Modular And Portable Building Market Size 2024-2028

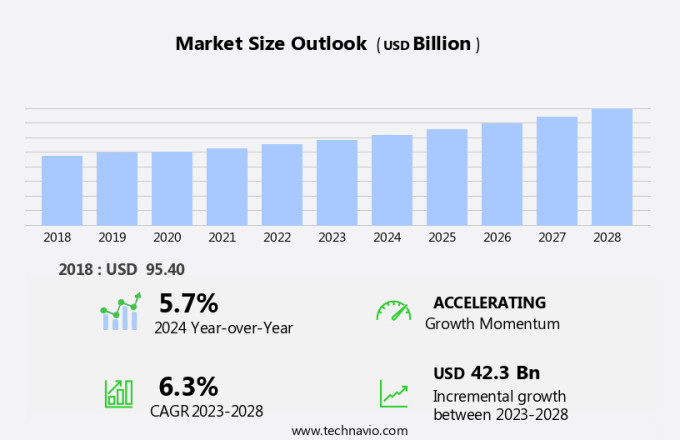

The modular and portable building market size is forecast to increase by USD 42.3 billion at a CAGR of 6.3% between 2023 and 2028. The market is experiencing significant growth due to the increasing demand for flexible and sustainable infrastructure solutions. Prefabricated construction techniques, including volumetric construction, are gaining popularity for their ecofriendly nature and ability to reduce construction time and costs. These methods involve the manufacturing of walls, Roofs, floors, columns, and beams off-site and transporting them to the construction site for assembly.

Rapid urbanization and the need for rapid infrastructure development are driving the adoption of these construction techniques. Furthermore, the sustainability benefits associated with modular and portable buildings make them an attractive option for both residential and commercial applications. However, the lack of skilled labor in the construction industry may pose a challenge to the growth of this market. As the industry continues to evolve, innovations in technology and design will play a crucial role in addressing these challenges and driving market growth.

What will be the Modular And Portable Building Market Size During the Forecast Period?

The market is gaining significant traction in the non-residential construction sector, with off-site manufacturing and preplanning becoming increasingly popular. These structures, also known as prefabricated buildings, offer numerous advantages, including quicker construction, flexibility, reduced waste, and structural stability. Modular and portable buildings are manufactured off-site in volumetric building modules, which are transported to the construction site for assembly. These structures can be used for various purposes, such as temporary workspaces, storage areas, and even permanent offices or retail spaces. Their semi-permanent and temporary usage makes them an attractive option for businesses requiring short-term solutions or those looking to expand their operations quickly.

Moreover, tenant comfort is a crucial consideration in the market. These structures are designed to provide optimal air quality and energy efficiency, ensuring a comfortable working environment. Prefabricated buildings can be constructed using eco-friendly materials and incorporate green infrastructure, making them a sustainable solution for businesses. One of the primary benefits of modular and portable buildings is their quicker construction time compared to traditional on-site construction methods. The offsite manufacturing process allows for faster production and assembly, reducing the overall project timeline. Additionally, the modular design allows for easy customization and flexibility, enabling businesses to tailor their structures to their specific needs.

Furthermore, another advantage of modular and portable buildings is their reduced waste. The offsite manufacturing process minimizes material waste, as components are precision-cut and building prefabricated in a controlled environment. This not only helps in cost savings but also aligns with the growing trend towards sustainable construction. In conclusion, the market is an emerging trend in the non-residential construction sector. These building materials structures offer numerous benefits, including quicker construction, flexibility, reduced waste, and tenant comfort. As businesses continue to seek sustainable and cost-effective solutions, the demand for modular and portable buildings is expected to grow.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Modular buildings

- Portable buildings

- Material

- Steel

- Wood

- Concrete

- Composite materials

- Geography

- APAC

- China

- Japan

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Sweden

- South America

- Middle East and Africa

- APAC

By Type Insights

The modular buildings segment is estimated to witness significant growth during the forecast period. Modular building technologies have gained popularity in various industries for their cost-effective and efficient construction methods. These techniques involve manufacturing building components in a factory setting and assembling them on-site, resulting in substantial savings on materials and labor. According to industry estimates, modular construction can save approximately 20% on construction costs and reduce the need for on-site labor by around 30%. The benefits of modular construction extend beyond cost savings. It also supports sustainability efforts in the construction industry, which is a significant contributor to CO2 emissions. By streamlining the construction process and minimizing waste, modular construction promotes eco-friendly building practices.

Furthermore, modular construction is widely used in various sectors, including specialty buildings such as guardhouses and ticket booths, as well as portable structures like mobile medical clinics and portable toilets. In the education sector, modular classrooms provide affordable and flexible solutions for schools and universities. Similarly, in the healthcare sector, modular buildings offer cost-effective and efficient solutions for remote workspaces and affordable housing. Modular building technologies offer durability and flexibility, making them an ideal choice for various applications. These structures are engineered to meet or exceed local building codes and can withstand extreme weather conditions. Additionally, they can be easily transported and reassembled, making them a practical solution for temporary or permanent structures.

Get a glance at the market share of various segments Request Free Sample

The modular buildings segment accounted for USD 80.10 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

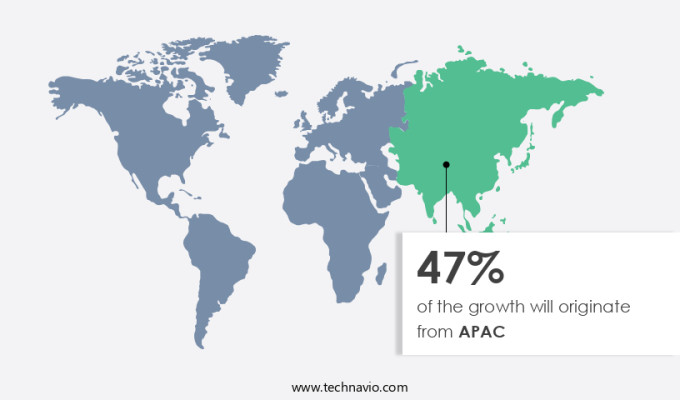

APAC is estimated to contribute 47% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The modular construction market in the Asia Pacific region is experiencing notable expansion, with the non-residential sector spearheading the growth. Modular construction, also referred to as off-site manufacturing or prefabrication, entails producing building components in a factory setting and assembling them on-site. This approach encompasses prefabricated units, precast slabs, and other structural elements, which can be fabricated off-site and subsequently assembled on-site. In India, the healthcare sector is increasingly embracing modular construction for its architecture and design. This method offers several advantages over traditional construction techniques, including reduced material waste and emissions from construction equipment, making it a sustainable alternative.

Furthermore, it facilitates project preplanning and expedites the construction process. Modular construction techniques can be employed using various materials, including concrete, steel, and wood, to create permanent or relocatable structures. The adoption of modular construction is expected to continue growing as the industry focuses on implementing green infrastructure and sustainable construction practices.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Modular And Portable Building Market Driver

Rising demand for versatile infrastructure solutions is the key driver of the market. The market in the United States is experiencing significant growth due to the increasing demand for flexible and cost-effective infrastructure solutions. Commercial applications, such as healthcare and hospitality, are major sectors driving this trend, as customization and energy efficiency are key priorities. Modular buildings offer structural stability and quicker construction times, making them an attractive option for businesses looking to reduce waste and save on costs.

Additionally, the use of eco-friendly products and energy-efficient buildings is becoming increasingly important, further boosting the market's growth. The flexibility of modular buildings allows them to be easily transported and assembled, making them ideal for various applications, including commercial real estate and emergency situations. During crises, such as natural disasters, portable, modular buildings can provide essential services and infrastructure, making them an essential part of disaster response efforts. Overall, the market is a valuable solution for businesses and communities in need of versatile and efficient infrastructure.

Modular And Portable Building Market Trends

Sustainability benefits associated with modular and portable constructions is the upcoming trend in the market. Modular and portable building construction is gaining popularity in the United States as an economical and time-efficient solution compared to traditional building methods. One of the major advantages of this construction approach is the significant reduction in energy consumption. Approximately 90% of modular building construction takes place off-site in a controlled factory environment, minimizing environmental disturbance at the construction site.

Furthermore, this method ensures efficient use of resources and energy, leading to minimal waste. Furthermore, modular buildings can be completed in approximately half the time compared to traditional construction, making them increasingly attractive. The use of recycled and recyclable materials is another significant sustainability benefit of modular construction.

Modular And Portable Building Market Challenge

Lack of skilled labor is a key challenge affecting the market growth. Modular and portable building construction, which includes ecofriendly solutions like volumetric and prefabricated techniques, is gaining popularity due to rapid urbanization and the need for sustainable solutions. These construction methods utilize prefabricated walls, roofs, floors, columns, and beams that are manufactured off-site and transported to the construction site for assembly. However, despite the numerous benefits of a modular and portable building, there is a significant challenge in the form of a skilled labor shortage. The construction industry's shift towards modular approaches is driven by their efficiency and cost advantages. Nevertheless, the modular and portable building market application installation and assembly of these prefabricated components require specialized workers

The shortage of skilled labor trained in modular construction techniques can result in project delays, increased costs, and compromised quality. This skill gap is a significant hurdle for the industry, as it hinders the execution of projects effectively and efficiently. To address this challenge, it is crucial to invest in training programs and initiatives that focus on developing a workforce skilled in modular construction techniques. This will ensure that the modular and portable building market structure can continue to deliver high-quality, sustainable, and cost-effective solutions to meet the growing demand for modular and portable buildings.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Abtech Inc. - The company offers modular and portable building solutions such as Custom Modular Steel Mezzanines, Abtech Forkliftable Prefabricated Buildings, and others.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ahura Gas Enterprise Pvt Ltd

- Allied Modular Building Systems, Inc.

- Cotaplan

- CRATE Modular Inc.

- Cube Modular Ltd

- EPACK Polymers Pvt Ltd.

- Excel Modular

- Henan K-Home Steel Structure Co.,Ltd.

- Loom Crafts Shade Systems Pvt Ltd

- Masterkabin Ltd

- McGrath RentCorp, Inc

- Morgan USA

- Panel Built, Inc.

- Parkut International Inc

- Portable Facilities Ltd

- PortaFab Corp.

- Portakabin Ltd.

- Pressmach Infrastructure Pvt Ltd.

- Thurston Group Ltd.

- United Partition Systems, Inc.

- WILLSCOT MOBILE MINI HOLDINGS CORP.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Latest Market Development and News

-

In December 2024, a leading player in the modular and portable building market, ABC Modular, launched a new range of eco-friendly portable office units designed with energy-efficient features and sustainable materials. The new products aim to meet the growing demand for green construction solutions in the commercial sector.

-

In November 2024, XYZ Construction formed a strategic partnership with a logistics company, Global Transport Solutions, to streamline the delivery and installation process of their modular buildings. This collaboration is set to improve delivery timelines and reduce transportation costs, making modular buildings more accessible to a broader range of clients.

-

In October 2024, DEF Group acquired GHI Structures, a competitor specializing in large-scale portable housing solutions. The acquisition allows DEF to expand its product offerings in the affordable housing sector and leverage GHI's expertise in custom-designed modular units for residential use.

-

In September 2024, JKL Innovations introduced a cutting-edge modular building system featuring smart technology integration. The new system includes IoT-enabled devices for temperature control, lighting, and security, catering to the growing demand for tech-enhanced, adaptable living and working spaces.

Research Analyst Overview

The market encompasses the production and sale of prefabricated structures for various applications, including temporary and semi-permanent usage. Off-site construction techniques, such as modular building technologies, are increasingly popular due to their efficiency and cost-effectiveness. These structures come in the form of prefabricated shelters, portable cabins, and temporary workspaces, among others. Tenant comfort is a priority in this market, with provisions for plumbing, heating, ventilation, and lighting. Specialty buildings, such as guardhouses, ticket booths, mobile medical clinics, and portable toilets, are also in demand. The education and healthcare sectors are significant consumers of modular buildings, with a focus on durability, structural stability, and quicker construction.

Furthermore, modern modular buildings incorporate smart technologies, such as internet access, remote monitoring, temperature management, and energy efficiency, making them sustainable solutions for the future. Eco-friendly materials, including recycled materials like bamboo, straw bale panels, and shipping containers, are gaining popularity. Insulation, thermal and acoustic, is crucial for energy efficiency and tenant comfort. The market caters to commercial applications, including healthcare, hospitality, and the customization of eco-friendly products. The use of materials like concrete, steel, and wood in modular construction continues, with a shift towards sustainable construction, green infrastructure, and the use of PVC free materials. Offsite manufacturing and project preplanning are essential for permanent and relocatable modular construction. The market is driven by rapid urbanization and foreign direct investment, with a focus on reducing waste and providing flexible, cost-effective construction solutions.

| Modular And Portable Building Market Report Scope | |

|

Report Coverage |

Details |

|

Page number |

208 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.3% |

|

Market growth 2024-2028 |

USD 42.3 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.7 |

|

Regional analysis |

APAC, North America, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 47% |

|

Key countries |

US, China, UK, Germany, Canada, Australia, France, Japan, The Netherlands, and Sweden |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Abtech Inc., Ahura Gas Enterprise Pvt Ltd, Allied Modular Building Systems, Inc., Cotaplan, CRATE Modular Inc., Cube Modular Ltd, EPACK Polymers Pvt Ltd., Excel Modular, Henan K-Home Steel Structure Co.,Ltd., Loom Crafts Shade Systems Pvt Ltd, Masterkabin Ltd, McGrath RentCorp, Inc, Morgan USA, Panel Built, Inc., Parkut International Inc, Portable Facilities Ltd, PortaFab Corp., Portakabin Ltd., Pressmach Infrastructure Pvt Ltd., Thurston Group Ltd., United Partition Systems, Inc., and WILLSCOT MOBILE MINI HOLDINGS CORP. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch