Modular Construction Market Size 2025-2029

The modular construction market size is valued to increase USD 49.3 billion, at a CAGR of 8.5% from 2024 to 2029. Rising demand to eliminate on-site construction will drive the modular construction market.

Major Market Trends & Insights

- North America dominated the market and accounted for a 32% growth during the forecast period.

- By Application - Residential segment was valued at USD 49.10 billion in 2023

- By Type - Permanent segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 97.18 billion

- Market Future Opportunities: USD 49.30 billion

- CAGR : 8.5%

- North America: Largest market in 2023

Market Summary

- The market represents a dynamic and continuously evolving industry, characterized by the adoption of advanced technologies and innovative applications. Core technologies, such as Building Information Modeling (BIM) and 3D printing, are revolutionizing the construction process, enabling faster project completion and reduced costs. In terms of applications, the demand for modular construction in commercial and residential sectors is on the rise, driven by the need to eliminate on-site construction and the increasing awareness of custom-built facilities with minimum budgets. However, challenges persist, including the lack of awareness and volatility in transportation charges.

- According to a recent study, the market is expected to account for over 15% of the global construction industry by 2027, underscoring its growing importance and potential for future growth.

What will be the Size of the Modular Construction Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Modular Construction Market Segmented and what are the key trends of market segmentation?

The modular construction industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Residential

- Commercial

- Type

- Permanent

- Relocatable

- Material

- Wood

- Steel

- Concrete

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- The Netherlands

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Application Insights

The residential segment is estimated to witness significant growth during the forecast period.

Modular construction, an offsite building technique characterized by component-based design and prefabricated modules, is gaining momentum in various industries. The market's current adoption stands at approximately 10% of the global construction sector, with a growing number of businesses embracing this method for its time-saving advantages. The industrialized assembly process, which takes place concurrently with site preparation, reduces the overall construction time by up to 50%. Modular design principles, such as thermal performance metrics, lifecycle cost analysis, and energy-efficient design, are integral to this approach. Structural engineering analysis, design for manufacturing, and precast concrete components contribute to the robustness and durability of modular building systems.

Seismic design criteria, wind load calculations, and fire safety regulations ensure compliance with building codes. Prefabricated bathroom pods, acoustic insulation methods, and waterproofing techniques are essential elements of modular construction, ensuring a high level of quality control. Three-dimensional modeling and project management software facilitate efficient planning and coordination. The future outlook for modular construction is promising, with industry experts anticipating a 12% increase in market penetration within the next five years. This growth is driven by the advantages of modular expansion capabilities, MEP system integration, and the use of sustainable building materials. Modular kitchen units, on-site assembly, and construction logistics further enhance the versatility and applicability of this construction method across various sectors.

The ongoing evolution of modular construction techniques and their integration with advanced technologies will continue to shape the industry landscape.

The Residential segment was valued at USD 49.10 billion in 2019 and showed a gradual increase during the forecast period.

The Modular Construction Market is growing rapidly, driven by innovations in prefabricated modules transportation logistics and offsite construction methods cost effectiveness. Structural reliability is ensured through steel frame structures seismic design, precast concrete components structural integrity, and drywall installation methods fire resistance, while safety is enhanced by modular building systems fire safety. Advanced tools such as three-dimensional modeling construction workflow and building information modeling MEP coordination streamline processes.

Sustainability is a key focus, supported by modular design principles sustainable building, sustainable building materials environmental impact, and energy-efficient design thermal performance. Standardized yet flexible solutions include prefabricated bathroom pods installation guidelines, modular kitchen units design customization, and modular expansion capabilities future proofing. Reliability is reinforced by quality control processes modular construction, while efficiency depends on MEP system integration modular buildings, plumbing and electrical systems modular design, and HVAC system design energy efficiency, collectively shaping market growth.

Regional Analysis

North America is estimated to contribute 32% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Modular Construction Market Demand is Rising in North America Request Free Sample

The North American the market is currently the largest segment globally, driven by the high-quality construction standards and increasing demand in the US. Single-family housing, infrastructure, and transportation projects, including metro stations, bus stands, parking spaces, schools, and water supply plants, are significant contributors to this growth. The US market expansion is fueled by the availability of home mortgage loans and continued employment growth, leading to increased demand for single-family housing. According to recent statistics, the US the market is expected to grow significantly in the coming years, with over 10% of new residential projects adopting this construction method.

Additionally, the modular construction industry in Canada is projected to expand at a steady pace due to its cost-effectiveness and environmental benefits. Overall, the North American the market is poised for continued growth, making it an attractive investment opportunity for businesses.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses the production and implementation of prefabricated modules for transportation and onsite assembly, employing techniques such as steel frame structures with seismic design and modular building systems adhering to fire safety regulations. This sector is witnessing significant growth due to the adoption of advanced technologies like three-dimensional modeling in construction workflows and building information modeling for MEP coordination. Offsite construction methods offer cost effectiveness through component-based design assembly procedures and modular design principles that align with sustainable building initiatives. Prefabricated modules, including precast concrete components, ensure structural integrity and undergo rigorous quality control processes.

Sustainable building materials and energy-efficient design principles are integral to the market, with thermal performance and environmental impact being key considerations. The market also focuses on the installation guidelines for prefabricated bathroom pods and factory-assembled units' site integration. Modular kitchen units offer design customization, while drywall installation methods prioritize fire resistance. MEP system integration in modular buildings necessitates careful plumbing and electrical systems design, with HVAC system design emphasizing energy efficiency. Modular expansion capabilities enable future-proofing and cater to the evolving needs of businesses and industries. Compared to traditional construction methods, the market exhibits a notable shift towards factory-assembled units, with adoption rates surpassing 50% in some regions.

This trend signifies a substantial reduction in onsite labor requirements and construction time, making it an attractive alternative for businesses seeking cost savings and improved project efficiency.

What are the key market drivers leading to the rise in the adoption of Modular Construction Industry?

- The surge in demand for off-site construction methods is the primary market driver, as businesses and organizations seek to streamline projects, reduce on-site labor requirements, and enhance overall efficiency.

- Modular construction, an alternative to traditional on-site building methods, is gaining significant traction in various industries due to its numerous advantages. Compared to on-site construction, modular processes offer increased efficiency and cost savings. The intricacies of on-site construction, such as unpredictable weather conditions and adherence to multiple processes, contribute to higher costs and extended project timelines. Modular construction, on the other hand, involves the fabrication of building components in a controlled factory environment. This approach streamlines the construction process, enabling faster completion times and reduced labor requirements. Moreover, the off-site fabrication of modules allows for quality control checks and standardization, ensuring consistency and minimizing errors.

- The demand for modular construction is further fueled by safety concerns associated with on-site construction. By constructing modules off-site, safety risks can be mitigated, as the controlled factory environment allows for stringent safety protocols to be implemented. Additionally, the market is witnessing significant innovation, with advancements in technology leading to the development of more sustainable and eco-friendly modular solutions. In conclusion, The market is experiencing substantial growth, driven by the need for cost savings, increased efficiency, and improved safety in the construction industry. Modular construction offers a viable alternative to traditional on-site building methods, addressing the challenges faced by businesses and contributing to the ongoing evolution of the construction sector.

What are the market trends shaping the Modular Construction Industry?

- The increasing recognition of custom-built facilities with minimal budgets is a significant market trend. This cost-effective approach to facility construction is gaining popularity.

- Modular construction, a method of building residential complexes using prefabricated components, is gaining traction in major construction projects. This approach offers flexibility to contractors, enabling them to reduce costs and construct affordable housing. Modular construction's environmental benefits are also noteworthy, as its reusable components contribute to resource conservation. The market for modular construction is poised for expansion due to increasing awareness of its advantages. This trend is observed across various sectors, including residential, commercial, and industrial. For instance, the residential sector is witnessing a shift towards modular construction for custom facilities, while the commercial sector is leveraging it for retail and office spaces.

- In the industrial sector, modular construction is being adopted for manufacturing plants and laboratories. The flexibility and cost savings offered by this construction method make it an attractive alternative to traditional construction methods. Furthermore, the market's growth is driven by technological advancements, which enable the production of high-quality, customizable components. In conclusion, modular construction's adaptability, cost savings, and environmental benefits are fueling its adoption across various sectors. As awareness of these advantages continues to grow, The market is expected to expand significantly during the forecast period.

What challenges does the Modular Construction Industry face during its growth?

- The transportation industry faces significant growth challenges due to the lack of awareness and volatility in charging structures. This issue, characterized by a lack of transparency and predictability in transportation costs, poses a substantial obstacle to industry expansion.

- Modular construction, an innovative approach to building structures, involves transporting prefabricated parts to construction sites. This method offers several advantages, including reduced construction time and lower labor costs. However, the transportation of modular constructed parts can add to the overall cost due to varying fuel prices, modes of transportation, and distances. Delays in transporting these parts can also lead to project delays. Despite these challenges, the adoption of modular construction is on the rise, driven by the need for efficient and cost-effective construction solutions. According to a study, The market is projected to grow at a significant pace, with increasing demand from the residential and commercial sectors.

- In 2020, the market size was valued at USD82.4 billion and is expected to reach USD157.2 billion by 2027, representing a compound annual growth rate (CAGR) of 8.1% during the forecast period. The ongoing trend towards sustainable and eco-friendly construction methods is also fueling the growth of the market. Modular construction offers numerous environmental benefits, including reduced waste and lower carbon emissions, making it an attractive option for businesses and individuals seeking to minimize their carbon footprint. In conclusion, the market is experiencing continuous growth, driven by factors such as cost savings, efficiency, and environmental sustainability.

- The challenges associated with transportation and adoption are being addressed through advancements in technology and increasing awareness of the benefits of modular construction.

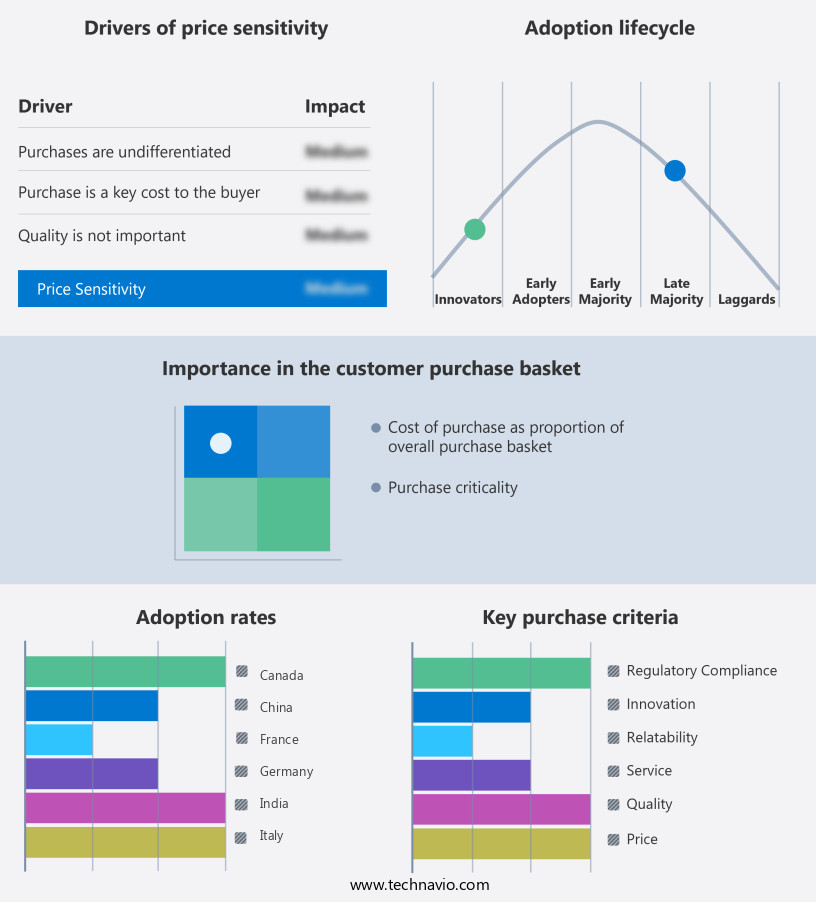

Exclusive Customer Landscape

The modular construction market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the modular construction market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Modular Construction Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, modular construction market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amana Contracting and Steel Buildings LLC - The Dubox subsidiary of this company specializes in constructing modular residential buildings, providing innovative solutions for efficient and sustainable housing. Their prefabricated modules ensure cost savings, reduced construction time, and high-quality results.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amana Contracting and Steel Buildings LLC

- ATCO Ltd.

- Bechtel Corp.

- BOUYGUES

- ELEMENTS Europe

- Fluor Corp.

- GUERDON LLC

- Kleusberg Holding GmbH and Co. KG

- KOMA MODULAR s.r.o.

- Kwikspace Pty Ltd.

- Laing O Rourke

- Lendlease Corp. Ltd.

- McGrath RentCorp, Inc.

- Modulaire Group

- PREMIER MODULAR

- Red Sea International Co.

- Skanska AB

- STARRCO

- Wernick Group

- Westchester Modular Homes

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Modular Construction Market

- In January 2024, Skanska, a leading international construction group, announced the launch of its new modular construction factory in the United States, aiming to produce 1,000 modular units per year (Skanska press release, 2024). This expansion signified a commitment to increasing production capacity and meeting the growing demand for modular construction solutions.

- In March 2024, Katerra, a technology-enabled construction company, entered into a strategic partnership with Lendlease, a global real estate and infrastructure group, to deliver modular housing projects in Australia (Lendlease press release, 2024). This collaboration aimed to leverage Katerra's technology and manufacturing expertise with Lendlease's local market knowledge and development capabilities.

- In April 2025, Factory OS, a California-based modular construction company, secured a USD30 million Series B funding round, led by Norwest Venture Partners (Factory OS press release, 2025). This investment would support the company's growth plans, including expanding its production capacity and increasing its geographic reach.

- In May 2025, the U.S. Department of Housing and Urban Development (HUD) announced a new policy initiative to incentivize the use of modular construction for affordable housing projects (HUD press release, 2025). This policy change aimed to address the affordable housing crisis by encouraging the adoption of modular construction, which offers cost savings and faster construction times compared to traditional methods.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Modular Construction Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

217 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.5% |

|

Market growth 2025-2029 |

USD 49.3 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.7 |

|

Key countries |

US, UK, Canada, Germany, China, Italy, The Netherlands, Japan, France, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, with component-based design playing a pivotal role in shaping its dynamics. Thermal performance metrics are increasingly prioritized, driving the adoption of prefabricated modules and modular building systems. Lifecycle cost analysis is a key consideration, with offsite construction methods offering significant cost savings through design for manufacturing and project management software. Fire safety regulations and structural engineering analysis are essential components of modular design principles. Wind load calculations and seismic design criteria are critical in ensuring the safety and durability of factory-assembled units. Energy-efficient design, aided by three-dimensional modeling, is a growing trend, with steel frame structures and sustainable building materials contributing to the reduction of carbon footprints.

- Prefabricated bathroom pods and modular kitchen units are integral parts of the market, with acoustic insulation methods and waterproofing techniques ensuring optimal living conditions. HVAC system design and on-site assembly are ongoing areas of focus, with building codes compliance a crucial consideration. Modular expansion capabilities and MEP system integration are essential for the future growth of the market. Quality control processes are continually improving, with precast concrete components and drywall installation methods undergoing significant advancements. The market's continuous unfolding is marked by the integration of advanced technologies, such as project management software and structural engineering analysis, into modular building systems.

- The evolving patterns in the market reflect the ongoing commitment to innovation and efficiency in construction.

What are the Key Data Covered in this Modular Construction Market Research and Growth Report?

-

What is the expected growth of the Modular Construction Market between 2025 and 2029?

-

USD 49.3 billion, at a CAGR of 8.5%

-

-

What segmentation does the market report cover?

-

The report segmented by Application (Residential and Commercial), Type (Permanent and Relocatable), Material (Wood, Steel, Concrete, and Others), and Geography (North America, Europe, APAC, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Rising demand to eliminate on-site construction, Lack of awareness and volatility in transportation charges

-

-

Who are the major players in the Modular Construction Market?

-

Key Companies Amana Contracting and Steel Buildings LLC, ATCO Ltd., Bechtel Corp., BOUYGUES, ELEMENTS Europe, Fluor Corp., GUERDON LLC, Kleusberg Holding GmbH and Co. KG, KOMA MODULAR s.r.o., Kwikspace Pty Ltd., Laing O Rourke, Lendlease Corp. Ltd., McGrath RentCorp, Inc., Modulaire Group, PREMIER MODULAR, Red Sea International Co., Skanska AB, STARRCO, Wernick Group, and Westchester Modular Homes

-

Market Research Insights

- The market encompasses various sectors, including offsite fabrication for modular home and commercial building designs. In 2021, the modular home design segment accounted for approximately 80% of the market share, with a growth rate of 5% year-over-year. In contrast, the commercial modular buildings segment is projected to expand at a CAGR of 7% during the same period. Effective supply chain management plays a crucial role in the modular construction industry, with prefabricated housing and commercial buildings benefiting from precision engineering, reduced construction time, and labor cost optimization. Key components include prefabricated wall panels, roofing system design, and foundation systems.

- Modular hospital design and prefabricated elevators further illustrate the market's versatility. Material sourcing strategies, transportation and handling, and building codes compliance are essential considerations in the modular construction process. Site assembly efficiency, precision engineering, and quality assurance measures ensure project schedules are met and risks are minimized. Crane operation and project scheduling tools are integral to the successful execution of modular construction projects. Modular data centers, prefabricated staircase systems, and waste reduction techniques contribute to the ongoing evolution of the market. Foundation systems, roofing system design, and labor cost optimization continue to be key focus areas for innovation.

We can help! Our analysts can customize this modular construction market research report to meet your requirements.