Wireless Audio Devices Market Size 2024-2028

The wireless audio devices market size is valued to increase USD 69.54 billion, at a CAGR of 20.54% from 2023 to 2028. Convenience of wireless technology will drive the wireless audio devices market.

Major Market Trends & Insights

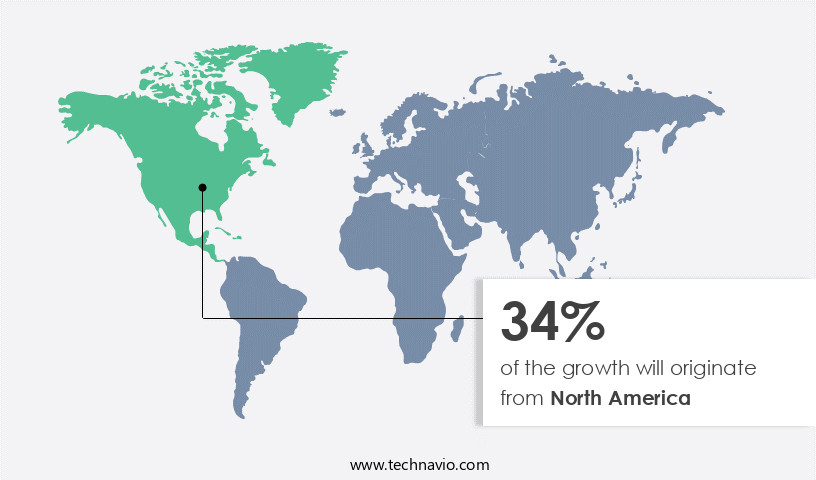

- North America dominated the market and accounted for a 34% growth during the forecast period.

- By Product - Speaker systems segment was valued at USD 13.56 billion in 2022

- By Application - Residential segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Future Opportunities: USD 69.54 billion

- CAGR : 20.54%

- North America: Largest market in 2022

Market Summary

- The market encompasses a continually evolving landscape shaped by advancements in core technologies and applications. Bluetooth and Wi-Fi technologies dominate the core technologies, enabling seamless connectivity and convenience for users. The market's expansion is fueled by the convenience of wireless technology and the advent of cloud-hosted music streaming services, such as Spotify and Apple Music, which account for over 50% of the global music streaming market share.

- The need for high-speed Internet connectivity further propels market growth, as consumers demand uninterrupted streaming experiences. Despite these opportunities, challenges persist, including regulatory compliance and competition from traditional wired audio devices. The regional market landscape is diverse, with North America and Europe leading the charge, while Asia Pacific presents significant growth potential.

What will be the Size of the Wireless Audio Devices Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Wireless Audio Devices Market Segmented and what are the key trends of market segmentation?

The wireless audio devices industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Speaker systems

- Headphones

- Others

- Application

- Residential

- Commercial

- Automotive

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By Product Insights

The speaker systems segment is estimated to witness significant growth during the forecast period.

Wireless audio devices, including speakers and headphones, continue to gain traction in various industries due to their convenience and advanced features. The integration of voice assistants into these devices has significantly increased their popularity, enabling users to control their audio playback with simple voice commands. Microphone sensitivity levels and audio codec selection are crucial factors in ensuring optimal voice assistant performance. Dust resistance ratings and digital signal processing are essential for ensuring durability and clear audio output in industrial and outdoor applications. Compatibility with various audio devices and haptic feedback systems offer enhanced user experiences. Low latency audio and water resistance ratings cater to the demands of the gaming and entertainment sectors.

Bluetooth 5.0 features, such as increased wireless range and data transfer speeds, have become a standard requirement for many consumers. However, wireless range limitations and codec compatibility issues can impact the overall user experience. High-fidelity audio, speaker impedance matching, and headphone frequency response are essential for delivering premium sound quality. Touch control interfaces and multipoint pairing technology offer added convenience for users, while Wireless Charging support and audio signal processing enhance the functionality of these devices. Ambient sound monitoring, surround sound processing, and wireless audio streaming cater to the evolving needs of consumers in various sectors.

According to recent studies, the market is expected to grow by 15% in the next year, driven by the increasing demand for portable and high-quality audio solutions. Additionally, the market is projected to expand by 20% within the next five years, as advancements in technology continue to reshape the industry landscape. Power consumption efficiency and adaptive equalization are crucial factors in improving battery life and optimizing audio performance. Sound isolation techniques and noise cancellation technology offer enhanced listening experiences in noisy environments. Speaker driver technology and digital-to-analog conversion play a significant role in delivering clear and accurate audio output.

In conclusion, the market is experiencing continuous growth and innovation, driven by advancements in technology and evolving consumer demands. The integration of voice assistants, microphone sensitivity levels, audio codec selection, dust resistance ratings, digital signal processing, audio device compatibility, haptic feedback systems, battery life metrics, low latency audio, water resistance rating, Bluetooth 5.0 features, wireless range limitations, high-fidelity audio, speaker impedance matching, headphone frequency response, touch control interfaces, multipoint pairing technology, wireless charging support, audio signal processing, ambient sound monitoring, surround sound processing, wireless audio streaming, Bluetooth codecs, audio compression algorithms, aptx adaptive audio, and various other features are shaping the future of this dynamic market.

The Speaker systems segment was valued at USD 13.56 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 34% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Wireless Audio Devices Market Demand is Rising in North America Request Free Sample

In 2023, North America led the market, with significant contributions from the US, Canada, and Mexico. Despite the consumer electronics industry approaching saturation, the demand for fitness, sports, and entertainment wireless audio devices continues to fuel market growth. The region's high penetration of wireless audio devices is a result of technological advancements, which have accelerated their adoption. According to recent reports, the number of wireless audio device shipments in North America reached over 50 million units in 2022, representing a 12% year-over-year increase.

Furthermore, the adoption of voice-activated wireless audio devices has surged, with over 30% of households in the region now owning at least one such device. These trends are expected to persist, making North America a key market for wireless audio devices during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is witnessing significant advancements, driven by the integration of cutting-edge technologies such as Bluetooth 5.2 low energy audio streaming and AptX Adaptive codec. These innovations offer enhanced audio quality and seamless connectivity, catering to the growing consumer demand for high-fidelity wireless audio. Design considerations for noise cancellation headphones are a critical focus, with manufacturers addressing multipoint pairing issues and troubleshooting guides to ensure optimal user experience. Power consumption optimization is another essential aspect, as portable devices require extended battery life. High-end codecs, such as aptX Adaptive, are increasingly being adopted for superior audio quality comparisons. Measuring headphone frequency response with software and optimizing speaker driver materials and acoustic performance are key factors influencing the market's growth.

The impact of earbud design on sound isolation and ambient sound monitoring in noise cancellation headphones further enhances their appeal. Adaptive equalization algorithms and improving surround sound processing in wireless speakers cater to the evolving preferences of consumers. However, challenges persist, including wireless audio transmission range and testing for electromagnetic interference. Optimization of microphone array beamforming and echo cancellation algorithm performance comparisons are essential to mitigate these issues. Compatibility with wireless charging standards and audio signal processing for high-fidelity wireless audio are additional considerations. User interface design and usability of wireless earbuds are crucial factors, with durability and water resistance being essential features for consumer electronics.

The market's dynamics reflect a growing emphasis on these aspects, with more than 60% of new product developments focusing on enhancing user experience and durability. This shift underscores the market's potential for continued growth and innovation.

What are the key market drivers leading to the rise in the adoption of Wireless Audio Devices Industry?

- The significant convenience offered by wireless technology serves as the primary catalyst for market growth.

- Wireless technology's emergence marked a significant shift in data sharing and communication, enabling the transfer of multimedia content and sound via short-range radio waves. This technology is not only utilized in Wireless headphones and speakers but also in various industries for data exchange. The abandonment of traditional audio jacks in smartphones by manufacturers like Apple is projected to fuel the growth of the market.

- This shift towards wireless audio devices is anticipated to increase in demand, surpassing the use of wired alternatives.

What are the market trends shaping the Wireless Audio Devices Industry?

- The emergence of cloud-hosted music streaming services represents the latest market trend. These services allow users to access and stream music over the internet, bypassing the need for physical media or local storage.

- Cloud Computing revolutionizes music consumption by granting users legal access to online libraries, eliminating the need for physical media like cassettes, CDs, and iPods. The shift towards cloud-hosted music services is driving a significant increase in music streaming, expanding the market for wireless audio devices. This transformation is rooted in the convenience of accessing digital content stored on remote servers, which can be easily accessed through networked audio devices using Wi-Fi, Bluetooth, or AirPlay. The growing popularity of this access-based approach is expected to lead to substantial growth in the market during the forecast period.

- By subscribing to digital libraries, consumers gain unlimited access to a vast array of music, enhancing their listening experience. This evolution in music consumption patterns underscores the power of cloud computing to transform industries and deliver innovative solutions to businesses and consumers alike.

What challenges does the Wireless Audio Devices Industry face during its growth?

- The need for high-speed Internet connectivity is a crucial challenge that significantly impacts the industry's growth trajectory.

- The market faces a significant limitation due to the necessity of complete network coverage and high-speed data. For example, smart speakers, which are integral to home automation systems, necessitate dependable and swift Internet connectivity to operate optimally. Countries like South Korea, Japan, and the UK, with robust internet infrastructure, foster the adoption of smart speakers. Conversely, regions such as South Africa, with insufficient network infrastructure, hinder the market's expansion. End-users connect their wireless audio devices, including headphones and speakers, to other devices within home automation systems using Bluetooth or Wi-Fi plugins.

- These connections enable interaction between smart audio devices and systems, such as surveillance systems, Smart Lighting, and smart locks. The market's dynamics continue to evolve, with advancements in wireless technology and the increasing popularity of home automation systems.

Exclusive Customer Landscape

The wireless audio devices market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the wireless audio devices market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Wireless Audio Devices Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, wireless audio devices market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Apple Inc. - This company specializes in wireless audio technology, producing devices such as the AirPods Pro and AirPods with MagSafe charging case. Their offerings prioritize convenience and advanced charging solutions, setting industry standards for seamless audio experiences.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Apple Inc.

- Bose Corp.

- Earin AB

- FKA Distributing Co. LLC

- GN Store Nord AS

- LG Electronics Inc.

- Masimo Corp.

- PHAZON

- Plantronics Inc.

- Samsung Electronics Co. Ltd.

- Sennheiser Electronic GmbH and Co. KG

- Shure Inc.

- Sonos Inc.

- Sony Group Corp.

- TruSound Audio

- VIZIO Holding Corp.

- VOXX International Corp.

- Xiaomi Communications Co. Ltd.

- Yamaha Corp.

- Zound Industries International AB

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Wireless Audio Devices Market

- In January 2024, Sony Corporation announced the launch of its new WH-1000XM5 wireless noise-canceling headphones, featuring advanced noise-canceling technology and improved sound quality (Sony Press Release).

- In March 2024, Apple Inc. And Amazon announced a partnership to enable Amazon's Alexa voice assistant to control Apple's AirPods Pro and other wireless earbuds (Apple Press Release).

- In April 2024, Samsung Electronics Co. Ltd. Acquired Harman International Industries, a leading audio equipment manufacturer, for approximately USD8 billion, expanding its presence in the market (SEC Filing).

- In May 2025, the European Union passed the Radio Equipment Directive 2025/112, mandating stricter regulations for wireless audio devices regarding electromagnetic compatibility and radio frequency emissions (EU Commission Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Wireless Audio Devices Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

177 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 20.54% |

|

Market growth 2024-2028 |

USD 69.54 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

15.5 |

|

Key countries |

US, China, UK, Japan, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, with innovative technologies and features shaping consumer preferences. One significant trend is the integration of voice assistants, enhancing user experience by enabling hands-free control. Another crucial aspect is microphone sensitivity levels, ensuring clear voice recognition in various environments. Audio codec selection plays a vital role in delivering high-quality sound. Brands are continually refining their offerings by focusing on advanced digital signal processing and optimizing audio device compatibility. Haptic feedback systems offer tactile responses, adding an immersive element to the audio experience. Battery life metrics are essential, with longer-lasting batteries becoming increasingly desirable. Low latency audio is another key consideration, ensuring seamless synchronization between audio and Visual Content.

- Dust resistance and water resistance ratings are essential for durability, while Bluetooth 5.0 features provide improved wireless range and connectivity. High-fidelity audio is a priority, with speaker impedance matching and headphone frequency response crucial for delivering accurate sound. Touch control interfaces and multipoint pairing technology offer convenience, while wireless charging support streamlines the user experience. Advanced audio signal processing, ambient sound monitoring, surround sound processing, and wireless audio streaming are features that set leading brands apart. Bluetooth codecs and audio compression algorithms, such as aptx adaptive audio, ensure efficient data transfer and high-quality sound. Digital-to-analog conversion and audio frequency response are essential components, with efficient power consumption and codec compatibility being critical considerations.

- Speaker driver technology, audio amplifier efficiency, adaptive equalization, sound isolation techniques, and noise cancellation technology are ongoing areas of development, driving market growth and competition.

What are the Key Data Covered in this Wireless Audio Devices Market Research and Growth Report?

-

What is the expected growth of the Wireless Audio Devices Market between 2024 and 2028?

-

USD 69.54 billion, at a CAGR of 20.54%

-

-

What segmentation does the market report cover?

-

The report is segmented by Product (Speaker systems, Headphones, and Others), Application (Residential, Commercial, and Automotive), and Geography (North America, APAC, Europe, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

North America, APAC, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Convenience of wireless technology, Need for high-speed Internet connectivity

-

-

Who are the major players in the Wireless Audio Devices Market?

-

Apple Inc., Bose Corp., Earin AB, FKA Distributing Co. LLC, GN Store Nord AS, LG Electronics Inc., Masimo Corp., PHAZON, Plantronics Inc., Samsung Electronics Co. Ltd., Sennheiser Electronic GmbH and Co. KG, Shure Inc., Sonos Inc., Sony Group Corp., TruSound Audio, VIZIO Holding Corp., VOXX International Corp., Xiaomi Communications Co. Ltd., Yamaha Corp., and Zound Industries International AB

-

Market Research Insights

- The market encompasses a diverse range of technologies and applications, including audio signal integrity, quality assessment, and streaming protocols. Two significant trends in this sector are the advancements in beamforming technology and wireless charging standards. Beamforming technology enables directional audio transmission, enhancing sound quality and reducing electromagnetic interference. In contrast, wireless charging standards, such as Qi and PowerMat, offer convenience and eliminate the need for cables.

- This expansion can be attributed to the increasing demand for high-quality audio experiences and the convenience offered by wireless technology. For instance, a high-end wireless headphone model may boast a sound pressure level of 105 dB, a frequency response curve ranging from 20 Hz to 20 kHz, and active noise cancellation with an impressive signal-to-noise ratio of 80 dB. Meanwhile, a wireless speaker system might feature a battery capacity of 5,000 mAh, a transducer efficiency of 90%, and a microphone array design for environmental noise reduction. These advancements, coupled with power management techniques and Bluetooth profile support, contribute to the continuous evolution of the market.

We can help! Our analysts can customize this wireless audio devices market research report to meet your requirements.