Mobile Phone Accessories Market Size 2024-2028

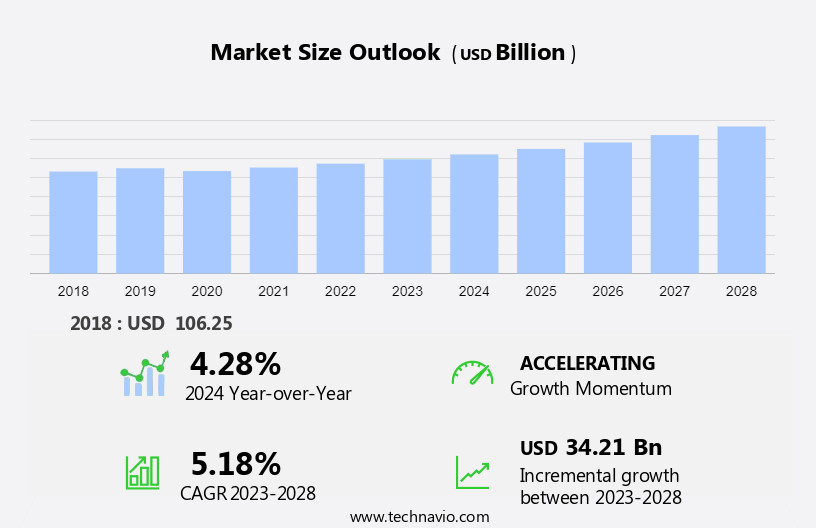

The mobile phone accessories market size is forecast to increase by USD 34.21 billion at a CAGR of 5.18% between 2023 and 2028.

- The market is experiencing significant growth, driven by several key trends and factors. One major trend is the integration of advanced functionalities in smartphones, leading to an increased demand for complementary accessories such as wireless charging pads, protective cases, and high-quality headphones. Another trend is the increasing focus on improving telecommunication network infrastructure, which necessitates the use of advanced accessories like signal boosters and antenna extenders.

-

The expanding market for counterfeit mobile accessories creates both opportunities and challenges for legitimate businesses. While it reflects strong consumer demand for affordable accessories, it also threatens industry reputation and quality standards.

What will the Mobile Phone Accessories Market Size During the Forecast Period?

- The market encompasses a wide range of products, including smartphones, wireless devices, wireless headsets, speakers, power banks, headphones, earphones, smartwatches, and tablets. This market is significantly impacted by supply chain disruptions, which can affect the availability of batteries, chargers, mobile covers, pouches, leather cases, OTG (On-The-Go) smartphones, Bluetooth keyboards, and wireless headphones. The increasing penetration of the internet and the growing popularity of portable devices have fueled the demand for mobile phone accessories.

- Connectivity and wireless accessories, such as Bluetooth headphones and speakers, have gained popularity due to their convenience and compatibility with various devices. The market is diverse, with both multi-brand and single-brand stores catering to consumers' preferences. The market has also contributed to the demand for high-capacity batteries and storage capacity in mobile phone accessories. Picture quality and music playback are other important factors driving the growth of the market.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- Product

- Protective cases

- Screen protectors

- Headphones and earphones

- Wired chargers

- Power bank and others

- Geography

- APAC

- China

- India

- North America

- Canada

- US

- Europe

- South America

- Brazil

- Middle East and Africa

- APAC

By Distribution Channel Insights

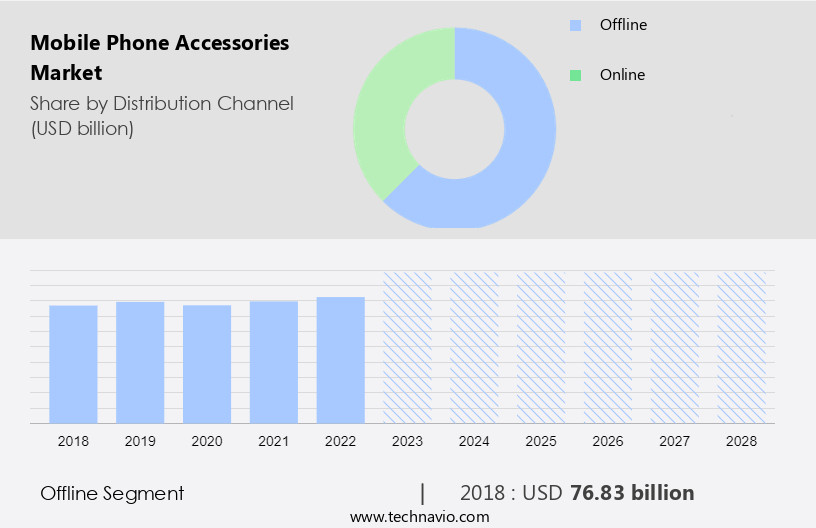

- The offline segment is estimated to witness significant growth during the forecast period.

The market has experienced significant growth in 2020, with offline distribution channels leading the way. These channels encompass the sale of accessories through retail outlets, including retail stores, hypermarkets, and supermarkets. While retail stores remain the dominant segment, the increasing popularity of these larger retail establishments is anticipated to fuel market expansion during the forecast period. Department stores, in particular, are preferred destinations for premium mobile phone accessories due to their extensive product offerings. Smartphones and wireless devices, such as wireless headsets and speakers, dominate the mobile accessories landscape. However, supply chain disruptions have presented challenges in recent times.

Power banks, headphones, and earphones continue to be popular choices among consumers. The rise of the female consumer group and the headphone segment, in particular, have been noteworthy trends. New product launches, such as the Pixel 7 and Pixel 7 Pro, have driven demand for mobile phone accessories, particularly those related to connectivity, wireless accessories, and portable devices like tablets. Battery life, music quality, picture quality, and storage capacity are key considerations for consumers. The mobile gaming boom has led to the emergence of accessories like Bluetooth joysticks, mobile triggers, and smartphone cooling fans. Online retailing platforms have gained traction due to increasing internet penetration and usage.

Get a glance at the market report of share of various segments Request Free Sample

The offline segment was valued at USD 76.83 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

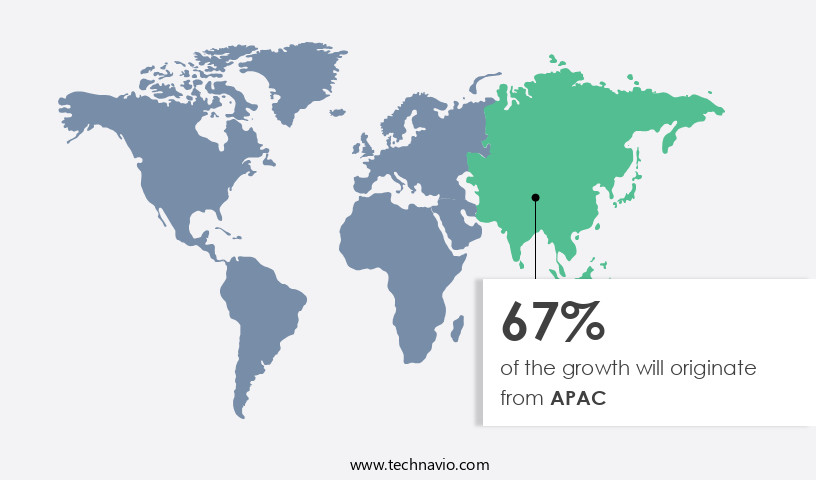

- APAC is estimated to contribute 67% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in APAC is experiencing substantial growth due to several factors. The increasing urban population and rising disposable income have led to a significant increase in demand for tablets, feature phones, and smartphones. This trend is particularly prominent in countries like India, Indonesia, Vietnam, China, Sri Lanka, and Pakistan. The availability of high-end smartphones at competitive prices, coupled with the advancement of technology, has further fueled this demand. Technological advancements, such as 5G, blockchain, cloud services, artificial intelligence, and smart wearable devices, are driving the growth of the consumer electronics industry in APAC. Fashion-conscious consumers in the region are also showing a keen interest in protective cases and other accessories for their devices.

The market for mobile phone accessories is characterized by the presence of both organized stores and independent stores, as well as single-brand stores. The e-commerce industry is playing a significant role in the growth of the market, providing consumers with easy access to a wide range of accessories. However, the lack of standardization in the market poses a challenge, with issues such as piracy and the use of substandard materials being common concerns.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Mobile Phone Accessories Market?

Integration of advanced functionalities in smartphones is the key driver of the market.

- The market has experienced significant growth in tandem with the increasing popularity of smartphones and wireless devices. With advancements in technology, consumers now seek complementary gadgets to enhance their user experience. For instance, wireless headsets and speakers have gained traction, offering connectivity and portability. However, supply chain disruptions and increasing demand for accessories like protective cases, headphones, and earphones, have posed challenges for manufacturers. Moreover, the emergence of smartwatches, power banks, and other wearable devices, fueled by internet penetration and artificial intelligence, has expanded the market scope. The headphone segment, in particular, has witnessed a boom due to the mobile gaming boom and the preference for low-latency headphones.

- The launch of flagship devices like the Pixel 7 and Pixel 7 Pro has further fueled demand for accessories, with consumers seeking improved picture quality, storage capacity, and connectivity. The market for wireless accessories, including Bluetooth joysticks, mobile triggers, and smartphone cooling fans, has also gained momentum, catering to the needs of mobile gamers. The rise of online retailing platforms and the convenience of internet usage have facilitated the purchase of accessories, enabling consumers to access music, text messages, and other multimedia content seamlessly. Advancements in technology, such as noise-cancellation technology, Bluetooth/NFC speakers, and selfie sticks, have added value to the market.

What are the market trends shaping the Mobile Phone Accessories Market?

Increasing focus on improving telecommunication network infrastructure is the upcoming trend in the market.

- The market is experiencing significant growth, driven by advancements in wireless technology and the increasing use of smartphones and other wireless devices for multimedia consumption. Smartphone manufacturers continue to innovate, releasing new models such as the Pixel 7 and Pixel 7 Pro, which support high-speed connectivity and advanced features. This trend is fueling demand for wireless accessories like headphones and speakers, as well as power banks and protective cases. Internet penetration and the mobile gaming boom are also contributing to the market's expansion. Consumers are increasingly relying on their mobile devices for gaming, music, and picture and video viewing, leading to a rise in demand for low-latency headphones, Bluetooth joysticks, and mobile triggers.

- Additionally, the rise of artificial intelligence and smart gadgets, such as smartwatches and selfie sticks, is driving growth in the market for wireless accessories. However, supply chain disruptions and the ongoing rollout of 5G technology pose challenges for the market. Manufacturers must adapt to meet the demands of consumers for high-speed connectivity and advanced features, while also addressing concerns around battery life, music quality, and storage capacity. Online retailing platforms are playing a crucial role in meeting this demand, offering a wide range of wireless accessories for consumers to choose from. Noise-cancellation technology and Bluetooth/NFC speakers are also popular choices for consumers, particularly in the headphone segment.

Female consumers represent a significant consumer group, with a growing preference for wireless headphones and earphones. Overall, the market is poised for continued growth, driven by advancements in wireless technology and the increasing use of mobile devices for multimedia consumption.

What challenges does Mobile Phone Accessories Market face during the growth?

The growing market for counterfeit mobile accessories is a key challenge affecting the market growth.

- The global market for mobile phone accessories experiences impeded growth due to the escalating trend of counterfeit accessories among users. A diverse assortment of accessories, encompassing protective cases, screen protectors, power banks, batteries, Bluetooth speakers, and more, are increasingly being peddled in the counterfeit market. This phenomenon is particularly prevalent in emerging economies in Asia Pacific, such as Indonesia, Malaysia, India, and Taiwan, where the preference for affordable products and the ubiquitous availability of counterfeit goods fuel demand. Approximately 18% of the global mobile handsets sold are counterfeits. Smartphones and wireless devices, including wireless headsets and speakers, are the primary drivers of this market.

- Supply chain disruptions due to counterfeit accessories can adversely impact connectivity and performance. Headphones and earphones, a significant segment, are in high demand, with the latest models like Pixel 7 and Pixel 7 Pro gaining popularity. Power banks, essential for portable devices like tablets and smartphones, are also sought after. Internet penetration and the rise of artificial intelligence have expanded the market's scope. Protective cases cater to the female consumer group, while the headphone segment offers low-latency headphones, Bluetooth joysticks, and mobile triggers for enhanced mobile gaming experiences. Smartphone cooling fans and selfie sticks are other popular accessories. The advent of 5G technology and the proliferation of smart gadgets and smart wearables have further broadened the market.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Anker Technology UK Ltd.

- Apple Inc.

- AUKEY Online

- Bose Corp.

- Callmate India Pvt. Ltd.

- Case Mate Inc.

- Hon Hai Precision Industry Co. Ltd.

- HP Inc.

- Intex Technologies India Ltd.

- JVCKENWOOD Corp.

- Koninklijke Philips N.V.

- LG Electronics Inc.

- Logitech International SA

- Panasonic Holdings Corp.

- Samsung Electronics Co. Ltd.

- Sennheiser Electronic GmbH and Co. KG

- Skullcandy Inc.

- Sony Group Corp.

- Vinci Brands LLC

- Xiaomi Communications Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is a significant sector, encompassing a wide range of products. Heads, headphones, and protective cases are among the popular accessories in this market. Consumers seek convenience and compatibility with their devices, driving demand for these accessories. Brands offer various designs, materials, and features to cater to diverse preferences. Mobile phone users look for headphones that deliver superior sound quality and comfort. Protective cases are essential to safeguard devices from damage. Brands employ innovative technologies to create sleek, durable cases that enhance the look and feel of mobile phones.

Additionally, mobile phone accessories include power banks, screen protectors, and mounts. Power banks provide an extended battery life, while screen protectors shield the display from scratches and cracks. Mounts enable hands-free usage, making them popular among drivers and multitaskers. The market for mobile phone accessories is dynamic, with constant innovation and competition. Brands focus on creating accessories that offer unique value propositions to consumers. The market is expected to grow as mobile phone usage continues to increase worldwide.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

178 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.18% |

|

Market Growth 2024-2028 |

USD 34.21 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.28 |

|

Key countries |

US, Canada, China, India, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch