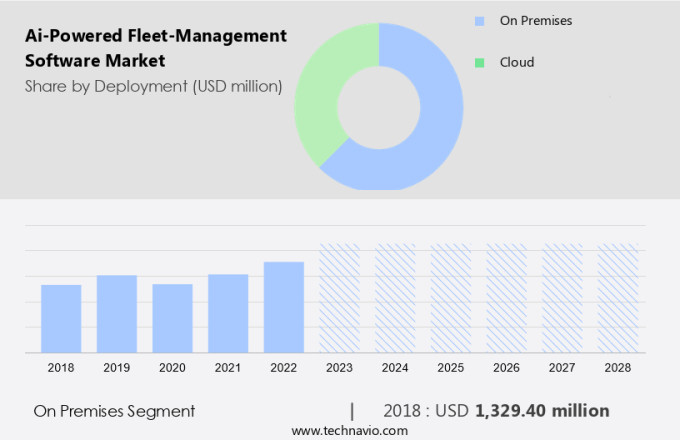

The on premises segment is estimated to witness significant growth during the forecast period. Fleet management software, powered by artificial intelligence (AI), plays a pivotal role in optimizing finance for vehicles and ensuring effective vehicle maintenance in various industries such as mining, oil and gas, aerospace and defense, utility, logistics and transportation, passenger automobile mobility, and the omnichannel shopping sectors. These advanced systems integrate IoT solutions, including alarm systems, asset trackers, and telematics data, to provide real-time fleet tracking, routing, and diagnostics. Cloud-based fleet management systems offer convenience and flexibility, while on-premises solutions prioritize system security.

Get a glance at the market share of various regions Download the PDF Sample

The on premises segment accounted for USD 1.33 billion in 2018. On-premises fleet management software requires a robust IT infrastructure for deployment and offers more control over hardware and software. In contrast, cloud-based fleet management systems use wireless communication systems that are susceptible to hacking and data breaches. Fleet managers can leverage AI-powered fleet management tools to enhance driver safety, vehicle security, and fleet timing, as well as monitor unauthorized access and data privacy violations. Mobility-as-a-Service providers also benefit from these systems, integrating GPS, IoT, and telematics data to offer seamless, efficient services.

By Region

For more insights on the market share of various regions Download PDF Sample now!

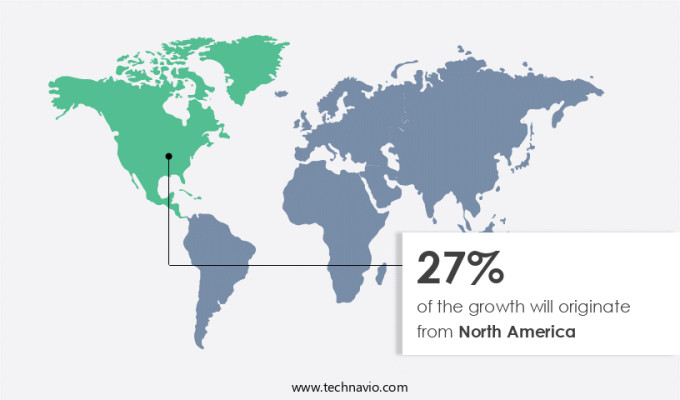

North America is estimated to contribute 27% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. AI-powered fleet management software is revolutionizing finance for vehicles by optimizing costs through effective vehicle maintenance, tracking, and diagnostics. Cloud-based, IoT-driven solutions employ artificial intelligence and telematics to monitor fleet vehicles in real-time, providing fleet managers with valuable insights for routing, driver safety, and vehicle security. Dashboard cameras, alarm systems, and asset trackers are integral components of these systems.

Further, deployment options range from cloud-based to on-premises or hybrid solutions, catering to diverse industries such as mining, oil and gas, aerospace and defense, utility, logistics and transportation, passenger automobile mobility, and omnichannel shopping sectors. IoT solutions facilitate seamless data exchange, enhancing fleet timing and cyber security against unauthorized access and data privacy violations. Mobility-as-a-Service providers leverage these systems for efficient fleet operations, while GPS and telematics data enable advanced routing strategies.

Segment Overview

The market research report provides comprehensive data, with forecasts and estimates in "USD Billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

- Deployment Outlook

- On premises

- Cloud

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- South America

- Chile

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

Market Analyst Overview

The Role of AI-Powered Software in Finance for Vehicles and Beyond AI-powered fleet management software is transforming the way businesses manage their vehicle fleets, offering advanced features such as vehicle maintenance, tracking and diagnostics, and real-time analytics. This cloud-based technology leverages the Internet of Things (IoT) and telematics to provide valuable insights for fleet managers in various industries, including mining, oil and gas, aerospace and defense, utility, logistics and transportation, passenger automobile mobility, and more. Key functions include fleet timing, routing, vehicle security, driver safety, and asset tracking. Deployment options range from cloud-based to on-premises and hybrid solutions, catering to diverse business needs. AI capabilities enable predictive maintenance, optimized fuel consumption, and improved fleet performance.

Additionally, AI-powered fleet management software integrates with IoT solutions like alarm systems and dashboard cameras for enhanced security and data privacy. As the market continues to grow, addressing concerns like cyber security and unauthorized access becomes increasingly important. The future of fleet management lies in Mobility-as-a-Service, where AI and GPS enable seamless, omnichannel shopping sector experiences. In conclusion, AI-powered fleet management software is a game-changer for businesses seeking to optimize their fleet operations, reduce costs, and enhance safety. With continuous advancements in technology, the potential for growth and innovation is vast.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

139 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 20.28% |

|

Market growth 2024-2028 |

USD 4.80 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

17.17 |

|

Regional analysis |

North America, Europe, APAC, Middle East and Africa, and South America |

|

Performing market contribution |

North America at 27% |

|

Key countries |

US, China, Germany, UK, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AnyConnect Pvt. Ltd., Azuga Inc., Fleet Complete, FleetCor Technologies Inc., Geotab Inc., GoFleet Inc., Inseego Corp., Intelex Systems Pvt. Ltd., International Business Machines Corp., MiX Telematics Ltd., Motive Technologies, NetraDyne Inc., Pegasus Transtech LLC, PowerFleet Inc., Samsara Inc., ThinAir Telematics, Trimble Inc., TrueLite Trace Inc., Verizon Communications Inc., and VIA TECHNOLOGIES Inc. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the market forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behavior

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies