Smart Antenna Market Size 2024-2028

The smart antenna market size is forecast to increase by USD 5.93 billion, at a CAGR of 11% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing demand for smart devices and the advent of 5G technology. The market is characterized by frequent advances and upgrades, as technology companies continuously strive to enhance connectivity and improve network performance. This dynamic market environment presents both opportunities and challenges for businesses. On the one hand, the growing popularity of smart devices and the rollout of 5G networks offer ample opportunities for companies to expand their offerings and cater to the evolving needs of consumers and businesses.

- However, the rapid pace of technological change also poses challenges, as companies must invest heavily in research and development to stay competitive and maintain a strong market position. Additionally, the complex nature of smart antenna technology and the need for interoperability with various devices and networks can create integration and compatibility issues that must be addressed to ensure seamless user experiences.

What will be the Size of the Smart Antenna Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in beam steering, interference cancellation, and spatial multiplexing technologies. These innovations find applications in various sectors, including cellular networks, satellite communication, and autonomous vehicles. The ongoing unfolding of market activities reveals a focus on network optimization and cost optimization through frequency hopping, channel estimation, and antenna calibration. Intellectual property and RF energy harvesting are also key areas of interest. In the realm of wireless communication, phased array and low noise amplifier technologies are gaining traction, enhancing the performance of smart antenna arrays. Digital beamforming and adaptive beamforming are essential components of the system integration process, enabling frequency synchronization and time synchronization for improved spectral efficiency and multi-carrier modulation.

Moreover, the integration of RF front-end components, such as power amplifiers, with wireless power transfer technologies, is paving the way for advanced applications in industrial IoT, smart cities, and sensor fusion. The continuous dynamism of the market is further emphasized by the ongoing research and development in signal processing and performance evaluation, ensuring the delivery of cutting-edge solutions for diverse industries.

How is this Smart Antenna Industry segmented?

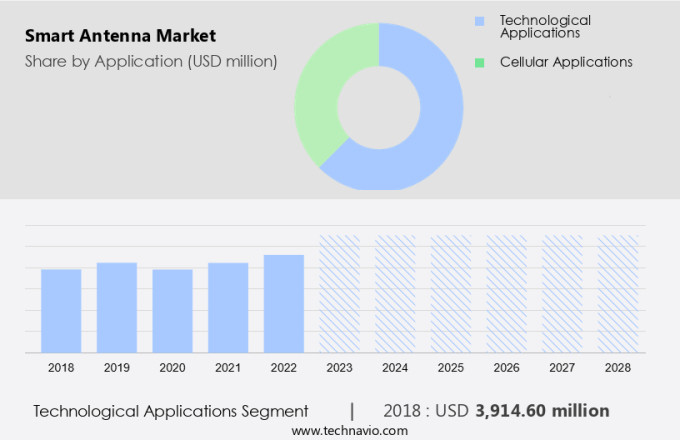

The smart antenna industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Technological applications

- Cellular applications

- Geography

- North America

- US

- Europe

- Germany

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

.

By Application Insights

The technological applications segment is estimated to witness significant growth during the forecast period.

The market encompasses various technological applications, including Wi-Fi systems, WiMAX systems, cellular networks, and broadband and wireless access networks (BWA). In Wi-Fi systems, smart antennas enhance signal quality and coverage by employing techniques such as beam steering, interference cancellation, and spatial multiplexing. These advancements improve network performance, spectral efficiency, and multi-carrier modulation. However, security remains a concern due to the radio waves used for transmission, necessitating the need for robust security measures. In cellular networks, smart antenna arrays implement adaptive beamforming and digital beamforming for network optimization and cost optimization. These techniques enable frequency hopping, channel estimation, and frequency synchronization, ensuring seamless communication between devices and base stations.

Moreover, smart antenna technology is integral to satellite communication, RF energy harvesting, and autonomous vehicles, offering diversity gain and time synchronization. Smart antennas also contribute to the development of industrial IoT, smart cities, sensor fusion, and radar systems by providing improved signal processing capabilities. Intellectual property, advanced driver-assistance systems, power consumption, and lidar systems further benefit from smart antenna technology. Integration of low noise amplifiers, phased arrays, and power amplifiers enhances system performance and reliability. Overall, the market continues to evolve, addressing the demands of various industries and applications.

The Technological applications segment was valued at USD 3.91 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 46% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The surge in urbanization across Asia Pacific countries, particularly China and India, drives the demand for advanced technological solutions to support environmental and economic development. According to the World Bank Group, the number of Internet users in this region has experienced significant growth, with China, India, and Indonesia reporting increases of 14.2 percentage points, 26.1 percentage points, and 25.6 percentage points, respectively, between 2015 and 2019. This trend is accompanied by improvements in the telecommunications sector in various countries, including China, India, and Malaysia. The widespread use of affordable 3G- and 4G-enabled smartphones and the growing demand for IP-based voice, data services, and video have fueled the need for smart antennas.

Smart antennas, which incorporate technologies such as beam steering, interference cancellation, spatial multiplexing, frequency hopping, channel estimation, and adaptive beamforming, are essential components of modern cellular networks. These antennas enable network optimization, cost optimization, and improved frequency synchronization, enhancing overall system performance and spectral efficiency. Furthermore, smart antennas play a crucial role in various applications, including satellite communication, autonomous vehicles, smart cities, industrial IoT, advanced driver-assistance systems, and radar systems. In addition, smart antenna technology is integrated with other emerging technologies, such as RF energy harvesting, digital beamforming, and phased arrays, to address power consumption concerns and improve overall system integration.

Intellectual property considerations and signal processing techniques are essential aspects of the market. As the market evolves, the focus on performance evaluation, time synchronization, and system integration will continue to be critical factors in its growth.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Smart Antenna Industry?

- The surge in demand for smart devices serves as the primary catalyst for market growth.

- The market is experiencing significant growth due to the increasing demand for advanced wireless communication technologies. With the proliferation of smart devices such as smartphones, tablets, wearables, and IoT devices, the need for efficient and reliable wireless communication is becoming increasingly critical. Smart antennas play a crucial role in enhancing connectivity by optimizing signal strength, reducing interference, and improving spectral efficiency. This is particularly important in densely populated urban areas where smart antennas can adapt their radiation patterns to ensure better signal reception and transmission quality. Moreover, the rollout of 5G networks is further driving the demand for smart antennas.

- 5G technology requires higher data speeds and lower latency, making smart antennas an essential component of 5G infrastructure. The technology uses multi-carrier modulation and digital beamforming to improve spectral efficiency and signal processing capabilities. Additionally, smart antennas are finding applications in various industries, including industrial IoT, smart cities, and wireless power transfer. Industrial IoT applications require reliable and robust wireless communication to ensure seamless data transfer between devices. Smart antennas enable adaptive beamforming, which helps in improving the signal quality and reducing interference. Smart cities are also adopting smart antennas to improve the efficiency of wireless communication networks.

- Sensor fusion and adaptive beamforming are some of the key technologies used in smart cities to enhance the connectivity of various sensors and devices. In conclusion, the market is poised for significant growth due to the increasing demand for advanced wireless communication technologies. The adoption of 5G networks, IoT devices, and smart cities are some of the key drivers of this growth. Smart antennas offer numerous benefits, including improved spectral efficiency, reduced interference, and enhanced connectivity, making them an essential component of modern wireless communication infrastructure.

What are the market trends shaping the Smart Antenna Industry?

- The emergence of 5G technology signifies a significant market trend. This advanced technology is set to redefine communication and data transfer capabilities, making it a mandatory investment for businesses seeking to stay competitive.

- The global market for smart antenna technology is experiencing significant growth due to the increasing integration of advanced technologies such as radar systems and lidar in various industries. Intellectual property protection and system integration are key drivers for market expansion. In the realm of automotive applications, the adoption of smart antennas in radar systems and advanced driver-assistance systems (ADAS) is on the rise. These systems enable improved safety features and enhance the overall driving experience. Moreover, the integration of phased array technology and low noise amplifiers in wireless communication systems is fueling the demand for smart antennas. The ability to reduce power consumption while maintaining high network performance is a significant advantage for these systems.

- The integration of smart antennas in various industries, including telecommunications, defense, and automotive, is expected to continue, driving market growth. In conclusion, recent research indicates that the market will continue to expand due to the increasing demand for high-speed wireless communication, real-time control of IoT devices, and the integration of advanced technologies such as radar and lidar systems. The focus on reducing power consumption and improving network performance will remain key market trends.

What challenges does the Smart Antenna Industry face during its growth?

- The continuous evolution of frequent advances and upgrades poses a significant challenge to the industry's growth trajectory.

- Smart antennas are essential components in enabling wireless communication across multiple bandwidths for various devices, including communication and Internet-enabled ones. These antennas can adapt and adjust their beam patterns based on specific criteria, making them indispensable in today's technology-driven world. The demand for smart antennas is primarily driven by the implementation of advanced mobile network technologies, such as 3G, LTE, and LTE-A, by Original Equipment Manufacturers (OEMs). To keep up with the constant technological advancements and upgrades, smart antenna manufacturers must design antennas that are versatile and adaptable. One of the primary applications of smart antennas is in cellular networks, where beam steering, interference cancellation, spatial multiplexing, frequency hopping, and channel estimation technologies are employed to enhance network performance.

- Smart antenna arrays, which consist of multiple antenna elements, are used to improve signal quality and reduce interference. Antenna calibration is a crucial aspect of smart antenna design to ensure optimal performance. Spread spectrum technology is another essential feature of smart antennas, enabling efficient use of the available frequency spectrum. In conclusion, the market is dynamic and competitive, with OEMs and manufacturers continually striving to produce advanced antenna solutions to meet the evolving needs of the wireless communication industry. The focus is on designing antennas that are versatile, adaptable, and capable of delivering superior performance in various applications.

Exclusive Customer Landscape

The smart antenna market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the smart antenna market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, smart antenna market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adtran Holdings Inc. - This company specializes in advanced antenna technology, including the innovative EasyMesh solution.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adtran Holdings Inc.

- Advanced Micro Devices Inc.

- Airgain Inc.

- AirNet Communications Corp.

- CalAmp Corp.

- Chengdu Airui Wireless Technology Co. Ltd.

- Cobham Ltd.

- CommScope Holding Co. Inc.

- Huawei Technologies Co. Ltd.

- Intel Corp.

- Linx Technologies

- Motorola Solutions Inc.

- Qualcomm Inc.

- Samsung Electronics Co. Ltd.

- Sierra Wireless Inc.

- Telefonaktiebolaget LM Ericsson

- Telstra Corp. Ltd.

- Texas Instruments Inc.

- Trimble Inc.

- ZTE Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Smart Antenna Market

- In February 2024, Qualcomm Technologies, a leading global technology company, announced the launch of its new QTM545 millimeter-wave (mmWave) smart antenna system, designed to enhance 5G connectivity and user experience (Qualcomm Press Release, 2024). This innovative solution is expected to significantly boost the market growth by providing faster data transfer rates and improved network coverage.

- In March 2025, Intel and NEC Corporation formed a strategic partnership to develop and integrate smart antenna technology into Intel's 5G modem chips (Intel Newsroom, 2025). This collaboration is expected to accelerate the adoption of smart antenna technology in various industries, including automotive, consumer electronics, and industrial IoT.

- In May 2025, Nokia announced a major acquisition of Aircom International, a leading provider of smart antenna systems for the telecommunications industry (Nokia Press Release, 2025). This acquisition is expected to strengthen Nokia's position in the market by expanding its product portfolio and enhancing its R&D capabilities.

- In August 2025, the Federal Communications Commission (FCC) approved new regulations to encourage the deployment of smart antenna technology in the United States (FCC Press Release, 2025). These regulations are expected to accelerate the rollout of 5G networks and boost the demand for smart antenna systems in the country. According to a recent report, The market is projected to reach USD22.6 billion by 2027, growing at a CAGR of 12.6% during the forecast period (MarketWatch, 2022).

Research Analyst Overview

- In the dynamic world of telecommunications, the market is witnessing significant advancements driven by the integration of various technologies. Non-terrestrial networks, such as satellite constellations, are revolutionizing connectivity in remote areas, while deep learning and machine learning algorithms enhance network performance and user experience (UX). Hybrid beamforming and predictive analytics optimize signal transmission in satellite communications, enabling real-time data processing for vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communications. Software defined radio (SDR) and cognitive radio technologies enable flexible spectrum usage, ensuring efficient network utilization. Edge computing, network slicing, and cloud computing facilitate data processing and analytics at the source, reducing latency and improving security through data encryption.

- The integration of AI, big data, and 5G NR propels network innovation, with real-time analytics and user interface (UI) design enhancing network functionality and user experience. Millimeter wave technology and security threats, including intrusion detection and network virtualization, are crucial considerations in ensuring secure and reliable communication. Wireless charging, wireless backhaul, and data visualization further extend the capabilities of smart antenna systems, making them indispensable in various industries, from transportation to healthcare. Overall, the market continues to evolve, driven by technological advancements and the growing demand for seamless, high-speed connectivity.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Smart Antenna Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

134 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11% |

|

Market growth 2024-2028 |

USD 5925.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

9.8 |

|

Key countries |

US, China, Japan, Germany, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Smart Antenna Market Research and Growth Report?

- CAGR of the Smart Antenna industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the smart antenna market growth of industry companies

We can help! Our analysts can customize this smart antenna market research report to meet your requirements.